Infant Formula Market Size, Share, Growth, Trends, and Forecast 2030

Infant Formula Market By Ingredient (Protein Hydrolysate, Whey Protein Concentrate, and Soy Protein Concentrate), By Product Type (Special Milk, Toddlers Milk, Follow-On-Milk, and Starting Milk), By Distribution Channel (Online Retail and Store-Based Retailing), By Form (Liquid, Powder, and Ready to Feed), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

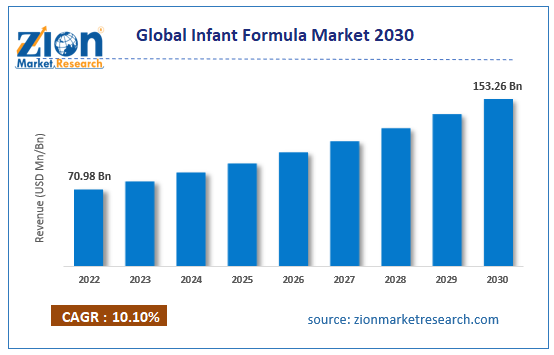

| USD 70.98 Billion | USD 153.26 Billion | 10.10% | 2022 |

Infant Formula Industry Prospective:

The global infant formula market size was worth around USD 70.98 billion in 2022 and is predicted to grow to around USD 153.26 billion by 2030 with a compound annual growth rate (CAGR) of roughly 10.10% between 2023 and 2030.

Infant Formula Market: Overview

Infant formula is also known as baby formula or infant milk. It is a manufactured or man-made nutrition-driven food product that intends to provide the same nutrients to an infant as that of human milk. Infant formula is designed for babies below the age of 12 months. While international health agencies such as the World Health Organization (WHO) recommend that babies should be fed with breast milk only for an initial 6 months, some parents may not produce enough milk or there may be other personal reasons to feed the child. In such cases, infant formula plays a crucial role in ensuring that a child is not deprived of any form of nutrition required during that age for proper mental, physical, and psychological growth. On the International level, given the sensitivity of food ingredients that should be used in infant formula, the allowed components are decided by the Codex Alimentarius. It is a joint food standard program run by WHO and the Food and Agriculture Organization of the United Nations. However, every region is free to include their regional-specific regulations depending on the food requirements of infants in their countries.

Key Insights:

- As per the analysis shared by our research analyst, the global infant formula market is estimated to grow annually at a CAGR of around 10.10% over the forecast period (2023-2030)

- In terms of revenue, the global infant formula market size was valued at around USD 153.26 billion in 2022 and is projected to reach USD 70.98 billion, by 2030.

- The infant formula market is projected to grow at a significant rate due to the increasing adoption rate

- Based on ingredient segmentation, whey protein concentrate was predicted to show maximum market share in the year 2022

- Based on form segmentation, powder was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Infant Formula Market: Growth Drivers

Increasing adoption rate to drive market growth

The global infant formula market is expected to benefit from the increasing number of parents choosing to adopt babies. The decision can either be medically influenced or a personal choice. Biologically, in most cases, mothers produce breast milk when they are pregnant and after childbirth. However, in the case of adoption, parents may not have the option to feed the adopted child with breast milk, especially in cases where couples are male partners or a single male parent. A July 2022 report stated that India registered around 3000 adoptions between 2021 and 2022. In addition to this, several surveys indicate that more people are keen on adopting children. For instance, the latest survey by the Adoption Network concluded that around one-third of the American population has considered adoption as a means to enjoy parenthood. Regional governments have introduced several favoring laws to adopt parents helping them start the journey. As the rate of adoption continues to grow, the demand for infant formula will soar during the forecast period.

Introduction of organic baby formula to create higher demand

Infant formula is a matter of great consideration since it has the ability to impact a child’s initial growth period. With changing demands and expectations from new parents who prefer organic food products for infants, there is a growing segment with high potential for producers of infant formula. In March 2023, the US Food and Drug Administration (FDA) authority approved the sale of a second infant formula developed by Bobbie Labs. The product is called Bobbie Organic Gentle and is the only organic product made with 100% lactose in the American market. It does not contain any form of corn syrup or maltodextrin. In July 2022, Danone announced the launch of a new range of plants & dairy blend infant formula called Aptamil. The product is made of plant fibers, fats, and proteins. There have been several other launches of organic baby milk since the consumption rate has shown an upward trend in the last couple of years.

Infant Formula Market: Restraints

Concerns over the supply of contaminated infant formula to cause market disruption

The global infant formula market players have to be extremely careful with the ingredients of the product. Parents are weary of certain ingredients and purity of baby milk since there have been several incidents of warnings against certain products from pediatricians and international healthcare agencies. For instance, in February 2022, the FDA urged parents to stop using infant formula in powdered form produced by the production facility of Abbott Nutrition in Michigan. The recommendation was a result of fatalities reported by the Centers for Disease Control and Prevention (CDC) caused by Cronobacter infection. The agencies believe that the production facility was exposed to Cronobacter sakazakii. Such accidents cannot be taken lightly and any negligence on the part of infant formula manufacturers can lead to serious repercussions.

Infant Formula Market: Opportunities

Growing awareness around infant nutritional needs to create growth opportunities

With the help of several government initiatives and easier access to pediatric care, parents are more aware of the nutritional needs of infants. They also have a better understanding of alternatives to breast milk or safe infant food items. In February 2023, the Chief Minister of Tamil Nadu State in India launched a special nutrition program that is expected to benefit around 11900 infants below the age of 6 months and 1.11 lakh children in the age group of 6 months to 6 years. Similarly, other agencies such as the UN and WHO have been working in developing and underdeveloped nations to create better awareness among young parents.

Tremendous market potential in developing nations to create expansion possibilities

With the rising per capita income in emerging countries, the demand and consumption of infant formula are on the rise. As more people move toward urban areas while the online section continues to meet the needs of parents in remote locations, the infant formula industry players should expect higher demand in these countries. In August 2022, Junlebao Dairy Group in China announced the launch of a new infant formula which is claimed to have the highest amount of lactoferrin content.

Infant Formula Market: Challenges

Navigating through changing regional compliance laws to challenge market expansion

One of the key challenges faced by the infant formula industry players is navigating through regional compliance laws and regulations. Every nation has specific rules that monitor the commercial sale of food items, especially products that may have a serious impact on the general health population. Managing through these dynamic changes from one regional market to another is time-consuming and demands exhaustive investments.

Infant Formula Market: Segmentation

The global infant formula market is segmented based on ingredient, product type, distribution channel, form, and region.

Based on ingredient, the global market is divided into protein hydrolysate, whey protein concentrate, and soy protein concentrate. In 2022, the highest growth was observed in the whey protein segment. During the forecast period, segmental growth can lead to dominance over 29.9% of the global revenue share. Baby formula is mainly made of milk and whey protein is derived from cow’s milk. Another key product is casein. Both protein variants play a crucial role in the overall development of the infant’s health and hence the consumption of whey protein concentrate is higher.

Based on product type, the infant formula industry is divided into special milk, toddlers milk, follow-on milk, and starting milk.

Based on distribution channel, the global market is divided into online retail and store-based retailing.

Based on form, the infant formula industry is segmented into liquid, powder, and ready to feed. The powered segment is likely to grow at the fastest pace during the projection period. It is likely to contribute over 42.35% of the global revenue. The main reason for segmental growth is the affordability factor. They also have a longer shelf life and are easy to use. The liquid and ready-to-feed segments are also expected to grow at a steady rate with growing demand.

Infant Formula Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Infant Formula Market |

| Market Size in 2022 | USD 70.98 Billion |

| Market Forecast in 2030 | USD 153.96 Billion |

| Growth Rate | CAGR of 10.10% |

| Number of Pages | 224 |

| Key Companies Covered | Danone, Nestlé, Reckitt Benckiser, The Kraft Heinz Company, Abbott Laboratories, Pfizer, Mead Johnson Nutrition, Ausnutria Dairy Corporation Ltd., FrieslandCampina, Bellamy's Organic, Beingmate Group, HIPP, Hain Celestial Group, Meiji Holdings Co. Ltd., Synutra International, and others. |

| Segments Covered | By Ingredient, By Product Type, By Distribution Channel, By Form, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Infant Formula Market: Regional Analysis

North America to register the highest growth rate during the coming period

The global infant formula market is expected to witness the highest growth in North America with the US leading with hold over the largest part of the regional market share. Currently, the US controls around 19% of the total revenue in North America. The primary reason for higher growth is product awareness and the availability of a large number of options for infant milk. The region has been at the forefront of research and development in terms of launching novel yet effective and safe baby formula.

The increasing number of FDA approvals is an indicator of the growing regional trend. After receiving clearance from the healthcare agencies, Abbott restarted its Michigan facility for the production of Similac® infant formula in 2022. It was estimated that the company will produce over 8.7 million pounds of infant formula in June 2022. Europe is projected to become the second-highest revenue generator by 2030. It is home to some of the largest producers of infant milk. For instance, Nestle, a dominant giant in the food sector, contributes around 8% of the total global revenue generated from baby formula. Increasing domestic consumption and a higher adoption rate are expected to promote regional growth.

Infant Formula Market: Competitive Analysis

The global infant formula market is led by players like:

- Danone

- Nestlé

- Reckitt Benckiser

- The Kraft Heinz Company

- Abbott Laboratories

- Pfizer

- Mead Johnson Nutrition

- Ausnutria Dairy Corporation Ltd.

- FrieslandCampina

- Bellamy's Organic

- Beingmate Group

- HIPP

- Hain Celestial Group

- Meiji Holdings Co. Ltd.

- Synutra International

The global infant formula market is segmented as follows:

By Ingredient

- Protein Hydrolysate

- Whey Protein Concentrate

- Soy Protein Concentrate

By Product Type

- Special Milk

- Toddlers Milk

- Follow-On-Milk

- Starting Milk

By Distribution Channel

- Online Retail

- Store-Based Retailing

By Form

- Liquid

- Powder

- Ready to Feed

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Infant formula is also known as baby formula or infant milk. It is a manufactured or man-made nutrition-driven food product that intends to provide the same nutrients to an infant as that of human milk.

The global infant formula market is expected to benefit from the increasing number of parents choosing to adopt babies.

According to study, the global infant formula market size was worth around USD 70.98 billion in 2022 and is predicted to grow to around USD 153.26 billion by 2030.

The CAGR value of the infant formula market is expected to be around 10.10% during 2023-2030.

The global infant formula market is expected to witness the highest growth in North America with the US leading with hold over the largest part of the regional market share.

The global infant formula market is led by players like Danone, Nestlé, Reckitt Benckiser, The Kraft Heinz Company, Abbott Laboratories, Pfizer, Mead Johnson Nutrition, Ausnutria Dairy Corporation Ltd., FrieslandCampina, Bellamy's Organic, Beingmate Group, HIPP, Hain Celestial Group, Meiji Holdings Co., Ltd., and Synutra International.

The report explores crucial aspects of the infant formula market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed