Global IoT in Banking & Financial Services Market Is Set For A Rapid Growth And Is Anticipated To Reach USD 101.59 Billion by 2032

17-Apr-2024 | Zion Market Research

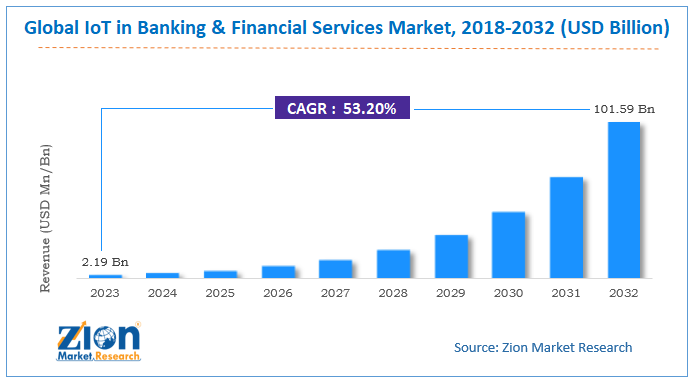

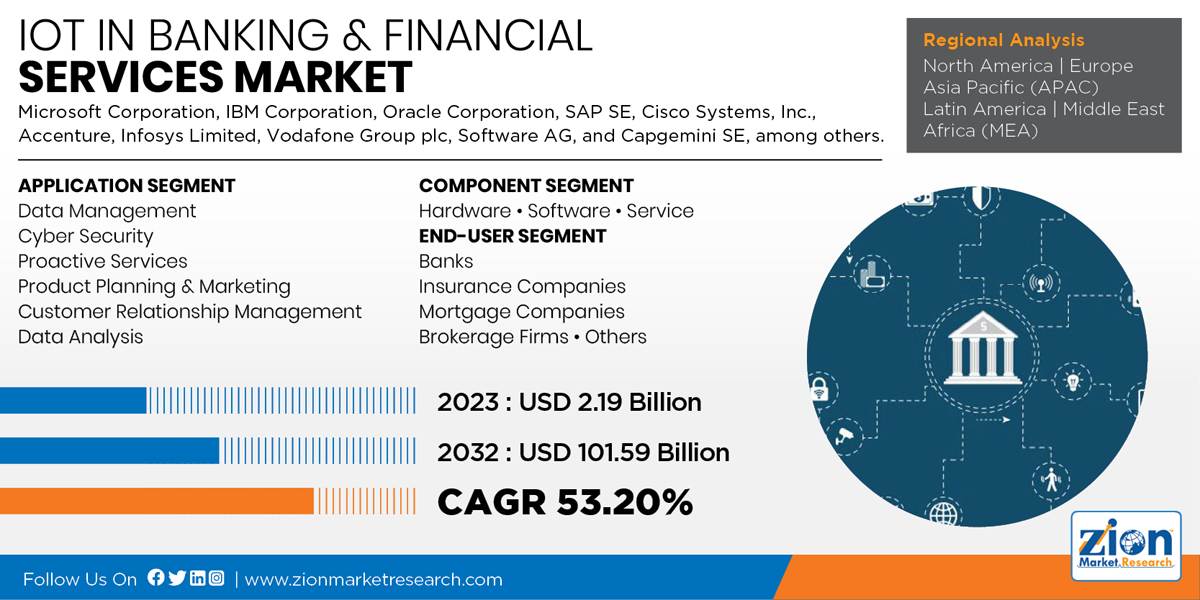

Zion Market Research has published a new report titled “IoT in Banking & Financial Services Market By Application (Data Management, Cybersecurity, Proactive Services, Product Planning & Marketing, Customer Relationship Management, And Data Analysis) By Component (Hardware, Software, And Service), And By End-User (Banks, Insurance Companies, Mortgage Companies, Brokerage Firms, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024–2032”. According to the report, the global IoT in banking & financial services market accounted for USD 2.19 billion in 2023 and is predicted to grow to around USD 101.59 billion by 2032, at a CAGR of 53.20% between 2024 and 2032.

IoT refers to the network of physical objects that are connected over the internet for transferring information without human intervention. These devices utilize embedded technology for communication. IoT is now being used in for banking and financial services to save time and reduce additional costs in various operations, such as accounts handling, payments, data management and verification, fraud detection, etc.

Browse the full "IoT in Banking & Financial Services Market By Application (Data Management, Cybersecurity, Proactive Services, Product Planning & Marketing, Customer Relationship Management, And Data Analysis) By Component (Hardware, Software, And Service), And By End-User (Banks, Insurance Companies, Mortgage Companies, Brokerage Firms, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024–2032" Report at https://www.zionmarketresearch.com/report/iot-in-banking-financial-services-market

Increasing number of smartphone users in the last decade is likely to propel the IoT in banking & financial services market. Various banks and other financial institutes are offering mobile banking and online payments, among other services. In 2016, the number of smartphone users globally was 2.1 billion as compared to 1.86 billion in 2015. Considering this growth, financial institutes are likely to adopt IoT to streamline their services and payment processes. In 2016, Santander announced its plan to offer mortgage schemes to their customers on smartphones along with providing the facility to scan and verify clients required documents on the bank’s mobile app.

Growing investments made by insurance firms in IoT are anticipated to fuel the IoT in banking & financial services market during the forecast timeframe. In 2016, insurance companies invested USD 711 million, accounting for 44% of the insurtech investments as compared to 10% in 2015. Furthermore, insurance technology startups have been successful in garnering investments. In 2016, Coya, a European digital insurance provider, raised about USD 10 million.

The IoT in banking & financial services market is fragmented based on component, application, and end-user. By component, this market includes hardware, software, and service. The software segment is projected to dominate the IoT in banking & financial services market during the forecast timeframe, due to the introduction of various online banking and payment platforms on smartphones. By application, the IoT in banking & financial services market is divided into data management, cybersecurity, proactive services, product planning and marketing, customer relationship management, and data analysis. By end-user, this market is divided into banks, insurance companies, mortgage companies, brokerage firms, and others. Mortgage companies are projected to grow at a noteworthy rate during the estimated time period. IoT helps the mortgage companies to monitor their condition in real-time and conduct remote maintenance of properties.

Europe is likely to witness a considerable growth in the IoT in banking & financial services during the estimated timeframe, due to increasing investments made in banking technology by various European nations. UK, Germany, France, and Russia are projected to contribute significantly toward this market during the forecast time period. The Middle East and Africa are likely to hold a significant market share by 2032, due to the rising adoption of IoT in UAE and Saudi Arabia, among other economically advanced nations in the region.

Some major players of the global IoT in banking & financial services market are Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Cisco Systems, Inc., Accenture, Infosys Limited, Vodafone Group Plc, Software AG, and Capgemini SE among, others.

This report segments the global IoT banking & financial services market as follows:

Global IoT in Banking & Financial Services Market: Application Segment Analysis

- Data Management

- Cyber Security

- Proactive Services

- Product Planning & Marketing

- Customer Relationship Management

- Data Analysis

Global IoT in Banking & Financial Services Market: Component Segment Analysis

- Hardware

- Software

- Service

Global IoT in Banking & Financial Services Market: End-User Segment Analysis

- Banks

- Insurance Companies

- Mortgage Companies

- Brokerage Firms

- Others

Global IoT in Banking & Financial Services Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed