Medical Polymer Market Trend, Share, Size, and Forecast 2032

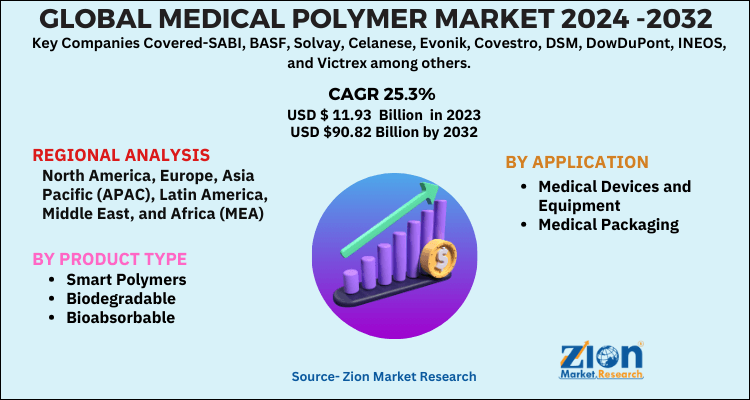

Medical Polymer Market by Product Type (Smart Polymers, Biodegradable, Bioabsorbable, and Others), by Application (Medical Devices and Equipment, Medical Packaging, and Others), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

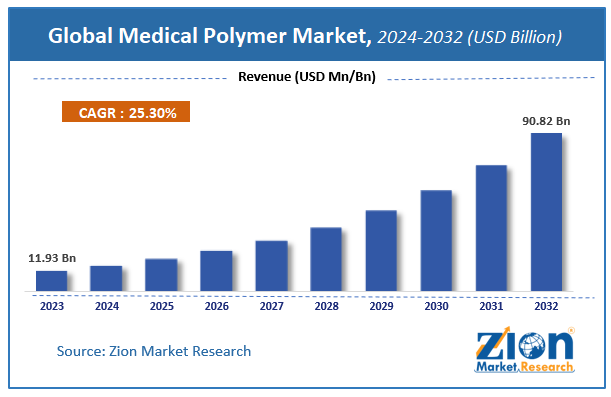

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.93 Billion | USD 90.82 Billion | 25.3% | 2023 |

Medical Polymer Market Size

According to Zion Market Research, the global Medical Polymer Market was worth USD 11.93 Billion in 2023. The market is forecast to reach USD 90.82 Billion by 2032, growing at a compound annual growth rate (CAGR) of 25.3% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Medical Polymer Market industry over the next decade.

Medical Polymer Market: Overview

Polymers are compounds that are usually of high molecular weight and are formed by the combination of simpler molecules (monomers). Medical-grade polymers are an integral part of the global healthcare infrastructure and have been used in the medical industry for decades. Polymers are used in a wide range of devices, from surgical instruments to implants and catheters. Metal substitution coupled with the growing awareness around maintaining proper health and hygiene are the driving factors for increasing demand for medical polymers, among others. The emergence of bioresorbables, use of polymers like PEEK and technological advancements in medical polymer industry are some of the trends witnessed by this industry in recent years.

COVID-19 Impact Analysis

The COVID-19 pandemic highlighted the role of polymers in modern times. If consumerism was once the driving force behind the use of polymers, personal well-being and medical crises have emerged as the driving forces in the aftermath of COVID. Due to the overwhelming demand for hospital resources, the healthcare industry witnessed a drop in medical-hospital materials and personal protective devices for health workers and the general population. This paved way to the emergence of alternative production movements focused on polymers.

Medical Polymer Market: Growth Factors

In the medical industry, polymers are increasingly used as a substitute for their metallic counterpart. When it comes to equipment, cleanliness is a crucial aspect in the medical industry. Infection is the most serious danger that hospital patients face. Metal is more difficult to disinfect and sterilize than polymer and plastic materials. In addition to this, orthopedic OEMs can reach ergonomic weight limits for surgical trays by using polymers and plastic surgical materials. Use of metallic instrument only adds weight and strain to the surgical team carrying and using metal instruments.

The COVID-19 pandemic has paved way to the growing awareness around maintaining proper health and hygiene not only by the professionals in the medical field but also by the general population. This has led to an increase in the consumption of polymers for the manufacturing of masks, gloves, drapes, gowns, trays, catheters, syringes, orthopedic instruments, surgical equipment, and lab wares. Increased demand for personal protective equipment (PPE) such as gloves, caps, drapes, gowns, and other items fueled the demand for traditional plastics such as PP, PE, and PVC.

Medical Polymer Market: Segmentation

Product Type Segment Analysis Preview

The smart polymers segment held a share of around 5% in 2020. This share is attributed to the growing potential of smart polymers in developing novel drug-delivery technologies. These smart polymers are designed to produce a pulsating drug release pattern for a variety of drug delivery applications, closely resembling natural biological release. The growing popularity of innovative drug delivery systems is boosting this segment’s growth. Developments in the chemistries of smart polymers are constantly revealing new opportunities in the smart polymers industry. A primary factor for new avenues in the smart polymers segment is the growing need for advanced packaging to maintain the freshness and sensory attributes of contents inside.

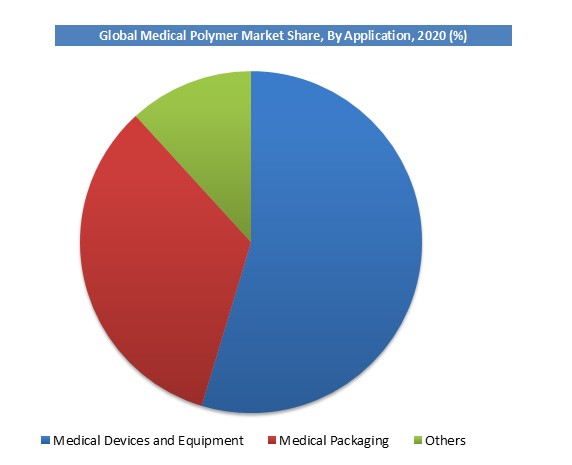

Application Segment Analysis Preview

The medical devices and equipment segment will grow at a CAGR of over 9% from 2021 to 2028. This is attributable to the increasing adoption of polymers in manufacturing of medical devices and equipment. Medical polymers have a number of advantages, including higher flexibility, comfort, and mobility. These polymers are best suited for medical applications because they are lighter, more biocompatible, and less expensive. PVC, preceded by PE, PET, PS, and PP, is the most commonly used plastic material in medical applications. PVC is a flexible plastic widely used in pre-sterilized single use medical application. Furthermore they are also used for packaging because of their lightness, low cost, durability, and transparency. As a result of the numerous advantages provided by medical polymers, their demand in the medical field is increasing and is thus accelerating the growth of the medical polymer industry.

Medical Polymer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Polymer Market |

| Market Size in 2023 | USD 11.93 Billion |

| Market Forecast in 2032 | USD 90.82 Billion |

| Growth Rate | CAGR of 25.3% |

| Number of Pages | 125 |

| Key Companies Covered | SABI, BASF, Solvay, Celanese, Evonik, Covestro, DSM, DowDuPont, INEOS, and Victrex among others |

| Segments Covered | By Product Type, By Application. and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Polymer Market: Regional Analysis

North America holds the largest share of the medical polymer market, driven by the region's strong healthcare infrastructure, high demand for advanced medical devices, and continuous innovation in polymer technology. The United States is the key contributor, with widespread use of medical polymers in applications like surgical instruments, drug delivery systems, and medical packaging. The emphasis on improving patient care and reducing healthcare costs further accelerates the demand for high-performance polymers in the medical sector.

Asia Pacific region is projected to grow at a CAGR of around xx% over the forecast period. This increase can be attributed to the fact that healthcare programs in countries like China, India, Bangladesh, Indonesia, and Pakistan are rapidly expanding, which will support the growth of this market in Asia Pacific region. The increased demand for medical polymers is also aided by the region's growing population coupled with the lack of adequate pharmacy facilities.

Medical Polymer Market: Competitive Players

Some of key players in medical polymer market are

- SABI

- BASF

- Solvay

- Celanese

- Evonik

- Covestro

- DSM

- DowDuPont

- INEOS

- Victrex

The global medical polymer market is segmented as follows:

By Product Type

- Smart Polymers

- Biodegradable

- Bioabsorbable

- Others

By Application

- Medical Devices and Equipment

- Medical Packaging

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical polymers are synthetic materials used in the manufacture of medical devices, equipment, and implants due to their biocompatibility, flexibility, and durability. Commonly used in products like syringes, catheters, and prosthetics, they offer advantages such as ease of sterilization, lightweight properties, and resistance to chemicals.

According to study, the Medical Polymer Market size was worth around USD 11.93 billion in 2023 and is predicted to grow to around USD 90.82 billion by 2032.

The CAGR value of Medical Polymer Market is expected to be around 25.3% during 2024-2032.

North America has been leading the Medical Polymer Market and is anticipated to continue on the dominant position in the years to come.

The Medical Polymer Market is led by players like SABI, BASF, Solvay, Celanese, Evonik, Covestro, DSM, DowDuPont, INEOS, and Victrex among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed