Rail Asset Management Market Size Report, Industry Analysis, Share, Trends, Growth, 2030

Rail Asset Management Market By Deployment Mode (On-Premise and Cloud), By Application (Infrastructure and Rolling Stock), By Offering (Network Management, Workforce Management, Asset Performance Management, Professional Services, Managed Services, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

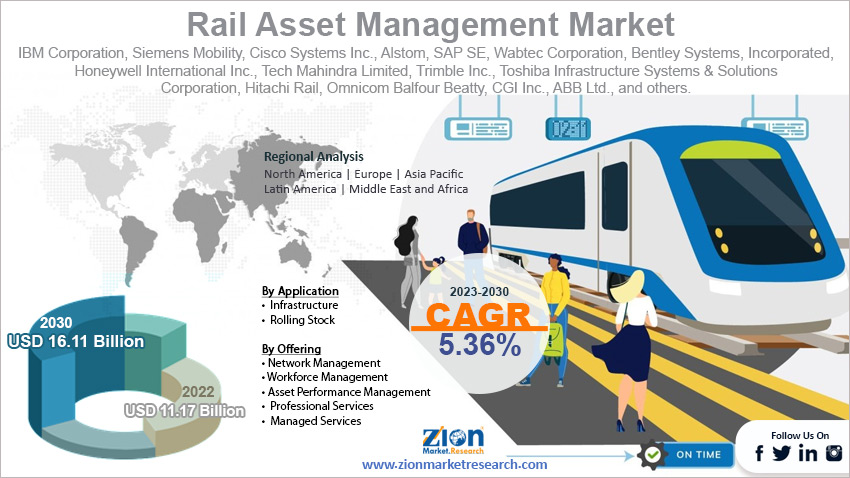

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.17 Billion | USD 16.11 Billion | 5.36% | 2022 |

Rail Asset Management Industry Prospective:

The global rail asset management market size was worth around USD 11.17 billion in 2022 and is predicted to grow to around USD 16.11 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.36% between 2023 and 2030.

Rail Asset Management Market: Overview

Asset management has been one of the most influential aspects of the global rail sector. As the demand and need for efficient rail systems have increased in recent times, the necessity of efficient systems for managing rail assets has surged. The term rail asset management encompasses a highly complex and vast network of interconnected systems. However, the end goal of these connected technologies is to ensure optimum rail asset performance in order to ultimately have a positive influence on business goals. It consists of all procedures, protocols, programs, and tools used for maximizing asset availability with minimum risk and whole-life cost.

Often, the management system includes the use of some form of intelligent software that performs the role of collecting, storing, analyzing, and concluding information so that preventative and predictive maintenance decisions can be taken by concerned parties. It is crucial to note that rail asset management is not limited to maintenance work since it tends to cover the entire lifecycle of the assets used in rail networks including designing, construction, and application until the asset is finally discarded or renewed. The growing investments in the expansion of the rail network will help the market deliver high results.

Key Insights:

- As per the analysis shared by our research analyst, the global rail asset management market is estimated to grow annually at a CAGR of around 5.36% over the forecast period (2023-2030)

- In terms of revenue, the global rail asset management market size was valued at around USD 11.17 billion in 2022 and is projected to reach USD 16.11 billion, by 2030.

- The rail asset management market is projected to grow at a significant rate due to the increasing investments in public transport infrastructure

- Based on deployment mode segmentation, on-premise was predicted to show maximum market share in the year 2022

- Based on offering segmentation, network management was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Rail Asset Management Market: Growth Drivers

Increasing investments in public transport infrastructure to drive market growth

The global rail asset management market is expected to grow owing to the increasing investments toward improving public transport infrastructure. With the rising population rate coupled with increasing levels of globalization and urbanization, the need for efficient connectivity has reached urgent levels in recent times. In addition to this, robust domestic and international transport connectivity has proven highly influential in the overall economic growth of a country since it affects foreign and regional investments. Rail has been a vital aspect of public transportation and regional governments have amped up investments to ensure smooth transportation from one place to another. Moreover, several countries are witnessing a change in legacy rail infrastructure as modern requirements continue to evolve.

In May 2023, Uganda announced that the construction of its much anticipated and delayed Standard Gauge Railway (SGR) project worth USD 2.2 billion is expected to commence in 2023 as the country fights skyrocketing transport prices. These projects are expected to drive the demand for rail asset management systems as the rail network gets more complicated.

Rising international trade partnerships for large-scale rail-based corridors will cause a higher growth rate

The impact of globalization can be witnessed in the changing international trade relationships as countries and regions from across the globe come together to develop several transcontinental rail-based projects for smoother and affordable freight transportation. The G20 Summit held in 2023 was accompanied by the announcement of a multinational rail and shipping venture connecting the Middle East and India.

The nations that will participate in this project include the European Union, Israel, the United Arab Emirates, India, and Saudi Arabia. It is expected to promote digital connectivity and boost international trade. Such large-scale projects require the existence of a proficient global rail asset management market that can facilitate functional parameters of complex rail networks with resource optimization.

Rail Asset Management Market: Restraints

High initial cost of investment to restrict the market growth

The global rail asset management industry is projected to be restricted due to the high cost of initial investment required to develop a functional and capable ecosystem. It employs several parameters including digital technology and skilled human resources that are essential contributors to higher pricing. In addition to this, the cost is further propelled due to the investments targeted toward employee training leading to a limited market growth rate.

Rail Asset Management Market: Opportunities

Rising launch of new solutions integrated with advanced technologies to create growth opportunities

The global rail asset management market players can expect massive growth opportunities by leveraging the growing need for improved solutions for managing rail assets that are integrated with advanced tools such as Artificial Intelligence (AI) and Machine Learning (ML). For instance, AI-powered sensors help in providing real-time data about asset conditions thus helping in predictive maintenance before faults or errors arise. Furthermore, these tools can be used in tandem with human resources to ensure that operational requirements are met irrespective of weather or environmental factors.

In December 2020, Serby Rail Technical Services (SRTS) announced that it had completed significant investments toward upgrading the Traction and Rolling Stock Parts and Documentation System (PADSnet). It is an online asset configuration management system used throughout the rail sector. The upgrade entails a progressive user-interface keeping in view the demand of existing and future customers. Companies are increasingly investing in developing AI and ML frameworks for rail asset management systems.

Infrastructure development projects in emerging countries to push product and service usage rate

Emerging nations hold exceptional growth potential as infrastructure development projects are on the rise in countries such as China, India, and African nations. The growing rate of domestic and foreign direct investment (FDI) along with mounting pressure from the regional population for better living standards with regional connectivity may lead to a higher adoption rate of affordable rail asset management solutions.

Rail Asset Management Market: Challenges

Seamless integration with legacy systems and changing regional expectations to challenge market growth rate

The global rail asset management industry faces challenges in terms of seamlessly integrating new and advanced solutions with existing protocols and procedures. The process is relatively slow leading to higher time and resource investments. Moreover, one of the key adoption barriers is the changing characteristics of rail systems across countries and regions leading to the need for tailor-made or flexible management solutions for rail assets.

Rail Asset Management Market: Segmentation

The global rail asset management market is segmented based on deployment mode, application, offering, and region.

Based on deployment mode, the global market is divided into on-premise and cloud. In 2022, the demand was higher in the on-premise segment since it offers several advantages, the primary being higher control over systems and technology. Additionally, cloud-based systems are vulnerable to breaches in data security and compromise in data integrity. Rail investments typically allocate a section of the complete budget to rail asset management systems thus paving the way for on-premise deployment. For the fiscal year 2023-2024, the Indian rail government has requested for a budget of INR 2.5 lakh crore as capital expenditure.

Based on application, the global rail asset management industry is segmented into infrastructure and rolling stock.

Based on offering, the global market is fragmented into network management, workforce management, asset performance management, professional services, managed services, and others. In 2022, the highest revenue was registered in the network management segment led by the rise in investments toward improvement and proficiency of the rail network. Additionally, asset performance management is projected to grow at a steady pace as businesses seek more ways to meet business objectives. The US rail network extends around 160,000 miles.

Rail Asset Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rail Asset Management Market |

| Market Size in 2022 | USD 11.17 Billion |

| Market Forecast in 2030 | USD 16.11 Billion |

| Growth Rate | CAGR of 5.36% |

| Number of Pages | 221 |

| Key Companies Covered | IBM Corporation, Siemens Mobility, Cisco Systems Inc., Alstom, SAP SE, Wabtec Corporation, Bentley Systems, Incorporated, Honeywell International Inc., Tech Mahindra Limited, Trimble Inc., Toshiba Infrastructure Systems & Solutions Corporation, Hitachi Rail, Omnicom Balfour Beatty, CGI Inc., ABB Ltd., and others. |

| Segments Covered | By Deployment Mode, By Application, By Offering, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rail Asset Management Market: Regional Analysis

Asia-Pacific to dominate market growth during the projection period

The global rail asset management market is expected to witness the highest growth rate in Asia-Pacific during the forecast period. The regional growth rate is a result of the presence of a large rail network across Asian countries including Australia, China, India, Japan, and others. In 2022, China witnessed the construction of several new railways in a bid to improve regional infrastructure and transport connectivity. For instance, the Xiongan High-Speed Railway Company has invested in the construction of a new high-speed rail line in China to provide faster traffic and cut travel time. Furthermore, in recent times, the country has invested more resources toward the ambitious Belt and Road initiative to connect regions such as Africa, Asia, and Europe.

On the other hand, western countries including the US have signed several deals with Asian economies to improve international trade relationships. North America is projected to grow rapidly as the regional governments continue to improve rail services and asset management. In September 2023, the US government allotted USD 1.4 billion to the US Federal Railroad Administration.

Rail Asset Management Market: Competitive Analysis

The global rail asset management market is led by players like:

- IBM Corporation

- Siemens Mobility

- Cisco Systems Inc.

- Alstom

- SAP SE

- Wabtec Corporation

- Bentley Systems

- Incorporated

- Honeywell International Inc.

- Tech Mahindra Limited

- Trimble Inc.

- Toshiba Infrastructure Systems & Solutions Corporation

- Hitachi Rail

- Omnicom Balfour Beatty

- CGI Inc.

- ABB Ltd.

The global rail asset management market is segmented as follows:

By Deployment Mode

- On-Premise

- Cloud

By Application

- Infrastructure

- Rolling Stock

By Offering

- Network Management

- Workforce Management

- Asset Performance Management

- Professional Services

- Managed Services

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Asset management has been one of the most influential aspects of the global rail sector.

The global rail asset management market is expected to grow owing to the increasing investments toward improving public transport infrastructure.

According to study, the global rail asset management market size was worth around USD 11.17 billion in 2022 and is predicted to grow to around USD 16.11 billion by 2030.

The CAGR value of rail asset management market is expected to be around 5.36% during 2023-2030.

The global rail asset management market is expected to witness the highest growth rate in Asia-Pacific during the forecast period.

The global rail asset management market is led by players like IBM Corporation, Siemens Mobility, Cisco Systems, Inc., Alstom, SAP SE, Wabtec Corporation, Bentley Systems, Incorporated, Honeywell International Inc., Tech Mahindra Limited, Trimble Inc., Toshiba Infrastructure Systems & Solutions Corporation, Hitachi Rail, Omnicom Balfour Beatty, CGI Inc., and ABB Ltd.

The report explores crucial aspects of the rail asset management market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed