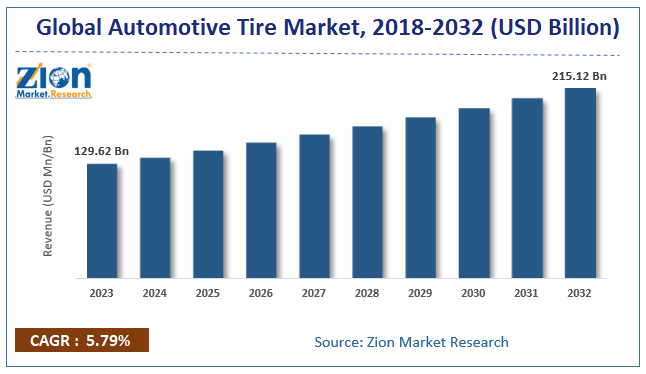

Automotive Tire market is expected to achieve a CAGR of 5.79% from 2024 to 2032.

03-Feb-2025 | Zion Market Research

The global automotive tire market size accrued earnings worth approximately USD 129.62 Billion in 2023 and is predicted to gain revenue of about USD 215.12 Billion by 2032, is set to record a CAGR of nearly 5.79% over the period from 2024 to 2032.

The automotive tire market is a critical segment of the automotive industry, comprising the production, distribution, and sale of tires designed for various vehicles, including passenger cars, trucks, and buses. Tires are essential components providing traction, stability, and safety while driving. They are engineered to withstand various conditions and loads, with specific designs tailored for different applications, such as all-season, winter, and performance tires.

Browse the full “Automotive Tire Market By Vehicle Type (Passenger Cars, LCV (Light Commercial Vehicles), HCV (Heavy Commercial Vehicles)), By Tire Type (Radial, Bias), By Material (13-15, 16-18, 19-21, >21 inches), By Sales Channel(OEM, Aftermarket), and By Region: Global and Europe Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032” Report at https://www.zionmarketresearch.com/report/automotive-tire-market

The automotive tire industry is growing due to increasing vehicle production, advancing tire technology, and rising demand for EV-specific tires.

Market Growth Factors

Several key factors are driving the growth of the automotive tire market:

- Rise in Ride-Sharing & Fleet Services: The expansion of car rental and logistics fleets accelerates tire wear due to higher vehicle utilization, leading to frequent tire replacements and boosting market demand.

- Technological Advancements: Innovations in tire design and materials enhance performance metrics such as fuel efficiency, durability, and safety.

- Growing Electric Vehicle Market: The surge in EV adoption results in specialized tires handling unique demands such as higher torque and weight distribution.

Restraints

- Raw Material Price Volatility: Fluctuations in rubber prices and other materials can impact production costs.

- Environmental Regulations: Stricter regulations regarding tire disposal and recycling may challenge manufacturers.

Automotive Tire Market Share: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Tire Market Size Report |

| Market Size in 2023 | USD 129.62 Billion |

| Market Forecast in 2032 | USD 215.12 Billion |

| Growth Rate | CAGR of 5.79% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | The Goodyear Tire & Rubber Company (USA), Pirelli & C.S.p.A. (Italy), Apollo Tyres Ltd. (India), CEAT Ltd. (Italy), China National Tire & Rubber Co. Ltd. (China), Cooper Tire & Rubber Co., Ltd. (UK), Giti Tire (Singapore), Bridgestone Corporation (Japan), Continental AG (Germany), Michelin (France), Sumitomo Rubber Industries, Ltd. (Japan), Toyo Tire & Rubber Co., Ltd. (Japan), Yokohoma Tire Corporation (Japan), Maxxis International (Taiwan), Cheng Shin Rubber Industry Co. (China), Hangzhou Zhongce Rubber Co., Ltd. (China), Hankook Tire (South Korea), JK Tyre & Industries Ltd. (India), Kumho Tire Co., Inc. (South Korea), Nexen Tire Corporation (South Korea), Nokian Tyres plc (Finland), Qingdao Fullrun Tyre Corp., Ltd. (China) |

| Segments Covered | By Product, By Application, And By Region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2023 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Market Segmentation

The automotive tire market can be segmented based on Tire type, vehicle type, sales channel, and region.

The market is classified into radial tires and bias tires based on type. Radial tires dominate due to their superior performance characteristics, fuel efficiency, and enhanced traction.

Based on vehicle types, the industry is categorized into passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and two-wheelers. The passenger car segment is expected to hold the largest market share due to increasing vehicle ownership, rising urbanization, and growing demand for fuel-efficient and high-performance tires.

On the basis of sales channel, the automotive tire industry is segmented into OEMs (Original Equipment Manufacturers) and aftermarket sales. Aftermarket Sales segment leads the market due to the continuous need for tire replacements, increasing vehicle lifespan, and consumer preference for cost-effective tire solutions.

Europe leads the global automotive tire market due to its well-established automotive industry and high demand for replacement tires. Germany stands out as the largest automotive tire market in Europe, producing over 200 million tires annually. The United Kingdom and France follow closely with production rates of 80 million and 70 million tires per year, respectively. Factors contributing to Europe’s largest market share include stringent safety regulations driving innovation in tire technology, a strong focus on sustainability leading to the adoption of eco-friendly tires, and a growing middle class increasing vehicle ownership. Additionally, the rise of smart tire technology enhances safety and performance metrics in vehicles across the region.

Key Market Players

Prominent companies operating in the automotive tire market include:

- The Goodyear Tire & Rubber Company (USA)

- CEAT Ltd. (Italy)

- Giti Tire (Singapore)

- Apollo Tyres Ltd. (India)

- Cheng Shin Rubber Industry Co. (China)

- Maxxis International (Taiwan)

- JK Tyre & Industries Ltd. (India)

- Kumho Tire Co., Inc. (South Korea)

- Hangzhou Zhongce Rubber Co., Ltd. (China)

- Nokian Tyres plc (Finland)

- Bridgestone Corporation (Japan)

- Michelin (France)

- China National Tire & Rubber Co. Ltd. (China)

- Pirelli & C.S.p.A. (Italy)

- Continental AG (Germany)

- Nexen Tire Corporation (South Korea)

- Cooper Tire & Rubber Co., Ltd. (UK)

- Qingdao Fullrun Tyre Corp., Ltd. (China)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Toyo Tire & Rubber Co., Ltd. (Japan)

- Yokohama Tire Corporation (Japan)

- Hankook Tire (South Korea)

Recent Developments

- In January 2024, Bridgestone announced the acquisition of Bandag to enhance its retreaded tire offerings and expand its market presence in North America.

- Goodyear Tire & Rubber Company revealed plans to invest $200 million in expanding its manufacturing facility in Akron, Ohio.

- Michelin launched a new line of eco-friendly tires made from sustainable materials in March 2024 to meet the growing consumer demand for environmentally conscious products.

Automotive Tire Market: Segments

By Vehicle Type

- Passenger Cars

- LCV (Light Commercial Vehicles)

- HCV (Heavy Commercial Vehicles)

By Tire type

- Radial

- Bias

By Material

- 13-15

- 16-18

- 19-21

- >21 inches

By Sales Channel

- OEM

- Aftermarket

Automotive Tire Market : Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed