Global Credit Management Software Market Expected to Reach USD 9.35 Billion By 2032

07-May-2024 | Zion Market Research

The new report by Zion Market Research on the “Credit Management Software Market By Deployment Type (On-Premises, And Cloud), By Service Type (Consulting, Operation & Maintenance, And System Integration), By Organization Size (Small & Medium Enterprises, And Large Enterprises), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024–2032" has a vast information about the market and its potential.

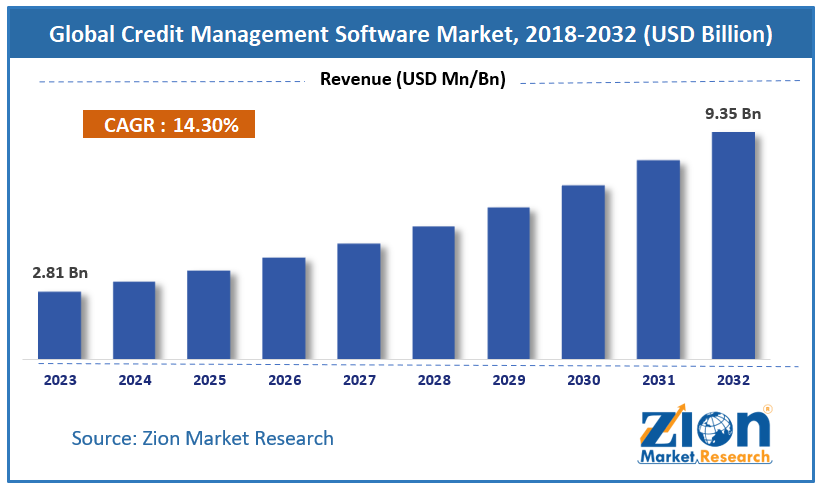

The global credit management software market was valued at around USD 2.81 billion in 2023 and is predicted to grow to around USD 9.35 billion by 2032 with a CAGR of roughly 14.30% between 2024 and 2032.

Browse the full “Credit Management Software Market By Deployment Type (On-Premises, And Cloud), By Service Type (Consulting, Operation & Maintenance, And System Integration), By Organization Size (Small & Medium Enterprises, And Large Enterprises), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024–2032” report at https://www.zionmarketresearch.com/report/credit-management-software-market

Increasing awareness about the benefits of using automation and dedicated software has triggered the growth of the credit management software market. Credit management software provides a certain set of advantages such as efficiency in credit record management, better cash flow management, maximum insights pertaining to customer behavior, and much more. Owing to these benefits a wide range of companies belonging to various sectors such as telecom, healthcare, manufacturing, information technology, and electronics are implementing the credit management software. The organizations are increasingly adopting credit management software as it provides key insights into the movement of the invoices for several transactions taking place within or outside the company thus increasing its popularity.

According to the analysis, there will be an increasing adoption of the credit management software in the medium-sized organizations. The implementation of the credit management software has enhanced the decision-making capability of the credit managers which has resulted in increased operational efficiency. Thus medium-sized businesses will be rapidly adopting the credit management software in the forecast period for making improved credit decisions.

Global Credit Management Software Market: Deployment Type Segment Analysis

- On-Premises

- Cloud

Global Credit Management Software Market: Service-Type Segment Analysis

- Consulting

- Operation & Maintenance

- System Integration

Global Credit Management Software Market: Organization Size Type Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

Global Credit Management Software Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

By deployment type, the cloud segment dominated the credit management software market. The cloud segment contributed the highest market share of over 58.10%. It is anticipated that this segment will retain its dominance during the forecast period owing to its increased CAGR of around 5.5%. The cloud-based solutions primarily offer online credit application, collaborative workflow, data aggregation, and easy retrieval and storage of credit data that can be accessed from any remote location. Hence cloud-based credit management software is being widely adopted by the organizations.

By service type, the consulting segment held the largest market share of more than 50% in the global credit management software market. There is an increased demand for the consulting services of the credit management software owing to the growing adoption of the software among the small and medium enterprises. However, it is anticipated that the operation and the maintenance services segment will register the highest CAGR growth in the coming years.

The large enterprises dominated the credit management software market in 2023 by contributing a market share of 66.38%. Being expensive, credit management software is more affordable for the large enterprises. But, it is anticipated that small and medium enterprises segment will grow at the highest CAGR of 6.19% over the forecast period owing to its benefits such as efficiency in credit management, better cash flow management, maximum insights pertaining to customer behavior, and much more. This is expected to boost the demand for credit management software over the forecast period.

Asia Pacific is expected to grow at the highest CAGR of 6.50% over the forecast period. Heavy investments by international companies in the Asia Pacific region owing to cheap labor has to lead to rapid industrialization over the last decade which, in turn, has increased the adoption of the credit management software in various organizations. Europe held the highest market share of 32.16% in 2016 and is anticipated to grow with a steady CAGR over the forecast period.

The major market players in the global credit management software market are High Radius, Rimilia, Solutions for Financials B.V., SOPLEX Consult GmbH, Equiniti, Esker, HanseOrga Group, Innovation Software Limited, Misys, Onguard, and Prof. Schumann GmbH, among others.

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed