ePayment System Market Trend, Share, Growth, Size Analysis and Forecast 2032

ePayment System Market - By Type (Services and Software Platforms), By Application (eCommerce, Grocery, Supermarket, and Others), And By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

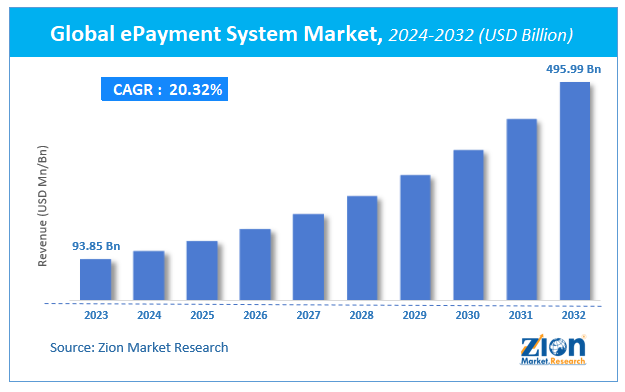

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 93.85 Billion | USD 495.99 Billion | 20.32% | 2023 |

ePayment System Market Insights

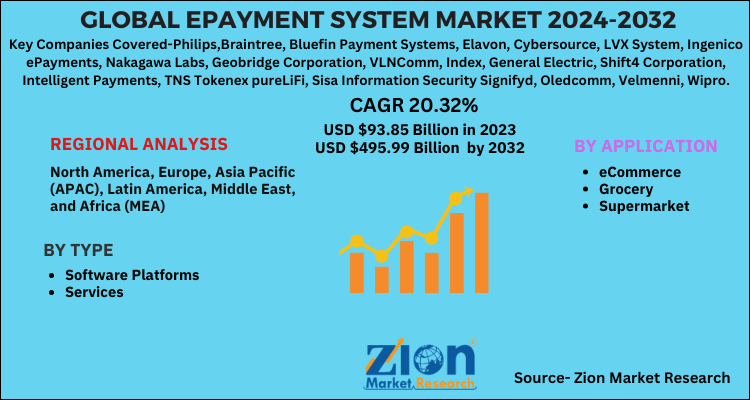

According to a report from Zion Market Research, the global ePayment System Market was valued at USD 93.85 Billion in 2023 and is projected to hit USD 495.99 Billion by 2032, with a compound annual growth rate (CAGR) of 20.32% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the ePayment System industry over the next decade.

ePayment system market: Overview

An electronic payment system is the way of carrying out financial transactions or is a method of paying for goods & services through electronic media in a cashless manner or without issuing cheque. It is also referred or abbreviated as ePayment system or digital payment system. The ePayment system is classified into e-credit payment system and e-Cash payment system.

Furthermore, technological breakthroughs like machine learning, robotic process automation, AI, and distributed ledger systems can help in reducing the transactional as well as operational costs of ePayment system and will further result in the geometric progression of the market both in terms of value and volume over the years ahead.

ePayment system market: Growth Factors

Escalating popularity of eCommerce as well as digital commerce activities along with acceptance of alternate methods of payments is likely to define the growth of ePayment system industry over the forecast timespan. Reportedly, debit cards are not allowed for online financial transactions in most of the countries and credit card utilization differs remarkably country wise and this is going to generate high preference for online payments. Such aspects will create lucrative growth avenues for the market over the years to come. Apparently, digital checkout services as well as new payment solutions have attributed remarkably towards trends of payment business towards electronification, thereby steering business space. In addition to this, development of digital commerce ecosystems has offered new growth opportunities for B2B payments, thereby paving way for the expansion of ePayment system business in the foreseeable future.

Furthermore, with surge in the electronic transactions contributing heftily towards total revenue of many of the emerging as well as developed countries, the market for ePayment system is anticipated to gain traction over the years ahead. With a steep rise in the smartphone penetration across the globe, m-commerce transactions like mobile browser payments & in-app payments have become the focal to the growth of digital commerce market. Such breakthroughs in the consumer electronics industry will enable the ePayment system industry to reach scalable heights of growth in the coming decade. Growing inclination towards online shopping and enhancements in the internet bandwidth & speed facilitating instantaneous online banking activities will open new horizons of growth for the market during the forecast timespan. Moreover, cross border payments sector has reached its highest peak of growth with trade and regional banks contributing majorly towards the cross-border payment flow and this will further optimize the progression of ePayment system industry in the years ahead. Transaction banking activities will contribute lucratively towards the geometric increase of ePayment system market earnings within the next couple of years.

ePayment System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | ePayment System Market |

| Market Size in 2023 | USD 93.85 Billion |

| Market Forecast in 2032 | USD 495.99 Billion |

| Growth Rate | CAGR of 20.32% |

| Number of Pages | 110 |

| Key Companies Covered | Philips,Braintree, Bluefin Payment Systems, Elavon, Cybersource, LVX System, Ingenico ePayments, Nakagawa Labs, Geobridge Corporation, VLNComm, Index, General Electric, Shift4 Corporation, Intelligent Payments, TNS Tokenex pureLiFi, Sisa Information Security Signifyd, Oledcomm, Velmenni, Wipro, and LightPointe Communications |

| Segments Covered | By Type, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

ePayment system market: Regional Insights

North American Market To Witness Astounding Growth Over Forecast Timespan

The prolific growth of the ePayment system business in the sub-continent can be credited to rise in the use of mobile wallets in the countries like the U.S. and Canada. Reportedly, in the countries like the U.S., young persons are making maximum use of in-apps and online payment options to make payments. For the record, half of the financial transactions in North America are carried out electronically and this will further drive the regional market trends over the forthcoming years. Strong presence of NFC infrastructure in the countries like the U.S. will further augment the regional market growth in the years to come.

ePayment system market: Competitive Space

Key players influencing the market growth are

- Philips,Braintree

- Bluefin Payment Systems

- Elavon

- Cybersource

- LVX System

- Ingenico ePayments

- Nakagawa Labs

- Geobridge Corporation

- VLNComm

- Index

- General Electric

- Shift4 Corporation

- Intelligent Payments

- TNS Tokenex pureLiFi

- Sisa Information Security Signifyd

- Oledcomm

- Velmenni

- Wipro

- LightPointe Communications.

The global ePayment system market is segmented as follows:

By type:

- Software Platforms

- Services

By application:

- eCommerce

- Grocery

- Supermarket

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Escalating popularity of eCommerce as well as digital commerce activities along with acceptance of alternate methods of payments is likely to define the growth of ePayment system industry over the forecast timespan. Reportedly, debit cards are not allowed for online financial transactions in most of the countries and credit card utilization differs remarkably country wise and this is going to generate high preference for online payments. Such aspects will create lucrative growth avenues for the market over the years to come.

According to a report from Zion Market Research, the global ePayment System Market was valued at USD 93.85 Billion in 2023 and is projected to hit USD 495.99 Billion by 2032, with a compound annual growth rate (CAGR) of 20.32% during the forecast period 2024-2032.

North America is likely to make noteworthy contributions towards overall market revenue. The growth of the industry in the sub-continent over the estimated timespan and its contributions to the overall market earnings can be attributed to rise in the use of mobile wallets in the countries like the U.S. and Canada. Reportedly, in the countries like the U.S., young persons are making maximum use of in-apps and online payment options to make payments. For the record, half of the financial transactions in North America are carried out electronically and this will further drive the regional market trends over the forthcoming years.

The key players profiled in the report include Philips,Braintree, Bluefin Payment Systems, Elavon, Cybersource, LVX System, Ingenico ePayments, Nakagawa Labs, Geobridge Corporation, VLNComm, Index, General Electric, Shift4 Corporation, Intelligent Payments, TNS Tokenex pureLiFi, Sisa Information Security Signifyd, Oledcomm, Velmenni, Wipro, and LightPointe Communications. With the market being highly fragmented and new players entering the market, the market is likely to be highly competitive and hence the existing players are focusing on technological innovations with a view to enhance their market share as well as retain their positions in the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed