Coffee Subscription Services Market Size, Share, Trends, Growth and Forecast 2034

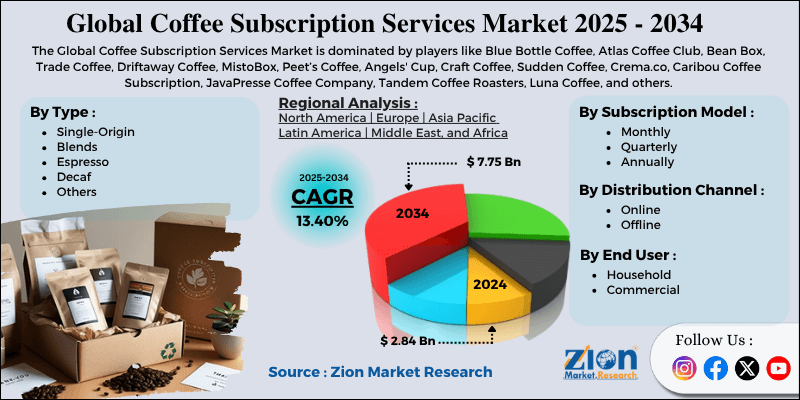

Coffee Subscription Services Market By Type (Single-Origin, Blends, Espresso, Decaf, and Others), By Subscription Model (Monthly, Quarterly, Annually), By Distribution Channel (Online, Offline), By End-User (Household, Commercial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

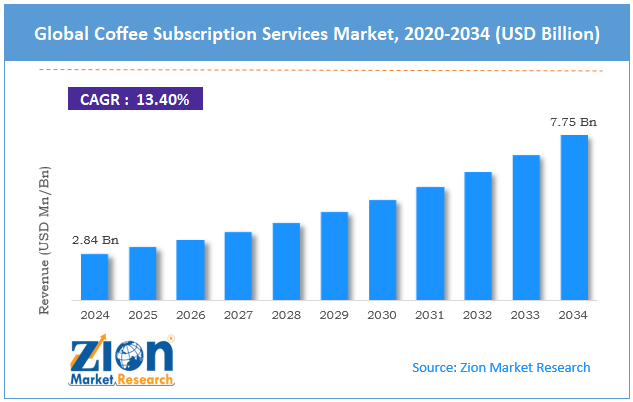

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.84 Billion | USD 7.75 Billion | 13.40% | 2024 |

Coffee Subscription Services Industry Prospective:

The global coffee subscription services market size was approximately USD 2.84 billion in 2024 and is projected to reach around USD 7.75 billion by 2034, with a compound annual growth rate (CAGR) of roughly 13.40% between 2025 and 2034.

Coffee Subscription Services Market: Overview

Coffee subscription services provide regular supplies of freshly roasted coffee grounds, beans, and pods directly to consumers' doorsteps. These are delivered on a monthly or weekly basis. These services cater to coffee lovers by offering curated selections tailored to user preferences, roast level, origin, and brewing techniques.The global coffee subscription services market is poised for notable growth, driven by increasing global coffee consumption, growing awareness of ethical sourcing and sustainability, and the surging prominence of specialty coffee.

According to the International Coffee Organization (ICO), global coffee consumption is expected to reach 178 million 60-kg bags by 2025. This mounting demand directly impacts the need for consistent and convenient access to high-class coffee, which coffee subscription models majorly address.Moreover, consumers are highly preferring brands that facilitate fair trade and ecologically responsible sourcing. Several subscription services are associated with ethical and eco-friendly suppliers, appealing to the conscious groups.

Additionally, the shift from mass-industry coffee to premium, artisanal blends and single-origin coffee is transforming consumer demand. The consumption of specialty coffee is growing at a rate of over 9% CAGR, primarily among Gen Z and millennials, which is fueling the adoption of subscription services.

Nevertheless, the global market faces limitations due to subscription fatigue, supply chain disruptions, and limited local brand penetration. As consumers manage multiple subscription services, such as groceries and streaming, a majority of them experience subscription overload or fatigue, prompting them to cancel non-essential services, like coffee.

Additionally, events such as global shipping delays, geopolitical tensions, and disruptions in coffee-producing regions can significantly impact the availability of coffee, leading to reduced product quality and inconsistent deliveries.In the developing markets, several consumers are unfamiliar with subscription models or prefer buying coffee in person. Hence, online trust issues and low brand awareness may negatively hinder market growth.

Still, the global coffee subscription services industry benefits from the integration of smart home brewing devices, corporate gifting, and advancements in eco-friendly packaging. Collaborations with IoT-based devices and smart machines create a unified home experience, driving subscription loyalty and enhancing overall user satisfaction.

Additionally, with the hybrid work trend, corporations are investing in employee wellness by offering coffee subscriptions as office supplies or perks, a growing B2B profit stream.

Additionally, offering reusable or compostable packaging and utilizing carbon-neutral shipping enhances the brand's image and appeal to eco-conscious users.

Key Insights:

- As per the analysis shared by our research analyst, the global coffee subscription services market is estimated to grow annually at a CAGR of around 13.40% over the forecast period (2025-2034)

- In terms of revenue, the global coffee subscription services market size was valued at around USD 2.84 billion in 2024 and is projected to reach USD 7.75 billion by 2034.

- The coffee subscription services market is projected to grow significantly due to the rising prominence of specialty coffee, customization, and convenience, as well as increasing awareness of ethical sourcing.

- Based on type, the single-origin segment is expected to lead the market, while the blends segment is expected to grow considerably.

- Based on the subscription model, the monthly segment is the dominant segment, while the quarterly segment is projected to witness sizable revenue over the forecast period.

- Based on the distribution channel, the online segment is expected to lead the market, surpassing the offline segment.

- Based on end-user, the household segment holds a dominant share, followed by the commercial segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Coffee Subscription Services Market: Growth Drivers

Increased focus on ethical sourcing and sustainability spurs market growth

Social responsibility and sustainability have become key factors in decision-making for users, particularly in the food industry. Coffee subscription services associated with sustainable roasters and fair-trade farms are gaining expansive demand from eco-conscious consumers.

According to a Nielsen report, nearly 73% of global users may switch companies for enhanced environmental impact, and subscription platforms are actively responding by providing carbon-neutral supply chains, complete supply chain transparency, and compostable packaging.

Expansion of loyalty-based offerings and tiered pricing remarkably propels the market growth

To appeal to a broader consumer base, several services have launched tiered pricing models, loyalty points, and free trials. This boosts the penetration of the coffee subscription services market in premium and budget consumer segments. Low entry obstacles may help convert casual purchasers into long-term subscribers.

Lifeboost Coffee and Coffee Circle introduced dynamic pricing plans in early 2025. This allowed consumers to create personalized bundles tailored to their consumption and budget. Early data from these initiatives show an increase in rates of 18% to 24%, which aids the model's prosperity.

Coffee Subscription Services Market: Restraints

Logistical and delivery challenges in developing markets are unfavorable for market progress

The success of a coffee subscription company mainly relies on efficient logistics. In several emerging regions, delivery delays, inadequate postal infrastructure, and customs barriers hinder the growth of these services.

For example, Sudden Coffee closed its growth model in Southeast Asia in late 2024, citing greater last-mile delivery costs and repetitive package losses. These restrictions add complexity for operating companies to maintain service consistency and scale globally.

Coffee Subscription Services Market: Opportunities

Expansion through corporate gifting positively impacts market growth

Corporate wellness initiatives and B2B associations denote a highly unexplored segment. Coffee subscriptions for co-working spaces, employee gifting, and offices may fuel long-term and large-volume contracts for service providers. This is a key opportunity for the coffee subscription services industry to drive progress.

In early 2025, Bean Box introduced a specialized corporate gifting platform, offering pre-paid subscriptions for workers. The program led to a 30% increase in quarterly profit, driven by HR departments implementing effective employee engagement strategies. This vertical offers better visibility and high scalability.

Coffee Subscription Services Market: Challenges

Customs and regulatory barriers in cross-border delivery restrict the market growth

Subscription services aiming for global expansion experience legal and logistical barriers when shipping coffee globally. Labeling requirements, tariffs, and customs delays result in substantial costs and dissatisfied clients due to held and late packages.

Over 45 nations apply diverse food safety regulations and import duties on green or roasted coffee, which increases the challenges for small and medium-sized subscription companies to scale globally, according to the World Trade Organization (WTO).

Coffee Subscription Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Coffee Subscription Services Market |

| Market Size in 2024 | USD 2.84 Billion |

| Market Forecast in 2034 | USD 7.75 Billion |

| Growth Rate | CAGR of 13.40% |

| Number of Pages | 211 |

| Key Companies Covered | Blue Bottle Coffee, Atlas Coffee Club, Bean Box, Trade Coffee, Driftaway Coffee, MistoBox, Peet’s Coffee, Angels' Cup, Craft Coffee, Sudden Coffee, Crema.co, Caribou Coffee Subscription, JavaPresse Coffee Company, Tandem Coffee Roasters, Luna Coffee, and others. |

| Segments Covered | By Type, By Subscription Model, By Distribution Channel, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Coffee Subscription Services Market: Segmentation

The global coffee subscription services market is segmented based on type, subscription model, distribution channel, end-user, and region.

Based on type, the global coffee subscription services industry is divided into single-origin, blends, espresso, decaf, and others. The single-origin coffee segment holds a substantial market share due to its premium appeal, distinct and rich flavor profiles, and transparency in sourcing associated with specific regions.

Conversely, the blends segment holds a second-leading position due to its preference for consistency, cost-effectiveness, and balanced flavors.

Based on subscription model, the global market is segmented into monthly, quarterly, and annually. The monthly subscription model holds a remarkable share and is highly popular. They offer an ideal balance between commitment and frequency, providing consumers with daily access to fresh coffee without requiring long-term contracts.

On the other hand, the quarterly segment held a considerable share, attracting more committed users who favor fewer shipments with cost-saving packaged goods or larger quantities.

Based on the distribution channel, the global coffee subscription services market is segmented into online and offline. The online distribution channel segment captured a majority share, registering higher coffee subscription sales. Brand websites, e-commerce platforms, and mobile applications allow users to customize subscriptions, receive home deliveries, and browse curated selections.

Conversely, the offline segment ranks second and comprises cafes, physical retail stores, and specialty coffee shops offering subscription sign-ups for individuals. Although less common, the model is suitable for local restaurants and boutique roasters, helping to build community loyalty.

Based on end-user, the global market is segmented into household and commercial. The household segment leads notably, accounting for the largest share, driven by rising interest in specialty coffee at home, the growing trend of remote work, and surging demand for convenience.

However, the commercial segment comprises co-working spaces, offices, and hospitality businesses and is the second-leading category. Although smaller in size than the household segment, the commercial segment is steadily growing in Europe and North America, where premium office perks are increasing rapidly.

Coffee Subscription Services Market: Regional Analysis

North America to witness significant growth over the forecast period

North America held a dominating share in the global coffee subscription services market owing to high coffee consumption rates, well-developed e-commerce infrastructure, and higher disposable income and spending on premium products. North America, particularly the United States, has a leading consumption rate globally.

Over 66% of Americans drink coffee regularly, with specialty coffee consumption growing rapidly, according to the National Coffee Association. This strong demand builds a fertile ground for recurring models like subscriptions. Moreover, the region boasts an established digital ecosystem characterized by the highest internet penetration and consumer trust in online platforms.

More than 80% of coffee subscriptions in the U.S. are performed online, facilitated by mobile-friendly interfaces and secure payment systems. This digital readiness boosts subscription management. In addition, regional consumers typically have high spending, allowing them to spend willingly on premium products, such as coffee.Over 45% of subscribed users in the United States choose plans costing more than $20 per month, indicating their willingness to invest in customization, convenience, and sustainability.

Europe is making remarkable progress in the coffee subscription services industry. The growth is attributed to a diverse and strong coffee culture, growing demand for organic and specialty coffee, and increased hybrid and WFH lifestyles.Europe holds a historic tradition of coffee, with Germany, France, and Italy deeply rooted in regular coffee rituals. The region consumes more than 3 million tonnes of coffee yearly, according to the European Coffee Federation. This increases the region's prominence as the leading coffee market.Such demand supports subscription models for artisanal and premium coffee. European consumers are inclining towards organic, specialty, and ethically sourced coffee.

According to reports, sales of specialty coffee surged by over 9% CAGR from 2020 to 2024, primarily in Western Europe and Nordic nations. Coffee subscriptions that offer fair trade, eco-friendly blends, and single-origin coffee are gaining popularity.

Europe has also adopted hybrid and remote work models similar to those in North America, primarily in the Netherlands, the United Kingdom, and Germany. With more time at home, consumers are increasingly opting for subscription models and home brewing methods.

Coffee Subscription Services Market: Competitive Analysis

The players fueling the global coffee subscription services market include:

- Blue Bottle Coffee

- Atlas Coffee Club

- Bean Box

- Trade Coffee

- Driftaway Coffee

- MistoBox

- Peet’s Coffee

- Angels' Cup

- Craft Coffee

- Sudden Coffee

- Crema.co

- Caribou Coffee Subscription

- JavaPresse Coffee Company

- Tandem Coffee Roasters

- Luna Coffee

Coffee Subscription Services Market: Key Market Trends

Hyper-personalization through data analytics and AI:

Subscription platforms are utilizing AI-based behavioral data and taste quizzes to refine coffee recommendations. Leading companies like Bean Box and Trade Coffee analyze user preferences to curate coffee roasts, origins, and flavor notes. This personalization reduces churn and improves customer satisfaction, with nearly 30% of customers experiencing long retention rates due to personalized services.

Blend with smart home brewing devices:

Technology-based coffee machines that synchronize subscription platforms are gaining traction. Smart brewers, such as Keurig's and Spinn’s connected devices, may automatically adjust brew settings and reorder beans, depending on the type of coffee received. This integration of IoT offers a unified consumer experience and boosts brand loyalty.

The global coffee subscription services market is segmented as follows:

By Type

- Single-Origin

- Blends

- Espresso

- Decaf

- Others

By Subscription Model

- Monthly

- Quarterly

- Annually

By Distribution Channel

- Online

- Offline

By End-User

- Household

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Coffee subscription services provide regular supplies of freshly roasted coffee grounds, beans, and pods directly to consumers' doorsteps. These are delivered on a monthly or weekly basis. These services cater to coffee lovers by offering curated selections tailored to user preferences, roast level, origin, and brewing techniques.

The global coffee subscription services market is projected to grow due to increasing global coffee consumption, the growth of mobile commerce and digitalization, and rising disposable income among consumers.

According to study, the global coffee subscription services market size was worth around USD 2.84 billion in 2024 and is predicted to grow to around USD 7.75 billion by 2034.

The CAGR value of the coffee subscription services market is expected to be approximately 13.40% from 2025 to 2034.

North America is expected to lead the global coffee subscription services market during the forecast period.

The key players profiled in the global coffee subscription services market include Blue Bottle Coffee, Atlas Coffee Club, Bean Box, Trade Coffee, Driftaway Coffee, MistoBox, Peet’s Coffee, Angels' Cup, Craft Coffee, Sudden Coffee, Crema.co, Caribou Coffee Subscription, JavaPresse Coffee Company, Tandem Coffee Roasters, and Luna Coffee.

The report examines key aspects of the coffee subscription services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed