Green Logistics Services Market Size, Share, Trends, Growth 2034

Green Logistics Services Market By Business Type (Warehousing, Distribution, Value Added Services, and Others), By Mode of Operation (Storage, Roadways Distribution, Seaways Distribution, and Others), By End-Use (Healthcare, Manufacturing, Automotive, Banking and Financial Services, Retail and E-Commerce, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

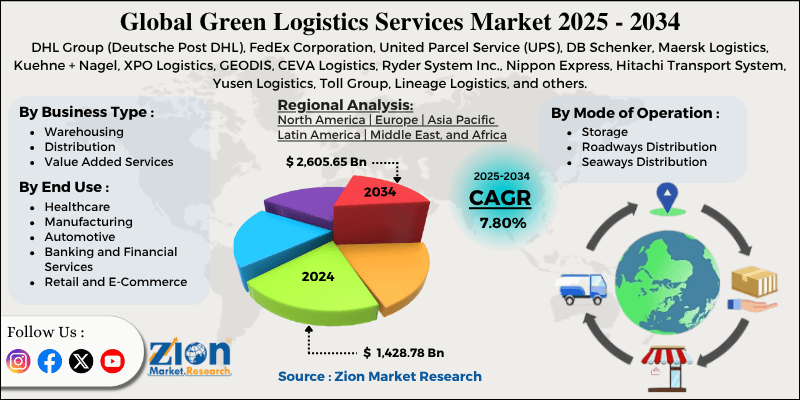

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,428.78 Billion | USD 2,605.65 Billion | 7.80% | 2024 |

Green Logistics Services Industry Prospective:

The global green logistics services market size was approximately USD 1,428.78 billion in 2024 and is projected to reach around USD 2,605.65 billion by 2034, with a compound annual growth rate (CAGR) of approximately 7.80% between 2025 and 2034.

Green Logistics Services Market: Overview

Green logistics services are ecologically sustainable practices in the warehousing, distribution, and transportation sectors that aim to reduce energy consumption, ecological impact, and carbon emissions. These services use low-emission or electric vehicles, eco-friendly packaging, energy-efficient storage solutions, and route optimization, supporting regulatory compliance and CSR. The global green logistics services market is poised for significant growth, driven by stringent emission regulations and environmental protocols, increasing corporate sustainability commitments, and heightened consumer awareness of environmental issues. Governments worldwide are implementing strict carbon emission standards for supply chains and transportation.

For instance, the European Union's 'Fit for 55' scheme aims to decrease emissions by 55% by 2030. Such initiatives are forcing logistics firms to deploy cleaner practices and technologies. Moreover, multinational companies such as IKEA and Amazon are committing to net-zero emissions, driving their logistics partners to offer greener and more viable services. These corporate obligations are growing the demand for sustainable warehousing, packaging, and shipping solutions. Likewise, companies are actively choosing brands with green credentials. More than 73% of global consumers are expected to change their consumption habits to decrease their ecological impact, burdening supply chains to become more sustainable, according to a Nielsen Report (2024).

Despite the growth, the global market is hindered by factors such as limited charging infrastructure for electric vehicles and the complexity of retrofitting legacy systems. In several regions, the lack of private and public charging stations hinders the adoption of e-logistics cars, particularly for long-haul operations.

Additionally, traditional arrangements may not be suitable for modern sustainable technologies, as they can increase the cost of retrofitting and disrupt operations. Nonetheless, the global green logistics services industry stands to gain from several key opportunities, including the growth of green warehousing, the emergence of circular economy logistics, and green last-mile delivery solutions. There is a surging demand for energy-saving, LEED-certified, and solar-powered warehouses. Providers offering green solutions are assured to benefit from long-term contracts.

Additionally, as businesses increasingly adopt circular economy models, logistics companies can benefit from reverse logistics, reusable, and recycling packaging services. With the notable progress of e-commerce, companies offering bike-based or EV-based last-mile deliveries, mainly in urban areas, can explore high-growth potential.

Key Insights:

- As per the analysis shared by our research analyst, the global green logistics services market is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2025-2034)

- In terms of revenue, the global green logistics services market size was valued at approximately USD 1,428.78 billion in 2024 and is projected to reach USD 2,605.65 billion by 2034.

- The green logistics services market is projected to grow significantly due to rising operational savings, increasing consumer awareness and eco-conscious behavior, and improvements in clean transportation solutions.

- Based on business type, the distribution segment is expected to lead the market, while the warehousing segment is expected to grow considerably.

- Based on mode of operation, the roadway distribution is the dominant segment, while the storage segment is projected to witness sizable revenue growth over the forecast period.

- Based on end use, the retail and e-commerce segment is expected to lead the market compared to the automotive segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Green Logistics Services Market: Growth Drivers

Increasing investments in renewable energy-powered infrastructure and warehousing boost market growth

Green logistics extends to distribution and warehousing hubs, where the use of renewable energy is becoming a competitive differentiator. Green building certifications, such as BREEAM and LEED, as well as energy-efficient systems and solar-powered warehouses, are widely adopted. For instance, Prologis, the largest industrial real estate firm, committed to installing 2 GW of solar power capacity in its global warehouse by 2025.

Likewise, Amazon's fulfillment hubs in the United States and India are not fully powered by solar rooftops, reducing their dependency on fossil fuels. These developments underscore the importance of green warehousing as a key driver of holistic, sustainable logistics solutions.

Technological improvements in autonomous and electric logistics fleets contribute to the market growth

Speedy advancements in autonomous truck technologies and electric vehicles are permitting the decarbonization of freight transport. Companies like Volvo Trucks and Tesla (with the Semi) are heavily investing in long-haul electric cars, while newcomers like TuSimple and Einride are modernizing autonomous electric freight networks. These efforts are significantly impacting the progress of the green logistics services market.

DHL expanded its electric vehicle fleet to over 27,000 units worldwide in 2024. This has majorly reduced its logistics carbon footprint. These solutions not only reduce emissions but also offer long-term cost savings due to lower fuel costs and reduced maintenance.

Green Logistics Services Market: Restraints

Uncertain return on investment negatively impacts market progress

Despite green logistics delivering long-term savings, they often face delayed or uncertain ROI, which can increase discouragement among profit-focused logistics firms. For instance, transitioning to hydrogen trucks or solar-powered warehouses may take 7-12 years to break even, based on local energy prices, operational scale, and government incentives.

In unpredictable markets, like the global freight downturn 2024 – 2025, logistics firms are cautious on long-term capital expenditure. A survey by Transport Intelligence (Ti) in 2024 revealed that 39% of global freight operators delayed green investments due to varying economic conditions.

Green Logistics Services Market: Opportunities

Expansion of climate-positive and carbon-neutral logistics services positively impacts market growth

As global corporations adopt even climate-positive supply chains and net-zero climate goals, green logistics providers in the green logistics services industry have the opportunity to offer dedicated carbon-neutral transportation, climate impact tracking, and offset programs. Companies can distinguish themselves by adopting sustainability in their service models, providing carbon accounting solutions, and building offset-aided delivery options.

Maersk increased its ECO Delivery program in March 2025. It uses green fuels to reduce lifecycle emissions by 83% and is now delivering it in all key routes. Logistics providers that adhere to such climate targets may establish long-term partnerships and access premium market segments.

Green Logistics Services Market: Challenges

Skills gap and resistance to digital transformation limit the market growth

Green logistics is closely associated with digital transformation, encompassing emissions tracking, smart routing, and AI-powered fleet optimization and automation. Nonetheless, a continuous skills gap persists, primarily in developing markets, where logistics operators and workers lack training in carbon monitoring tools, data analytics, and green technologies.

Kuehne+Nagel introduced an internal upskilling program in May 2024, following the implementation of digital sustainability tools that had been delayed due to concerns about workforce readiness. Without a skilled workforce, the use of tech-based green logistics stays slow, vulnerable to failure, and inefficient.

Green Logistics Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Green Logistics Services Market |

| Market Size in 2024 | USD 1,428.78 Billion |

| Market Forecast in 2034 | USD 2,605.65 Billion |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 212 |

| Key Companies Covered | DHL Group (Deutsche Post DHL), FedEx Corporation, United Parcel Service (UPS), DB Schenker, Maersk Logistics, Kuehne + Nagel, XPO Logistics, GEODIS, CEVA Logistics, Ryder System Inc., Nippon Express, Hitachi Transport System, Yusen Logistics, Toll Group, Lineage Logistics, and others. |

| Segments Covered | By Business Type, By Mode of Operation, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Green Logistics Services Market: Segmentation

The global green logistics services market is segmented based on business type, mode of operation, end use, and region.

Based on business type, the global green logistics services industry is divided into warehousing, distribution, value added services, and others. The distribution segment held a dominating share of the market. It includes last-mile delivery and transportation, which are the key emission-intensive features of logistics. Brands are investing in fuel-emission routing, electric vehicles, and green distribution solutions to lessen their carbon footprints. With the growing global trade volumes and progressing e-commerce, green distribution solutions like route optimization solutions and EV fleets are increasing in demand.

Based on mode of operation, the global green logistics services market is segmented as storage, roadways distribution, seaways distribution, and others. The roadways distribution segment held a dominant position due to its broader use in intercity and urban logistics. It also supports green innovation, which is driving companies to invest in electric vehicles, real-time route optimization, and the use of biofuels to reduce emissions.

Based on end use, the global market is segmented as healthcare, manufacturing, automotive, banking and financial services, retail and e-commerce, and others. The retail and e-commerce segment accounted for a larger market share due to growing consumer demand for sustainable delivery options and the remarkable growth in online shopping, particularly during and after the COVID-19 pandemic. Companies like Walmart, Alibaba, and Amazon are heavily investing in electric last-mile delivery vehicles, carbon-neutral fulfillment centers, and recyclable packaging. Frequent deliveries and the sector's massive shipment volumes contribute to its dominance and choice for green logistics transportation.

Green Logistics Services Market: Regional Analysis

Europe to witness significant growth over the forecast period

Europe is projected to maintain its dominant position in the global green logistics services market due to its robust policy framework and stringent ecological regulations, as well as the growing adoption of alternative fuels and electric vehicles, and the increasing importance of ESG integration and corporate sustainability. Europe has implemented stringent environmental laws, including the 'Fit for 55' and the EU Green Deal, to reduce emissions by 55% by 2030. These mandates impact logistics operations, requiring companies to adopt green practices in warehousing and transportation. The ETS, or EU Emissions Trading System, also encompasses the logistics and shipping sectors, motivating decarbonization.

Moreover, European nations are leaders in the deployment of E-vans and trucks, as well as hydrogen-powered vehicles for logistics. For instance, Germany had more than 1,30,000 electric commercial vehicles in 2024, the highest among others. Urban low-emission zones and subsidies further accelerate the electrification of fleets among logistics firms.

Additionally, European corporations are at the forefront of integrating ESG goals into their logistics operations. According to the European Commission, more than 85% of large EU-based companies report on sustainability in their supply chains. This broad corporate commitment drives the demand for green logistics services, which include low-impact storage and carbon-neutral deliveries.

The Asia Pacific region maintains its position as the second-largest in the global green logistics services industry, driven by rapid urbanization and the advancement of e-commerce, supportive government policies for green logistics, and innovation and digitalization. The Asia Pacific region is a leader in the fastest-growing and largest e-commerce markets, particularly in Japan, China, Southeast Asia, and India. The region accounted for over 60% of worldwide e-commerce sales in 2024, driving demand for sustainable last-mile delivery solutions. Concerns about pollution and urban congestion are prompting cities to adopt low-emission logistics strategies.

Additionally, regional governments are implementing incentives and strict policies to reduce logistics-related emissions. These policies foster a favorable environment for investment in green logistics. Furthermore, the region is adopting IoT, digital twin technologies, and AI for logistics sustainability and efficiency. APAC registered for over 35% of global logistics tech investments in 2024, mainly in cold chain sustainability, emission tracking, and predictive route planning. These innovations directly contribute to reducing carbon footprints in the logistics sector.

Green Logistics Services Market: Competitive Analysis

The global green logistics services market profiles players like:

- DHL Group (Deutsche Post DHL)

- FedEx Corporation

- United Parcel Service (UPS)

- DB Schenker

- Maersk Logistics

- Kuehne + Nagel

- XPO Logistics

- GEODIS

- CEVA Logistics

- Ryder System Inc.

- Nippon Express

- Hitachi Transport System

- Yusen Logistics

- Toll Group

- Lineage Logistics

Green Logistics Services Market: Key Market Trends

Last-mile delivery and electrification of fleets:

Logistics firms are actively adopting electric vans, trucks, and bikes, especially for last-mile delivery. Key players, including FedEx, Amazon, and DHL, are expanding their electric fleets to comply with city regulations and meet emission reduction targets. With over 1.2 million e-commercial vehicles deployed in 2024, electrification is progressing as a core strategy in green logistics.

Growth of reverse logistics and circular supply chains:

Green logistics is increasing in facilitating returns, reverse logistics, refurbishing, reusing, and recycling. Companies are leveraging circular supply chain models, and logistics providers are engaged in offering specialized services to support them. This trend is strong in packaging, retail, and electronics, where sustainable product life cycles are essential.

The global green logistics services market is segmented as follows:

By Business Type

- Warehousing

- Distribution

- Value Added Services

- Others

By Mode of Operation

- Storage

- Roadways Distribution

- Seaways Distribution

- Others

By End Use

- Healthcare

- Manufacturing

- Automotive

- Banking and Financial Services

- Retail and E-Commerce

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Green logistics services are ecologically sustainable practices in the warehousing, distribution, and transportation sectors that aim to reduce energy consumption, ecological impact, and carbon emissions. These services use low-emission or electric vehicles, eco-friendly packaging, energy-efficient storage solutions, and route optimization, supporting regulatory compliance and CSR.

What key factors will influence the growth of the green logistics services market from 2025 to 2034?

The global green logistics services market is projected to grow due to stringent emission regulations, real-time optimization and digitalization, and the increasing adoption of smart city initiatives.

According to a study, the global green logistics services market size was worth around USD 1,428.78 billion in 2024 and is predicted to grow to around USD 2,605.65 billion by 2034.

The CAGR value of the green logistics services market is expected to be approximately 7.80% from 2025 to 2034.

Europe is expected to lead the global green logistics services market during the forecast period.

The key players profiled in the global green logistics services market include DHL Group (Deutsche Post DHL), FedEx Corporation, United Parcel Service (UPS), DB Schenker, Maersk Logistics, Kuehne + Nagel, XPO Logistics, GEODIS, CEVA Logistics, Ryder System, Inc., Nippon Express, Hitachi Transport System, Yusen Logistics, Toll Group, and Lineage Logistics.

The report examines key aspects of the green logistics services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed