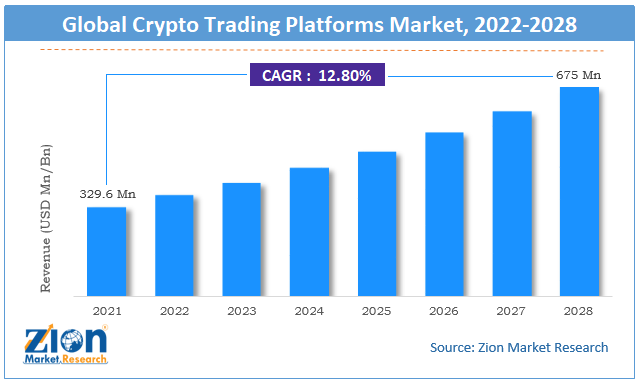

Global Crypto Trading Platforms Market To Generate A Revenue Of USD 675 Million By 2028

04-Aug-2022 | Zion Market Research

The global crypto trading platforms market size was worth around USD 329.6 million in 2021 and is predicted to grow to around USD 675 million by 2028 with a compound annual growth rate (CAGR) of roughly 12.8% between 2022 and 2028.

Cryptocurrency or simply known as crypto refers to a digital or virtual form of currency and uses cryptography for secure transactions. Cryptocurrencies lack a centralized issuing or regulatory authority, unlike those agencies that regulate paper currencies. Decentralized systems are used to transact or record units of cryptos. Cryptocurrency can also be termed as a digital payment system that does not rely on banks or financial institutions to authorize payments. It is a peer-to-peer system that enables transactions from anywhere. Crypto trading platforms are used to buy or make trades with digital money where they exist as digital entries. When transactions are made through platforms supporting cryptos, the data is entered in or recorded in a public ledger. The first cryptocurrency Bitcoin was founded in 2009 and to date remains the top most used form of digital money.

Crypto trading platforms are also termed cryptocurrency exchange and are a business that allows the trade of cryptos for assets such as other digital money or fiat money. There are some platforms that allow trade in assets like stocks. These platforms are eToro and Robinhood which allow users to trade but not withdraw the digital coins. Whereas, some dedicated platforms like Coinbase and Binance allow for withdrawals as well. Exchanges occurring through crypto trade platforms let the user transfer the cryptocurrency to crypto wallets. Some are able to convert the digital money to certain anonymous cards that can be further used to withdraw money from ATMs across the globe. Generally, crypto trading firms operate from outside the western countries in order to avoid regulatory bodies and stringent laws laid down by western governments.

Covid-19 led to increased awareness amongst the general population about cryptocurrencies. During the strict lockdown phase that was imposed worldwide, there was a higher trend of searches on online search engines about cryptocurrencies and systems supporting their trade. A general shift of curiosity can be witnessed amongst end-users related to learning more about cryptos and their potential benefits. The global market may reap excellent benefits due to this rise in information about digital money.

Market Growth Factors

The global crypto trading platforms market may register higher growth owing to these platforms receiving funds from leading fintech companies. In August 2021, PNC bank announced that it will be partnering with Coinbase which is a leading crypto trading platform. PNC is the fifth largest commercial bank in the USA and Coinbase is an American publicly traded company that facilitates cryptocurrency exchange and trade. Such partnerships are expected to aid the upcoming digital money-related platforms to penetrate deeper thus propelling global market share. A large section of the world’s population is now using cryptocurrencies and the number is expected to grow further in the coming years. Bitcoin, the world’s most famous cryptocurrency exchange platform has over 180 million users as of 2022. India has registered more than 15 million users in a short span of time. Nigeria, a developing economy boasts of 6.3% of its total population being registered as cryptocurrency users. These high numbers are indicative of the popularity of crypto trading platforms globally.

The ambiguity surrounding the understanding of cryptocurrency may impede the global market growth.

The backing received from established firms is expected to provide growth opportunities in the global market.

The security concerns related to digital money may create challenges for market growth.

Market Segmentation

The global crypto trading platforms market is segmented based on cryptocurrency end-user, type, and region.

Based on end-users, the global market segments are credit unions, fintech companies, banks, and others. Fintech companies are projected to generate the highest revenue in the global market. More than 9 cryptocurrency-related companies made it to the Forbes Fintech 50 list of 2022

Based on cryptocurrency type, the global market segments are Ethereum, Bitcoin, Solanda, Cardona, and others. The global market is dominated by Bitcoin. It is the original cryptocurrency, one of the first digital currencies, and continues to lead the segment with the highest user database popularity. Bitcoin’s market capitalization currently stands at 42% of the total market share.

North America dominated the global crypto trading platforms market in 2021 and is expected to generate the highest revenues during the projection period. In 2021, the USA generated more than USD 47 billion in realized crypto gains. The high growth is directly related to the advancements in the field of digital technologies in regions like Canada and the USA. In 2020, the information technology sector in the USA spent over USD 3.9 trillion to aid digital transformation. Such activities are anticipated to aid regional growth.

Europe and Asia-Pacific are expected to generate significant revenues in the global market share. China led the Asia-Pacific market in the last few years since it was one of the early enthusiasts who encouraged the adoption of cryptocurrency. It was rated as the trading and mining capital for Bitcoin. However, in 2018, the government banned all forms of cryptocurrency in the region and since then India has been leading the regional growth with the user database increasing day by day.

Crypto Trading Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Crypto Trading Platforms Market Research Report |

| Market Size in 2021 | USD 329.6 Million |

| Market Forecast in 2028 | USD 675 Million |

| Growth Rate | CAGR of 12.8% |

| Number of Pages | 206 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Bitstamp, FTX, Coinbase, eToro, AirSwap, BlockFi, and Binance. |

| Segments Covered | By Cryptocurrency Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Key Market Players

The global crypto trading platforms market is led by players like

- Bitstamp

- FTX

- Coinbase

- eToro

- AirSwap

- BlockFi

- Binance.

Recent Developments:

- In June 2021, Kraken announced the launch of its mobile application in order to bolster crypto access. The mobile application promises to offer an easy-to-use interface along with an upgraded secure way to invest in cryptocurrencies. It also offers services for investors at every level, from beginner to advanced investors

- In July 2022, Global Inc. criticized the Securities and Exchange Commission (SEC) for its adopted approach to policing crypto exchange platforms. Questions were raised on the SEC’s prospects of working towards convincing Coinbase, the largest crypto trading platform to adhere to the investor-protection rules laid down by SEC.

Browse the full “Global Crypto Trading Platforms Market By Cryptocurrency Type (Ethereum, Bitcoin, Solanda, Cardano, and Others), By End-User (Credit Unions, Fintech Companies, Banks, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 – 2028.” Report at https://www.zionmarketresearch.com/report/global-crypto-trading-platforms-market

The global crypto trading platforms market is segmented as follows:

By Cryptocurrency Type

- Ethereum

- Bitcoin

- Solanda

- Cardano

- Others

By End-User

- Credit Unions

- Fintech Companies

- Bank

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed