Femtech Market Growth, Size, Share, Trends, and Forecast 2030

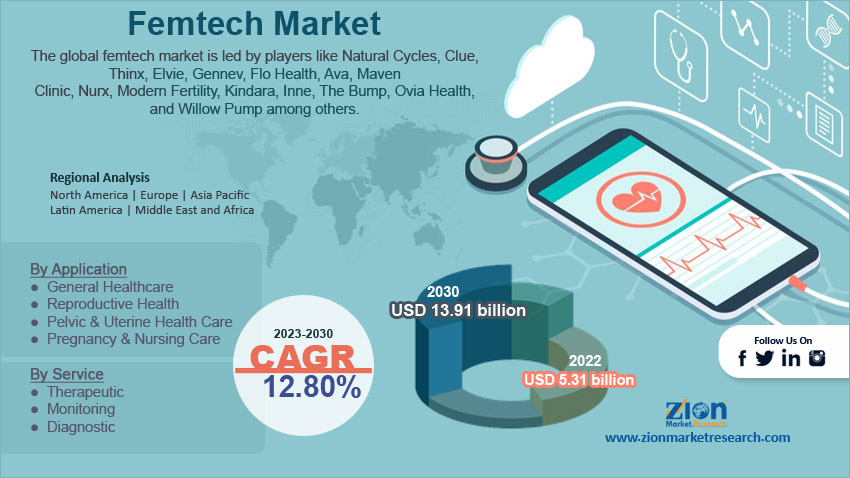

Femtech Market By Application (General Healthcare, Reproductive Health, Pelvic & Uterine Health Care, and Pregnancy & Nursing Care), By Service (Therapeutic, Monitoring, and Diagnostic), By Product (Mobile Application and Wearable Devices), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

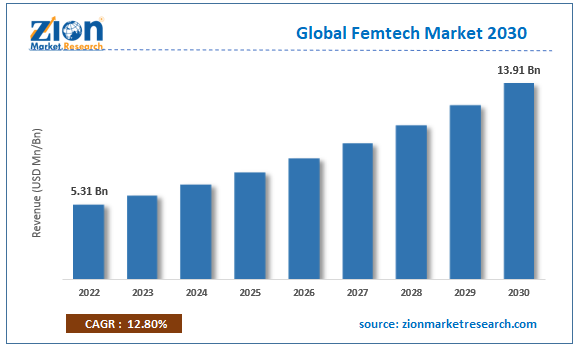

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.31 Billion | USD 13.91 Billion | 12.80% | 2022 |

Femtech Industry Prospective:

The global femtech market size was worth around USD 5.31 billion in 2022 and is predicted to grow to around USD 13.91 billion by 2030 with a compound annual growth rate (CAGR) of roughly 12.80% between 2023 and 2030.

Femtech Market: Overview

The femtech industry is a segment of the broader healthcare sector. It deals specifically with female biological needs using technology and smart devices. It intends to establish inclusion of otherwise excluded women’s health requirements and needs as it works toward developing targeted solutions around critical medical aspects such as pregnancy, fertility, and menstrual cycle. It is a relatively new market and the term ‘Femtech’ was coined in 2016. Since its inception by entrepreneur Ida Tin, the sector now deals with an extensive range of consumer-centric, technology-enabled products and solutions. While the main focus of femtech companies is related to female-specific issues, it also encompasses general health conditions that tend to affect women in a manner different from how they may impact men. For instance, conditions such as cardiovascular diseases and osteoporosis tend to affect men and women in different ways. In a short span of its existence, the femtech industry has managed to disrupt the global healthcare sector and massive investments are being registered globally as the demand for customized medical care for women's health is on the rise.

Key Insights:

- As per the analysis shared by our research analyst, the global femtech market is estimated to grow annually at a CAGR of around 12.80% over the forecast period (2023-2030)

- In terms of revenue, the global femtech market size was valued at around USD 5.31 billion in 2022 and is projected to reach USD 13.91 billion, by 2030.

- The femtech market is projected to grow at a significant rate due to the increasing female population and rising demand for quality medical care

- Based on application segmentation, reproductive health was predicted to show maximum market share in the year 2022

- Based on product segmentation, wearable devices was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Femtech Market: Growth Drivers

Increasing female population and rising demand for quality medical care to drive market growth

The global femtech market is expected to grow due to the rising number of female population across the globe. As per official reports published by the United Nations (UN), around 49.7% of the current global population is women. However, in the same report, the international organization gave a detailed account of the massive gap in terms of efforts undertaken to meet the basic needs of the women population including healthcare. The origin of femtech in 2016 was because male investors were finding it difficult to address female-related products and the market now acts as a safe space to learn and provide solutions that impact quality of life among women. The growing acceptance and slow eradication of social stigma around female biological needs has allowed more women to seek medical assistance without visiting doctors and medical professionals in person. The growing number of applications and effective services provided by companies operating in the femtech sector will act as a driving force in the coming years.

Rising access to technology and smartphones along with urbanization to create a higher demand

The femtech market size will be further impacted by the increasing access to technology with the surging sale of smartphones and other technologies. Additionally, urbanization has played a key role in improving consumer awareness about the existence and benefits of using femtech solutions including menstruation-tracking applications and ovulation-tracking services to name a few. The availability of affordable smartphones and wearables is a leading reason for increasing market revenue. On the other hand, companies providing femtech solutions are increasingly becoming more customer-oriented. These applications are beneficial for females who may find it difficult to speak to doctors or medical staff in person. Platforms such as Gennev and others offer telehealth services thus showing potential to cater to a wider range of consumers.

Femtech Market: Restraints

Concerns over data leak and privacy may restrict market expansion

The femtech industry growth is likely to be impacted by the increasing concerns over personal data leaks. As per the latest report submitted by the Organization for the Review of Care and Health Apps, several service providers offering period tracking solutions tend to share patient data with third-party applications. The organization surveyed over 25 applications and only 1 was concluded to be following all necessary protocols. These statistics raise serious questions of personal data security and integrity and pose privacy concerns.

Femtech Market: Opportunities

Increasing research-oriented developments in the femtech industry to create several growth opportunities

The global femtech market will benefit from research and development-oriented approaches adopted by service providers. Companies are increasingly spending on improving user experience and safeguarding sensitive information. Additionally, more players are entering the market thus allowing consumers access to a large pool of options meeting their specific medical needs. For instance, in October 2023, leading period tracking application Flo announced the launch of a new feature for male users. This feature is expected to assist in a couple's sex life and help in improving conception chances. The company claimed that almost 60% of the app's female users mentioned the limited understanding among their respective male partners about women’s reproductive health. In November 2023, OURA, the pioneer in the development of health-oriented smart ring, and Clue, a leading reproductive health and period tracking application, launched an innovative partnership with research acting as the foundational aspect of the alliance. With this move, the Clue app on iOS can now be paired with Oura ring for tracking temperature trends which is also a crucial biomarker on the Clue app.

Rising number of patients with postpartum depression (PPD) and medical issues may open new avenues for growth

As awareness around postpartum depression and other medical conditions has improved, the demand for strategic solutions has also surged simultaneously. More women are willing to undertake external help to navigate the changes in body and lifestyle postpartum. A report by the National Institutes for Health (NIH) claimed that nearly 1 in every 7 women suffers from PPD. The condition can be treated with the aid of medicines and therapy.

Femtech Market: Challenges

Cost factors and result inaccuracies may create growth challenges

The global femtech market growth is expected to be challenged by the high cost associated with femtech apps. Free-to-use applications may not deliver accurate results while premium apps charge nominal amounts. Furthermore, a significant number of the female population still feel comfortable talking to medical professionals in person as they offer better comfort.

Femtech Market: Segmentation

The global femtech market is segmented based on application, service, product, and region.

Based on application, the global market is segmented into general healthcare, reproductive health, pelvic & uterine health care, and pregnancy & nursing care. In 2022, the highest growth was observed in the reproductive health segment. Most women use femtech applications to track periods and ovulation days. Knowing these dates can improve the chances of conceiving. Furthermore, they are also helpful in managing unwanted pregnancies. Femtech applications are used by women to manage symptoms and impact of menopause. As per official estimates, more than 50 million women use period trackers regularly.

Based on service, the global femtech industry is divided into therapeutic, monitoring, and diagnostic.

Based on product, the femtech industry is divided into mobile applications and wearable devices. The wearable segment dominated around 76% of the total revenue. The growth is a result of the increasing urban population and rising popularity of smart wearables that track critical health-related information including body temperature, weight, physical activity, and heart rate. The accuracy of the application is thus improved. The mobile application segment is also growing at a steady rate.

Femtech Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Femtech Market |

| Market Size in 2022 | USD 5.31 Billion |

| Market Forecast in 2030 | USD 13.91 Billion |

| Growth Rate | CAGR of 12.80% |

| Number of Pages | 214 |

| Key Companies Covered | Natural Cycles, Clue, Thinx, Elvie, Gennev, Flo Health, Ava, Maven Clinic, Nurx, Modern Fertility, Kindara, Inne, The Bump, Ovia Health, Willow Pump, and others. |

| Segments Covered | By Application, By Service, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Femtech Market: Regional Analysis

North America to continue delivering exceptional results

The global femtech market is projected to witness the highest growth in North America. In 2022, the region dominated nearly 39% of the global revenue. One of the primary reasons for the higher growth rate is a growing level of user awareness and accessibility to applications and smart devices that facilitate the use of such services. The growing rate of the female population along with the rising number of women with medical conditions will also help in shaping the regional market. As per official data, nearly one-third of America’s female population uses period trackers to manage their menstrual cycle needs. In September 2022, Flo entered Anonymous Mode to meet the privacy requirements of its customers who do not have to enter any personal details henceforth while using the application. In the same month, Apple, a leading smart devices giant, added a new feature that will help users to accurately estimate ovulation date and flag any sign of abnormal period symptoms.

Femtech Market: Competitive Analysis

The global femtech market is led by players like:

- Natural Cycles

- Clue

- Thinx

- Elvie

- Gennev

- Flo Health

- Ava

- Maven Clinic

- Nurx

- Modern Fertility

- Kindara

- Inne

- The Bump

- Ovia Health

- Willow Pump

The global femtech market is segmented as follows:

By Application

- General Healthcare

- Reproductive Health

- Pelvic & Uterine Health Care

- Pregnancy & Nursing Care

By Service

- Therapeutic

- Monitoring

- Diagnostic

By Product

- Mobile Application

- Wearable Devices

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The femtech industry is a segment of the broader healthcare sector. It deals specifically with female biological needs using technology and smart devices.

The global femtech market is expected to grow due to the rising number of female population across the globe.

According to study, the global femtech market size was worth around USD 5.31 billion in 2022 and is predicted to grow to around USD 13.91 billion by 2030.

The CAGR value of the femtech market is expected to be around 12.80% during 2023-2030.

The global femtech market is projected to witness the highest growth in North America.

The global femtech market is led by players like Natural Cycles, Clue, Thinx, Elvie, Gennev, Flo Health, Ava, Maven Clinic, Nurx, Modern Fertility, Kindara, Inne, The Bump, Ovia Health, and Willow Pump, among others.

The report explores crucial aspects of the femtech market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed