Brown Hydrogen Market Size, Share, Trends, Growth 2034

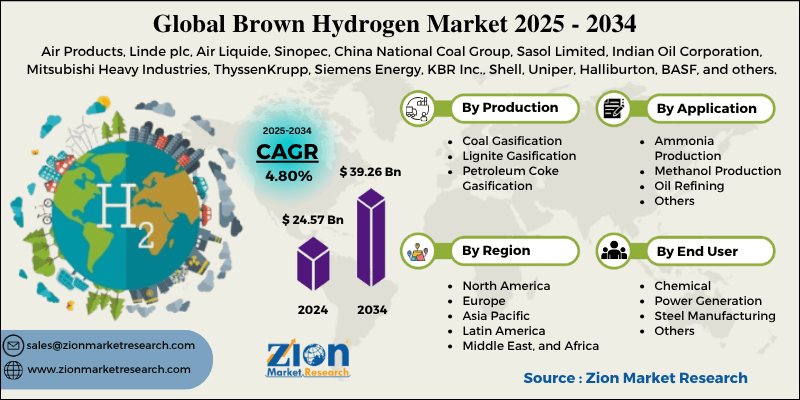

Brown Hydrogen Market By Production Method (Coal Gasification, Lignite Gasification, and Petroleum Coke Gasification), By Application (Ammonia Production, Methanol Production, Oil Refining, and Others), By End-User Industry (Chemical, Power Generation, Steel Manufacturing, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

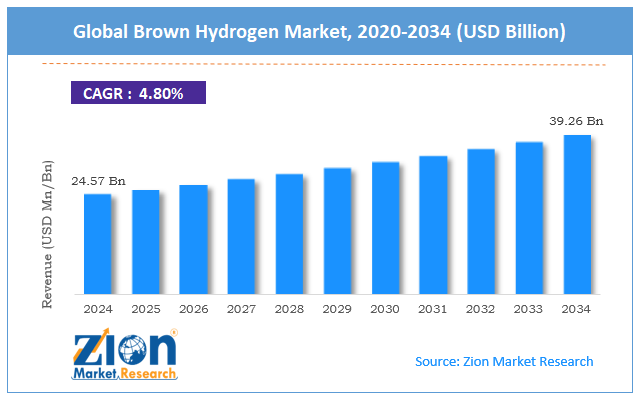

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.57 Billion | USD 39.26 Billion | 4.80% | 2024 |

Brown Hydrogen Industry Prospective:

The global brown hydrogen market was valued at approximately USD 24.57 billion in 2024 and is expected to reach around USD 39.26 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.80% between 2025 and 2034.

Brown Hydrogen Market: Overview

Brown hydrogen is hydrogen produced through coal gasification processes, where coal reacts with oxygen and steam under high temperatures to create hydrogen and carbon dioxide, representing one of the traditional hydrogen production methods with a significant carbon footprint. However, this conventional method of hydrogen production is still substantial in coal-rich areas despite the high carbon footprint.

The key characteristics of brown hydrogen are established technology, cost-effectiveness in coal areas, high carbon emissions, and integration with existing industrial infrastructure. The brown hydrogen market serves industries that require hydrogen as feedstock or fuel, chemical manufacturing, petroleum refining, and metallurgical processes.

Although under increasing environmental pressure, brown hydrogen will still play a role in the energy transition as infrastructure and capabilities for cleaner hydrogen sources develop globally.

The persistence of established industrial systems, cost advantages in certain regions, and the integration of carbon capture technologies to reduce emissions will influence the brown hydrogen industry dynamics over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global brown hydrogen market is estimated to grow annually at a CAGR of around 4.80% over the forecast period (2025-2034)

- In terms of revenue, the global brown hydrogen market size was valued at around USD 24.57 billion in 2024 and is projected to reach USD 39.26 billion by 2034.

- The brown hydrogen market is influenced by industrial decarbonization efforts, carbon pricing mechanisms, technological advancements in carbon capture, utilization, and storage (CCUS), and integration with emerging hydrogen economy initiatives.

- Based on production methods, coal gasification leads the segment and will continue to dominate the global market.

- Based on application, ammonia production is expected to lead the market.

- Based on the end-user industry, the chemical sector is anticipated to command the largest market share.

- Based on region, North America is projected to lead the global market during the forecast period.

Brown Hydrogen Market: Growth Drivers

Industrial continuity and established infrastructure

The brown hydrogen market remains resilient due to its deep integration with existing industrial systems and infrastructure. Long-established hydrogen production facilities tied to coal gasification plants represent significant capital investments with decades remaining in operational life.

Many industrial processes in chemical manufacturing, refining, and metallurgy depend on hydrogen from these sources. Countries with significant coal reserves prioritize resource utilization for energy security, supporting continued brown hydrogen production. The extensive pipeline networks, storage facilities, and distribution systems built around conventional hydrogen sources represent substantial investments.

Additionally, workforce expertise and operational knowledge in coal-based hydrogen production remain highly valuable in many industrial regions, contributing to market stability despite growing environmental concerns.

Economic considerations in transition economies

The brown hydrogen industry provides economic advantages in regions transitioning toward cleaner energy systems but still depend on fossil fuels. In coal-rich countries, particularly in Asia, Eastern Europe, and parts of North America, coal-based hydrogen is economical where natural gas prices are high or supply is constrained. Brown hydrogen creates jobs in coal mining regions facing economic challenges from the energy transition.

Existing subsidies and policy support for coal industries indirectly support brown hydrogen in many markets. Lower capital expenditure compared to building new green hydrogen facilities makes brown hydrogen economic in the short to medium term.

As hydrogen demand grows across various applications, brown hydrogen’s existing capacity meets the market while cleaner alternatives scale up, and economic stability is provided during the transition.

Brown Hydrogen Market: Restraints

Environmental regulations and decarbonization pressures

Despite its economic advantages, the brown hydrogen industry faces increasing regulatory challenges and decarbonization pressures. Carbon pricing mechanisms like emissions trading schemes and carbon taxes directly impact production costs, particularly in Europe and increasingly in other regions.

Stricter emission standards for industrial processes force producers to invest in pollution control technologies, raising operational expenses. Corporate sustainability goals and investor preferences increasingly favor low-carbon alternatives, limiting investment in new brown hydrogen facilities.

Consumer markets and industrial customers are demanding clean hydrogen for their products and processes, shrinking the market. Reputational risks from high-carbon production processes influence corporate decision-making against brown hydrogen expansion, a significant constraint for future growth.

Brown Hydrogen Market: Opportunities

Carbon capture integration and hybrid systems

The brown hydrogen market has opportunities through carbon capture technology integration and the development of hybrid production systems. Retrofitting existing facilities with carbon capture, utilization, and storage (CCUS) technology could reduce emissions while maintaining production capacity. Some producers are exploring co-processing coal with biomass to reduce the carbon intensity of brown hydrogen.

Research into advanced gasification technologies will improve efficiency and reduce the environmental impact of traditional feedstock. The expertise developed in handling hydrogen from coal gasification can be applied to emerging clean hydrogen technologies. Producers can participate in carbon offset markets by implementing emission reduction technologies.

Regions with limited renewable energy but plenty of coal can develop transition hydrogen strategies using brown hydrogen with increasing carbon capture rates, a bridge to cleaner hydrogen, while keeping industrial output and energy security.

Brown Hydrogen Market: Challenges

Technological limitations and investment challenges

The brown hydrogen industry has technical limitations with carbon capture tech and securing investment as the world moves to cleaner options. Current carbon capture for coal gasification captures 60-90% of emissions, not nearly the zero emissions required by climate targets.

The energy penalty of carbon capture reduces overall process efficiency and increases operating costs big time. The capital cost of retrofitting existing plants with carbon capture is higher than the financial returns under current carbon pricing. Investment uncertainty is high due to changing policy landscapes and stranded asset risks. Blue and green hydrogen are being researched and developed more.

The water requirements for coal gasification and carbon capture are under increasing scrutiny in water-stressed regions, an operational constraint and a potential regulatory hurdle for expansion or continued operation.

Brown Hydrogen Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Brown Hydrogen Market |

| Market Size in 2024 | USD 24.57 Billion |

| Market Forecast in 2034 | USD 39.26 Billion |

| Growth Rate | CAGR of 4.80% |

| Number of Pages | 214 |

| Key Companies Covered | Air Products, Linde plc, Air Liquide, Sinopec, China National Coal Group, Sasol Limited, Indian Oil Corporation, Mitsubishi Heavy Industries, ThyssenKrupp, Siemens Energy, KBR Inc., Shell, Uniper, Halliburton, BASF, and others. |

| Segments Covered | By Production Method, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Brown Hydrogen Market: Segmentation

The global brown hydrogen market is segmented into production method, application, end-user industry, and region.

Based on the production method, the market is segregated into coal gasification, lignite gasification, and petroleum coke gasification. Coal gasification leads the market due to the established infrastructure and technical expertise, particularly in countries with significant coal reserves like China, India, and Eastern Europe.

Based on application, the brown hydrogen industry is classified into ammonia production, methanol production, oil refining, and others. Of these, ammonia production leads the market due to brown hydrogen's established role in fertilizer manufacturing, where ammonia is a key input for producing nitrogen fertilizers.

Based on the end-user industry, the market is divided into chemical, power generation, steel manufacturing, and others. The chemical sector is expected to lead the market during the forecast period due to the substantial hydrogen requirements in chemical processing, particularly in ammonia and methanol production.

Brown Hydrogen Market: Regional Analysis

North America to lead the market

North America leads the global brown hydrogen market due to its large coal reserves, existing coal gasification infrastructure, and growing industrial hydrogen demand. It accounts for around 60% of the global market share, with the US being the largest producer and consumer. Industrial clusters in the US, Canada, and parts of Mexico rely heavily on coal-based hydrogen for chemical production, refining, and emerging applications.

National energy security policies in several North American countries prioritize domestic coal resource utilization, which supports brown hydrogen production.

Regional economic development strategies focus on coal value chain maximization with hydrogen production as a key component. The developing regulatory environments in many North American markets provide a longer transition timeline for high-carbon production methods than in European markets.

State support for carbon capture technology development and deployment is increasing, which may extend the life of brown hydrogen in the region. Significant investments in industrial modernization across North America are focused on efficiency improvements and emissions reduction for existing hydrogen production facilities rather than full system replacement.

Asia Pacific is the second-largest market.

Asia Pacific is the second-largest region in the brown hydrogen industry, driven by the region’s high coal usage and industrial growth. The area has large coal reserves, especially in China and India, which support large brown hydrogen production capacity.

Industrial users across the chemical, refining, and metallurgical sectors drive regional demand. State-backed industrial policies in several Asian countries are supporting coal-based hydrogen production as part of their overall economic development plans.

The region’s energy transition approach is a gradual decarbonization pathway that will continue to produce brown hydrogen while incrementally improving efficiency and emissions performance.

Investments in carbon capture technologies are increasing in the Asia Pacific, which can extend the life of existing brown hydrogen facilities. Regional industrial clusters are developing integrated approaches that combine traditional coal-based hydrogen with new production methods.

Recent Market Developments:

- In January 2025, Nel ASA acquired a 4.85% stake in Cavendish Hydrogen to support strategic growth in the hydrogen sector.

Brown Hydrogen Market: Competitive Analysis

The global brown hydrogen market is led by players like:

- Air Products

- Linde plc

- Air Liquide

- Sinopec

- China National Coal Group

- Sasol Limited

- Indian Oil Corporation

- Mitsubishi Heavy Industries

- ThyssenKrupp

- Siemens Energy

- KBR Inc.

- Shell

- Uniper

- Halliburton

- BASF

The global brown hydrogen market is segmented as follows:

By Production Method

- Coal Gasification

- Lignite Gasification

- Petroleum Coke Gasification

By Application

- Ammonia Production

- Methanol Production

- Oil Refining

- Others

By End-User Industry

- Chemical

- Power Generation

- Steel Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Brown hydrogen is hydrogen produced through coal gasification processes, where coal reacts with oxygen and steam under high temperatures to create hydrogen and carbon dioxide, representing one of the traditional hydrogen production methods with a significant carbon footprint.

Industrial decarbonization timelines, carbon pricing mechanisms, carbon capture technology advancements, energy security considerations in coal-rich regions, and the pace of clean hydrogen infrastructure development influence the brown hydrogen market.

According to our study, the global brown hydrogen market was worth around USD 24.57 billion in 2024 and is predicted to grow to around USD 39.26 billion by 2034.

The CAGR value of the brown hydrogen market is expected to be around 4.80% during 2025-2034.

The global brown hydrogen market will register the highest growth in North America during the forecast period.

Key players in the brown hydrogen market include Air Products, Linde plc, Air Liquide, Sinopec, China National Coal Group, Sasol Limited, Indian Oil Corporation, Mitsubishi Heavy Industries, ThyssenKrupp, Siemens Energy, KBR Inc., Shell, Uniper, Halliburton, and BASF.

The report comprehensively analyzes the brown hydrogen market, including an in-depth discussion of market drivers, restraints, regional dynamics, and future growth opportunities amid the energy transition. It also examines competitive dynamics, technological developments in carbon capture, and the evolving regulatory landscape shaping this segment of the hydrogen production industry.

Choose License Type

List of Contents

Brown HydrogenIndustry Prospective:OverviewKey Insights:Growth DriversEconomic considerations in transition economiesRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisRecent Market Developments:Competitive AnalysisThe global brown hydrogen market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed