Membrane Materials Recycling and Upcycling Market Size, Share, Trends, Growth 2034

Membrane Materials Recycling and Upcycling Market By Type (Ceramic, Metallic, and Polymeric), By Method (Physical Cleaning & Backwashing and Chemical Cleaning & Regeneration), By End-User (Food & Beverage, Biotechnology, Pharmaceutical, Chemical & Metal Processing, Water Treatment, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

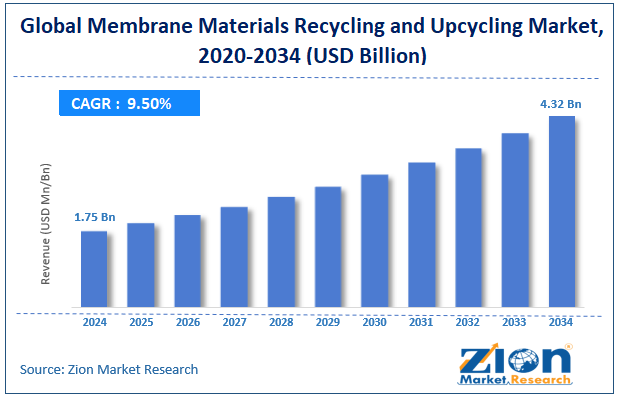

| USD 1.75 Billion | USD 4.32 Billion | 9.50% | 2024 |

Membrane Materials Recycling and Upcycling Industry Prospective:

The global membrane materials recycling and upcycling market size was worth around USD 1.75 billion in 2024 and is predicted to grow to around USD 4.32 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.50% between 2025 and 2034.

Membrane Materials Recycling and Upcycling Market: Overview

Membrane materials recycling and upcycling refer to the use of novel practices and materials that encourage the recycling and reuse of membrane materials. The industry aims to reduce waste generated from the excessive use of membrane materials across major end-user industries.

A common means of achieving desired goals in the industry includes introducing next-generation membrane materials that can be easily recycled or repurposed for extended use. Some common methods involved in recycling or upcycling membrane materials include recovering essential raw materials from spent membranes and developing new applications.

Additionally, chemical conversion is a popular method of restoring the original performance capacity of membrane materials. During the forecast period, revenue in the industry for membrane materials recycling and upcycling is expected to grow due to concerns over rising waste worldwide.

In addition to this, growing advancements in the development of recyclable materials and novel upcycling techniques will generate higher market revenue for the industry players. The complexities associated with membrane material recycling or upcycling will impact market revenue in the coming years.

Key Insights:

- As per the analysis shared by our research analyst, the global membrane materials recycling and upcycling market is estimated to grow annually at a CAGR of around 9.50% over the forecast period (2025-2034)

- In terms of revenue, the global membrane materials recycling and upcycling market size was valued at around USD 1.75 billion in 2024 and is projected to reach USD 4.32 billion by 2034.

- The membrane materials recycling and upcycling market is projected to grow at a significant rate due to the growing concerns about excessive waste generation and demand for the circular economy.

- Based on the type, the polymeric segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user, the water treatment segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Membrane Materials Recycling and Upcycling Market: Growth Drivers

Growing concerns about excessive waste generation and demand for the circular economy to propel market expansion

The global membrane materials recycling and upcycling market is expected to be driven by the growing focus on developing a more circular economy worldwide. Excessive waste generation and its environmental impact are the main driving forces for increasing demand to establish a circular economy. It encourages continuous use of materials by reusing, recycling, remanufacturing, refurbishing, and composting.

According to market experts, the circular economy is expected to help world leaders fight climate change and other pressing global concerns, such as rising pollution levels and diminishing quality of life on the planet.

In March 2020, the European Commission announced the adoption of a new circular economy action plan (CEAP) with sustainable growth as the main agenda for the region in the coming years.

Membrane materials are some of the most commonly used components used for filtering and separating specific substances. They have applications across some of the major thriving industries, including automotive, food & beverage, water & wastewater management, and others.

Most membranes are produced using synthetic polymers, which cause excessive waste generation after membrane disposal. With a growing focus on promoting a circular economy, demand for membrane materials recycling & upcycling is expected to grow at a steady pace.

Ongoing introduction of new chemical recycling and upcycling techniques to promote market expansion

In recent times, investments toward the development of effective chemical treatments promoting membrane material recycling and upcycling have improved. For instance, in April 2022, Enerkem Inc. and NOVA Chemicals Corporation announced the expansion of their novel chemical recycling technology as the agencies received funding of CAD 4.5 million from Alberta Innovates.

The global membrane materials recycling and upcycling market is expected to benefit from the construction of a pilot-scale reactor system that converts syngas produced from non-compostable and non-recyclable plastics into feedstock for virgin-grade plastics.

Certain advantages of chemical membrane materials recycling and upcycling include higher chances of recovering high-quality raw materials and better management of contaminated membranes.

Membrane Materials Recycling and Upcycling Market: Restraints

Complexities associated with the recycling and upcycling of materials to limit market expansion

The global membrane materials recycling and upcycling industry is expected to be restricted due to the complexities associated with the techniques. The complications arise from extensive contamination of membrane materials, especially those used in chemical and wastewater treatment plants.

Furthermore, restoring the original performance rate of the materials may be difficult once recycled or upcycled. They may require additional processing to deliver expected performance, leading to increased costs and overall investments.

Membrane Materials Recycling and Upcycling Market: Opportunities

Increasing innovation in terms of the development of recyclable materials and recycling technology to generate growth opportunities

The global membrane materials recycling and upcycling market is projected to generate growth opportunities due to the rising development of environmentally friendly materials. In March 2025, Rice University announced the launch of a new unit dedicated to the development of advanced membrane materials.

The center will also dedicate resources toward novel separation technologies, promoting energy transition. The facility will be known as Rice Center for Membrane Excellence (RiCeMe) and is expected to secure its initial funding soon.

In January 2025, PolyCycl, an emerging circular economy technology start-up in India, launched a novel patented solution. The Contiflo Cracker Generation VI chemical recycling pyrolysis technology will allow the conversion of difficult-to-recycle plastic into usable renewable chemicals, food-grade polymers, and future-oriented fuel.

Membrane Materials Recycling and Upcycling Market: Challenges

Resource intensiveness of recycling or upcycling procedures to challenge market expansion

The global membrane materials recycling and upcycling industry is projected to be challenged by the resource-intensive nature of the procedures. Chemical methods of material recycling can be expensive due to the use of advanced solutions and technical experts.

Furthermore, the growing production of brand-new membrane materials offering longer performance lifecycles and slowed demand for refurbished items may dilute the industry’s overall growth rate during the forecast period.

Membrane Materials Recycling and Upcycling Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Membrane Materials Recycling and Upcycling Market |

| Market Size in 2024 | USD 1.75 Billion |

| Market Forecast in 2034 | USD 4.32 Billion |

| Growth Rate | CAGR of 9.50% |

| Number of Pages | 213 |

| Key Companies Covered | Toray Industries, Aqua Membranes, Koch Separation Solutions, MemRe (Membrane Recycling and Engineering), Veolia Water Technologies, Dupont Water Solutions, Hydranautics (Nitto Group), BlueTech Research (research + project developers), Pentair, Synder Filtration, H2O Innovation, NX Filtration, LG Chem, Reclaimed Water Solutions, Lanxess, and others. |

| Segments Covered | By Type, By Method, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Membrane Materials Recycling and Upcycling Market: Segmentation

The global membrane materials recycling and upcycling market is segmented based on type, method, end-user, and region.

Based on the type, the global market divisions are ceramic, metallic, and polymeric. In 2024, the highest revenue was generated by the polymeric segment. Synthetic materials such as polyethylene and polyamide are some of the most commonly used membrane materials. According to industry research, polymeric membranes contribute more than 75.01% of the total revenue in 2024 and will continue to dominate the market during the forecast period.

Based on method, the global membrane materials recycling and upcycling industry is divided into physical clearing & backwashing and chemical cleaning & regeneration.

Based on the end-user, the global market divisions are food & beverage, biotechnology, pharmaceutical, chemical & metal processing, water treatment, and others. In 2024, the fastest-growing segment was water treatment. Growing concerns over water scarcity and the rising rate of water pollution have caused increased demand for membrane materials. According to the United Nations Environment Program, more than 40% of the world's water bodies are severely polluted.

Membrane Materials Recycling and Upcycling Market: Regional Analysis

Europe to lead the market during the forecast period, according to research

The global membrane materials recycling and upcycling market is projected to be led by Europe during the forecast period. In 2024, more than 38.01% of the global revenue was generated by European countries such as Germany, France, the UK, and others, leading the European growth rate.

In September 2024, European companies MBM Innovations and DSM-Firmenich announced the launch of a new recyclable alternative to the traditionally used Polyvinyl Alcohol (PVA) coating.

The companies have combined their vacuum packaging machines and high-performance maturation membranes respectively to develop a new substitute. The packaging solution will deliver a lower energy application and prevent cheese loss. Europe has been one of the pioneers in helping trends related to the circular economy gain more momentum.

North America is projected to continue delivering the second-highest growth rate in the membrane materials recycling and upcycling industry. The region held a prevalence of over 28.9% of the global revenue in 2024. The US is expected to propel the North American market with the increasing introduction of improved materials to be used as membranes across industries.

In July 2024, American firm Dow Corporation launched NORDEL™ REN Ethylene Propylene Diene Terpolymers (EPDM). The new material is the bio-based variant of the company’s existing range of EPDM rubber used in consumer electronics, infrastructure, and automotive. The region's market players are focusing on developing sustainable and biodegradable plastics for applications as membranes, fueling revenue in North America.

Membrane Materials Recycling and Upcycling Market: Competitive Analysis

The global membrane materials recycling and upcycling market is led by players like:

- Toray Industries

- Aqua Membranes

- Koch Separation Solutions

- MemRe (Membrane Recycling and Engineering)

- Veolia Water Technologies

- Dupont Water Solutions

- Hydranautics (Nitto Group)

- BlueTech Research (research + project developers)

- Pentair

- Synder Filtration

- H2O Innovation

- NX Filtration

- LG Chem

- Reclaimed Water Solutions

- Lanxess

The global membrane materials recycling and upcycling market is segmented as follows:

By Type

- Ceramic

- Metallic

- Polymeric

By Method

- Physical Cleaning & Backwashing

- Chemical Cleaning & Regeneration

By End-User

- Food & Beverage

- Biotechnology

- Pharmaceutical

- Chemical & Metal Processing

- Water Treatment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Membrane materials recycling and upcycling refer to the use of novel practices and materials that encourage the recycling and reuse of membrane materials.

The global membrane materials recycling and upcycling market is expected to be driven by the growing focus on developing a more circular economy worldwide.

According to study, the global membrane materials recycling and upcycling market size was worth around USD 1.75 billion in 2024 and is predicted to grow to around USD 4.32 billion by 2034.

The CAGR value of the membrane materials recycling and upcycling market is expected to be around 9.50% during 2025-2034.

The global membrane materials recycling and upcycling market is projected to be led by Europe during the forecast period.

Which are the major players leveraging the membrane materials recycling and upcycling market growth?

The global membrane materials recycling and upcycling market is led by players like Toray Industries, Aqua Membranes, Koch Separation Solutions, MemRe (Membrane Recycling and Engineering), Veolia Water Technologies, Dupont Water Solutions, Hydranautics (Nitto Group), BlueTech Research (research + project developers), Pentair, Synder Filtration, H2O Innovation, NX Filtration, LG Chem, Reclaimed Water Solutions, and Lanxess.

The report explores crucial aspects of the membrane materials recycling and upcycling market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed