Cypermethrin Insecticide Market Size, Share, Trends, Growth and Forecast 2034

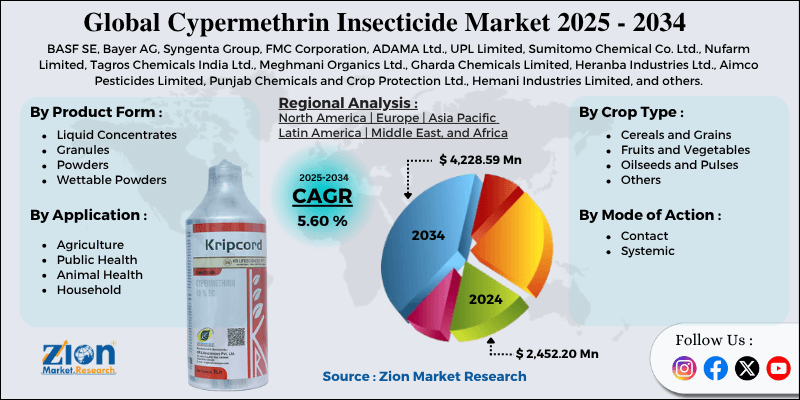

Cypermethrin Insecticide Market By Product Form (Liquid Concentrates, Granules, Powders, and Wettable Powders), By Application (Agriculture, Public Health, Animal Health, and Household), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, and Others), By Mode of Action (Contact and Systemic) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

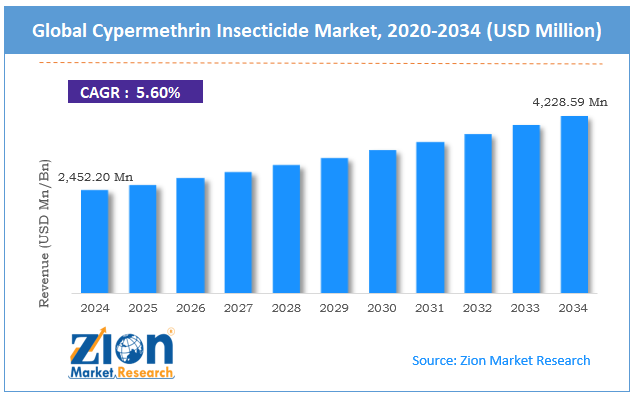

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2,452.20 Million | USD 4,228.59 Million | 5.60% | 2024 |

Cypermethrin Insecticide Industry Prospective:

The global cypermethrin insecticide market was valued at approximately USD 2,452.20 million in 2024 and is expected to reach around USD 4,228.59 million by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.60% between 2025 and 2034.

Cypermethrin Insecticide Market: Overview

Cypermethrin is a synthetic pyrethroid insecticide that disrupts the nervous system of target pests, providing broad-spectrum control against a wide range of agricultural and public health insect pests. This widely used insecticide offers rapid knockdown effects, residual activity, and relatively low mammalian toxicity compared to older insecticide classes.

The key features of cypermethrin are its effectiveness against multiple pest orders, including Lepidoptera, Coleoptera, and Diptera, compatibility with IPM programs, photostability for outdoor use, and cost-effectiveness for large-scale pest management.

The cypermethrin insecticide market serves agricultural producers protecting crops from insect damage, public health agencies controlling disease vectors, livestock producers managing ectoparasites, and households looking for effective pest control solutions. Products range from technical grade cypermethrin for manufacturing to ready-to-use formulations for various application requirements.

The increasing global food security concerns and resistance management needs in agricultural and urban pest control are expected to drive significant demand for cypermethrin over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global cypermethrin insecticide market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2025-2034)

- In terms of revenue, the global cypermethrin insecticide market size was valued at around USD 2,452.20 million in 2024 and is projected to reach USD 4,228.59 million by 2034.

- The cypermethrin insecticide market is projected to grow steadily due to increasing agricultural intensification in developing regions, the expanding threat of vector-borne diseases, growing resistance to older insecticide classes, and the development of improved formulations with enhanced safety profiles.

- Based on product form, liquid concentrates lead the segment and will continue to dominate the global market.

- Based on application, agriculture is expected to lead the market.

- Based on crop type, cereals and grains are anticipated to command the largest market share.

- Based on the mode of action, contact insecticides are expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Cypermethrin Insecticide Market: Growth Drivers

Agricultural intensification and crop protection needs

The cypermethrin insecticide market is expanding due to agricultural intensification and growing crop protection requirements worldwide. Global food security concerns drive greater crop protection needs as agricultural land per capita decreases and production intensifies. Climate change alters pest distribution and behavior patterns, leading to new insect pressures in previously unaffected regions.

The growing middle class in developing nations is increasing demand for high-quality produce with minimal pest damage, supporting insecticide use. Resistance in pest populations to older insecticide classes creates demand for pyrethroid products like cypermethrin in rotation programs.

Agriculture is expanding into marginal lands with more pest pressure, so chemical control is needed. Post-harvest losses from insect damage are still high in many areas, so preventive chemical treatments are required.

Vector-borne disease control requirements

Cypermethrin insecticide industry demand is driven by global public health vector control needs. Mosquito-borne diseases like dengue, Zika, and malaria are expanding into new regions, and insecticide usage for vector management is increasing. Urbanization in tropical areas creates ideal conditions for disease vectors, and large-scale control programs often include pyrethroid insecticides.

Climate change is extending disease vectors' range and activity period, and insecticide requirements for public health programs are increasing. Cypermethrin's rapid action against adult mosquitoes makes it valuable for emergency disease outbreak responses.

Limited vaccine availability for many vector-borne diseases means chemical control is essential in integrated management approaches. All these factors support the continued demand for cypermethrin in vector control applications and complement its agricultural market.

Cypermethrin Insecticide Market: Restraints

Regulatory restrictions and environmental concerns

Despite being effective, the cypermethrin insecticide industry faces increasing regulatory hurdles and environmental concerns. Tightening maximum residue limits (MRLs) in major import markets restricts application rates and timing, especially for agricultural exports. Re-registration in developed markets is imposing additional use restrictions and safety measures.

Toxicity to non-target organisms, especially aquatic invertebrates and beneficial insects like pollinators, is a concern. Environmental persistence leads to monitoring requirements and potential use restrictions near sensitive ecosystems. Consumer activist groups and environmental organizations are challenging pyrethroid registrations through legal and public pressure campaigns.

Cypermethrin Insecticide Market: Opportunities

Advanced formulations and resistance management solutions

There are opportunities in the cypermethrin insecticide market through advanced formulation technology and positioning in resistance management programs. Microencapsulation and controlled-release formulations can reduce environmental impact while maintaining efficacy to address regulatory concerns.

Combination products with insecticides of different modes of action create premium products that manage resistance and broader pest spectrum control. Low-drift formulations reduce off-target movement to address environmental concerns while maintaining effectiveness.

Water-based formulations with reduced solvent content meet the growing demand for safer handling in professional and consumer markets. An increasing opportunity exists to integrate into precision agriculture systems through optimized application technology and timing recommendations.

Cypermethrin Insecticide Market: Challenges

Resistance development and alternative pest management approaches

The cypermethrin insecticide market faces challenges with insect resistance development and competition from other pest management technologies. Cross-resistance patterns between pyrethroids make class rotation strategies in resistance management programs less effective.

The pipeline for new insecticide modes of action will create competition in the future as products with better environmental profiles come to market. Integrated Pest Management (IPM) adoption reduces prophylactic insecticide applications and could reduce overall volume demand.

The biological control market, including microbial and beneficial insects, has alternatives in some applications. Gene editing technologies like CRISPR can create pest-resistant crop varieties that could reduce chemical insecticide use.

Cypermethrin Insecticide Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cypermethrin Insecticide Market |

| Market Size in 2024 | USD 2,452.20 Million |

| Market Forecast in 2034 | USD 4,228.59 Million |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 211 |

| Key Companies Covered | BASF SE, Bayer AG, Syngenta Group, FMC Corporation, ADAMA Ltd., UPL Limited, Sumitomo Chemical Co. Ltd., Nufarm Limited, Tagros Chemicals India Ltd., Meghmani Organics Ltd., Gharda Chemicals Limited, Heranba Industries Ltd., Aimco Pesticides Limited, Punjab Chemicals and Crop Protection Ltd., Hemani Industries Limited, and others. |

| Segments Covered | By Product Form, By Application, By Crop Type, By Mode of Action, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cypermethrin Insecticide Market: Segmentation

The global cypermethrin insecticide market is segmented into product form, application, crop type, mode of action, and region.

Based on product form, the market is segregated into liquid concentrates, granules, powders, and wettable powders. Liquid concentrates lead the market due to ease of handling, precise dosing capabilities, compatibility with modern spray equipment, and effectiveness across various application scenarios, from agricultural fields to urban pest control.

Based on application, the cypermethrin insecticide industry is classified into agriculture, public health, animal health, and household. Of these, agriculture holds the largest market share due to cypermethrin's broad-spectrum activity against major crop pests, cost-effectiveness compared to newer insecticide classes and established position in pest management programs worldwide.

Based on crop type, the cypermethrin insecticide market is divided into cereals and grains, fruits and vegetables, oilseeds and pulses, and others. Cereals and grains are expected to lead the market during the forecast period due to the large cultivation area dedicated to these crops globally and their vulnerability to numerous insect pests that can be effectively controlled with cypermethrin.

Based on the mode of action, the market is segmented into contact and systemic activity. The contact insecticide segment leads the market due to cypermethrin's primary mode of action through direct contact with target pests, providing rapid knockdown and control.

Cypermethrin Insecticide Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific leads the global cypermethrin insecticide market due to high agricultural production, large numbers of smallholder farmers, and substantial public health vector control programs. The region accounts for around 45% of the global market, with China and India being the major producers and consumers.

Rice is a staple crop in the area and requires significant insect management; hence, the demand for effective and affordable insecticides is sustained. The tropical and subtropical climate of the region means year-round pest pressure and a longer insecticide application season.

Many Asian countries are developing their regulatory frameworks, and the implementation is more gradual than in Western markets. China and India have strong manufacturing capacity, which provides a cost advantage and scale.

The high population density in urban areas drives public health insecticide applications for mosquito and fly control. Agricultural intensification in Southeast Asia has increased insecticide use as farmers protect crops of higher value and investments.

North America is to focus on specialized applications.

North America is the fastest-growing cypermethrin insecticide market, characterized by higher regulatory scrutiny and specialization in specific applications. The professional pest management segment in these regions still uses cypermethrin for targeted applications with limited alternatives. Public health emergency response has strategic stockpiles of pyrethroid insecticides, including cypermethrin.

The regions are focused on resistance management and have positioned cypermethrin in rotation programs rather than standalone solutions. Specialized agriculture segments like orchard crops and vegetables still use cypermethrin, whereas alternatives are limited or more expensive.

The regions are moving towards more precise application technology to minimize environmental impact while maintaining efficacy. Premium pricing on advanced formulations with improved safety profiles has partially offset volume declines in these mature markets.

Recent Market Developments:

- January 2025 marked the market availability of Ridesco WG (α-cypermethrin + dinotefuran), introduced by BASF Pest Control Solutions for broad-spectrum pest control.

Cypermethrin Insecticide Market: Competitive Analysis

The global cypermethrin insecticide market is led by players like:

- BASF SE

- Bayer AG

- Syngenta Group

- FMC Corporation

- ADAMA Ltd.

- UPL Limited

- Sumitomo Chemical Co. Ltd.

- Nufarm Limited

- Tagros Chemicals India Ltd.

- Meghmani Organics Ltd.

- Gharda Chemicals Limited

- Heranba Industries Ltd.

- Aimco Pesticides Limited

- Punjab Chemicals and Crop Protection Ltd.

- Hemani Industries Limited

The global cypermethrin insecticide market is segmented as follows:

By Product Form

- Liquid Concentrates

- Granules

- Powders

- Wettable Powders

By Application

- Agriculture

- Public Health

- Animal Health

- Household

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

By Mode of Action

- Contact

- Systemic

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cypermethrin is a synthetic pyrethroid insecticide that disrupts the nervous system of target pests, providing broad-spectrum control against a wide range of agricultural and public health insect pests.

The cypermethrin insecticide market is expected to be driven by agricultural intensification in developing regions, expanding threats from vector-borne diseases, insect resistance to older chemistries, development of improved formulations, and continued cost-effectiveness compared to newer insecticide classes.

According to our study, the global cypermethrin insecticide market was worth around USD 2,452.20 million in 2024 and is predicted to grow to around USD 4,228.59 million by 2034.

The CAGR value of the cypermethrin insecticide market is expected to be around 5.60% during 2025-2034.

The global cypermethrin insecticide market will register the highest growth in Asia Pacific during the forecast period.

Key players in the cypermethrin insecticide market include BASF SE, Bayer AG, Syngenta Group, FMC Corporation, ADAMA Ltd., UPL Limited, Sumitomo Chemical Co., Ltd., Nufarm Limited, Tagros Chemicals India Ltd., Meghmani Organics Ltd., Gharda Chemicals Limited, Heranba Industries Ltd., Aimco Pesticides Limited, Punjab Chemicals and Crop Protection Ltd., and Hemani Industries Limited.

The report comprehensively analyzes the cypermethrin insecticide market, including an in-depth discussion of market drivers, regulatory constraints, formulation advancements, application trends, and regional dynamics. It also examines competitive strategies, resistance management approaches, and the evolving balance between conventional chemical control and alternative pest management technologies.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed