Defense Navigation Market Size, Share, Trends, Growth and Forecast 2034

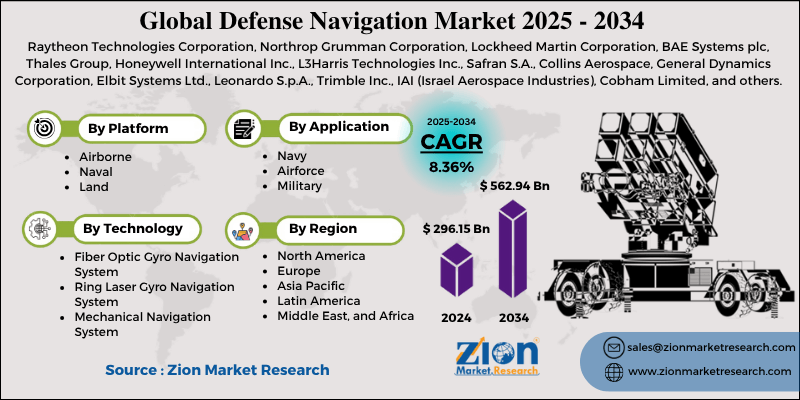

Defense Navigation Market By Platform Type (Airborne, Naval, Land), By Application (Navy, Airforce, Military), By Technology (Fiber Optic Gyro Navigation System, Ring Laser Gyro Navigation System, Mechanical Navigation System, Hemispherical Resonator Gyro Navigation System, Micromechanical Systems Based Navigation System, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

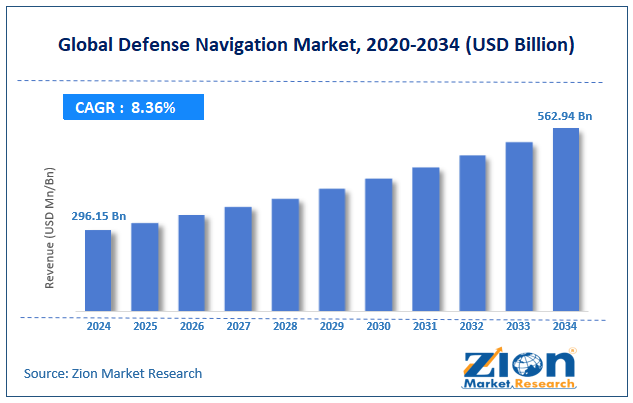

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 296.15 Billion | USD 562.94 Billion | 8.36% | 2024 |

Defense Navigation Industry Prospective:

The global defense navigation market size was worth around USD 296.15 billion in 2024 and is predicted to grow to around USD 562.94 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.36% between 2025 and 2034.

Defense Navigation Market: Overview

Defense navigation is the use of systems, technologies, and methodologies that determine the correct position, movement, and direction of military personnel, aircraft, vehicles, and naval vessels. These systems are essential for target tracking, mission planning, and operational coordination in combat and non-combat situations.

Defense navigation enhances situational awareness, improves the effectiveness of modern defense operations, and reduces risk. The global defense navigation market is expected to experience remarkable growth due to rising global military expenditure, the expansion of autonomous and unmanned systems, and advancements in satellite navigation infrastructure.

The global defense budgets, primarily in the economies of China, the United States, and NATO, are expanding, driving the procurement of advanced technologies. Global defense spending is reaching new heights, with navigation systems being a leading investment domain. Nations aim to improve their control and command infrastructure, depending on accurate geolocation to maintain a strategic edge.

Moreover, UGVs, UUVs, and UAVs are revolutionizing modern combat. These systems are primarily dependent on strong navigation tools. Their growing adoption in ISR missions is notably driving the demand for precise and compact navigation systems.

Global constellations are improving in terms of precision, encryption, and reliability. The defense sector benefits from these improvements by using military-grade satellite signals, allowing secure and accurate battlefield operations.

Nevertheless, the global market is hindered by vulnerability to jamming and cyberattacks, as well as the high price of advanced navigation solutions. GPS-based systems are susceptible to signal jamming and spoofing, which can mislead assets or troops, potentially compromising their security. This increases security issues and restricts dependency on satellite systems.

Additionally, systems such as atomic clocks, quantum navigation, and FOG are significantly expensive, thus limiting their adoption in low-income defense sectors.

Yet, the global defense navigation industry is anticipated to progress considerably due to the advancement of quantum navigation and inertial solutions, as well as the growth of space-based navigation programs.

Research into gyroscopes and quantum accelerometers offers excellent potential for accurate GPS-independent navigation, changing military navigation. Moreover, the development of military satellite constellations presents lucrative opportunities for vendors of defense-grade navigation systems.

Key Insights:

- As per the analysis shared by our research analyst, the global defense navigation market is estimated to grow annually at a CAGR of around 8.36% over the forecast period (2025-2034)

- In terms of revenue, the global defense navigation market size was valued at around USD 296.15 billion in 2024 and is projected to reach USD 562.94 billion by 2034.

- The defense navigation market is projected to grow significantly due to the growing need for precision in modern warfare, improvements in navigation technologies, and advancements in the military fleet.

- Based on platform type, the airborne segment is expected to lead the market, while the naval segment is expected to grow considerably.

- Based on application, the Air Force is the dominant segment, while the Navy segment is projected to experience significant revenue growth over the forecast period.

- Based on technology, the fiber optic gyro navigation system segment is expected to lead the market, surpassing the ring laser gyro navigation system segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Defense Navigation Market: Growth Drivers

The emergence of satellite advancements and space-based navigation propels market growth

The increasing deployment of defense-based LEO satellites and enhanced global satellite constellations is transforming navigation capabilities for defense platforms. The global militaries are shifting towards more encrypted and secure satellite navigation services, such as IRNSS (NavIC) in India, M-Code GPS in the United States, and Galileo PRS in Europe.

The United States Space Force introduced GPS-III SV08 in April 2024, offering enhanced signal strength, long lifespan, and anti-jamming capabilities. These satellites allow more precise and secure navigation for valuable defense assets.

Rising cross-border conflicts and geopolitical tensions considerably fuel the market growth

The escalation of territorial disputes and regional conflicts has positively impacted the demand for improved navigation systems to aid reconnaissance, surveillance, and combat operations. The current stresses in the Indo-Pacific region, Eastern Europe, and the Middle East have spiked the procurement of missile guidance systems, maritime navigation platforms, and armored vehicle INS.

This amplified threat outlook has boosted the growth of the defense navigation market. Moreover, nations are also prioritizing real-time tracking, reduced reliance on vulnerable satellite links, and precision strike capabilities.

Defense Navigation Market: Restraints

Restricted integration with legacy platforms adversely impacts market progress

Several nations still operate older military platforms, such as aircraft, tanks, and submarines, which are not compatible with advanced navigation systems. Upgrading these platforms requires significant interface development and retrofitting, necessitating custom engineering efforts and substantial downtime.

A British Royal Navy modernization report in 2024 revealed that updating Type 23 frigates with advanced navigation technology would require 24-30 months per vessel, potentially deterring speedy system production.

Defense Navigation Market: Opportunities

Surging demand for navigation systems in long-range missiles and the hypersonic fuels market growth

With the growing investments in ICBMs (intercontinental ballistic missiles) and hypersonic systems, there is an increasing need for navigation systems that can operate in high-G-force environments, without GPS, and at high speeds. These systems should integrate high-grade RLGs, HRGs, and Fogs to support high-precision trajectory correction and targeting.

Nations like China, India, and the United States are also intensifying research and development in resilient guidance systems, which offer opportunities for navigation technology providers to develop strong and thermally shielded technologies. These opportunities are expected to fuel the global defense navigation industry directly.

Defense Navigation Market: Challenges

Interoperability across platforms and allied forces restricts the growth of the market

Modern coalition warfare, such as NATO missions, requires unified interoperability of navigation systems across multiple countries and various platforms, including land, air, space, and sea. Yet, disparities in technology standards, encryption, and communication protocols pose significant challenges to interoperability.

For example, during the 2024 NATO exercises, issues regarding compatibility between American and European Drone navigation systems delayed coordinated UAV operations by 48 hours. According to the EDA, a lack of communal technical standards in defense navigation causes intricacies in interoperability in over 25 percent of joint operations.

Defense Navigation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Defense Navigation Market |

| Market Size in 2024 | USD 296.15 Billion |

| Market Forecast in 2034 | USD 562.94 Billion |

| Growth Rate | CAGR of 8.36% |

| Number of Pages | 214 |

| Key Companies Covered | Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, Thales Group, Honeywell International Inc., L3Harris Technologies Inc., Safran S.A., Collins Aerospace, General Dynamics Corporation, Elbit Systems Ltd., Leonardo S.p.A., Trimble Inc., IAI (Israel Aerospace Industries), Cobham Limited, and others. |

| Segments Covered | By Platform Type, By Application, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Defense Navigation Market: Segmentation

The global defense navigation market is segmented based on platform type, application, technology, and region.

Based on platform type, the global defense navigation industry is divided into airborne, naval, and land. The airborne segment accounts for a substantial share of the market, driven by the increasing use of advanced navigation systems in military transport aircraft, fighter jets, helicopters, and UAVs. These platforms demand anti-jamming navigation for flight stability, high precision, target accuracy, and mission execution.

Primarily, combat aircraft utilize INS integrated with GPS and terrain mapping, while UAVs rely on hybrid and autonomous navigation to operate in GNSS-based environments.

Based on application, the global defense navigation market is segmented into navy, air force, and military. The air force segment dominates the market due to air superiority strategies employed by leading powers. Air force operations, mainly combat missions, electronic warfare, aerial refueling, and surveillance, demand anti-jamming and ultra-precise navigation systems. UAVs, fighter jets, and strategic bombers utilize tactical inertial sensors, integrated GNSS-INS systems, and AI route optimization solutions to promise mission success.

The increasing deployment of UAVs and next-generation fighter programs has driven up the demand for autonomous and resilient airborne navigation systems.

Based on technology, the global market is segmented into fiber optic gyro navigation systems, ring laser gyro navigation systems, mechanical navigation systems, hemispherical resonator gyro navigation systems, micromechanical systems-based navigation systems, and other navigation systems. The FOG is the dominant segment in the market, accounting for the largest share of revenue.

FOG systems offer low drift, high accuracy, and resistance to temperature variations and vibrations. This increases their suitability for a broader range of military platforms, mainly naval and airborne applications. These systems do not contain moving components, resulting in a longer operational life and improved reliability under extreme combat conditions.

Defense Navigation Market: Regional Analysis

North America to witness significant growth over the forecast period

North America held a dominant share of the global defense navigation market, backed by the highest defense spending, widespread adoption of advanced platforms, technological dominance, and significant research and development investments. North America, mainly the United States, maintains the leading defense budget on a global scale, registering for nearly 38% of the worldwide military expenditure.

The United States Department of Defense had a budget exceeding $850 billion, with a significant share allocated to advancements. This capacity enables large-scale investment in navigation technologies for air, land, and naval applications.

Moreover, the region leads in the deployment of fighter jets embedded with superior navigation systems. These platforms incorporate inertial navigation, satellite-based tracking, and AI guidance, creating heavy demand for high-grade systems. This advanced fleet profile fuels the regional prominence in defense navigation.

Additionally, the United States is a leading center for defense navigation providers, such as Honeywell, Northrop Grumman, and L3Harris, among others, which are primarily investing in the research and development of next-generation solutions. DARPA allocated over $100 million to alternative navigation research programs in 2023, thereby strengthening regional innovation capabilities.

The Asia Pacific region registers a considerable share of the defense navigation industry due to its speedy growth in defense budgets, innovation in naval and air fleets, and emphasis on indigenous capability development.

The region has experienced a consistent double-digit rise in defense budgets, led by Japan, India, China, and South Korea. In 2023, China allocated over $225 billion to defense, ranking it as the second-largest global spender. These expanding budgets aid the procurement of advanced navigation systems in air, land, and naval forces.

Nations in the region are speedily advancing their navies and air forces with diverse platforms. These platforms are well-equipped with fiber-optic and inertial navigation systems, enhancing strike capability, precision targeting, and mission stability, thereby significantly expanding the defense navigation sector.

Furthermore, APAC governments are aiming for self-reliance in defense solutions, resulting in strong domestic research and development efforts in navigation technologies.

For instance, India's DRDO is advancing ring laser gyro and MEMS-based systems, while China's CASIC is focusing on quantum inertial navigation. These plans promise enduring supply chain safety and regional attractiveness.

Defense Navigation Market: Competitive Analysis

The prominent players in the global defense navigation market are:

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- BAE Systems plc

- Thales Group

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Safran S.A.

- Collins Aerospace

- General Dynamics Corporation

- Elbit Systems Ltd.

- Leonardo S.p.A.

- Trimble Inc.

- IAI (Israel Aerospace Industries)

- Cobham Limited

Defense Navigation Market: Key Market Trends

Miniaturization and MEMS-based systems:

There is a growing demand for rugged, miniaturized, and low-power navigation systems that utilize MEMS technology. These are deployed in portable soldier systems, loitering munitions, unmanned aerial vehicles (UAVs), and smart missiles. The MEMS trend aids agile deployment strategies and swarm warfare.

Rising adoption of satellite navigation augmentation:

Militaries are increasingly using dual-GNSS and regional systems to enhance accuracy and redundancy. Moreover, military-grade encrypted GNSS and Satellite-Based Augmentation Systems are deployed to improve precision and security. These upgrades strengthen resilience across all platform types.

The global defense navigation market is segmented as follows:

By Platform Type

- Airborne

- Naval

- Land

By Application

- Navy

- Airforce

- Military

By Technology

- Fiber Optic Gyro Navigation System

- Ring Laser Gyro Navigation System

- Mechanical Navigation System

- Hemispherical Resonator Gyro Navigation System

- Micromechanical Systems Based Navigation System

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Defense navigation is the use of systems, technologies, and methodologies that determine the correct position, movement, and direction of military personnel, aircraft, vehicles, and naval vessels. These systems are essential for target tracking, mission planning, and operational coordination in combat and non-combat situations.

The global defense navigation market is projected to grow due to the rising proliferation of unmanned systems, increasing military conflicts, and the integration of machine learning (ML) and artificial intelligence (AI).

According to study, the global defense navigation market size was worth around USD 296.15 billion in 2024 and is predicted to grow to around USD 562.94 billion by 2034.

The CAGR value of the defense navigation market is expected to be approximately 8.36% from 2025 to 2034.

North America is expected to lead the global defense navigation market during the forecast period.

The key players profiled in the global defense navigation market include Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, Thales Group, Honeywell International Inc., L3Harris Technologies, Inc., Safran S.A., Collins Aerospace, General Dynamics Corporation, Elbit Systems Ltd., Leonardo S.p.A., Trimble Inc., IAI (Israel Aerospace Industries), and Cobham Limited.

The report examines key aspects of the defense navigation market, including a detailed discussion of existing growth factors and restraints, as well as future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed