Automotive Alloy Market Size, Share, Growth, Industry Analysis 2034

Automotive Alloy Market by Alloys Type (Steel, Aluminum, Magnesium, and Others), Vehicle Type (Passenger Car, LCV and HCV), Area of Application (Structural, Powertrain, Exterior and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

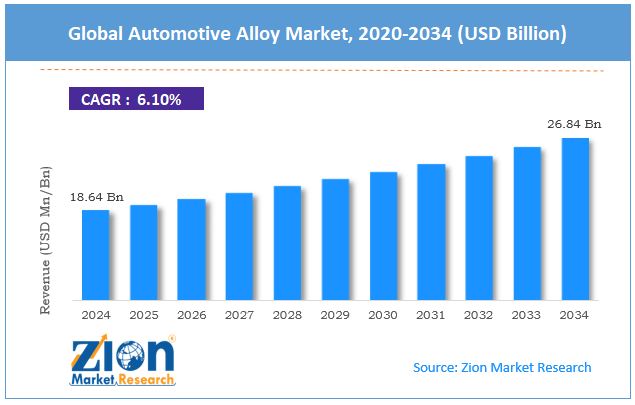

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.64 Billion | USD 26.84 Billion | 6.1% | 2024 |

Automotive Alloy Industry Prospective:

With a compound annual growth rate (CAGR) of about 6.1% between 2025 and 2034, the size of the global automotive alloy market, estimated at around USD 18.64 billion in 2024, is expected to increase to roughly USD 26.84 billion by 2034.

The report analyzes the automotive alloy market’s drivers and restraints, as well as their impact on demand throughout the projection period. In addition, the report examines global opportunities in the global automotive alloy market.

Automotive Alloy Market: Overview

The automotive alloys market encompasses the global industry of alloys used in the manufacturing of automobiles. These alloys are specifically engineered to meet the stringent requirements of the automotive sector, offering enhanced performance, durability, and lightweight characteristics. The market is driven by the growing demand for fuel-efficient and eco-friendly vehicles, as well as the increasing adoption of electric and hybrid vehicles.

Automotive alloys are used in various components, including engine blocks, wheels, transmissions, and body structures, due to their excellent strength-to-weight ratio and corrosion resistance properties. The market is highly competitive, with key players continuously investing in research and development activities to introduce innovative alloys that meet the evolving demands of the automotive industry.

Factors such as stringent regulations, advancements in material technologies, and shifting consumer preferences are expected to shape the growth and dynamics of the automotive alloys market in the coming years.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive alloys market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2025-2034)

- In terms of revenue, the global automotive alloy market size was valued at around USD 18.64 billion in 2024 and is projected to reach USD 26.84 billion by 2034.

- The automotive alloys market is projected to grow at a significant rate due to the increasing adoption of electric and hybrid vehicles, which has a positive impact on the automotive alloys market.

- Based on the alloy type, the aluminum alloys segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of vehicle type, the passenger cars segment is anticipated to command the largest market share.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period

Automotive Alloys Market: Growth Drivers

Increasing Adoption of Electric and Hybrid Vehicles

The increasing adoption of electric and hybrid vehicles has a positive impact on the automotive alloys market. These vehicles require lightweight materials to improve fuel efficiency and overall performance. Automotive alloys, such as aluminum and magnesium alloys, offer significant weight reduction while maintaining structural integrity. This enables manufacturers to meet the stringent fuel economy and emissions regulations imposed by governments worldwide.

Additionally, the demand for electric vehicles is growing due to environmental concerns and government incentives. As a result, there is an escalating need for automotive alloys to meet the rising production of electric and hybrid vehicles. This trend is driving the growth of the automotive alloys market as more manufacturers incorporate these alloys into their vehicle designs.

Improved Driving Dynamics

Improved driving dynamics play a significant role in driving the growth of the automotive alloys market. Automotive alloys, such as aluminum and high-strength steel, offer enhanced stiffness and strength compared to traditional materials like cast iron or steel. These alloys are lighter, enabling automakers to reduce the overall weight of vehicles while maintaining structural integrity. The reduced weight contributes to improved handling, agility, and responsiveness, resulting in enhanced driving dynamics.

Consumers are increasingly valuing driving experiences that offer better performance, maneuverability, and improved fuel efficiency. As a result, automakers are incorporating automotive alloys into their designs to achieve these goals. The demand for improved driving dynamics, coupled with the advantages offered by automotive alloys, stimulates the growth of the automotive alloys market as manufacturers seek lightweight materials to enhance the performance of their vehicles.

Automotive Alloys Market: Restraints

Higher costs

Higher costs act as a restraint for the growth of the automotive alloys market. Automotive alloys, such as aluminum and magnesium alloys, generally come with a higher price tag compared to traditional materials like steel or cast iron. The cost of producing and processing these alloys, along with the additional complexity involved in their integration into vehicle designs, contributes to their higher price. As a result, automakers and consumers may hesitate to adopt these alloys due to the increased costs associated with manufacturing and purchasing.

Additionally, the price volatility of raw materials used in automotive alloys, such as aluminum, can impact the overall cost and profitability of using these materials. Higher costs associated with automotive alloys create a barrier for widespread adoption, especially for budget-conscious consumers and manufacturers. This limitation can restrain the growth of the market to some extent.

Automotive Alloys Market: Opportunities

The rising middle class in emerging markets is driving increased demand for automobiles, leading to a growing market for automotive alloys.

The rising middle class in emerging markets is a major driving force behind the increased demand for automobiles. As people's incomes grow, they become more likely to purchase personal vehicles for transportation, convenience, and status. This, in turn, fuels the demand for automotive alloys, which are essential components in car manufacturing. Rapid urbanization creates a demand for efficient transportation, making cars a popular choice for many.

Improved infrastructure, such as roads and highways, supports vehicle ownership. The growing demand for automotive in emerging countries represents a significant opportunity for global automakers and suppliers. By understanding the unique dynamics of these markets, companies can tailor their products and strategies to meet the needs of local consumers and capitalize on the growth potential.

Automotive Alloys Market: Challenges

New Materials

The emergence of alternative materials like advanced ceramics and composites is indeed a significant challenge for the traditional automotive alloys market. These materials offer unique properties that can compete with alloys in certain applications. Ceramics and composites can be significantly lighter than many alloys, leading to improved fuel efficiency and reduced emissions.

Ceramics, in particular, can withstand extremely high temperatures, making them suitable for components like engine parts and exhaust systems. Certain ceramics and composites exhibit excellent resistance to corrosion, making them ideal for applications in harsh environments. The competition between alloys and alternative materials is likely to continue evolving.

As technology advances and manufacturing processes improve, the balance between these materials may shift. It will be crucial for both alloy and alternative material manufacturers to stay ahead of the curve and develop innovative solutions to meet the changing needs of the automotive industry.

Automotive Alloy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Alloy Market |

| Market Size in 2024 | USD 18.64 Billion |

| Market Forecast in 2034 | USD 26.84 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 212 |

| Key Companies Covered | Constellium, AMG Advanced Metallurgical Group N.V., KOBE STEEL LTD, Novelis Inc., UACJ Corporation, ArcelorMittal S.A., Nippon Steel & Sumitomo Metal Corporation, Norsk Hydro ASA, Thyssenkrupp AG, Alcoa Corporation, and others. |

| Segments Covered | By Alloy Type, By Vehicle Type, By Area of Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Alloy Market: Segmentation Analysis

The global automotive alloys market is segmented based on alloy type, vehicle type, area of application, and region.

Based on the alloy type, the automotive alloys market encompasses various types of alloys, including steel, aluminum, magnesium, and others. Among these, aluminum alloys currently hold the largest market share. Aluminum alloys are favored for their lightweight properties, making them a popular choice for automotive manufacturers aiming to reduce vehicle weight and improve fuel efficiency.

Aluminum alloys offer a good balance of strength and corrosion resistance, making them suitable for various automotive components such as body panels, chassis, wheels, and engine parts. Steel alloys also have a significant market share due to their strength, durability, and cost-effectiveness. They are commonly used in structural components that require high strength, such as frames and safety structures. Magnesium alloys, while lightweight, face challenges such as higher costs and limited availability, leading to a smaller market share.

Other alloys, including titanium and composites, have niche applications in certain high-performance or luxury vehicles but have a relatively smaller market share compared to steel and aluminum.

On the basis of vehicle type, the automotive alloys industry is categorized into passenger car, LCV, and HCV. Of these, passenger cars hold the largest market share. Passenger cars, including sedans, hatchbacks, SUVs, and crossovers, have a significant demand for automotive alloys due to their large production volume and consumer appeal. Automotive alloys are used extensively in passenger cars to improve fuel efficiency, enhance safety, and reduce overall vehicle weight. Light commercial vehicles (LCVs) have a relatively smaller market share compared to passenger cars.

LCVs, such as pickup trucks and vans, require robust and durable alloys to withstand heavy loads and rough terrains. heavy commercial vehicles (HCVs), including trucks and buses, also have a smaller market share in terms of automotive alloys. However, HCVs often utilize specialized alloys to meet the demanding requirements of heavy-duty applications, such as increased strength and durability. Overall, the passenger car segment dominates the automotive alloys market, followed by LCVs and HCVs.

Based on the area of application, the market is segregated into structural, powertrain, exterior, and others. Of these, the structural segment was the largest market segment in 2024. Automotive alloys such as high-strength steel and aluminum alloys are used in the chassis and frame of vehicles to provide structural integrity while reducing weight. Components like control arms, shock absorbers, and struts are often made from alloys to enhance both durability and performance. Lightweight alloys are used in body panels to improve overall vehicle efficiency and reduce weight without compromising safety.

Moreover, powertrain is one of the fastest-growing segments of the market. Aluminum alloys are commonly used in engine blocks, cylinder heads, and pistons to reduce weight and improve thermal efficiency. Magnesium alloys are also used in some high-performance applications.

Automotive Alloy Market: Regional Analysis

Asia Pacific is expected to witness significant market growth

The Asia Pacific is the dominant region in the automotive alloys market due to several key factors. The region is home to some of the world's largest automotive manufacturers and has a strong presence in the automotive industry. The growing demand for vehicles in countries like China, India, Japan, and South Korea has fueled the need for automotive alloys.

Additionally, Asia Pacific has a robust manufacturing infrastructure and supply chain network, allowing for efficient production and distribution of automotive alloys. The region also benefits from favorable government policies and initiatives promoting the adoption of lightweight materials for improved fuel efficiency and reduced emissions. Moreover, the presence of a large consumer base, rapid urbanization, and increasing disposable incomes contribute to the growth of the automotive sector, further driving the demand for automotive alloys in the Asia Pacific region.

Recent Development

- March 2022 - The Ronal Group has introduced the Ronal R67, a newly developed wheel design for application in automotive vehicles. This innovative wheel features a combination of five distinct double spokes and five narrow spokes, resulting in an aesthetically appealing design. The incorporation of vibrant design elements adds a touch of vibrancy to the overall appearance. Furthermore, the inclusion of aero-style applications in either Tornado Red or Track Grey (anthracite) enhances the wheel's sporty character while ensuring optimal air intake. The Ronal R67 wheel design not only offers a visually appealing option but also delivers an ideal blend of style and performance.

- July 2022 - Alcoa Corporation has recently announced the operational challenges it is facing. As a result, the company has initiated the immediate process of shutting down one of its three operating smelting lines at the Warrick Operations facility, located in Indiana. The decision has been made in response to the difficulties encountered during operations, and Alcoa Corporation is taking necessary steps to address these challenges efficiently.

- Meridian Lightweight Technologies developed its MgRE20 magnesium alloy in August 2023, incorporating rare-earth elements to improve corrosion resistance. BMW has adopted this advanced magnesium alloy for seat frames in its i7 luxury electric sedan to reduce weight without compromising durability.

- In March 2024, Norsk Hydro introduced Hydro CIRCAL 100R, the world's first commercially available 100% recycled automotive aluminum with a carbon footprint of just 6 kg CO₂ per kg of material. Mercedes-Benz has already adopted this for its EQXX concept vehicle to reduce lifecycle emissions.

- ArcelorMittal unveiled Usibor® 2000 in February 2024, currently the world's strongest automotive steel with 2GPa tensile strength. Ford has implemented this in the F-150 Lightning's battery protection system to enhance safety while minimizing weight.

Automotive Alloy Market: Competitive Landscape

The major players operating in the Automotive Alloys market include:

- Constellium

- AMG Advanced Metallurgical Group N.V.

- KOBE STEEL LTD

- Novelis Inc.

- UACJ Corporation

- ArcelorMittal S.A.

- Nippon Steel & Sumitomo Metal Corporation

- Norsk Hydro ASA

- Thyssenkrupp AG

- Alcoa Corporation

The global automotive alloy market is segmented as follows:

By Alloy Type

- Steel

- Aluminum

- Magnesium

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Area of Application

- Structural

- Powertrain

- Exterior

- Others

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive alloys are specialized materials used in the manufacturing of various components in vehicles, designed to improve performance, safety, and efficiency. These alloys typically involve combinations of metals, such as aluminum, magnesium, and titanium, among others, to create materials with desirable properties, including lightweight, high strength, corrosion resistance, and durability.

The global automotive alloy market is expected to grow due to the increasing adoption of electric and hybrid vehicles, which has a positive impact on the automotive alloys market.

According to study, the global automotive alloy market size was worth around USD 18.64 billion in 2024 and is predicted to grow to around USD 26.84 billion by 2034.

The CAGR value of the automotive alloy market is expected to be around 6.2% during 2025-2034.

The global automotive alloys market growth is expected to be driven by Asia Pacific. The region is home to some of the world's largest automotive manufacturers and has a strong presence in the automotive industry.

The global automotive alloy market is led by players like Constellium, AMG Advanced Metallurgical Group N.V., KOBE STEEL, LTD, Novelis, Inc., UACJ Corporation, ArcelorMittal S.A., Nippon Steel & Sumitomo Metal Corporation, Norsk Hydro ASA, Thyssenkrupp AG, Alcoa Corporation, and others.

The report explores crucial aspects of the automotive alloy market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Automotive AlloyIndustry Prospective:OverviewKey Insights:Automotive Alloys Growth DriversAutomotive Alloys RestraintsAutomotive Alloys OpportunitiesAutomotive Alloys ChallengesReport ScopeSegmentation AnalysisRegional AnalysisRecent DevelopmentCompetitive LandscapeThe global automotive alloy market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed