Fluorspar Market Size, Share, Trend Analysis, Growth, Forecast 2034

Fluorspar Market By Product (Metspar, Acidspar, Ceramic, and Others), By Application (Steel Production, Aluminum Production, Hydrofluoric Acid, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

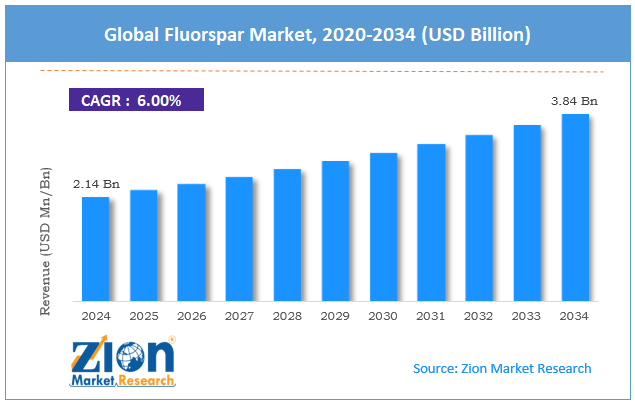

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.14 Billion | USD 3.84 Billion | 6.00% | 2024 |

Fluorspar Industry Prospective:

The global fluorspar market size was worth around USD 2.14 billion in 2024 and is predicted to grow to around USD 3.84 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.00% between 2025 and 2034.

Fluorspar Market: Overview

Fluorspar (CaF2) is the commercial name of fluorite, which is a widely used mineral. Fluorspar is a colorful substance that occurs worldwide across 9,000 sites. One of the main applications of fluorspar is in the iron & steel making industry. It is further used in the air conditioning & refrigeration sector along with aluminum production. In the commercial market, two types of fluorspar are available. One is acid grade and the other is metallurgical grade. According to industry research, fluorspar is mainly found in countries such as Mongolia, China, Vietnam, Mexico, and South Africa. It is mined across 20 countries, and China leads the global production of fluorspar.

During the forecast period, the demand for fluorspar is expected to continue growing due to the rising application of steel and iron across industries. Furthermore, the surge in investments in the chemicals sector worldwide will further help the industry for fluorspar to flourish. According to industry research, the changing global trading partnerships and the risk of supply chain disruptions may affect the final revenue generated by the industry players during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the global fluorspar market is estimated to grow annually at a CAGR of around 6.00% over the forecast period (2025-2034)

- In terms of revenue, the global fluorspar market size was valued at around USD 2.14 billion in 2024 and is projected to reach USD 3.84 billion by 2034.

- The fluorspar market is projected to grow at a significant rate due to the rising applications in steel and iron production.

- Based on the product, the acidspar segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the hydrofluoric acid segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Fluorspar Market: Growth Drivers

Rising applications in steel and iron production to propel the market growth rate

The global fluorspar market is expected to be driven by the rising applications of the mineral in the production of steel & iron. According to industry research, CaF2 is used as a fluxing agent during steel production. Fluorspar helps eliminate impurities such as silica and sulfur from molten metal. Furthermore, fluorspar is also used in additional procedures such as adjusting slag velocity in the furnace or eliminating gangue materials. The rising demand for pure steel and iron will promote higher use of fluorspar in the coming years. According to official reports, more than 1888 million metric tons of steel were produced in 2023.

The global building & construction industry is one of the largest consumers of superior-grade steel & iron. The surge in infrastructure development projects, increased demand for affordable residential houses, including smart cities, and several offshore projects have helped promote the use of steel worldwide. Recent studies indicate that steel producers are seeking novel ways to reduce energy consumption and deliver higher yields. Fluorspar is an effective agent used to reduce fuel consumption, as it lowers the melting point of slag. In addition to this, it is known to improve furnace efficiency, further helping the market for fluorspar thrive.

Growing investments in the chemicals & materials industry to propel higher market revenue

Fluorspar is a primary raw material required for producing hydrofluoric acid, which in turn is used in several chemicals containing fluorine. For instance, inorganic compounds prepared using fluorine include calcium fluoride and sulfur hexafluoride, while organic counterparts are atorvastatin, ciprofloxacin, and fludioxonil. These final compounds are used in pharmaceutical and agrochemical industries. The surging demand for chemicals & materials across the globe will lead to more investments in the production of fluorspar.

In January 2025, official reports emerged suggesting that the fluorspar mining and flotation project in Kashgar, Xinjiang, China, had begun construction. The site is expected to become operational for producing CaF2 in 2025, thus benefiting the global fluorspar market. According to official reports, the site has an estimated CaF2 reserve of 50 million tonnes of raw ore.

Fluorspar Market: Restraints

Escalating geopolitical tension worldwide and disruptions in the supply chain may affect market revenue

The global fluorspar industry is expected to be restricted due to the rising geopolitical tensions worldwide. The ongoing trade war between the US and China may have an effect on the fluorspar supply chain involving other stakeholders.

Furthermore, economic uncertainty, changing trading partnerships between global companies, and other rising complexities in establishing international partnerships, especially in the chemicals & materials sector, may affect final growth trends in the industry.

Fluorspar Market: Opportunities

Surging advancements in battery technology and electric vehicles (EVs) generate growth opportunities

The global fluorspar market is expected to generate growth opportunities due to the surging advancements in battery solutions propelled by the growing demand for EVs. Fluoropolymers are some of the most commonly used compounds in electronic batteries as they are used in separators and electrolytes. The EV industry is one of the fastest-growing segments of the global automotive sector. EV production and adoption rates skyrocketed during 2024 and are expected to deliver improved results during the projection period. EV makers are increasingly investing in research & development (R&D) of high-performance and long-ranging batteries to eliminate one of the most performance-based concerns of modern EVs.

In April 2024, Syensqo, a leading multinational materials company, initiated the construction of a new battery-grade polyvinylidene fluoride (PVDF) facility in the US. PVDF is a popular thermoplastic fluoropolymer. It is used as a binder and separator coating for lithium-ion batteries. Government support toward the amplification of EV production and research on battery solutions will further escalate the industry’s final revenue in the long term.

Fluorspar Market: Challenges

Environmental concerns over excessive mining are a major challenge to overcome

The global fluorspar industry is expected to be challenged by the growing concerns over the severe environmental impact of excessive mineral mining. These operations can degrade the quality of ecological systems and the quality of land.

Furthermore, the mining of fluorspar is also linked to the growing rate of air pollution and soil degradation. Personnel involved in fluorspar mining are at risk of health hazards, which further adds to the growth-related complications in the industry.

Fluorspar Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fluorspar Market |

| Market Size in 2024 | USD 2.14 Billion |

| Market Forecast in 2034 | USD 3.84 Billion |

| Growth Rate | CAGR of 6.0% |

| Number of Pages | 215 |

| Key Companies Covered | RUSAL, China Kings Resources Group Co. Ltd., Mongolrostsvetmet LLC, Masan High-Tech Materials Corporation, Steyuan Mineral Resources Group Ltd., Seaforth Mineral & Ore Co. Inc., Canada Fluorspar Inc., Minersa Group, Yingpeng Chemical Co. Ltd., British Fluorspar Ltd., Mexichem S.A.B. de C.V., Centralfluor Industries Group Inc., Groupe Managem, Koura, Kenya Fluorspar Company Ltd., and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fluorspar Market: Segmentation

The global fluorspar market is segmented based on product, application, and region.

Based on the product, the global market is divided into metspar, acidspar, ceramic, and others. In 2024, the highest growth was listed in the acidspar segment. As per the market study, CaF2 content in acidspar products is more than 97%. It is used in the production of hydrofluoric acid, which is further used in several end applications. During the projection period, acidspar is expected to dominate nearly 70.01% of the final revenue.

Based on the application, the global market divisions are steel production, aluminum production, and hydrofluoric acid. In 2024, around 59%of the total share was dominated by the hydrofluoric acid segment. It is the starting material for producing several other chemicals, such as refrigerants and pharmaceutical raw materials. The steel production segment is likely to account for 25% of the total revenue during the coming years.

Fluorspar Market: Regional Analysis

Asia-Pacific to emerge victorious during the forecast period

The global fluorspar market is expected to be led by Asia-Pacific during the projection period. The region is expected to control the major part of the global revenue, with China leading the regional supply chain. According to official reports, China alone supplies more than 55% of fluorspar across regional and global scales. Furthermore, the country has several fluorspar-rich reserves, helping the region thrive.

In addition, Mongolia and Vietnam are also expected to emerge as critical contributors to the region’s overall growth rate. Mongolia supplies around 7% of global fluorspar consumption, while Vietnam delivers nearly 3% of the total fluorspar produced worldwide. The increasing use of the mineral to produce electric batteries will further encourage regional expansion in the coming years.

North America is the second-highest revenue generator across the global market. Mexico accounts for around 20% of the global CaF2 supply. Moreover, the US is rapidly investing in faster fluorspar production and distribution as the economy seeks to diversify its trading partners beyond China. According to recent reports, US-based Ares Strategic Mining is expected to launch a new fluorspar manufacturing facility in the US, as the country imports 100% of its CaF2 requirements.

Fluorspar Market: Competitive Analysis

The global fluorspar market is led by players like:

- RUSAL

- China Kings Resources Group Co. Ltd.

- Mongolrostsvetmet LLC

- Masan High-Tech Materials Corporation

- Steyuan Mineral Resources Group Ltd.

- Seaforth Mineral & Ore Co. Inc.

- Canada Fluorspar Inc.

- Minersa Group

- Yingpeng Chemical Co. Ltd.

- British Fluorspar Ltd.

- Mexichem S.A.B. de C.V.

- Centralfluor Industries Group Inc.

- Groupe Managem

- Koura

- Kenya Fluorspar Company Ltd.

The global fluorspar market is segmented as follows:

By Product

- Metspar

- Acidspar

- Ceramic

- Others

By Application

- Steel Production

- Aluminum Production

- Hydrofluoric Acid

- Others

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fluorspar (CaF2) is the commercial name of fluorite, which is a widely used mineral.

The global fluorspar market is expected to be driven by the rising applications of the mineral in the production of steel & iron.

According to study, the global fluorspar market size was worth around USD 2.14 billion in 2024 and is predicted to grow to around USD 3.84 billion by 2034.

The CAGR value of the fluorspar market is expected to be around 6.00% during 2025-2034.

The global fluorspar market is expected to be led by Asia-Pacific during the projection period.

The global fluorspar market is led by players like RUSAL, China Kings Resources Group Co., Ltd., Mongolrostsvetmet LLC, Masan High-Tech Materials Corporation, Steyuan Mineral Resources Group Ltd., Seaforth Mineral & Ore Co., Inc., Canada Fluorspar Inc., Minersa Group, Yingpeng Chemical Co., Ltd., British Fluorspar Ltd., Mexichem S.A.B. de C.V., Centralfluor Industries Group, Inc., Groupe Managem, Koura, and Kenya Fluorspar Company Ltd.

The report explores crucial aspects of the fluorspar market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed