Beer Market Size, Share, Growth Report 2032

Beer Market - Size, Share, Trends By Product Type (Lager, Ale, Stout & Porter, Malt, and Others), By Packaging (Metal Can and Glass Bottles), By Category (Premium beer and Regular beer), By Distribution Channel (Off-trade channels and On-trade channels) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028-

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 750.00 Billion | USD 814.54 Billion | 6.00% | 2021 |

Beer Market Size: Industry Analysis

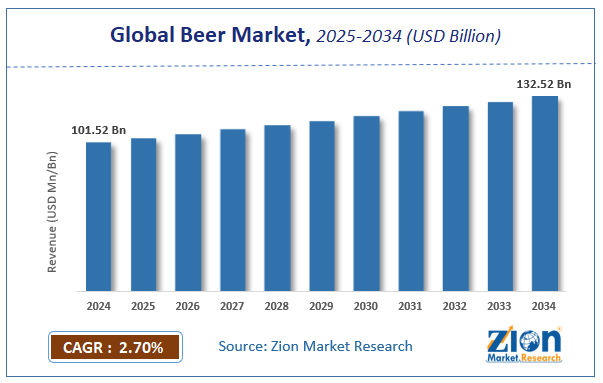

The global beer market size was worth around USD 610.34 billion in 2021 and is estimated to grow to about USD 814.54 billion by 2028, with a compound annual growth rate (CAGR) of approximately 3.4 percent over the forecast period. The report analyzes the beer market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the beer market.

To know more about this report, Request A Sample Copy.

Beer Market: Overview

Beer is among the most popular alcoholic drinks on the planet, it is an alcoholic drink produced by fermentation procedure. It is generally prepared from hops, water, and a variety of cereal grains such as rice, wheat, maize, and rye. Depending on the type and composition of the formulation, the alcohol percentage ranges from less than 3% to 40% alcohol by volume.

COVID-19 Impact:

The COVID-19 pandemic severely impacted the global beer market. To begin with, shut down of restaurants, bars, pubs, and wine shops to halt the spread of the infection significantly dropped the sale of beer in the world. Secondly, a slowdown in manufacturing processes due to supply chain restraints, raw materials, and labor shortages caused low product sales during the pandemic period. However, huge demand for beer around the world is likely to surge the market with the occurrence of pre-pandemic conditions in the market.

Growth Drivers

Growing preference for low-alcoholic drinks may boost the beer consumption

Due to increased exposure and digitization, consumers' preferences and lifestyle choices have transformed in recent years. Alcohol has become a component of social relations as a result of urbanization and shifts in cultural viewpoints, as well as technical improvements. Due to a rise in disposable money and a demand for low-alcohol beverages, the beer business has gained popularity and social acceptance in recent years. The introduction of low- and no-alcohol beer variants, as well as online availability and convenience of delivery to doorsteps in some areas, are all moving the market forward. All these variables have played a crucial role in product diversity, clearing the path for low-alcoholic beverages to arise.

Restraints of Beer Market

Strict rules and regulations imposed by many governments to sell and advertise alcoholic beverages may hamper the market growth.

Beer is an alcoholic beverage and if drank in excess, alcoholic beverages are known to be addicting as well as harmful to one's health. The rise in the number of people addicted to alcohol has been a major source of concern for governments across the world. As a result, several countries have enacted strict laws governing the sale and distribution of these items. Furthermore, advertising and promotion of such items are restricted, limiting the marketing tactics accessible to producers. Furthermore, several governments back campaigns and non-governmental organizations (NGOs) that oppose the consumption of such beverages. These variables will operate as key roadblocks to market expansion.

Beer Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Beer Market Research Report |

| Market Size in 2021 | USD 610.34 Billion |

| Market Forecast in 2028 | USD 814.54 Billion |

| Compound Annual Growth Rate | CAGR of 11.1% |

| Number of Pages | 180 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Innovega Inc, Novartis AG, Samsung Electronics Co., Ltd., Google Inc., Sensimed AG, Sony Corporation, Liner Technologies, EP Global Communications, Inc., Analog Devices, Knowles, InvenSense, NXP Semiconductor, Rockwell Automation, Banner Engineering, Atmel, Murata Manufacturing, Nanomix, Hitachi, TOWA, STMicroelectronics, and Texas Instruments. |

| Segments Covered | By Product Type, By Category, By Packaging, By Distribution Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Market Opportunities

Crafted beers with bigger flavors and aromas offer a great opportunity for market expansion.

Major players are investing heavily in the development of craft beers that have different flavors and aromas to expand their consumer base and maintain a strong position in the market. With growing demand from millennials for such products, the market is expected to have beneficial opportunities for the growth of the global beer market during the forecast period.

Challenges.

Increasing trends for non-alcoholic beverages pose the biggest challenge for the beer market.

The beverage sector is continually undergoing huge transformations, especially with the rise of healthier parts of alcohol. Because consumers are becoming more aware of the considerable health concerns connected with alcohol usage, beverages that are low in alcohol content or devoid of alcohol are becoming more popular than typical alcoholic drinks. Non-alcoholic drinks are growing increasingly popular across the world, which is in line with shifting consumer attitudes toward alcohol usage.

Market Segmentation

The global beer market is categorized based on product type, category, packaging, distribution channel, and region. The product type segment of the market comprises ale, malt, large, stout & porter, and others. Based on the category, the market is segregated into premium beer and regular beer. Among these, the regular beer segment holds nearly 60 percent share whereas, the premium beer segment is expected to grow at a rapid rate over the forecast period. By packaging, the global market is bifurcated into metal cans and glass bottles. The distribution channel segment of the market is categorized into off-trade channels and on-trade channels. Among these, off-trade channels hold a dominant share of the market.

Recent Developments

- In April 2021, B9 Beverages, the Indian company behind the Bira 91 beer brand, announced the launch of a slew of new beers as well as the re-launch of numerous existing ones.

- In March 2021, BrewDog, the world-famous Scottish beer brand, opens its first outlet in India.

Regional Landscape

Europe is expected to lead the global beer market with a market share touching 40 percent. Key factors such as the large population of beer consumers, increasing beer consumption in the younger generation, and the presence of key beer manufacturers are fueling the market growth in European countries. Beer is an essential component of culture, tradition, and nutrition in all European countries. The European Union is one of the world's most important beer-producing areas. According to The Brewers of Europe, over 365,000 hectoliters of beer were consumed in 2019, made by over 11,050 brewers across Europe. The European beer business is a relatively diversified sector in terms of structure. It consists mostly of small and medium-sized businesses, such as microbreweries and breweries that operate on a local, regional, or national scale, as well as significant European brewers that are global leaders in their professions. Asia Pacific is the fastest-growing market for beer. The number of beer consumers is increasing rapidly, and besides availability of a large number of products and sale channels are contributing to the speedy growth of the market in APAC.

Competitive Landscape

Key players with major market share operating in the global beer market include

- Heineken N.V.

- Diageo Plc

- Carlsberg A/S

- China Resources Breweries

- Anheuser-Busch InBev

- Beijing Yanjing Beer Group Corporation

- Kirin Holdings Co. Ltd

- Asahi Group Holdings Ltd

- Boston Beer Company

- Molson Coors Beverage Company

- among others.

The Global Beer market is segmented as follows:

By Product Type

- Ale

- Malt

- Large

- Stout & porter

- Others

By Category

- Premium beer

- Regular beer

By Packaging

- Metal can

- Glass bottle

By Distribution Channel

- Off-trade channels

- On-trade channels

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Growing preference for low alcoholic drinks may boost beer consumption is majorly driving the global beer market. Due to a rise in disposable money and a demand for low-alcohol beverages, the beer business has gained popularity and social acceptance in recent years. The introduction of low- and no-alcohol beer variants, as well as online availability and convenience of delivery to doorsteps in some areas, are all moving the market forward. all these variables have played a crucial role in product diversity, clearing the path for low alcoholic beverages to arise.

According to the Zion Market Research report, the global beer market was worth about 610.34 (USD billion) in 2021 and is predicted to grow to around 814.54 (USD billion) by 2028, with a compound annual growth rate (CAGR) of around 3.4 percent.

Europe is expected to lead the global beer market with the market share touching 40 percent. Key factors such as large population of beer consumers, increasing beer consumption in the younger generation, and the presence of key beer manufacturers are fueling the market growth in European countries. Beer is an essential component of culture, tradition, and nutrition in all European countries. The European Union is one of the world's most important beer-producing areas. According to The Brewers of Europe, over 365,000 hectoliters of beer were consumed in 2019, made by over 11,050 brewers across Europe.

Key players with major market share operating in the global beer market include Heineken N.V., Diageo Plc, Carlsberg A/S, China Resources Breweries, Anheuser-Busch InBev, Beijing Yanjing Beer Group Corporation, Kirin Holdings Co. Ltd, Asahi Group Holdings Ltd, Boston Beer Company, and Molson Coors Beverage Company, among others.

Beer is an alcoholic beverage that is traditionally brewed with malted barley as the primary grain, along with hops, yeast, and water.

Choose License Type

List of Contents

Market Size: Industry AnalysisOverviewCOVID-19 Impact:Growth DriversGrowing preference for low-alcoholic drinks may boost the beer consumptionRestraints of MarketStrict rules and regulations imposed by many governments to sell and advertise alcoholic beverages may hamper the market growth.Market Report Scope:Market OpportunitiesChallenges.Market SegmentationRecent DevelopmentsRegional LandscapeCompetitive Landscape The Global market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed