Fishing Rod Market Size, Share, Trends, Growth and Forecast 2034

Fishing Rod Market By Product (Spinning Rods, Fly Fishing Rods, Casting Rods, and Others), By Raw Material (Bamboo, Fiberglass, Carbon Fiber, and Others), By Application (Competitive Casting, Recreational Fishing, Commercial Fishing, and Others), By Distribution Channel (Online, Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

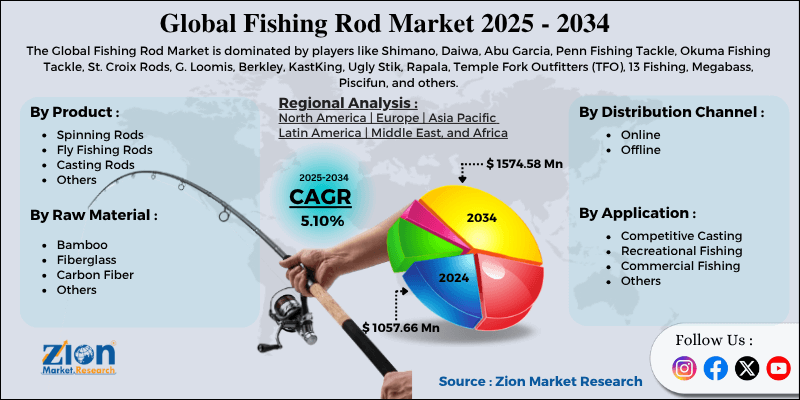

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1057.66 Million | USD 1574.58 Million | 5.10% | 2024 |

Fishing Rod Industry Prospective:

The global fishing rod market size was worth around USD 1057.66 million in 2024 and is predicted to grow to around USD 1574.58 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.10% between 2025 and 2034.

Fishing Rod Market: Overview

A fishing rod is a flexible, long rod used to catch fish, usually embedded with a reel, fishing line, and hook. It is available in various lengths and strengths, making it well-suited for fishing methods such as fly fishing, saltwater fishing, or freshwater fishing. Their design enables anglers to cast bait with accuracy and reel in fish efficiently, increasing the significance of fishing rods in both commercial and recreational fishing.

The leading drivers of the fishing rod market include the rising popularity of recreational fishing, advancements in fishing rod materials, and the preservation of traditional practices and cultural heritage.

The increasing prominence of recreational fishing, primarily in Europe, North America, and Japan, is a leading market driver. Fishing is now widely regarded as a leisure activity that fosters social bonding and promotes mental well-being. Hence, on a global scale, hobbyists demand quality fishing rods.

Moreover, advancements in composite materials, such as graphite, carbon fiber, and nanomaterials, are enhancing the flexibility and strength of rods. These novel materials enhance casting precision and durability while lowering weight.

High-performing rods appeal to seasoned anglers. In several regions, fishing is deeply rooted in cultural heritage, passed down through generations. Conventional fishing communities in Africa and Asia are integrating advanced rods with old methods.

Nevertheless, the global market is hindered by the high prices of premium rods, ecological concerns, and overfishing. Advanced reel systems or high-performance carbon fiber rods are typically expensive. This pricing restricts affordability for beginner and casual fishers. It also limits expansion in developing or low-income regions.

In addition, habitat degradation and overfishing are resulting in stringent rules in several nations. These policies may restrict fishing zones or seasons, thus reducing the use of rods. Ecological watchdogs also discourage angling in environmentally sensitive regions.

Yet, the global fishing rod industry will grow flourishingly due to the use of sustainable and eco-friendly rod materials, as well as fishing travel packages and adventure tourism. There is a rising interest in fishing rods made of bamboo, recycled materials, and biodegradable composites. Sustainability-focused groups are willing to pay for premium rods and environmentally friendly products. This trend offers opportunities for niche branding and innovation.

Additionally, fishing holidays in destinations such as Norway, Canada, Alaska, and the Maldives are in high demand. Rod companies can partner with tour operators to provide bundled travel packages that include quick-setup gear, travel cases, and portable rods.

Key Insights:

- As per the analysis shared by our research analyst, the global fishing rod market is estimated to grow annually at a CAGR of around 5.10% over the forecast period (2025-2034)

- In terms of revenue, the global fishing rod market size was valued at approximately USD 1,057.66 million in 2024 and is projected to reach USD 1,574.58 million by 2034.

- The fishing rod market is projected to grow significantly owing to rising interest in recreational fishing, improvements in rod design and lightweight materials, and increasing disposable income in developing regions.

- Based on product, the spinning rods segment is expected to lead the market, while the casting rods segment is expected to grow considerably.

- Based on raw material, the carbon fiber segment is projected to lead the market, while the fiberglass segment is expected to progress significantly.

- Based on application, the recreational fishing is the dominant segment, while the competitive casting segment is projected to witness sizable revenue growth over the forecast period.

- Based on distribution channel, the offline segment is expected to lead the market compared to the online segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Fishing Rod Market: Growth Drivers

Licensing programs and government support drive market growth

A majority of governments globally are promoting angling as an ecologically responsible recreational activity to stimulate local economies and tourism. For instance, Canada's National Recreational Fisheries Program, New Zealand's Fish & Game Council, and India's National Fisheries Development Board are notably investing in enhanced fishing infrastructure, easy access licensing, and training programs.

These supportive architectures motivate participation and regular machinery upgrades, directly benefiting rod makers.

Demand from the urban and youth angling movement considerably fuels the market growth

Younger generations are accepting fishing as a part of minimalist and urban lifestyles. Urban angling, which involves fishing in city rivers, lakes, and canals, has emerged as a leading trend in North America and Europe, thereby boosting the global fishing rod market. Travel-friendly and lightweight rods, primarily spinning and telescopic models, are widely preferred by the Millennial and Gen Z generations.

Additionally, social media platforms such as TikTok, Instagram, and YouTube have played a significant role in popularizing fishing and making it more accessible to a broader audience. Influencers demonstrate compact rod setups, city-based catch-and-release methods, and fishing hacks, thus surging interest.

Fishing Rod Market: Restraints

Limited accessibility and awareness in developing markets negatively impact market progress

In several developing regions, primarily those in South Asia, Africa, and Latin America, angling is not widely recognized as a recreational sport due to a lack of awareness, minimal government support, and inadequate infrastructure. Fishing is still seen as a commercial or subsistence activity rather than a hobby.

For example, a 2024 study found that fewer than 2% of adults in Nigeria and 5% in India have engaged in recreational fishing. Restricted marketing, due to poor retail penetration and the presence of global brands, also hampers product availability, which limits sales potential in these densely populated regions.

Fishing Rod Market: Opportunities

Rising youth and female participation in angling positively impacts market growth

Fishing is breaking conventional demographics, with the rising engagement from the younger generation and women. Conservation groups and brands are organizing inclusive campaigns to attract new audiences, thereby expanding the market for entry-level, stylish, and ergonomic rods.

Leading companies like Wild Waters and Ugly Stik are launching fishing rods with gender-neutral designs, vibrant color options, and lighter grips, particularly targeting young anglers. Catering to these demographics with knowledgeable content, safer beginner kits, and customizable gear is a key growth propeller in the fishing rod industry.

Fishing Rod Market: Challenges

Climate change's impact on aquatic Ecosystems limits the market progress

Climate change is altering fish migration patterns, aquatic biodiversity, and water temperatures, thereby decreasing the productivity of fishing locations. This leads to reduced fishing trips and low enthusiasm among the recreational groups and the hobbyist populace. This negatively impacts the demand for fishing rods.

For instance, the rising river temperatures are noticeably affecting salmon fishing seasons and trout in the U.S. Pacific Northwest. Anglers who fish continuously are now seeing less predictable windows, which directly impacts replacement frequency and rod usage.

Fishing Rod Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fishing Rod Market |

| Market Size in 2024 | USD 1057.66 Million |

| Market Forecast in 2034 | USD 1574.58 Million |

| Growth Rate | CAGR of 5.10% |

| Number of Pages | 211 |

| Key Companies Covered | Shimano, Daiwa, Abu Garcia, Penn Fishing Tackle, Okuma Fishing Tackle, St. Croix Rods, G. Loomis, Berkley, KastKing, Ugly Stik, Rapala, Temple Fork Outfitters (TFO), 13 Fishing, Megabass, Piscifun, and others. |

| Segments Covered | By Product, By Raw Material, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fishing Rod Market: Segmentation

The global fishing rod market is segmented based on product, raw material, application, distribution channel, and region.

Based on product, the global fishing rod industry is divided into spinning rods, fly fishing rods, casting rods, and others. The spinning rods segment leads the global market due to their affordability, simplicity, and adaptability. These rods are specifically designed for use with spinning reels, enhancing their suitability for various fishing styles, including saltwater angling and freshwater fishing. Their user-friendly design allows beginners to cast smoothly and with minimal tangling. They are highly popular in the recreational fishery because of their ability to manage lure sizes and different bait types.

Based on application, the global fishing rod market is segmented into competitive casting, recreational fishing, commercial fishing, and others. Recreational fishing leads as a dominating segment, accounting for a larger revenue share. Millions of global hobbyists engage in fishing for travel, outdoor enjoyment, and relaxation. The broader appeal of fishing as a leisure activity, particularly in North America, the Asia-Pacific region, and Europe, has led to increased demand for diverse rod types among casual anglers. The growth of fishing tourism, e-commerce growth, and outdoor programs supports the segmental leadership. Seasonal spikes, such as summer vacations or holiday fishing, also drive sales remarkably.

Based on distribution channel, the global market is segmented into online and offline. The offline distribution segment captured a notable share of the market, driven by sporting goods stores, large chains, and outdoor retailers. This is particularly true for beginners or those who purchase high-end gear, where personal consultation is preferred. Offline channels can also benefit from regional fishing expos, community engagement events, and tournaments, where brands showcase new products.

By raw material, the market is divided into bamboo, fiberglass, carbon fiber, and others.

Fishing Rod Market: Regional Analysis

North America to witness significant growth over the forecast period

North America held a dominant share of the fishing rod market due to high participation in recreational fishing, an established distribution and retail network, media coverage, and a rise in sport fishing tournaments. North America, particularly the United States, has the highest number of recreational participants globally. According to the ASA, American Sportfishing Association, over 54.5 million individuals enjoyed fishing in 2022. This massive angler population propels constant demand for different types of fishing rods.

The region boasts a mature and robust retail ecosystem featuring leading chains such as Dick's Sporting Goods, Bass Pro Shops, and Cabela's, which offer a diverse range of fishing gear. These stores, coupled with the rise of e-commerce platforms, support both premium and entry-level rod sales. The widespread accessibility amplifies the replacement and purchase of cycles, thus keeping the industry active throughout the year.

Additionally, North America is a leader in sports events, such as the Bassmaster Classic, which attracts thousands of participants worldwide. These tournaments fuel the demand for branded gear and specialized rods among fans and professionals. This competitive landscape drives frequent rod advancements and innovation, maintaining the market dynamics.

Europe holds a second-leading share in the fishing rod industry due to strong recreational fishing traditions in many nations, coastal fishing locations, and abundant freshwater resources, as well as intense brand penetration and robust retail infrastructure.

Europe has a long-established angling culture, primarily in countries such as France, Germany, the Netherlands, and the United Kingdom. As of 2023, over 25 million individuals in the region engage in recreational fishing, according to the European Anglers Alliance. This rooted tradition backs sustained demand for entry-level fishing and premium rods.

Moreover, the region boasts thousands of coastal zones, rivers, and lakes that are well-suited for both saltwater and freshwater angling. Economies like Norway and Sweden offer huge fishing grounds, while the North Sea and the Mediterranean are open for sea angling. This geographic variety fuels the need for a broad range of rod types, including casting, spinning, and fly rods.

Furthermore, Europe boasts a mature retail infrastructure for fishing gear, with leading chains such as Askari, Angling Direct, and Decathlon offering extensive product availability. This accessibility motivates both online and offline purchases in all fishing segments.

Fishing Rod Market: Competitive Analysis

The leading players in the global fishing rod market are:

- Shimano

- Daiwa

- Abu Garcia

- Penn Fishing Tackle

- Okuma Fishing Tackle

- St. Croix Rods

- G. Loomis

- Berkley

- KastKing

- Ugly Stik

- Rapala

- Temple Fork Outfitters (TFO)

- 13 Fishing

- Megabass

- Piscifun

Fishing Rod Market: Key Market Trends

The remarkable growth of direct-to-consumer and online sales:

Brand-owned stores and e-commerce platforms are emerging as leading sales channels, particularly among younger consumers and in urban areas. Online platforms like AliExpress, Amazon, and Fishing-based websites offer a variety of products and better pricing ranges. Online reviews, influencer marketing, and unboxing videos back this trend.

Customization and integration of smart technology:

Smart fishing rods with bite alarms, Bluetooth connectivity, and app integration are gaining prominence among tech-savvy groups. On the contrary, there is a surging trend for customized rods, where individuals can choose their rod length, materials, and action. These characteristics add value and differentiate premium offerings in the competitive setting.

The global fishing rod market is segmented as follows:

By Product

- Spinning Rods

- Fly Fishing Rods

- Casting Rods

- Others

By Raw Material

- Bamboo

- Fiberglass

- Carbon Fiber

- Others

By Application

- Competitive Casting

- Recreational Fishing

- Commercial Fishing

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A fishing rod is a flexible, long rod used to catch fish, usually embedded with a reel, fishing line, and hook. It is available in various lengths and strengths, making it well-suited for fishing methods such as fly fishing, as well as saltwater and freshwater fishing. Their design enables anglers to cast bait with accuracy and reel in fish efficiently, increasing the significance of fishing rods in both commercial and recreational fisheries.

The global fishing rod market is projected to grow due to rising fishing tournaments, the advancement of e-commerce and online retail, and supportive government initiatives.

According to a study, the global fishing rod market size was worth around USD 1,057.66 million in 2024 and is predicted to grow to around USD 1,574.58 million by 2034.

The CAGR value of the fishing rod market is expected to be around 5.10% during 2025-2034.

North America is expected to lead the global fishing rod market during the forecast period.

The key players profiled in the global fishing rod market include Shimano, Daiwa, Abu Garcia, Penn Fishing Tackle, Okuma Fishing Tackle, St. Croix Rods, G. Loomis, Berkley, KastKing, Ugly Stik, Rapala, Temple Fork Outfitters (TFO), 13 Fishing, Megabass, and Piscifun.

The report examines key aspects of the fishing rod market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed