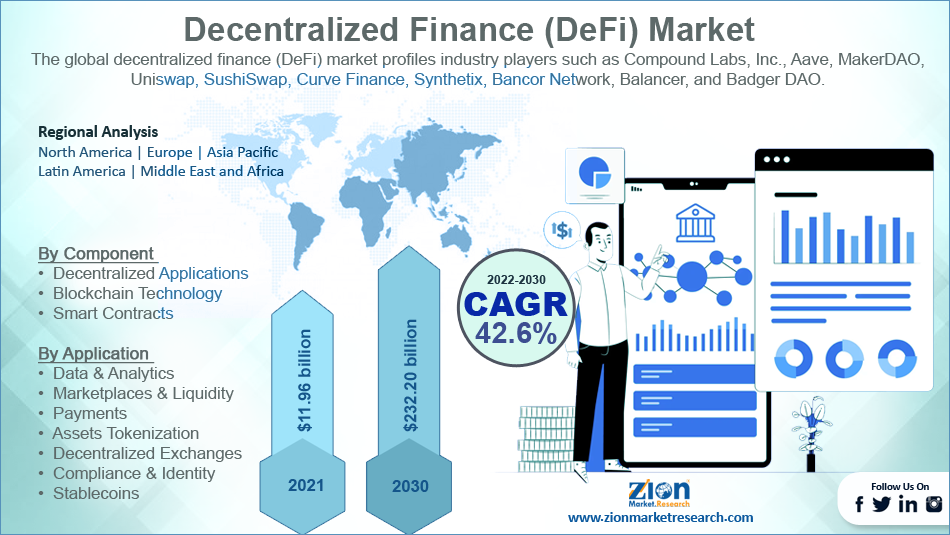

Global Decentralized Finance (DeFi) Market Revenue To Hit Nearly $232.20 Billion By 2030

20-Jan-2023 | Zion Market Research

The global Decentralized finance (DeFi) industry size was nearly $11.96 billion in 2021 and is set to increase to about $232.20 billion by 2030 with a CAGR of nearly 42.6% between 2022 and 2030.

Decentralized finance (DeFi) provides financial instruments and proves to be the best alternative for brokerages, banks, and exchanges. Moreover, DeFi tools enable people to either borrow or lend funds, venture into price changes on assets by using derivatives, and trade cryptocurrencies. In addition to this, DeFi offers insurance against risks and helps end-users earn interest on savings accounts. Some of the applications of DeFi include promoting high-interest rates.

The growth of the global decentralized finance (DeFi) industry over the forecast timespan can be attributed to its robust scalability and security and improved functionalities. With a large number of people entering the digital asset business, the market for decentralized finance (DeFi) is predicted to gain traction in the years ahead. A prominent increase in e-sports activities globally is a key growth driver for the global decentralized finance (DeFi) market.

Nonetheless, coding errors and hacking have been common in DeFi and this can put brakes on the expansion of the global market. Apart from this, the expansion of DeFi’s infrastructure is in its nascent stage and it is not insured. Moreover, DeFi tools are associated with specific risks and hence can pose a threat to the growth of the global market. However, the growing use and popularity of blockchain-based prediction tools will open new avenues of growth in the global decentralized finance (DeFi) market in the years ahead.

The global decentralized finance (DeFi) market is divided into component, application, and region.

The global decentralized finance (DeFi) market is divided into component, application, and region.

On the basis of component, the global decentralized finance (DeFi) industry are sectored into decentralized applications, smart contracts, and blockchain technology segments. Furthermore, the decentralized applications segment is anticipated to register notable growth over the forecast period. The growth of the segment over 2022-2030 can be owing to a rise in decentralized fiscal operations such as insurance, investing, lending, and banking. Apart from this, centralized finance tools can become decentralized with the help of smart contracts, thereby boosting the expansion of the smart contracts segment.

Based on the application, the global decentralized finance (DeFi) market is segmented into data & analytics, compliance & identity, marketplaces & liquidity, assets tokenization, payments, decentralized exchanges, and stablecoins. Moreover, the payments segment is predicted to register the fastest CAGR in the forecasting years. The segmental growth can be attributed to the use of peer-to-peer payment methods in the DeFi industry. Apart from this, DeFi payment helps financial institutions in improving their business infrastructure and efficiently serve wholesale as well as retail customers.

The Asia-Pacific decentralized finance (DeFi) market is predicted to record the highest CAGR over the forecast timeframe owing to strong economic expansion and the use of new technologies in Asian countries. In addition to this, there are many platforms operating in blockchain technology in the Asia-Pacific zone. In the first half of 2022, Huobi Global, an online asset exchange organization, introduced Ivy Blocks, which is a new investment unit of Ivy Blocks focusing on Web3 as well as DeFi projects. These strategic initiatives will help in massive contribution to the growth of the regional market size in the forthcoming years.

This review is based on a report by Zion Market Research, titled “Decentralized Finance (DeFi) Market By Component (Decentralized Applications, Smart Contracts, and Blockchain Technology), By Application (Data & Analytics, Marketplaces & Liquidity, Payments, Assets Tokenization, Decentralized Exchanges, Compliance & Identity, and Stablecoins), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2022 – 2030.”- Report at https://www.zionmarketresearch.com/report/decentralized-finance-market

Recent Developments:

- In January 2022, Metamask, a Web3 wallet firm, declared the beta launch of Ethereum staking features that can be availed through Lido’s liquid staking solutions. Reportedly, end-users who want to earn staking prizes can choose any one of the staking providers from the interface of Web3 wallet. The initiative will help in boosting the expansion of the global decentralized finance (DeFi) market.

- In January 2022, Blue, a firm offering identity verification solutions for DeFi traders, launched $3.2 million in funding from stealth mode. The strategic move will be used for bringing a massive improvement in DeFi protocol identity verification activities.

- In the first half of 2021, two firms Sheesha Finance and EQIFI joined hands to help end-users access DeFi tool as well as global banking services on a single platform used for carrying out investing, lending, and borrowing activities.

Key participants profiled in the global decentralized finance (DeFi) industry include:

- Compound LabsInc.

- Balancer

- Aave

- MakerDAO

- Bancor Network

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Badger DAO.

The global Decentralized Finance (DeFi) market is segmented as follows:

By Component

- Decentralized Applications

- Blockchain Technology

- Smart Contracts

By Application

- Data & Analytics

- Marketplaces & Liquidity

- Payments

- Assets Tokenization

- Decentralized Exchanges

- Compliance & Identity

- Stablecoins

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed