Chemical Distribution Market Size, Share, Trends, Growth and Forecast 2034

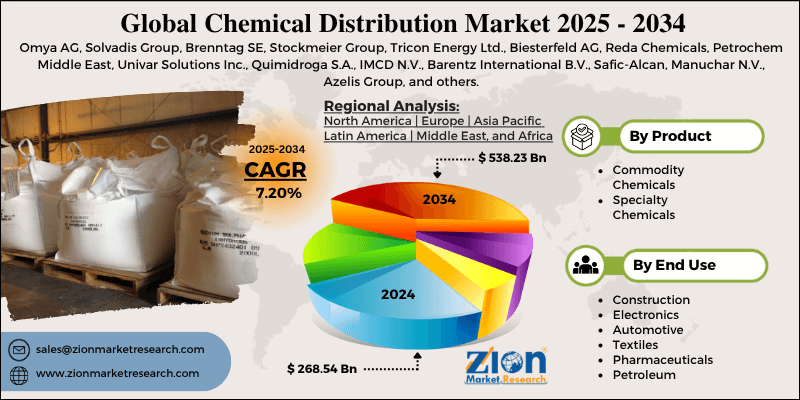

Chemical Distribution Market By Product (Commodity Chemicals and Specialty Chemicals), By End-User Industry (Construction, Electronics, Automotive, Textiles, Pharmaceuticals, Petroleum, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

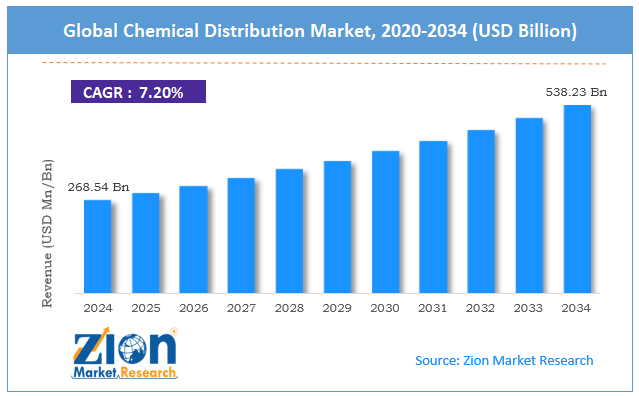

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 268.54 Billion | USD 538.23 Billion | 7.20% | 2024 |

Chemical Distribution Industry Prospective:

The global chemical distribution market size was worth around USD 268.54 billion in 2024 and is predicted to grow to around USD 538.23 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.20% between 2025 and 2034.

Chemical Distribution Market: Overview

Chemical distribution refers to the process of procuring chemicals from manufacturers and selling them to end buyers. Companies partaking in chemical distribution act as a connecting link between chemical producers and buyers. They are responsible for processes such as chemical procurement, storage, transportation, and final invoicing to the customers.

A key benefit of an effective chemical distribution process emerges in transactions occurring across borders. Industries that rely heavily on efficient chemical distribution processes include pharmaceuticals, food & beverages, electronics, construction, and beauty & personal care. The growing demand for chemicals and materials in the construction industry is helping the chemical distribution industry generate significant revenue.

During the forecast period, the introduction of novel advanced technologies promoting a smooth supply chain of chemicals will be critical to the industry’s growth trajectory.

In addition to this, increased consumption of green and specialty chemicals will open more avenues for further growth. A key growth barrier for the industry players will emerge in the form of the high cost of logistics across borders and stringent rules concerning the supply or procurement of hazardous chemicals.

Key Insights:

- As per the analysis shared by our research analyst, the global chemical distribution market is estimated to grow annually at a CAGR of around 7.20% over the forecast period (2025-2034)

- In terms of revenue, the global chemical distribution market size was valued at around USD 268.54 billion in 2024 and is projected to reach USD 538.23 billion by 2034.

- The chemical distribution market is projected to grow at a significant rate due to the rising demand for chemicals in the construction & building industry.

- Based on the product, the commodity chemicals segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user industry, the petroleum industry segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Chemical Distribution Market: Growth Drivers

Rising demand for chemicals in the construction & building industry to fuel market expansion rate

The global chemical distribution market is expected to be driven by the rising use of chemicals in the construction & building industry. The increasing development of commercial and residential buildings influences the growth trajectory in the end-user industry. Urbanization has played a crucial role in the demand for more residential facilities worldwide including remote locations.

Furthermore, investment in the redevelopment of existing infrastructure has amplified the use of construction chemicals worldwide. The modern building industry is guided by an increased focus on constructing climate-resistant buildings as the number of natural disasters worldwide has grown at unprecedented levels.

Moreover, the evolving government regulations encouraging construction companies to enlist sustainable building practices, chemicals, and materials will further amplify the demand for effective chemical distribution in the coming years.

Shifting focus toward green and specialty chemicals to foster innovation in the industry during the projection period

Chemical distributing companies and agencies are gaining more revenue due to the increased applications of specialty and green chemicals. The former are high-functioning chemical solutions used for specific applications.

Some common specialty chemicals include hydrazine, ethylene glycol, gallium arsenide, and benzophenone-4, among many others. Hydrazine, for instance, is a widely used rocket fuel, whereas benzophenone-4 is applied during the production of cosmetic items.

In July 2023, India’s Gujarat Alkalies in partnership with Chemicals Limited (GACL) shipped the first consignment of domestically produced Hydrazine Hydrate (80%) from the newly inaugurated Dahej complex in Gujarat state.

Furthermore, green chemicals are also gaining higher popularity among end-user industries. The global chemical distribution market players can benefit as the consumption of eco-conscious chemicals continues to rise in the future.

Chemical Distribution Market: Restraints

High cost of transportation and logistics to limit market expansion rate

The global chemical distribution industry is expected to be restricted by the high cost of transportation and logistics. Chemicals can be transported only in authorized vehicles to ensure smooth logistics.

The cost of transporting and storing chemicals across international borders is more expensive due to the additional freight charges. The growing fuel prices worldwide have further impacted the overall cost of shipping and transporting chemicals from one location to another.

Chemical Distribution Market: Opportunities

Growing rate of innovation in the industry to generate market growth opportunities for the industry players

The global chemical distribution market is expected to generate growth opportunities due to the rising rate of innovation. Chemical distribution companies are increasingly investing in advanced solutions to optimize the transportation and storage processes. It includes cutting-edge digital programs for inventory managers, improved safety gear for employees handling the components, next-generation transport vehicles, and blockchain technology to maintain supply chain transparency.

For instance, in July 2023, SABIC, one of the world’s leading chemical companies, announced the launch of a new blockchain software associated with Circularise. The platform will be used to track and reduce emissions across value chains. SABIC will leverage Circularise’s technology to capture emissions using a consistent methodological and reporting framework.

In March 2025, Honeywell announced a partnership with Corvus Robotics aiming to make significant technological improvements in the inventory tracking solutions in warehouses and distribution centers. The partnership will allow autonomous inventory drones by Corvus Robotics to use SwiftDecoder barcode decoding software by Honeywell.

Growing international trading partnerships to create demand for novel chemical distribution strategies

Global partnerships for chemicals and materials have registered steady growth in the last few years. Chemical manufacturers are increasingly diversifying product portfolios to meet evolving regulatory frameworks worldwide.

The increase in the number of international partnerships for chemical production and procurement will significantly impact demand for effective chemical distribution.

Chemical Distribution Market: Challenges

Changing distribution tariffs and increased competition to challenge market expansion

The global industry for chemical distribution is expected to be challenged by the changing distribution tariff. These changes can affect the overall profile generated by a chemical distributor.

In addition, rising competition levels within the industry can fragment market revenue in the long run. The addition of new players can dilute overall revenue of all companies involved in the industry.

Chemical Distribution Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Chemical Distribution Market |

| Market Size in 2024 | USD 268.54 Billion |

| Market Forecast in 2034 | USD 538.23 Billion |

| Growth Rate | CAGR of 7.20% |

| Number of Pages | 212 |

| Key Companies Covered | Omya AG, Solvadis Group, Brenntag SE, Stockmeier Group, Tricon Energy Ltd., Biesterfeld AG, Reda Chemicals, Petrochem Middle East, Univar Solutions Inc., Quimidroga S.A., IMCD N.V., Barentz International B.V., Safic-Alcan, Manuchar N.V., Azelis Group, and others. |

| Segments Covered | By Product, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Chemical Distribution Market: Segmentation

The global chemical distribution market is segmented based on product, end-user industry, and region.

Based on the product, the global market segments are commodity chemicals and specialty chemicals. In 2024, the highest revenue was listed in the commodity chemicals segment. The increasing demand for commonly used chemicals across end-user industries is fueling the segmental revenue.

During the projection period, the specialty chemicals segment is expected to deliver a CAGR of over 5. The increased consumption of green chemicals will create segmental revenue in the future.

Based on the end-user industry, the chemical distribution industry divisions are construction, electronics, automotive, textiles, pharmaceuticals, petroleum, and others.

In 2024, the highest revenue-generating segment was the petroleum industry. The increasing demand for chemicals such as propylene, ethylene, and others for the production of synthetic fibers and plastics will fuel segmental demand in the future. The construction segment will emerge as the second-highest revenue generator by 2034 with a CAGR of over 6%.

Chemical Distribution Market: Regional Analysis

Asia-Pacific to continue dominating the market during the forecast period

The global chemical distribution market will be led by Asia-Pacific during the forecast period. China is currently a world leader in terms of chemical production and distribution. It accounts for over 43% of the global chemical supply. The presence of massive chemical manufacturing facilities across China has been pivotal in shaping the region’s chemical distribution infrastructure.

In January 2025, Shell Petrochemicals Company Limited (CSPC), a joint venture between Shell Nanhai B.V. and China National Offshore Oil Corporation (CNOOC), announced the expansion of its petrochemical facility located in Daya Bay, Huizhou, southern China.

North America is another prominent market with high returns on investment. The growing demand for green chemicals across end-user industries in North America will fuel regional revenue.

Additionally, the integration of advanced technologies to create a robust chemical distribution network in the region will deliver significant avenues for further growth. The US is projected to emerge as the highest regional market revenue generator.

In January 2025, PURE Bioscience, Inc. and Hydrite Chemical Company announced the beginning of a multi-year distribution partnership. The former is a creator of a patented non-toxic silver dihydrogen citrate (SDC) antimicrobial. Hydrite now has access to the purchase and sale of SDC under special conditions.

Chemical Distribution Market: Competitive Analysis

The global chemical distribution market is led by players like:

- Omya AG

- Solvadis Group

- Brenntag SE

- Stockmeier Group

- Tricon Energy Ltd.

- Biesterfeld AG

- Reda Chemicals

- Petrochem Middle East

- Univar Solutions Inc.

- Quimidroga S.A.

- IMCD N.V.

- Barentz International B.V.

- Safic-Alcan

- Manuchar N.V.

- Azelis Group

The global chemical distribution market is segmented as follows:

By Product

- Commodity Chemicals

- Specialty Chemicals

By End-User Industry

- Construction

- Electronics

- Automotive

- Textiles

- Pharmaceuticals

- Petroleum

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Chemical distribution refers to the process of procuring chemicals from manufacturers and selling them to end-buyers.

The global chemical distribution market is expected to be driven by the rising use of chemicals in the construction & building industry.

According to study, the global chemical distribution market size was worth around USD 268.54 billion in 2024 and is predicted to grow to around USD 538.23 billion by 2034.

The CAGR value of the chemical distribution market is expected to be around 7.20% during 2025-2034.

The global chemical distribution market will be led by Asia-Pacific during the forecast period.

The global chemical distribution market is led by players like Omya AG, Solvadis Group, Brenntag SE, Stockmeier Group, Tricon Energy Ltd., Biesterfeld AG, Reda Chemicals, Petrochem Middle East, Univar Solutions Inc., Quimidroga S.A., IMCD N.V., Barentz International B.V., Safic-Alcan, Manuchar N.V., and Azelis Group.

The report explores crucial aspects of the chemical distribution market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed