Zeolite Market Size, Share, Analysis, Trends, Growth Report, 2030

Zeolite Market By Application (Adsorbents, Catalysts, Animal Feed, Detergent Builders, Cement, and Others), By Product (Synthetic and Natural), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

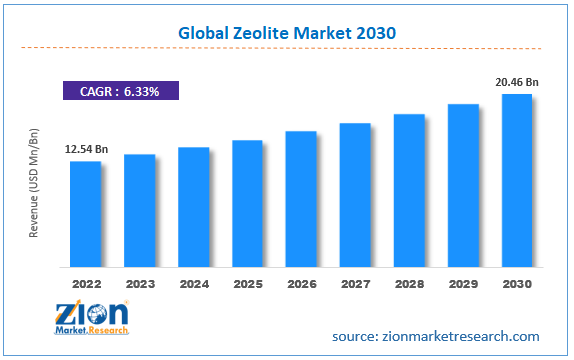

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.54 Billion | USD 20.46 Billion | 6.33% | 2022 |

Zeolite Industry Prospective:

The global zeolite market size was worth around USD 12.54 billion in 2022 and is predicted to grow to around USD 20.46 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.33% between 2023 and 2030.

Zeolite Market: Overview

Zeolites are crystalline, microporous materials consisting of aluminum, silicon, and oxygen. They are classified as aluminosilicates since they are made of anionic Si-O-Al linkages. Zeolites have been commercially used as catalysts and adsorbents. During catalysis, they are used to change the rate of a chemical reaction whereas when used as adsorbents they help in the adhesion of molecules, ions, and atoms from liquid, gas, or dissolved solid to a surface. Although zeolites are known to occur naturally, they are also produced in industries at an extremely large scale due to the growing demand and consumption in several end-user industries.

As of 2018, the science community has access to 253 unique zeolite frameworks out of which 40 are naturally occurring. The International Zeolite Association Structure Commission (IZA-SC) plays a crucial role in managing the zeolite market since every new structure obtained has to be examined by the commission which then issues a 3 letter designation to the structure before it becomes commercially available for further application. The extreme popularity of zeolites as sorbents is mainly due to the presence of adjustable molecules and well-defined pore structure which makes them highly potent or active materials that can be used in several reactions. The zeolite industry is likely to grow at a steady pace during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global zeolite market is estimated to grow annually at a CAGR of around 6.33% over the forecast period (2023-2030)

- In terms of revenue, the global zeolite market size was valued at around USD 12.54 billion in 2022 and is projected to reach USD 20.46 billion, by 2030.

- The zeolite market is projected to grow at a significant rate due to the growing application of zeolites as detergent builders

- Based on application segmentation, catalysts was predicted to show maximum market share in the year 2022

- Based on product segmentation, synthetic was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Zeolite Market: Growth Drivers

Growing application of zeolites as detergent builders to promote higher growth

The global zeolite market is expected to grow owing to the increasing application of the material in detergent building applications. Studies have shown that zeolites are capable of selectively absorbing or rejecting molecules depending on the shape differences and other essential properties including polarity. These attributes have resulted in zeolites becoming a preferred choice as water-softening agents in the global detergent industry along with other sectors.

Over the years, the detergent industry has undergone tremendous changes mainly influenced by the government regulations surrounding the impact of detergent ingredients on the environment. In addition to this, the common expectation of consumers from any detergent that they use is efficiency and easier handling which further led to detergent manufacturers investing in modifying the products to meet consumer demands. This has resulted in the development of more efficient zeolites that can not only soften the water but also remove dirt and inhibit the graying of the clothes. Zeolites have become essential in the production of washing powders because they can influence the powder structure.

Higher demand as a catalyst in fast-growing industries to generate higher production

Zeolites are essential catalysts that are used in several fast-growing and important end-user verticals. Some of the largest consumers of zeolites for their catalytic properties are gas separation, fine chemicals, and petrochemical sectors. The higher application is due to the unique structure of zeolites that acts like a sieve. It means that zeolites only allow the passing of molecules that are smaller than the pore size. The application of the material in these industries ranges from drying to separation including purification.

Zeolite Market: Restraints

Possibility of higher demand for substitute products to restrict market growth

The chemicals and materials industry is rapidly evolving with the discovery and development of new materials as the global demand pattern is changing. There is a growing focus on developing several substitutes for a broad group of products to avoid relying completely on a specific material for industrial and commercial purposes. For instance, researchers are actively working on understanding and implementing the use of transition metals such as zinc, cobalt, manganese, and iron in place of aluminum and using elements such as titanium and germanium, They can be used for the production of Brönsted acid sites which perform the same role as zeolites. This could severely impact the global zeolite market growth trend.

Zeolite Market: Opportunities

Growing investments in new production facilities for zeolites may lead to better growth possibilities

Since the demand for zeolites has grown in recent times, the zeolite industry giants are investing in new and advanced production facilities for the material. In September 2017, BAFF, a leading player in the global chemicals and materials sector announced the inauguration of a new production facility built in Germany. The unit will produce zeolite catalysts specifically for light-duty and heavy-duty vehicles thus impacting the demand in the global market. This move has made BASF one of the largest producers of the crucial material. In addition to this, there have been several revolutionary developments in the production of zeolites. In January 2022, researchers at the Georgia Institute of Technology in Sweden discovered a new form of zeolites that exists in a 1D nanotubular shape. Until then, zeolite production was largely limited to 2D and 3D materials. The researchers are predicting the application of the newly found variant for the production of several new nanoscale components that may be used for transporting heat, mass, or charge using the length of the structure or through the walls.

Zeolite Market: Challenges

Problems associated with zeolite mining to create greater challenges during the forecast period

Zeolites are extensively available in synthetic form. However, the demand for naturally occurring zeolites is equally high, especially for modern and novel applications. However, irresponsible mining of zeolites can have a detrimental impact on the environment since zeolites are not abundantly available in nature. Moreover, the material is considered expensive or less cost-effective when compared to the price of the raw material that is used during zeolite synthesis which acts as an additional barrier against the global market growth.

Zeolite Market: Segmentation

The global zeolite market is segmented based on application, product, and region.

Based on application, the global market segments are adsorbents, catalysts, animal feed, detergent builders, cement, and others. In 2022, the highest revenue was generated from the catalysts segment which controlled over 47.1% of the total share driven by the extensive application of zeolites to trigger chemical reactions in the growing petrochemical industry. With the surging demand for essential products such as fertilizers, plastics, resins, and fuel additives that are a part of the petrochemical sector, segmental consumption has reached a new peak in recent times. In August 2023, Bharat Petroleum Group, a dominant Indian refiner, announced an investment of USD 18.16 billion in the next 5 years to improve the country’s oil sector.

Based on product, the zeolite industry divisions are synthetic and natural. In 2022, more than 87.2% of the total share was led by the synthetic segment purely influenced by the large-scale production of synthetic zeolite. In March 2023, International Zeolite Corp. announced that its first production facility in Jordan was ready for operation and it will start producing zeolite by the end of the month. The company is already planning to expand the facility in the coming years which is expected to help the unit reach a production capacity of 25,000 kilograms per day of nutrient-rich zeolite for agricultural applications.

Zeolite Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Zeolite Market |

| Market Size in 2022 | USD 12.54 Billion |

| Market Forecast in 2030 | USD 20.46 Billion |

| Growth Rate | CAGR of 6.33% |

| Number of Pages | 227 |

| Key Companies Covered | Albemarle Corporation, W.R. Grace & Co., BASF SE, Clariant AG, Honeywell UOP, Chemiewerk Bad Köstritz GmbH (CWK), Zeochem AG, Interra Global Corporation, Tosoh Corporation, Blue Pacific Minerals, Arkema Group, St. Cloud Mining Company, Zeolyst International, Rota Mining Corporation, KNT Group, Bear River Zeolite Company, Zeotech Corporation, Anten Chemical Co. Ltd., Canadian Zeolite Corp, Zeo Natural, and others. |

| Segments Covered | By Application, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Zeolite Market: Regional Analysis

Growth in North America to be led by the United States

The global zeolite market is expected to be dominated by North America during the projection period. In 2022, the region was responsible for generating more than 22.5% of the total revenue. As per official reports, 6 companies from the United States mined around 98,000 tons of zeolite in 2019. The country is a rich source of naturally-occurring zeolites with active mines located in areas such as Idaho, California Oregon, New Mexico, and Texas.

In addition to this, the region has extensive application of naturally and synthetically produced zeolites across the detergent and petrochemical industries. The presence of state laws surrounding the environmental impact of washing detergents has forced more players to adopt zeolite as a key water softener to reduce environmental damage. Additionally, the growing applications of zeolites in agriculture and animal feed production have allowed regional dominance to continue. Asia-Pacific, on the other hand, is growing rapidly with increasing regional investments toward zeolite production. In April 2021, Kumho Mitsui Chemicals Inc. announced that it would invest USD 358 million to expand its chemical production facility in the South Korean region.

Zeolite Market: Competitive Analysis

The global zeolite market is led by players like:

- Albemarle Corporation

- W.R. Grace & Co.

- BASF SE

- Clariant AG

- Honeywell UOP

- Chemiewerk Bad Köstritz GmbH (CWK)

- Zeochem AG

- Interra Global Corporation

- Tosoh Corporation

- Blue Pacific Minerals

- Arkema Group

- St. Cloud Mining Company

- Zeolyst International

- Rota Mining Corporation

- KNT Group

- Bear River Zeolite Company

- Zeotech Corporation

- Anten Chemical Co. Ltd.

- Canadian Zeolite Corp

- Zeo Natural

The global zeolite market is segmented as follows:

By Application

- Adsorbents

- Catalysts

- Animal Feed

- Detergent Builders

- Cement

- Others

By Product

- Synthetic

- Natural

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zeolites are crystalline, microporous materials consisting of aluminum, silicon, and oxygen. They are classified as aluminosilicates since they are made of anionic Si-O-Al linkages.

The global zeolite market is expected to grow owing to the increasing application of the material in detergent building applications.

According to study, the global zeolite market size was worth around USD 12.54 billion in 2022 and is predicted to grow to around USD 20.46 billion by 2030.

The CAGR value of the zeolite market is expected to be around 6.33% during 2023-2030.

The global zeolite market is expected to be dominated by North America during the projection period.

The global zeolite market is led by players like Albemarle Corporation, W.R. Grace & Co., BASF SE, Clariant AG, Honeywell UOP, Chemiewerk Bad Köstritz GmbH (CWK), Zeochem AG, Interra Global Corporation, Tosoh Corporation, Blue Pacific Minerals, Arkema Group, St. Cloud Mining Company, Zeolyst International, Rota Mining Corporation, KNT Group, Bear River Zeolite Company, Zeotech Corporation, Anten Chemical Co., Ltd., Canadian Zeolite Corp, and Zeo Natural.

The report explores crucial aspects of the zeolite market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed