Blockchain in Energy Market Trend, Share, Growth, Size and Forecast 2032

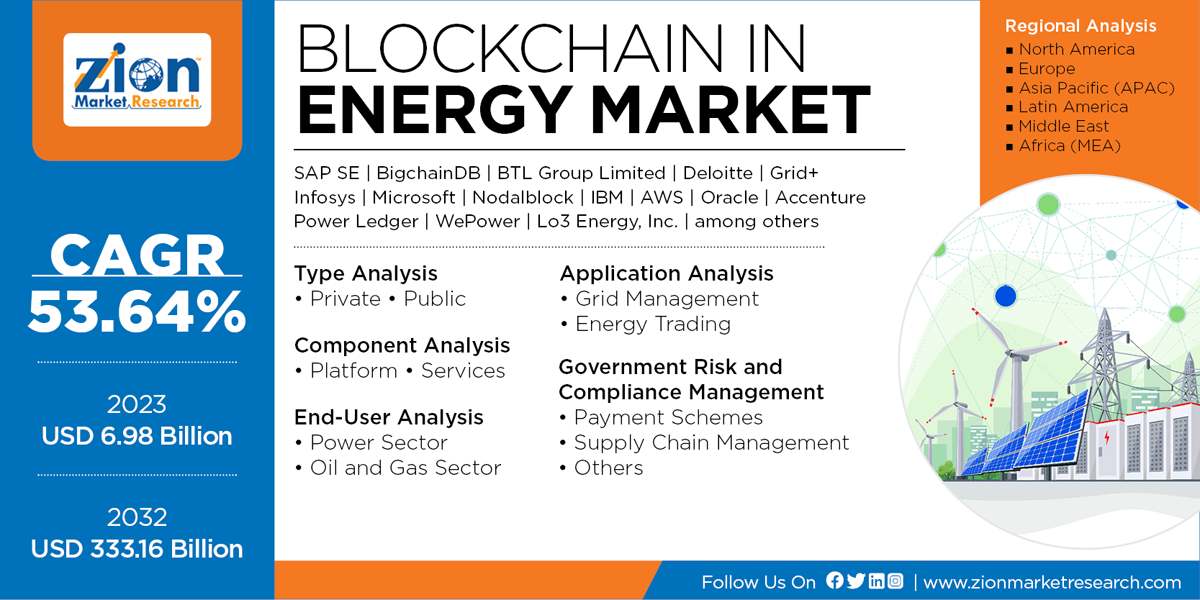

Blockchain in Energy Market by Type (Public and Private), by Component (Platform and Services), by End-User (Power Sector and Oil and Gas Sector), and by Application (Grid Management, Energy Trading, Government Risk and Compliance Management, Payment Schemes, Supply Chain Management, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

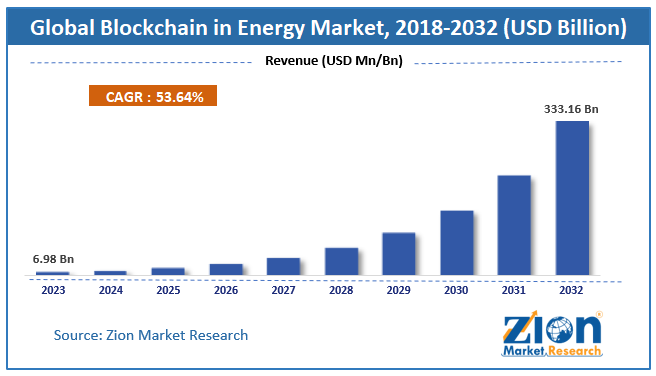

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.98 Billion | USD 333.16 Billion | 53.64% | 2023 |

Blockchain in Energy Market: Industry Perspective

The global Blockchain in Energy Market size was worth around USD 6.98 Billion in 2023 and is predicted to grow to around USD 333.16 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 53.64% between 2024 and 2032.

Blockchain in Energy Market Overview

Blockchain technology has the potential to revolutionize the energy industry by providing a secure and transparent platform for transactions and data management. The blockchain can be applied in the energy market for peer-to-peer energy trading, renewable energy certificates, grid management, supply chain management, and smart contracts.

Blockchain can be also termed as decentralized ledger technology. It has no core system or a central server. The authentication of these servers is handled publicly. It helps people to trade energy among themselves. The applications of blockchain in the energy market include payment schemes, grid management, governance risk, and compliance management, energy trading, and supply chain management.

Blockchain in Energy Market Growth Dynamics

Blockchain technology has the potential to enable the development of decentralized energy marketplaces in which individuals and businesses can buy and sell energy directly to one another. This could reduce the need for centralized utilities, resulting in a more efficient and resilient energy system. Renewable energy certificates (RECs) are tradable certificates that represent the environmental characteristics of renewable energy generation. Blockchain technology can provide a safe and transparent platform for tracking REC ownership and transfer, potentially increasing their value and encouraging investment in renewable energy projects.

The increase in the development of blockchain technology in the energy sector in the past few years is likely to drive this market in the future. The global energy prices are influenced by the availability of renewable energy at low costs. Various blockchain-based enterprises are working under customized energy solutions to fulfill the global energy demands. For instance, Elec-Tron, Inc., one of the key players of the blockchain in the energy market, has contributed to various developments in the blockchain-based smart agreement and supply chain management platform that is used in the oil and gas industry. Drift, one of the major players, is making a platform to form a centralized energy market for its customers. Though this technology is in its early stage, various startups and companies are working to make this technology adoptable in the market. However, the lack of a clear set of regulatory standards and uncertainty of the regulatory landscape might hinder this market. Nevertheless, advancements in the international trade and supply chain management are expected to provide many opportunities for the key players working in the global blockchain in energy market.

The report covers a forecast and an analysis of the blockchain in energy market on a global and regional level. The study provides historical data for 2017, 2018, and 2019 along with a forecast from 2023 to 2032 based on revenue (USD Million). The study includes drivers and restraints for the blockchain in energy market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the blockchain in energy market on a global level.

Request Free Sample

Request Free Sample

Global Blockchain in Energy Market: Segmentation

The study provides a decisive view on the blockchain in energy market by segmenting the market based on type, application, component, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2023 to 2032.

Based on type, the market is segmented into private and public. By component, this market is divided into platform and services.

By end-user, this market is segmented into power and oil and gas sectors. The application segment includes grid management, energy trading, government risk, and compliance management, payment schemes, supply chain management, and others.

By region, the global blockchain in energy market includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Europe held the most significant share of the blockchain in energy market, in terms of volume, in 2023. This can be due to the presence of major market players that are contributing toward substantial developments in this regional market. The North American blockchain in energy market is expected to witness significant growth in the upcoming years.

Blockchain in Energy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Blockchain in Energy Market Size Report |

| Market Size in 2023 | USD 6.98 Billion |

| Market Forecast in 2032 | USD 333.16 Billion |

| Growth Rate | CAGR of 53.64% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | SAP SE, BigchainDB, BTL Group Limited, Deloitte, Grid+, Infosys, Microsoft, Nodalblock, IBM, AWS, Oracle, Accenture, Power Ledger, WePower, and Lo3 Energy, Inc., among others |

| Segments Covered | By Equipment, By Application, By end-user, and By region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The key players in the global Blockchain in Energy Market are -

The report covers a detailed competitive outlook including the market share and company profiles of the key participants operating in the global blockchain in energy market are-

- SAP SE

- BigchainDB

- BTL Group Limited

- Deloitte

- Grid+

- Infosys

- Microsoft

- Nodalblock

- IBM

- AWS

- Oracle

- Accenture

- Power Ledger

- WePower

- Lo3 Energy

- among others.

This report segments the global blockchain in energy market into:

Blockchain in Energy Market: Type Analysis

- Private

- Public

Blockchain in Energy Market: Component Analysis

- Platform

- Services

Blockchain in Energy Market: End-User Analysis

- Power Sector

- Oil and Gas Sector

Blockchain in Energy Market: Application Analysis

- Grid Management

- Energy Trading

Government Risk and Compliance Management

- Payment Schemes

- Supply Chain Management

- Others

Blockchain in Energy Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Blockchain in Energy Market size was worth around USD 6.98 Billion in 2023 and is predicted to grow to around USD 333.16 Billion by 2032

compound annual growth rate (CAGR) of roughly 53.64% between 2024 and 2032.

The largest share of the Blockchain in Energy Market is held by Asia Pacific. Developing countries of Asia Pacific such as China, Japan, and India will be dominating the market scenario mainly due to the rising constructional activities. The growth of Asia-Pacific region is expected to be followed by the Middle East and North America. Also, significant growth is expected from Western Europe owing to the developments taking place in this region especially in countries such as Italy, Germany, the U.K, France, and Spain. However, growth in Africa, Latin America, and Eastern Europe is anticipated to be moderate over the forecast period.

SAP SE, BigchainDB, BTL Group Limited, Deloitte, Grid+, Infosys, Microsoft, Nodalblock, IBM, AWS, Oracle, Accenture, Power Ledger, WePower, and Lo3 Energy, Inc., among others

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed