Market Size, Share, Trends, Growth and Forecast 2034

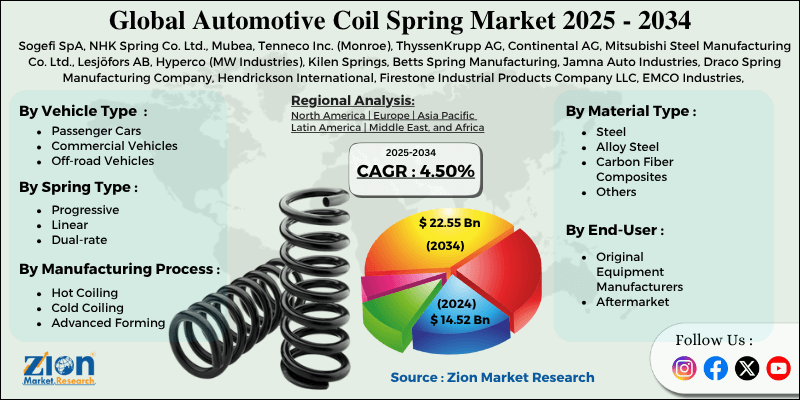

Automotive Coil Spring Market By Vehicle Type (Passenger Cars, Commercial Vehicles, and Off-road Vehicles), By Spring Type (Progressive, Linear, and Dual-rate), By Manufacturing Process (Hot Coiling, Cold Coiling, and Advanced Forming), By Material Type (Steel, Alloy Steel, Carbon Fiber Composites, and Others), By End-User (Original Equipment Manufacturers and Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

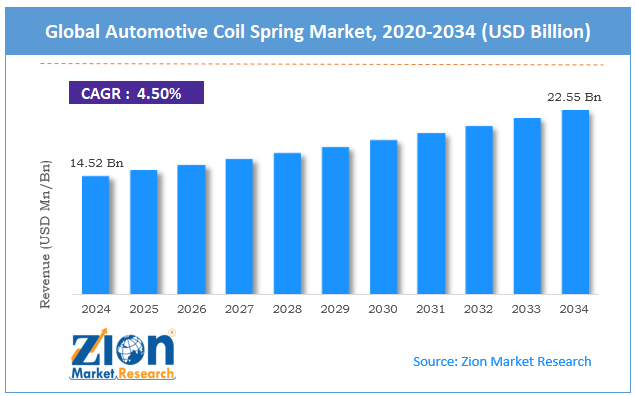

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.52 Billion | USD 22.55 Billion | 4.50% | 2024 |

Automotive Coil Spring Industry Prospective:

The global automotive coil spring market was valued at approximately USD 14.52 billion in 2024 and is expected to reach around USD 22.55 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.50% between 2025 and 2034.

Automotive Coil Spring Market: Overview

Automotive coil springs are helical-shaped mechanical devices that absorb and store energy, providing suspension support by compressing and expanding to absorb road shocks and keep the vehicle stable and comfortable. They offer load-bearing capacity, better handling, reduced road impact, and customizable performance for different driving conditions.

The automotive coil spring market serves vehicle manufacturers, aftermarket replacement parts providers, and specialty automotive sectors looking for performance-oriented solutions. Products range from standard steel springs for everyday vehicles to composite materials for high-performance applications.

The growing demand for vehicle comfort and handling, increasing vehicle production volumes, and rising aftermarket replacement needs are expected to drive substantial growth in the automotive coil spring industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive coil spring market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034)

- In terms of revenue, the global automotive coil spring market size was valued at around USD 14.52 billion in 2024 and is projected to reach USD 22.55 billion by 2034.

- The automotive coil spring market is projected to grow significantly due to rising EV adoption, stricter fuel efficiency norms, and increasing SUV demand, which drive innovation and growth in the automotive coil spring market.

- Based on vehicle type, passenger cars lead the segment and will continue to lead the global market.

- Based on spring type, progressive springs are expected to lead the market.

- Based on the manufacturing process, cold coiling is anticipated to command the largest market share.

- Based on the end-user, original equipment manufacturers are expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Automotive Coil Spring Market: Growth Drivers

Rising demand for vehicle comfort and performance

The automotive coil spring market is growing as consumer expectations for vehicle comfort and performance continue to rise globally. The premium segment, which focuses on better ride and handling, is growing annually. Recent automotive trends have brought customized driving experiences and comfort features across all vehicle segments.

Moreover, suspension is becoming a key differentiator in consumer buying decisions, and manufacturers are developing systems for different driving conditions and user preferences. Social media and automotive review platforms have raised consumer awareness about vehicle dynamics and suspension performance.

Technological advancements in materials and manufacturing

Automotive coil springs have greatly improved with new materials and better production methods. Lighter high-strength steels and composites now reduce vehicle weight without losing performance. Digital manufacturing makes coil springs more precise and consistent. New corrosion-resistant materials and coatings help springs last longer in harsh conditions.

Design software lets manufacturers fine-tune springs for each vehicle before making them. These changes have turned coil springs into important parts that improve how a car drives, performs, and uses fuel.

Automotive Coil Spring Market: Restraints

Price pressures and raw material volatility

Despite the growth, the automotive coil spring industry faces pricing pressures and raw material cost fluctuations affecting profitability and planning. Cost sensitivity is high in mass market segments with thin margins and fierce competition. Steel price volatility is a big challenge, as it’s the biggest material cost for most automotive springs.

Supply chain disruptions affect material availability and delivery schedules and complicate production planning. International trade tensions and tariff uncertainty add to the complexity of global material sourcing for multinationals. And the automotive industry’s move towards platformization is increasing price competition among component suppliers and forcing manufacturers to balance quality with cost optimization.

Automotive Coil Spring Market: Opportunities

Electric vehicle adaptation and lightweight solutions

The automotive coil spring market has opportunities in electric vehicle-specific designs and lightweight high-performance materials. Electric vehicles' unique weight distribution and performance requirements create demand for suspension components designed to address battery weight and altered chassis dynamics.

The industry-wide focus on vehicle light weighting to improve fuel efficiency and electric vehicle range has driven interest in advanced materials like carbon fiber reinforced polymers and titanium alloys.

The growing performance vehicle segment seeks specialized spring solutions that deliver handling without compromise on ride. Consumer interest is in adaptive and semi-active suspension systems incorporating intelligent coil spring technology.

Automotive Coil Spring Market: Challenges

Manufacturing complexity and quality consistency

The automotive coil spring industry faces technical challenges due to complex manufacturing and the need to maintain consistent quality in factories worldwide. Heat treatment processes need exact temperature control and special equipment to get the right metal properties every time.

Keeping parts accurate in large-scale production is hard, since even slight differences can affect how a vehicle handles and stays safe. Testing methods must be improved to check performance under different conditions and new regulations. Global manufacturers struggle to standardize processes across regions with different materials and skill levels.

Automotive Coil Spring Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Coil Spring Market |

| Market Size in 2024 | USD 14.52 Billion |

| Market Forecast in 2034 | USD 22.55 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 215 |

| Key Companies Covered | Sogefi SpA, NHK Spring Co. Ltd., Mubea, Tenneco Inc. (Monroe), ThyssenKrupp AG, Continental AG, Mitsubishi Steel Manufacturing Co. Ltd., Lesjöfors AB, Hyperco (MW Industries), Kilen Springs, Betts Spring Manufacturing, Jamna Auto Industries, Draco Spring Manufacturing Company, Hendrickson International, Firestone Industrial Products Company LLC, EMCO Industries, Duer/Carolina Coil Inc., Clifford Springs Ltd., Alco Spring Industries Inc., Advanced Suspensions Ltd., and others. |

| Segments Covered | By Vehicle Type, By Spring Type, By Manufacturing Process, By Material Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Coil Spring Market: Segmentation

The global automotive coil spring market is segmented into vehicle type, spring type, manufacturing process, material type, end-user, and region.

Based on vehicle type, the market is segregated into passenger cars, commercial vehicles, and off-road vehicles. Passenger cars lead the market due to their higher production volumes globally and the increasing consumer demand for improved ride comfort and handling across all vehicle segments.

Based on spring type, the automotive coil spring industry is classified into progressive, linear, and dual-rate. Of these, progressive springs hold the largest market due to their ability to provide variable spring rates that deliver both comfort during everyday driving and increased support during dynamic maneuvers or when carrying heavier loads.

Based on the manufacturing process, the automotive coil spring market is divided into hot coiling, cold coiling, and advanced forming. Cold coiling is expected to lead the market during the forecast period due to its superior dimensional accuracy, better surface finish, and higher fatigue resistance for automotive applications.

Based on material type, the market is segmented into steel, alloy steel, carbon fiber composites, and others. Steel leads the market due to its optimal balance of cost, durability, and performance characteristics for most automotive applications.

Based on end-users, the market is segmented into original equipment manufacturers and aftermarket. The original equipment manufacturer leads the market due to the large volume requirements for new vehicle production and long-term supplier agreements with major automotive manufacturers.

Automotive Coil Spring Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific leads the global automotive coil spring market since it is the top vehicle producer globally, with a strong supplier network and rising local demand. The region holds about 45% of the global market, led by China, Japan, and South Korea, which have advanced manufacturing systems.

As the middle class grows in developing Asian countries, more people are buying cars, keeping demand steady for suspension parts. Asia Pacific's huge automotive industry has built specialized centers that produce components at lower costs through economies of scale. The region’s push for electric vehicles has led to new suspension technologies suited for modern powertrains.

Strong government support in countries like China and India has boosted production capacity and improved component-making technology. Vehicle customization trends in markets like Japan and South Korea have created demand for performance-focused coil springs.

Europe is expected to grow significantly.

Europe holds a premium position in the automotive coil spring industry due to its emphasis on high-performance vehicles, strict quality standards, and strong engineering expertise.

Countries like Germany, Italy, and the UK have led the development of advanced suspension components, especially for luxury and performance cars. The region values precise driving dynamics and comfort, which has led to demand for advanced spring technologies.

European companies have led in material innovation and production methods, setting global performance and durability standards. Its deep motorsport tradition continues to shape commercial vehicle technology, bringing race-proven innovations into mainstream cars.

Recent Market Developments:

- In January 2025, Mitsubishi Steel inaugurated a new coil spring factory in India as part of a joint venture with Stumpp Schuele & Somappa Auto Suspension Systems Pvt. Ltd. (5S). This factory utilizes Mitsubishi's and 5S's expertise in coil spring manufacturing, including hot and cold forming, shot peening, and coating.

Automotive Coil Spring Market: Competitive Analysis

The global automotive coil spring market is led by players like:

- Sogefi SpA

- NHK Spring Co. Ltd.

- Mubea

- Tenneco Inc. (Monroe)

- ThyssenKrupp AG

- Continental AG

- Mitsubishi Steel Manufacturing Co. Ltd.

- Lesjöfors AB

- Hyperco (MW Industries)

- Kilen Springs

- Betts Spring Manufacturing

- Jamna Auto Industries

- Draco Spring Manufacturing Company

- Hendrickson International

- Firestone Industrial Products Company LLC

- EMCO Industries

- Duer/Carolina Coil Inc.

- Clifford Springs Ltd.

- Alco Spring Industries Inc.

- Advanced Suspensions Ltd.

The global automotive coil spring market is segmented as follows:

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Off-road Vehicles

By Spring Type

- Progressive

- Linear

- Dual-rate

By Manufacturing Process

- Hot Coiling

- Cold Coiling

- Advanced Forming

By Material Type

- Steel

- Alloy Steel

- Carbon Fiber Composites

- Others

By End-User

- Original Equipment Manufacturers

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive coil springs are helical-shaped mechanical devices that absorb and store energy, providing suspension support by compressing and expanding to absorb road shocks and keep the vehicle stable and comfortable.

The automotive coil spring market is expected to be driven by increasing vehicle production volumes, growing consumer demand for improved ride quality and handling, technological advancements in materials and manufacturing processes, the rise of electric vehicles requiring specialized suspension components, and expanding aftermarket replacement needs.

According to our study, the global automotive coil spring market was worth around USD 14.52 billion in 2024 and is predicted to grow to around USD 22.55 billion by 2034.

The CAGR value of the automotive coil spring market is expected to be around 4.50% during 2025-2034.

The global automotive coil spring market will register the highest growth in Asia Pacific during the forecast period.

Key players in the automotive coil spring market include Sogefi SpA, NHK Spring Co. Ltd., Mubea, Tenneco Inc. (Monroe), ThyssenKrupp AG, Continental AG, Mitsubishi Steel Manufacturing Co., Ltd., Lesjöfors AB, Hyperco (MW Industries), Kilen Springs, Betts Spring Manufacturing, Jamna Auto Industries, Draco Spring Manufacturing Company, Hendrickson International, Firestone Industrial Products Company, LLC, EMCO Industries, Duer/Carolina Coil, Inc., Clifford Springs Ltd., Alco Spring Industries Inc., and Advanced Suspensions Ltd.

The report comprehensively analyzes the automotive coil spring market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, material innovations, manufacturing process developments, and the evolving vehicle platform requirements shaping the automotive suspension component industry ecosystem.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed