Aircraft Radome Market Size, Share, Trends, Growth and Forecast 2034

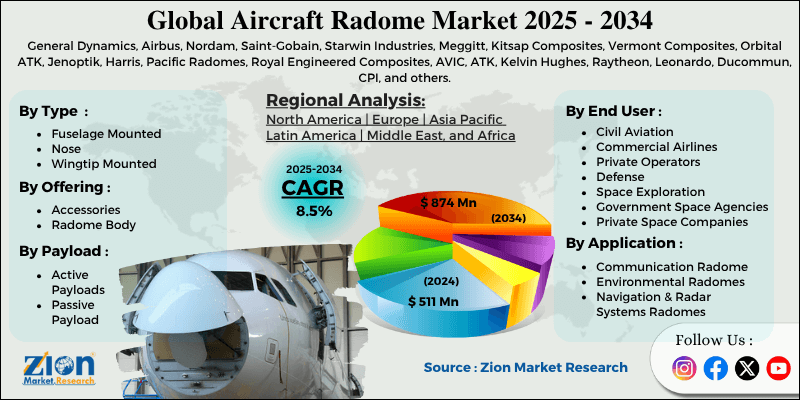

Aircraft Radome Market By Offering (Accessories and Radome Body), By Type (Fuselage Mounted, Nose, and Wingtip Mounted), By Payload Type (Active Payloads and Passive Payloads), By Application (Communication Radome, Environmental Radomes, and Navigation & Radar Systems Radomes), By End-User (Civil Aviation, Commercial Airlines, Private Operators, Defense, Space Exploration, Government Space Agencies, and Private Space Companies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

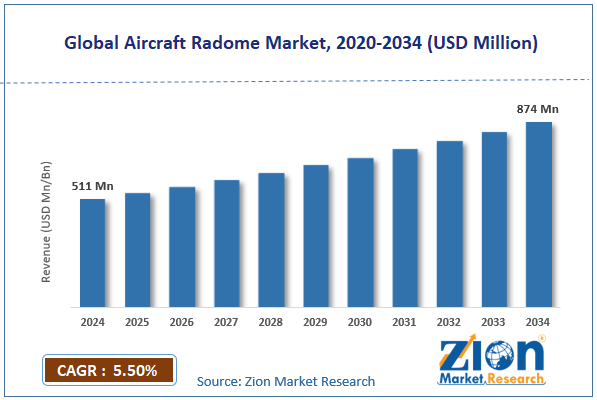

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 511 Million | USD 874 Million | 5.5% | 2024 |

Aircraft Radome Industry Prospective:

The global aircraft radome market size was worth around USD 511 million in 2024 and is predicted to grow to around USD 874 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034.

Aircraft Radome Market: Overview

An aircraft radome—a mix of radar and dome—protects the radar antenna of an airplane with a waterproof covering. Its main purposes are to lower aerodynamic drag and conceal the radar system from external elements, such as wind, rain, lightning, and debris, thereby preserving aircraft performance.

The rising need for improved aircraft performance and advances in aerospace technology are driving the fast expansion of the aviation radome market. Other key elements are changes in materials technology, the demand for better radar systems, and growing aviation traffic.

Key Insights

- As per the analysis shared by our research analyst, the global aircraft radome market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- In terms of revenue, the global aircraft radome market size was valued at around USD 511 million in 2024 and is projected to reach USD 874 million by 2034.

- The expansion in the aerospace sector is expected to drive the aircraft radome market over the forecast period.

- Based on the offering, the radome body segment is expected to hold the largest market share over the forecast period.

- Based on the type, the fuselage mounted segment is expected to dominate the market expansion over the projected period.

- Based on the payload type, the active payloads segment is expected to capture the largest market share over the projected period.

- Based on the application, the communication radome segment is expected to capture the largest market share over the projected period.

- Based on the end user, the commercial airlines segment holds a significant market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Aircraft Radome Market: Growth Drivers

Rising aircraft deliveries globally drive market growth

Advanced radomes are becoming more and more necessary to improve radar performance and guarantee reliable operations as airlines grow their fleets and aircraft manufacturers boost production. Modern aircraft models with cutting-edge radar systems need premium radomes for optimum performance and security.

The requirement for updated radome technology is also increasing as a result of modernization projects and the replacement of aging fleets. Radome demand is further accelerated by the growing aviation industry, which is fueled by increased passenger traffic and economic growth.

The radome market is anticipated to grow rapidly as aircraft deliveries continue to increase, propelled by design and material advancements to satisfy changing industry demands.

Aircraft Radome Market: Restraints

High development and certification costs hinder market growth

One of the biggest obstacles to aircraft radome market expansion in the aircraft radome industry is the high expenses of development and certification.

Both the product's technological complexity and the aerospace industry's strict regulations are responsible for these expenses. The radomes of aircraft must be electromagnetically transparent to radar and communication signals, while also being aerodynamically optimized.

Design methods necessitate extensive prototyping and sophisticated simulation technologies (such as computational fluid dynamics and RF modeling). Due to the impact on both flying performance and radar operation, even small modifications in shape or material may necessitate a complete redesign.

Aircraft Radome Market: Opportunities

Rising product launch offers a lucrative opportunity for market growth

The growing product launch is expected to offer a lucrative opportunity for the aircraft radome market expansion over the analysis period. For instance, in March 2024, a Leading supplier of sophisticated technologies for the global aerospace, defense, and other mission-critical sectors, Astronics Corporation, introduced the Typhon T-400 Series system, the next generation in Satellite Communications (SATCOM) communication technology.

Designed to run on any GEO-based Ku Satellite network, the Typhon T-400 Series essentially solves problems related to the high cost of outfitting an airplane with SATCOM connectivity. Using state-of-the-art technology and stressing installation flexibility, the Typhon T-400 series redefines connectivity gear.

By lowering the number of LRUs needed from four to two, this creative solution achieves notable optimization, therefore simplifying installation and greatly lowering the total fly-away cost. Moreover, tailored versions of the system—including a modem-less setup—offer certain mission and military end users additional freedom.

Aircraft Radome Market: Challenges

Maintenance and environmental issues pose a major challenge to market expansion

The aircraft radomes industry is heavily impacted by environmental and maintenance issues, which act as significant barriers to market expansion and reliability.

Although radomes are made to endure hostile environments, over time, corrosive substances, lightning, and extremely high or low temperatures can all impair their functionality. Their operating lifespan is limited by this deterioration, which also raises maintenance expenses.

Aircraft Radome Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Radome Market |

| Market Size in 2024 | USD 511 Million |

| Market Forecast in 2034 | USD 874 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 214 |

| Key Companies Covered | General Dynamics, Airbus, Nordam, Saint-Gobain, Starwin Industries, Meggitt, Kitsap Composites, Vermont Composites, Orbital ATK, Jenoptik, Harris, Pacific Radomes, Royal Engineered Composites, AVIC, ATK, Kelvin Hughes, Raytheon, Leonardo, Ducommun, CPI, and others. |

| Segments Covered | By Offering, By Type, By Payload Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Radome Market: Segmentation

The global aircraft radome industry is segmented based on offering, type, payload type, application, end-user, and region.

Based on the offering, the global market is bifurcated into accessories and radome bodies. The radome body segment is expected to hold the largest market share over the forecast period. Sophisticated radomes are required because of the increased need for new aircraft with sophisticated radar and communication systems brought on by the growth in international air traffic. Additionally, the necessity for radomes that can shield antennas while guaranteeing low signal loss has increased due to the widespread use of satellite communication systems in both military and commercial aviation.

Based on the type, the global aircraft radome industry is bifurcated into fuselage mounted, nose and wingtip mounted. The fuselage mounted segment is expected to dominate the market expansion over the projected period. Larger and more intricate antenna arrays must be housed in fuselage-mounted radomes due to the integration of advanced radar technology, such as Active Electronically Scanned Array (AESA) systems. Additionally, to ensure reliable connectivity, airlines have installed satellite communication systems, which are frequently placed behind fuselage-mounted radomes, in response to the increased demand for continuous internet access during flights.

Based on the payload type, the global aircraft radome market is bifurcated into active payloads and passive payloads. The active payloads segment is expected to capture the largest market share over the projected period. Specialized radomes are required to house these active payloads as a result of global defense programs aimed at equipping aircraft fleets with cutting-edge surveillance and communication technology. Additionally, the installation of radomes intended for active payloads has increased due to the growing need for in-flight communication and sophisticated navigation systems in commercial aircraft.

Based on the application, the global aircraft radome sector is bifurcated into communication radome, environmental radomes, and navigation & radar systems radomes. The communication radome segment is expected to capture the largest market share over the projected period. The widespread use of the internet and the demand for continuous connectivity have prompted airlines to outfit their planes with cutting-edge communication equipment. Radomes preserve signal integrity while shielding these systems from external influences.

Based on the end-user, the global market is bifurcated into civil aviation, commercial airlines, private operators, defense, space exploration, government space agencies, and private space companies. The commercial airlines segment holds a significant market share over the forecast period. This growth is attributable to the increasing number of air travel across the globe.

Aircraft Radome Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global aircraft radome market. The regional expansion is attributed to the rising technological advancements.

Advanced radar and communication systems must be integrated into both military and commercial aircraft, utilizing high-performance radomes that can withstand various exterior conditions while maintaining signal integrity.

Furthermore, airlines are updating their fleets with aircraft equipped with modern communication technologies in response to the increase in air travel and the demand for enhanced in-flight connectivity, thereby generating the need for suitable radomes.

For instance, North American Airlines noted in 2024 a 6.8% annual traffic increase over 2023. Capacity increased 7.4%; the load factor declined by -0.5 percentage points to 84.2%. In December 2024, traffic rose 5.1% compared to the same period last year.

Aircraft Radome Market: Competitive Analysis

The global aircraft radome market is dominated by players like:

- General Dynamics

- Airbus

- Nordam

- Saint-Gobain

- Starwin Industries

- Meggitt

- Kitsap Composites

- Vermont Composites

- Orbital ATK

- Jenoptik

- Harris

- Pacific Radomes

- Royal Engineered Composites

- AVIC

- ATK

- Kelvin Hughes

- Raytheon

- Leonardo

- Ducommun

- CPI

The global aircraft radome market is segmented as follows:

By Offering

- Accessories

- Radome Body

By Type

- Fuselage Mounted

- Nose

- Wingtip Mounted

By Payload Type

- Active Payloads

- Passive Payload

By Application

- Communication Radome

- Environmental Radomes

- Navigation & Radar Systems Radomes

By End User

- Civil Aviation

- Commercial Airlines

- Private Operators

- Defense

- Space Exploration

- Government Space Agencies

- Private Space Companies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An aircraft radome—a mix of radar and dome—protects the radar antenna of an airplane with a waterproof covering. Its main purposes are to lower aerodynamic drag and conceal the radar system from external elements, such as wind, rain, lightning, and debris, thereby preserving aircraft performance.

The aircraft radome market is driven by several variables, including technological advancements and the growing aerospace industry.

According to the report, the global aircraft radome market size was worth around USD 511 million in 2024 and is predicted to grow to around USD 874 million by 2034.

The global aircraft radome market is expected to grow at a CAGR of 5.5% during the forecast period.

The global aircraft radome market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and the robust aerospace sector.

The global aircraft radome market is dominated by players like General Dynamics, Airbus, Nordam, Saint-Gobain, Starwin Industries, Meggitt, Kitsap Composites, Vermont Composites, Orbital ATK, Jenoptik, Harris, Pacific Radomes, Royal Engineered Composites, AVIC, ATK, Kelvin Hughes, Raytheon, Leonardo, Ducommun, and CPI, among others.

The aircraft radome market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed