NBFC Market Size, Share, Trends, Growth and Forecast Report 2034

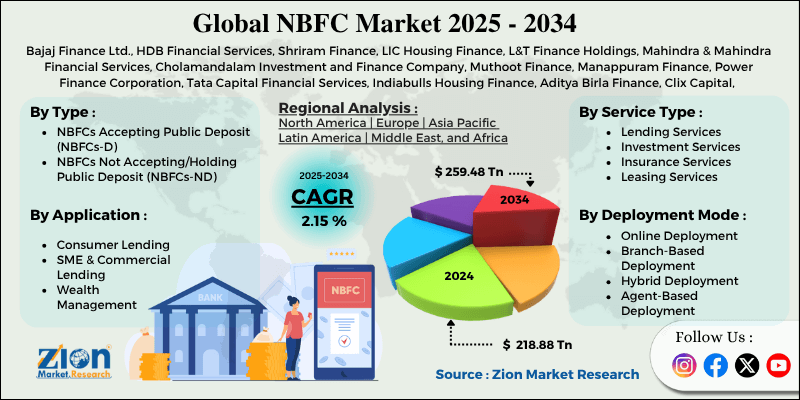

NBFC Market By Type (NBFCs Accepting Public Deposit [NBFCs-D], NBFCs Not Accepting/Holding Public Deposit [NBFCs-ND]), By Service Type (Lending Services, Investment Services, Insurance Services, Leasing Services, and Others), By Deployment Mode (Online Deployment, Branch-Based Deployment, Hybrid Deployment, Agent-Based Deployment, and Others), By Application (Consumer Lending, SME & Commercial Lending, Wealth Management, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

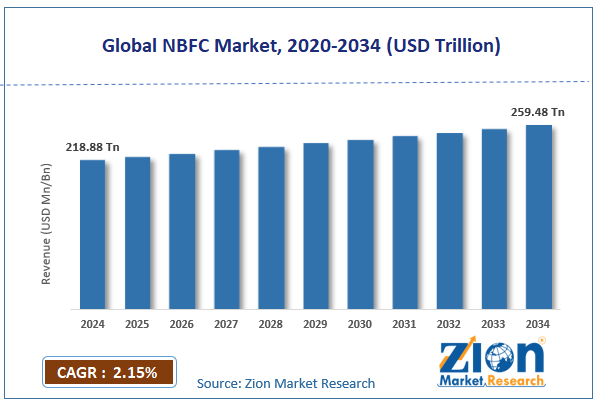

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 218.88 Trillion | USD 259.48 Trillion | 2.15% | 2024 |

NBFC Industry Prospective:

The global NBFC market size was approximately USD 218.88 trillion in 2024 and is projected to reach around USD 259.48 trillion by 2034, with a compound annual growth rate (CAGR) of approximately 2.15% between 2025 and 2034.

NBFC Market: Overview

Non-banking financial companies, or NBFCs, are financial institutions that offer banking services without holding a banking license. They provide a broad range of financial products but do not accept deposits, unlike traditional banks. They play a vital role in financial inclusion, particularly in rural and underserved areas, by facilitating sectors such as real estate, small businesses, and infrastructure. The global NBFC market is poised for significant growth, driven by increasing demand for personal and consumer loans, fintech integration, digital transformation, and expanding urbanization. Growing aspirations, rising middle-class incomes, and urbanization are driving the demand for two-wheeler loans, consumer durable financing, and personal loans, all core offerings by NBFCs.

In 2023, non-banking financial companies disbursed more than INR 2 trillion in personal loans in India. Several NBFCs are implementing digital platforms and collaborating with fintech companies to automate credit underwriting, improve customer experience, and reduce turnaround time. This tech-based approach increases reach and enhances operational efficacy. Moreover, with rapid urbanization, the demand for commercial real estate financing and housing loans is surging, and NBFCs play a vital role in meeting this need, particularly where conventional banks are cautious.

Nevertheless, the global market faces limitations due to factors such as compliance pressure, liquidity constraints, and funding difficulties. With the growing scalability of non-banking financial companies, central banks are imposing stringent regulations on capital adequacy, liquidity, and asset classification, amplifying compliance costs and operational burden. Several NBFCs, primarily small companies, face challenges in accessing low-cost funding. Events like Infrastructure Leasing & Financial Services’ default in 2018 promoted liquidity in the sector.

Still, the global NBFC industry benefits from several favorable factors, including growth through digital lending platforms and collaboration with digital banks and fintechs. The development of machine learning and artificial intelligence-based credit scoring, embedded finance, and mobile applications presents opportunities for scaling customer lending and acquisition with lower costs. Associations with fintechs help non-banking financial companies reduce operational costs, enhance the consumer experience, and access modernized solutions, such as alternative data-based lending.

Key Insights:

- As per the analysis shared by our research analyst, the global NBFC market is estimated to grow annually at a CAGR of around 2.15% over the forecast period (2025-2034)

- In terms of revenue, the global NBFC market size was valued at around USD 218.88 trillion in 2024 and is projected to reach USD 259.48 trillion by 2034.

- The NBFC market is projected to grow significantly due to the expansion of MSMEs requiring financial services, the rise of peer-to-peer lending platforms, and government initiatives promoting financial inclusion.

- Based on type, the NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND) segment is expected to lead the market. In contrast, the NBFCs Accepting Public Deposit (NBFCs-D) segment is expected to grow considerably.

- Based on service type, the lending services segment is the dominant segment, while the investment services segment is projected to witness sizable revenue growth over the forecast period.

- Based on deployment mode, the hybrid deployment segment is the largest, while the online deployment segment is projected to experience substantial revenue growth over the forecast period.

- Based on application, the SME & commercial lending segment is expected to lead the market compared to the consumer lending segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

NBFC Market: Growth Drivers

Fintech integration and rapid digital transformation boost market growth

Technology adoption in the NBFC market is transforming how services are provided. Several NBFCs are investing in AI-based credit scoring, mobile-based loan disbursals, cloud-based operations, and e-KYC to enhance consumer experiences and decrease turnaround times. This tech-based efficiency is propelling portfolio quality and customer acquisition.

Indian NBFCs, such as Capital Float and Bajaj Finance, reported a 30 percent Year-over-Year rise in customer onboarding via app-based platforms, supported by automation and digital verification, in March 2025.

How is the escalating demand for personal loans and consumer finance propelling the NBFC market growth?

Growing consumer aspirations, ease of borrowing, and urbanization have driven the need for vehicle loans, consumer durable financing, and personal loans. NBFCs are catering to this demand more efficiently than conventional banks, mainly among the middle and low-income groups and first-time borrowers.

Global NBFCs, such as CreditAccess Grameen and Home Credit, reported record quarterly growth in consumer loan disbursements, driven by increasing demand for appliances, smartphones, and two-wheelers.

NBFC Market: Restraints

Rising asset quality stress and delinquencies negatively impact market progress

NBFCs are primarily susceptible to growing non-performing assets due to their significant exposure to high-risk borrower categories, including low-income consumers, informal sector workers, and MSMEs. Inflation, economic uncertainties, and volatile loan flows have led to a surge in defaults.

This trend is echoed in other developing regions, such as Indonesia and Nigeria. In April 2025, many Indian NBFCs, comprising Altico Capital and Srei Infrastructure, continued to experience bankruptcy proceedings, underscoring sector-wide asset quality issues.

NBFC Market: Opportunities

How is the global NBFC market opportunistic with co-lending partnerships with banks?

NBFCs can significantly benefit from co-lending models, where banks provide a substantial portion of the loan amount and originate loans, thereby blending the NBFCs' field-level specialization with banks' access to low-cost capital. These collaborations enhance lending margins and reduce risk exposure, impacting the growth of the NBFC industry.

The Reserve Bank of India’s revised co-lending architecture in 2024 has augmented such collaborations.

NBFC Market: Challenges

How do funding volatility and liquidity constraints limit the NBFC market growth?

NBFCs rely on wholesale funding, which becomes unstable during periods of economic uncertainty. Global investors became more risk-averse, pulling back their funding from NBFCs in developing regions following the collapse of Silicon Valley Bank in 2023.

Several NBFCs also experience asset-liability mismatches as they borrow short-term but lend long-term, thereby creating systemic risk. Global events, such as oil price instability and Fed rate hikes, further impact their funding prices.

In May 2024, Moody’s warned that global NBFCs are experiencing tight funding conditions and reducing investor confidence, mainly in developing markets and frontier economies.

NBFC Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | NBFC Market |

| Market Size in 2024 | USD 218.88 Trillion |

| Market Forecast in 2034 | USD 259.48 Trillion |

| Growth Rate | CAGR of 2.15% |

| Number of Pages | 213 |

| Key Companies Covered | Bajaj Finance Ltd., HDB Financial Services, Shriram Finance, LIC Housing Finance, L&T Finance Holdings, Mahindra & Mahindra Financial Services, Cholamandalam Investment and Finance Company, Muthoot Finance, Manappuram Finance, Power Finance Corporation, Tata Capital Financial Services, Indiabulls Housing Finance, Aditya Birla Finance, Clix Capital, Piramal Capital & Housing Finance, and others. |

| Segments Covered | By Type, By Service Type, By Deployment Mode, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

NBFC Market: Segmentation

The global NBFC market is segmented based on type, service type, deployment mode, application, and region.

Based on type, the global NBFC industry is divided into NBFCs Accepting Public Deposit (NBFCs-D) and NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND). The NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND) segment held a dominating share in the market in terms of total assets under management (AUM) and number. They face lighter regulatory limitations and are more flexible, typically comprising large-scale players such as investment companies, fintech-banked lenders, and infrastructure finance companies.

However, the NBFCs Accepting Public Deposit (NBFCs-D) segment is the second-leading due to their ability to mobilize public funds.

Based on service type, the global market is segmented into lending services, investment services, insurance services, leasing services, and others. The lending services segment is the forerunning segment, fueled by the growing demand for personal loans, housing loans, vehicle loans, MSME financing, and microfinance.

Nonetheless, the investment services segment registered a leading share, as it caters to HNIs, retail investors, and institutional clients, mainly in the developed regions where capital markets are well-developed.

Based on deployment mode, the global NBFC market is segmented as online deployment, branch-based deployment, hybrid deployment, agent-based deployment, and others. The hybrid deployment segment captures the majority of the market, which combines physical and digital channels. It offers the perfect balance: the scale and efficiency of online platforms, with the reach and trust of in-person services.

Conversely, the online deployment segment held a considerable market share due to growing internet penetration, demand for faster loan approvals, and increasing mobile usage.

Based on application, the global market is segmented into consumer lending, SME & commercial lending, wealth management, and others. The SME & commercial lending segment leads due to their limited collateral and credit history. NBFCs play a vital role in financing MSMEs, which are often underserved by conventional banks.

The consumer lending segment ranks second in the market due to growing disposable income, rising preference for credit-backed consumption, and increasing urbanization. The segment is primarily popular among the tech-savvy and younger generation.

NBFC Market: Regional Analysis

What key factors enable the Asia Pacific to dominate the worldwide NBFC market among other regions?

The Asia Pacific is projected to maintain its dominant position in the global NBFC market, owing to a large unbanked population, supportive regulations and reforms, and strong adoption of digital lending solutions. APAC houses more than 1.7 billion unbanked adults, with nations like Indonesia, India, and the Philippines experiencing financial exclusion. Non-banking financial companies reduce this gap by offering customized credit products to smaller businesses and underserved individuals. Their flexible lending models are ideal for regions where traditional banking infrastructure is limited or unavailable. Central banks and governments in the region support NBFC growth via inclusive financial policies, digital lending guidelines, and credit guarantee schemes. This regulatory clarity has propelled industry growth and investor confidence.

Moreover, the APAC region leads in digital adoption, with internet penetration surpassing 70% in countries such as South Korea and China. NBFCs leverage fintech solutions like mobile applications, AI, and digital KYC to offer convenient and fast lending services. In China, digital non-banking financial companies, such as Ant Financial, have revolutionized the lending infrastructure, enabling them to reach a broader audience without the need for physical branches.

North America maintains its position as the second-leading region in the global NBFC industry due to its developed financial infrastructure, diverse NBFC portfolio, strong demand for auto finance, and modernized technological integration. North America, especially the United States, holds a diversified and well-developed financial sector where NBFCs play a vital role. In 2023, non-banking financial institutions in the region had more than $20 trillion in assets, accounting for approximately 30% of the total assets of the financial sector. These comprise mortgage lenders, leasing companies, consumer finance providers, and private credit firms.

Furthermore, consumer lending, primarily comprising credit cards, auto lending, and personal loans, is a significant contributor to regional growth. The leading NBFCs serve millions of individuals, mainly subprime borrowers. In the region, NBFCs hold more than 30% of the outstanding auto loan market, denoting strong appeal in the retail financing.

Additionally, North American NBFCs are at the forefront of adopting advanced technologies, including robotic process automation, AI-based credit scoring, and blockchain for lending. Fintech-NBFC hybrids, such as Affirm, SoFi, and LendingClub, utilize digital platforms to assist millions with personalized credit products and expedited loan processing. This digital inclination strengthens scale and efficacy.

NBFC Market: Competitive Analysis

The leading players in the global NBFC market are:

- Bajaj Finance Ltd.

- HDB Financial Services

- Shriram Finance

- LIC Housing Finance

- L&T Finance Holdings

- Mahindra & Mahindra Financial Services

- Cholamandalam Investment and Finance Company

- Muthoot Finance

- Manappuram Finance

- Power Finance Corporation

- Tata Capital Financial Services

- Indiabulls Housing Finance

- Aditya Birla Finance

- Clix Capital

- Piramal Capital & Housing Finance

NBFC Market: Key Market Trends

AI integration and digital-first lending:

NBFCs are speedily adopting AI-based credit scoring, mobile-first platforms, and digital KYC to simplify loan approvals and increase customer reach. Players like Navi and LendingClub are utilizing high-end digital journeys to provide more efficient and faster service. This trend is lowering cost-to-serve and allowing deeper industry penetration.

Focus on ESG and green financing:

There is a growing interest in green finance, with non-banking financial companies offering loans for climate-friendly housing, solar panels, and electric vehicles. ESG-focused investment is also gaining prominence among both borrowers and lenders.

The global NBFC market is segmented as follows:

By Type

- NBFCs Accepting Public Deposit (NBFCs-D)

- NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND)

By Service Type

- Lending Services

- Investment Services

- Insurance Services

- Leasing Services

- Others

By Deployment Mode

- Online Deployment

- Branch-Based Deployment

- Hybrid Deployment

- Agent-Based Deployment

- Others

By Application

- Consumer Lending

- SME & Commercial Lending

- Wealth Management

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Non-banking financial companies, or NBFCs, are financial institutions that offer banking services without holding a banking license. They provide a broad range of financial products but do not accept deposits, unlike traditional banks. They play a vital role in financial inclusion, particularly in rural and underserved areas, by facilitating sectors such as real estate, small businesses, and infrastructure.

The global NBFC market is projected to grow due to rising disposable income and urbanization, the growth of the digital payment ecosystem and e-commerce, and the adoption of alternative credit scoring models.

According to study, the global NBFC market size was worth around USD 218.88 trillion in 2024 and is predicted to grow to around USD 259.48 trillion by 2034.

The CAGR value of the NBFC market is expected to be approximately 2.15% from 2025 to 2034.

Asia Pacific is expected to lead the global NBFC market during the forecast period.

The key players profiled in the global NBFC market include Bajaj Finance Ltd., HDB Financial Services, Shriram Finance, LIC Housing Finance, L&T Finance Holdings, Mahindra & Mahindra Financial Services, Cholamandalam Investment and Finance Company, Muthoot Finance, Manappuram Finance, Power Finance Corporation, Tata Capital Financial Services, Indiabulls Housing Finance, Aditya Birla Finance, Clix Capital, and Piramal Capital & Housing Finance.

Major challenges limiting the growth of the NBFC market include limited access to low-cost capital and regulatory tightening. Moreover, growing default risks and liquidity emergencies have damaged investor confidence in the industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed