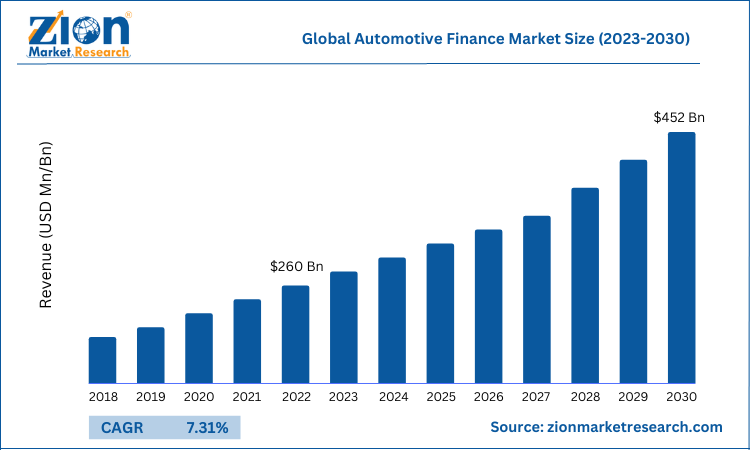

Global Automotive Finance Market is Predicted to Grow Around $452 Bn by 2030

15-Feb-2023 | Zion Market Research

The global automotive finance market size was worth around USD 260 Billion in 2022 and is predicted to grow to around USD 452 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 7.31% between 2023 and 2030.

Automotive finance is the financial service that pertains to the provision of external monetary assistance to help buyers purchase vehicles without having to pay one-part full payment. Such services are offered at an interest rate and can be called vehicle loans or leases, where the consumer undertaking the service takes the financial help of the institute offering the service in return for repayment with an interest amount.

There are several factors that are currently influencing the global automotive finance market, both in terms of positive and negative impact. Companies operating in the segment currently stand at a point where there is a shift in national economies as the western and the eastern countries are in political turmoil and are consistently working toward emerging as the next superpower. Furthermore, the rapidly penetrating digitization of the industry could work in the favor of the market players during the forecast period.

The global automotive finance market is projected to grow due to several factors, and the growth in the automobile sector remains a prominent reason for the expansion. In addition to this, the growth in consumer credit influenced by factors like increased availability and awareness could also lead to higher revenue during the forecast period.

In such scenarios, the consumers are more likely to undertake financial assistance. Furthermore, the increasing consumer preference toward leasing is a positive influence. This service allows consumers to drive different and new vehicles for a certain duration without undertaking any responsibility of owning the vehicles, which currently is considered a liability by many young buyers.

The increase in the used vehicles sector is an excellent segment for the automotive finance industry players. During the pandemic, car resale numbers increased tremendously, and with the availability of digital assistance in selecting a used or pre-owned car, the segment is projected to further generate higher revenue. Many new-age buyers prefer to opt for second-hand vehicles since they offer a better return on investment. The use of technology and the growing penetration in terms of the service platform and consumer database could open more doors for global sales volume to increase during the projection period.

However, there are several growth restraints as well during the forecast period and one such key negative influence is the regulatory environment which changes between regions or countries making operations difficult for the global market players. The automotive finance industry is subject to ever-evolving and dynamically changing regulations and laws, for instance, the Consumer Financial Protection Bureau (CFPB) regulation which can impact the overall growth in the global market. Additionally, the rise in competition, with the increase in the number of players offering financial services along with dynamic service offerings, could lead to a market slowdown.

The growing economies could hold excellent growth opportunities, whereas the fluctuating interest rate may challenge market growth

The global automotive finance market is segmented based on provider type, vehicle type, finance, and region

Based on type, the global market is segmented into OEMs, banks, and others

Based on vehicle type, the global market is divided into passenger vehicles and commercial vehicles.

- In 2022, the automotive finance industry registered the highest growth in the passenger vehicles segment and dominated almost 62.1% of the global market share

- The increase in distance and the preference of the consumer to ease the mobility concerns between home, office, or any other locations were the major growth propeller

- Furthermore, the growing standard of living, rising income, and larger availability of financial services are other important factors for segmental growth

- The commercial segment could grow, driven by the high price of commercial vehicles along with the rise in the number of players

Based on finance, the global market is segmented into indirect and direct

- In 2022, the automotive finance industry registered the highest growth in the direct segment, which generated almost 55.12% of the global market revenue

- Consumers have more access to information, allowing them to access companies offering services that best meet the consumer's requirement

- Furthermore, consumers now prefer to directly apply for loans instead of opting for external or third-party help since it allows them to eliminate the requirement of paying commissions, which was earlier an extra cost of the end-buyers

- It also offers higher control over the entire leasing or lending process and provides the consumer with more time

The global automotive finance market is projected to witness the highest growth in North America. The regional growth may be dominated by the US followed by Canada with the excellent automotive industry becoming the largest contributor. Europe in 2022 accounted for almost 38% of the global industry share, which is propelled by the presence of the service providers.

The increasing collaboration between automobile manufacturers and service providers along with the rising use of digital systems and technology to leverage the benefits. Furthermore, Asia-Pacific is projected to become a lucrative market during the forecast period, driven by the growing sales in the automotive industry and the rising number of joint ventures along with foreign industry players.

This review is based on a report by Zion Market Research, titled “Automotive Finance Market By Provider Type (OEMs, Banks, and Others), BY Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Finance (Indirect and Direct), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 – 2030.”- Report at https://www.zionmarketresearch.com/report/automotive-finance-market

Recent Developments:

- In November 2022, Marsh Valued Partnerships, a tailor-made service provider for car finance intermediaries announced the launch of new automotive finance compliances, operational consultancy solutions, and sales. With this move, the company has managed to extend its solutions to consumers.

- In November 2022, Mobilize Financial Services announced a collaboration with Accenture to create Mobilize Insurance which will act as a car insurance specialist, especially for the European market. The new product will provide integrated car insurance for Dacia, Renault, and Alpine customer

The global automotive finance market is led by players like:

- Alan Wire Company

- Prysmian Group

- Ningbo Jintian Copper (Group) Company

- Nexans

- Tongling Jingda Electromagnetic Wire Company Limited

- Aviva Metals

- SH Copper Products Co. Ltd.

- Sumitomo Electric Industries Ltd.

- General Technologies Corporation

- Schneider Electric SE

- Hitachi Metals Ltd.

- Belden Inc.

The global automotive finance market is segmented as follows:

By Provider Type

- OEMs

- Banks

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Finance

- Indirect

- Direct

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed