Industrial Lubricant Market Size, Share, Trends, Growth 2034

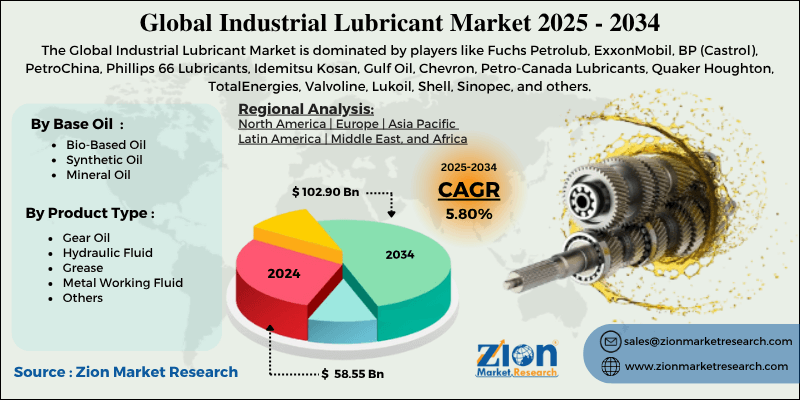

Industrial Lubricant Market By Base Oil (Bio-Based Oil, Synthetic Oil, and Mineral Oil), By Product Type (Gear Oil, Hydraulic Fluid, Grease, Metal Working Fluid, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 – 2034-

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

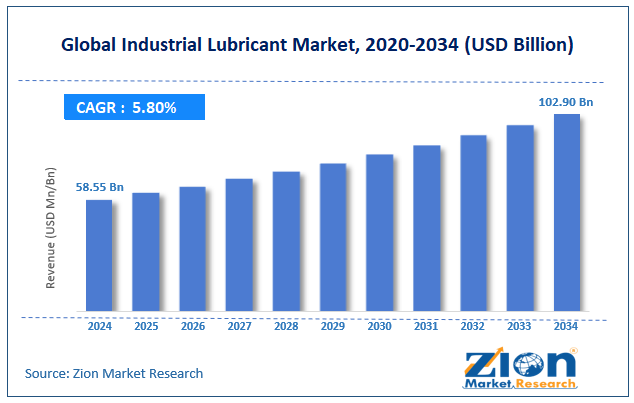

| USD 58.55 Billion | USD 102.90 Billion | 5.80% | 2024 |

Industrial Lubricant Industry Prospective:

The global industrial lubricant market size was worth around USD 58.55 billion in 2024 and is predicted to grow to around USD 102.90 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.80% between 2025 and 2034.

Industrial Lubricant Market: Overview

Industrial lubricants are specially designed substances used to provide lubrication to moving parts of industrial equipment or machinery. These substances are essential for the longevity, smooth operations, and reliability of several types of machines used across industrial facilities. Lubricants in the liquid form are known as oil and tend to deliver higher performance as compared to other forms of lubricating solutions. According to market research, industrial lubricants are generally divided into 4 types. They are synthetic lubricants, mineral lubricants, greases, and bio-based lubricants. Each variant has specific advantages and end applications.

For instance, bio-based lubricants are more environmentally friendly in comparison to the other three types. Industrial lubricants are mainly used in industries such as power generation, manufacturing & processing, automotive, and mining & construction. During the forecast period, demand for lubricants for industrial machinery is expected to grow rapidly, as per the latest trends. The industry players can expect higher usage of ecologically sustainable lubricants as concerns regarding the environmental impact of synthetic lubricants are on the rise.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial lubricant market is estimated to grow annually at a CAGR of around 5.80% over the forecast period (2025-2034)

- In terms of revenue, the global industrial lubricant market size was valued at around USD 58.55 billion in 2024 and is projected to reach USD 102.90 billion by 2034.

- The industrial lubricant market is projected to grow at a significant rate due to the rising automation in the manufacturing sector.

- Based on the base oil, the mineral oil segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the product, the hydraulic fluid segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Industrial Lubricant Market: Growth Drivers

Rising automation in the manufacturing sector to propel market expansion in the future

The global industrial lubricant market is expected to be driven by the rising rate of automation in the manufacturing industry worldwide. Modern production facilities are equipped with state-of-the-art automation solutions including advanced robotics. This equipment is designed to function throughout the day to increase production output with a reduced margin for error. The increasing use of automated solutions across major manufacturing sites will create demand for industrial lubricants.

Constant functioning of industrial automated machinery can lead to wear and tear. This can severely impact business operations and also lead to severe financial losses. Industrial lubricants are frequently applied to machines used in manufacturing plants to ensure the smooth functioning of the facility.

Expansion of the global automotive industry to impact market demand in the future

The automotive industry is one of the largest users of industrial lubricants. They are used across automotive parts such as transmissions, engines, and differentials. Industrial lubricants reduce friction, thus enhancing fuel efficiency. According to market analysis, a vehicle can experience a 20% decrease in fuel efficiency if the automotive system is not regularly oiled. With the surging rate of automobile production worldwide, driven by increasing commercial demand for modern vehicles, the industrial lubrication industry is expected to continue benefiting.

In July 2022, India’s leading automotive company, Tata Motors, signed a strategic partnership with PETRONAS Lubricants (India) Pvt. Ltd (PLIPL). With this move, PETRONAS has now become the official lubricants partner for commercial vehicles by Tata Motors.

In May 2025, Bolt Super Lubricant, a Nigerian engine oil producer, announced its plan to expand its business across African markets in the coming years. Such strategic measures adopted by associated stakeholders in the automotive industry and lubricant providers will aid in the expansion of the global industrial lubricant market.

Industrial Lubricant Market: Restraints

Environmental damage caused by harsh lubricants limits market expansion in the future

The global industrial lubricant industry is expected to be restricted due to the severe environmental damage caused by harsh lubricants. The increasing use of non-renewable fossil fuel for producing industrial lubricants has put the environment under pressure. On the other hand, production, use, and disposal of lubricants also contribute significantly to environmental pollution, especially in the form of soil and land quality degradation.

Industrial Lubricant Market: Opportunities

Increasing the launch of high-performance lubricants to generate growth opportunities for industry players

The global industrial lubricant market is expected to generate growth opportunities due to the rising launch of new and high-performance lubricants. In April 2024, Shell Lubricants, one of the world’s most prominent energy companies, announced the launch of three new products under its Shell Helix Ultra passenger car motor oil brand. The company has made the move to keep up with the upgraded industry specifications and original automotive manufacturer (OEM) requirements. The new launches are expected to help customers witness higher engine power with the oils.

In February 2024, Bericap and TotalEnergies, two key players from the European lubricants industry, announced a new partnership. The companies are expected to work on developing a closure for 20-liter lubricant packaging made using 50% post-consumer recycled plastic (PCR) to comply with DIN 60 standards for lubricants. Increasing demand for environmentally friendly lubricants will pave the way for further growth in the market. Regional governments are upgrading their regulatory requirements, encouraging companies to use sustainable raw materials and produce lubricants that do not harm the environment in the long run.

Industrial Lubricant Market: Challenges

Volatility in raw material availability to challenge market expansion during the forecast period

The global industrial lubricant industry is projected to be challenged by growing volatility in terms of availability of raw material. Fluctuating prices of crude oil, one of the most commonly used raw materials for producing base oil, are a major hindrance to the industry's smooth growth. In addition, evolving regulatory standards can further impact overall revenue for the industry players, as companies must comply 100% with regional and global frameworks.

Industrial Lubricant Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Lubricant Market |

| Market Size in 2024 | USD 58.55 Billion |

| Market Forecast in 2034 | USD 102.90 Billion |

| Growth Rate | CAGR of 5.80% |

| Number of Pages | 212 |

| Key Companies Covered | Fuchs Petrolub, ExxonMobil, BP (Castrol), PetroChina, Phillips 66 Lubricants, Idemitsu Kosan, Gulf Oil, Chevron, Petro-Canada Lubricants, Quaker Houghton, TotalEnergies, Valvoline, Lukoil, Shell, Sinopec, and others. |

| Segments Covered | By Base Oil, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Lubricant Market: Segmentation

The global industrial lubricant market is segmented based on base oil, product, and region.

Based on the base oil, the global market segments are bio-based oil, synthetic oil, and mineral oil. In 2024, the highest revenue was listed in the mineral oil segment. The easy availability of crude oil required to produce mineral oil is a major segmental growth driver. In addition, mineral oil offers higher general-purpose applications, resulting in greater use across applications. As per industry standards, heavy-duty industry machines must be oiled every 8 to 12 hours for consistent performance.

Based on the product, the global market divisions are gear oil, hydraulic fluid, grease, metal working fluid, and others. In 2024, around 35% of the final revenue was led by the hydraulic fluid segment due to its extensive use across industries. The growing expansion of hydraulic fluid production capacity worldwide will further aid steady revenue during the projection period. The metalworking fluid segment held a prominence over 25.09% of the total market share.

Industrial Lubricant Market: Regional Analysis

Asia-Pacific to lead the market during the projection period

The global industrial lubricant market is expected to be led by Asia-Pacific during the forecast period. The increasing economic growth across major Asian countries and a higher rate of industrialization are propelling regional revenue. Countries such as India, China, Malaysia, South Korea, and others are projected to generate the highest revenue during the forecast period.

In November 2024, Piaggio Vehicles Pvt Ltd from India and Gulf Oil Lubricants India Limited announced the extension of their strategic partnership to deliver co-branded and genuine lubricants across the commercial vehicle segment of Piaggio.

Europe is another growing region in the industrial lubricant industry with higher growth potential during the forecast period. The presence of some of the largest oil & lubricant companies in Europe helps the region thrive. In addition, increasing focus on developing bio-based lubricants for end-user industries may further accelerate market expansion.

North America will be led by the US during the forecast period. Increasing automation across major industries in the US, along with a rising number of prominent high-performance lubricant producers, will aid regional expansion. Additionally, North America’s construction and automotive industries are likely to act as major regional market growth propellers, according to research.

Industrial Lubricant Market: Competitive Analysis

The global industrial lubricant market is led by players like:

- Fuchs Petrolub

- ExxonMobil

- BP (Castrol)

- PetroChina

- Phillips 66 Lubricants

- Idemitsu Kosan

- Gulf Oil

- Chevron

- Petro-Canada Lubricants

- Quaker Houghton

- TotalEnergies

- Valvoline

- Lukoil

- Shell

- Sinopec

The global industrial lubricant market is segmented as follows:

By Base Oil

- Bio-Based Oil

- Synthetic Oil

- Mineral Oil

By Product Type

- Gear Oil

- Hydraulic Fluid

- Grease

- Metal Working Fluid

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial lubricants are specially designed substances used to provide lubrication to moving parts of industrial equipment or machinery.

The global industrial lubricant market is expected to be driven by the rising rate of automation in the manufacturing industry worldwide.

According to study, the global industrial lubricant market size was worth around USD 58.55 billion in 2024 and is predicted to grow to around USD 102.90 billion by 2034.

The CAGR value of the industrial lubricant market is expected to be around 5.80% during 2025-2034.

The global industrial lubricant market is expected to be led by Asia-Pacific during the forecast period.

The global industrial lubricant market is led by players like Fuchs Petrolub, ExxonMobil, BP (Castrol), PetroChina, Phillips 66 Lubricants, Idemitsu Kosan, Gulf Oil, Chevron, Petro-Canada Lubricants, Quaker Houghton, TotalEnergies, Valvoline, Lukoil, Shell, and Sinopec.

The report explores crucial aspects of the industrial lubricant market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed