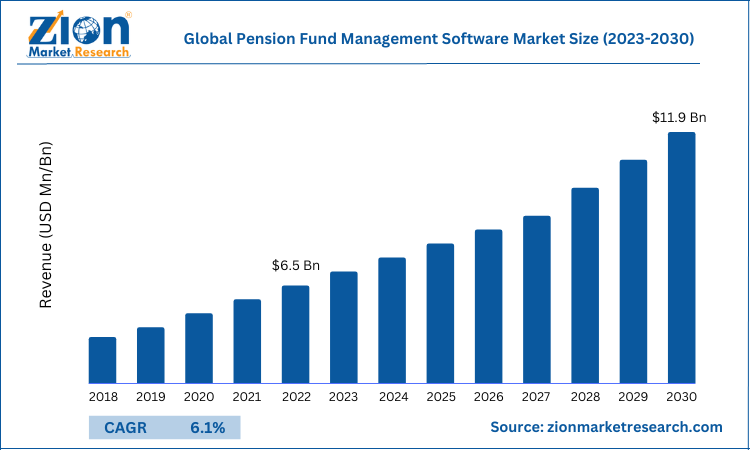

Global Pension Fund Management Software Market Is Set to Reach $11.9 Bn By 2030

20-Feb-2023 | Zion Market Research

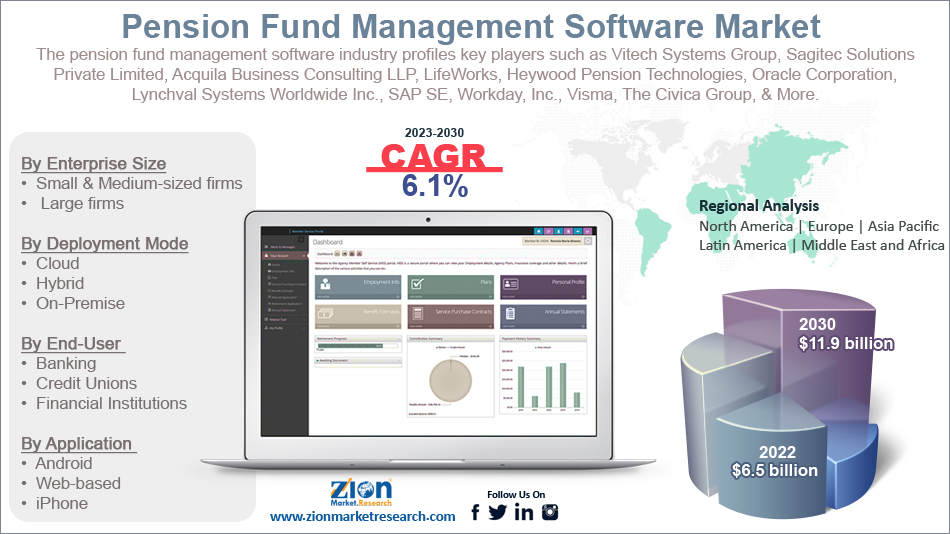

The global pension fund management software industry size was nearly $6.5 Billion in 2022 and is set to reach $11.9 Billion by 2030 with a CAGR of nearly 6.1% between 2023 and 2030.

A pension fund management software is a completely integrated system, designed for providing updated asset, liability, and risk information regularly to the end-users. Through this software, the end-users have in-depth information as to how they can aptly manage their pension plans and proficiently handle their direct benefit pension scheme. For example, the Asset Liability Suite Direct Benefit pension fund management software provides the best results for pension programs. A large number of elderly populations face huge pressure in controlling costs and risks associated with direct benefit (DB) pension programs, and the Asset Liability Suite Direct Benefit pension fund management software assists them in effectively handling the planning and reporting of their pension plans.

The need for reducing workload and less availability of workforce will boost the global pension fund management software market trends. Growing need for reducing maintenance and implementation costs will expand the scope of the growth of the global market. Massive penetration of cloud hosting solutions in the software industry has contributed notably towards the expansion of the pension fund management software market across the globe. Moreover, there is a large number of firms creating pension fund management software across the globe. This, in turn, is likely to translate into immense growth in the size of the global pension fund management software industry in the years to come.

However, fluctuating laws pertaining to pension funds and the easy availability of alternative software can impede the expansion of the global pension fund management software industry. Nevertheless, the huge allocation of funds for software automation activities along with the introduction of new software products will open new opportunities for growth for the global industry.

The global pension fund management software market is divided into application, deployment mode, enterprise size, end-user, and region.

Based on the enterprise size, the global pension fund management software market is divided into small & medium-sized firms and large firms segments. Moreover, the large firms segment is predicted to contribute majorly towards the global market share over the forecast timeline with giant software manufacturers adding new features to their products for helping large firms continuously handle their big data.

In terms of end-user, the global pension fund management software industry is bifurcated into credit unions, banking, and financial institutions segments. In addition to this, the banking segment, which held a major share of the global industry in 2022, is anticipated to dominate the end-user segment during the forecast period. The growth of this segment from 2023 to 2030 can be ascribed to the massive use of pension fund management software in banks with the surge in online banking activities.

On basis of deployment mode, the global pension fund management software market is sectored into hybrid, cloud, and on-premise segments. Moreover, the cloud segment is predicted to register large-scale growth over 2023-2030 due to the integration of cloud and pension fund management software. Furthermore, the huge demand for data security has led to the immense use of cloud in the pension fund management software market across the globe.

The North American pension fund management software industry is anticipated to register a remarkable surge over the forecast timespan. The regional market expansion over the forecast timeline can be owing to a surge in the elderly population in the countries such as Canada and the U.S. Apart from this, the thriving software sector in these countries will further contribute to the regional market growth. Increase in retirement savings in the U.S. will prompt regional market growth trends.

This review is based on a report by Zion Market Research, titled “Pension Fund Management Software Market By Application (Android, Web-based, and iPhone), By Deployment Mode (Cloud, Hybrid, and On-Premise), By Enterprise Size (Small & Medium-sized firms and Large firms), By End-User (Banking, Credit Unions, and Financial Institutions), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 – 2030.”- Report at https://www.zionmarketresearch.com/report/pension-fund-management-software-market

Recent Breakthroughs:

- In the last month of 2022, Milliman, an industry leading consulting & actuarial company, launched the latest version of Arius insurtech software solution, a complete solution for examining casualty reserves & determining loss costs. The tool will help insurance analysts and actuaries locate reports in the system and will provide flexibility to them when they perform actual versus expected analysis. The new software will offer Milliman’s Arius Enterprise system easy access to more data for using it in reporting, analytics, and drivers for change analysis. The move will contribute lucratively towards the growth of the pension fund management software market in the U.S.

- In the second half of 2022, Smart, the key provider of retirement technology tools across the globe, introduced a technology tool referred to as Keystone by Smart. The new tool will be offered to the clients of private and public sectors in the global pensions industry. Reportedly, Its platform as a service offering will be provided to regional governments, banks, national governments, pension providers, trade associations, affinity groups, and asset managers across the UK. The initiative will generate a strong base for the pension fund management software market in the UK and Europe.

Key participants in the global pension fund management software market include:

- Workday Inc.

- Vitech Systems Group

- Sagitec Solutions Private Limited

- Visma

- Lynchval Systems Worldwide Inc.

- Acquila Business Consulting LLP

- LifeWorks

- Heywood Pension Technologies

- The Civica Group

- Oracle Corporation

- SAP SE

- LRS Retirement Solutions.

The global pension fund management software market is segmented as follows:

By Enterprise Size

- Small & Medium-sized firms

- Large firms

By Deployment Mode

- Cloud

- Hybrid

- On-Premise

By End-User

- Banking

- Credit Unions

- Financial Institutions

By Application

- Android

- Web-based

- iPhone

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed