Online Legal Services Market Size, Share, Trends, Growth 2034

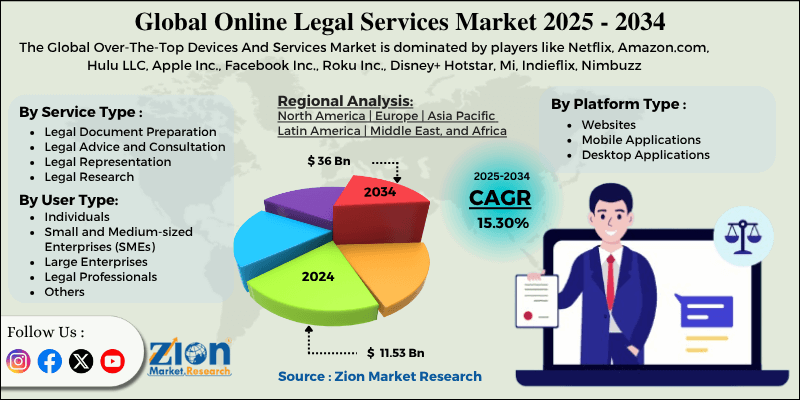

Online Legal Services Market By Service Type (Legal Document Preparation, Legal Advice and Consultation, Legal Representation, Legal Research, and Others), By User Type (Individuals, Small and Medium-sized Enterprises [SMEs], Large Enterprises, Legal Professionals, and Others), By Platform Type (Websites, Mobile Applications, Desktop Applications), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

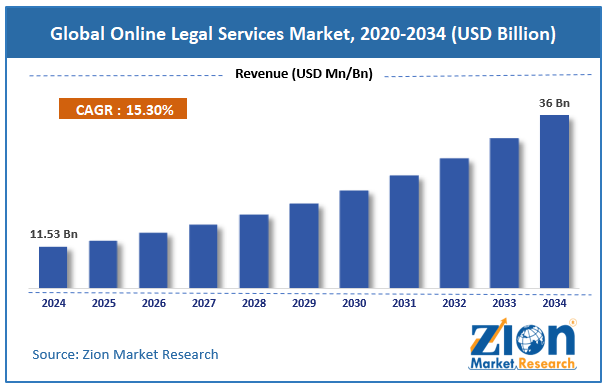

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.53 Billion | USD 36 Billion | 15.30% | 2024 |

Online Legal Services Industry Prospective:

The global online legal services market size was approximately USD 11.53 billion in 2024 and is projected to reach around USD 36 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.30% between 2025 and 2034.

Online Legal Services Market: Overview

Online legal services are digital tools and platforms that offer legal assistance, consultation, and documentation over the internet. These legal services provide a cost-effective and convenient alternative to traditional legal practices, enabling users to access legal documents, representation, and advice remotely.The global online legal services market is expected to expand rapidly, driven by the increasing digital transformation in the legal industry, growing smartphone and internet penetration, as well as the benefits of time efficiency and cost-effectiveness.Legal providers and law companies are actively adopting digital platforms for case tracking, automating document drafting, and client communications. This digital transformation has expanded the reach of digital legal services, particularly in emerging nations. The pandemic also boosted digital transformation, increasing the significance of online legal platforms.

Moreover, the growing use of mobile devices and internet access is enabling users to access legal services on demand. This broader connectivity enhances access in rural and remote regions. Additionally, online legal services often save time through the use of automated processes. Users can create legal documents, manage disputes, and access consultations without needing to visit a physical location. This efficacy and affordability are the leading propellers fueling consumer adoption. Despite the growth, the global market is hindered by factors such as the lack of personalized legal advice and concerns regarding cybersecurity and data privacy.Online platforms often provide generalized advice and standardized templates, which may not adequately support sensitive and complex cases. Users may experience legal risks if they depend on improper customization. This restricts the use of digital services for high-stakes legal matters.

Additionally, handling corporate legal information and sensitive personal details online increases the risk of data breaches. Server protection or insufficient encryption may result in legal malpractice claims. These concerns may create hesitation among users in trusting online platforms.Even so, the global online legal services industry is well-positioned due to its integration with insurtech and Fintech, as well as AI-enabled document drafting and review. Assimilating insurtech and Fintech may offer package services, such as automated claims, compliance tools, and legal insurance. These integrations enhance consumer trust and fuel the growth of infrastructure. Additionally, platforms that utilize generative AI offer context-aware and real-time drafting capabilities. This improves consumer satisfaction and differentiates industry leaders.

Key Insights:

- As per the analysis shared by our research analyst, the global online legal services market is estimated to grow annually at a CAGR of around 15.30% over the forecast period (2025-2034)

- In terms of revenue, the global online legal services market size was valued at around USD 11.53 billion in 2024 and is projected to reach USD 36 billion by 2034.

- The online legal services market is projected to grow significantly owing to the rising trend towards digitalization, regulatory support for online legal access, and increasing awareness and legal literacy.

- Based on service type, the legal document preparation segment is expected to lead the market, while the legal advice and consultation segment is expected to grow considerably.

- Based on user type, the individual segment is the dominant segment. In contrast, the Small and Medium-sized Enterprises (SMEs) segment is projected to witness sizable revenue growth over the forecast period.

- Based on platform type, the websites segment is expected to lead the market compared to the mobile applications segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Online Legal Services Market: Growth Drivers

Growth of the Freelance and Gig Economy drives market growth

The emergence of freelancers has driven the demand for on-demand legal services, thereby fueling the growth of the online legal services market. This comprises tax filing assistance, IP protection, and contract generation. Independent professionals often lack access to conventional legal resources, prompting them to turn to digital solutions that are reliable, fast, and easy to use.

A survey by Upwork revealed that more than 65% of freelancers in Europe and North America utilize online legal services to resolve disputes, draft contracts, and manage compliance. Services like LawDepot, UpCounsel, and LegalNature have invested in this trend, providing subscription-based legal solutions.

Growing consumer trust in online legal platforms notably fuels the market growth

Consumer trust has been majorly enhanced due to user-friendly interfaces, transparent pricing, strong cybersecurity measures, and verified attorneys. Platforms are offering real-time chat with legal experts, verified attorney profiles, and transparent documentation, thereby boosting consumer confidence.

Avvo restored its platform with AI-powered identity verification and legal matchmaking features in May 2025, resulting in a 22% increase in client retention. Similarly, LegalZoom experienced a 30% increase in repeat subscriptions, driven by a unified user experience and high customer satisfaction.

Online Legal Services Market: Restraints

Lack of human interaction and personalization negatively impact market progress

Several clients are seeking personalized interaction and support when navigating legal issues, particularly in emotionally charged matters such as child custody, criminal defense, or divorce. Online legal platforms often rely on AI and templates, which may lack the nuanced guidance and human empathy that law firms previously provided.

A report by Legal Trends by Clio (2024) revealed that 53% of legal consumers still prefer in-person visits and consultations for serious legal issues, citing trust, comfort, and improved communication as reasons.

Online Legal Services Market: Opportunities

Remote and cross-border legal services positively impact market growth

With the growth of global commerce and remote work, there is a surging demand for cross-border legal services, including international contract law, immigration filings, dispute resolution, and IP protection.Online legal platforms can offer jurisdiction-aware legal solutions that enable individuals and companies to navigate complex international legal frameworks. This potential spurs the online legal services industry remarkably.

VisaHQ, a digital visa and immigration service, integrated legal assistance features into its platform for remote employees and expats in March 2025, entering a progressive niche where legal technology can prosper across borders.

Online Legal Services Market: Challenges

Firm reliance on legal professionals for complex cases restricts the market growth

While AI and automation are increasingly used in legal tech, several digital platforms still rely on licensed attorneys to manage complex cases. This reliance presents scalability issues, primarily for businesses seeking to serve high-demand domains such as immigration appeals, litigation, or regulatory defense.

LegalZoom was criticized for under-delivering on a high-profile estate planning case that ultimately required law firm involvement. This incident highlighted the limitations of DIY legal platforms and underscored the importance of traditional legal specialization.

Online Legal Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Online Legal Services Market |

| Market Size in 2024 | USD 11.53 Billion |

| Market Forecast in 2034 | USD 36 Billion |

| Growth Rate | CAGR of 15.30% |

| Number of Pages | 213 |

| Key Companies Covered | LegalZoom, Rocket Lawyer, Avvo, Clio, LawDepot, UpCounsel, LegalShield, Nolo, LegalMatch, DoNotPay, DocuSign, Lawyers.com, MyCase, Contractbook, Lexoo, and others. |

| Segments Covered | By Service Type, By User Type, By Platform Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Online Legal Services Market: Segmentation

The global online legal services market is segmented based on service type, user type, platform type, and region.

Based on service type, the global online legal services industry is divided into legal document preparation, legal advice and consultation, legal representation, legal research, and others. The legal document preparation segment captured a substantial market share due to its minimal client-lawyer interaction requirements, high scalability, and ease of use in both business and personal legal needs. The ability to offer document creation in diverse languages and jurisdictions has widened the industry's appeal. Users can also access e-sign documents and personalized content and store them safely in the cloud, increasing the significance of the segment. With the increasing adoption of digital services, the legal document preparation market is expected to grow steadily, exhibiting strong annual growth.

Based on user type, the global online legal services market is segmented as individuals, small and medium-sized enterprises (SMEs), large enterprises, legal professionals, and others. The 'individuals' segment registered a majority share because of the rising demand for self-service and affordable legal tools. Common use cases include creating wills, resolving tenant-landlord disputes, filing for divorce, enforcing consumer rights, and preparing immigration documentation. These services offer reasonable alternatives to hiring personal attorneys, attracting first-time and price-sensitive legal users. The rising legal awareness among individuals, driven by social media, online content, and digital education, has propelled platform adoption.

Based on platform type, the global market is segmented into websites, mobile applications, and desktop applications. The 'websites' segment leads the market since they are easily accessible on devices without needing downloads, simplifying access to businesses and individuals. Web-based platforms offer enhanced content navigation, improved flexibility, and stronger service integration, including secure document storage, AI-based tools, and live chat. They also foster integrations with third-party services, such as cloud storage, e-signature tools, and payment gateways. Websites continue to attract new users daily due to their high visibility in search engines.

Online Legal Services Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to continue leading the online legal services market due to its high digital penetration, a well-developed legal tech ecosystem, and a supportive regulatory environment. North America boasts the highest internet penetration rate globally, providing broader access to online platforms.Legal services have embraced this connectivity to offer unified document filing, automated tools, and virtual consultations. The tech-savvy population is actively adopting online legal services, driving the industry's appeal.

Additionally, the region, particularly the United States, is home to leading legal tech firms such as UpCounsel, Rocket Lawyer, and LegalZoom. These companies have made significant progress in both B2B and B2C domains, offering comprehensive legal services through mobile applications and websites. Constant innovation and their early market entry have led the region as a global forerunner.

Additionally, the U.S. has a comparatively open legal framework that supports online legal service operations, including AI-supported consultations and self-help legal services. State bar associations are highly acknowledging digital platforms under regulatory sandboxes. This transforming legal policy environment supports expansion and experimentation.Europe holds a second-leading position in the online legal services industry, backed by the growing base of legal tech startups, strong demand from SMEs and freelancers, and surging use of ODR.

Europe is a leading hub for a higher number of legal tech firms like Legito, DoNotPay, and Legal OS. These companies are speedily advancing legal services by offering virtual consultations and automating document workflows. Investment in European legal tech exceeded €500 million in 2023, indicating strong innovation potential and industry confidence.

Additionally, Europe's SME industry and gig economy are the leading consumers of online digital services, with over 23 million SMEs across the continent. These entities often need affordable legal solutions for client contracts, compliance, and IP protection. Platforms offering EU-compliant forms and multilingual tools are gaining prominence among this demographic.

Furthermore, the region is a pioneer in ODR, with platforms like EODR (European Online Dispute Resolution), supported by the EU, for resolving cross-border electronic commerce disputes. The rise in small claims and online shopping cases following the pandemic has increased the appeal of digital mediation tools. The use of Online Dispute Resolution surged by 35% in 2023 in the European markets.

Online Legal Services Market: Competitive Analysis

The global online legal services market profiles the following players:

- LegalZoom

- Rocket Lawyer

- Avvo

- Clio

- LawDepot

- UpCounsel

- LegalShield

- Nolo

- LegalMatch

- DoNotPay

- DocuSign

- Lawyers.com

- MyCase

- Contractbook

- Lexoo

Online Legal Services Market: Key Market Trends

AI-enabled document automation and legal assistance:

AI is transforming the delivery of legal services, mainly in document drafting, contract analysis, and legal research. Platforms now use AI to produce wills, NDAs, and leases, and also offer primary legal assistance via chatbots. This notably lowers costs and turnaround times, increasing accessibility to SMEs and individuals.

Mounting integration with cloud-based and mobile tools:

Online legal services are becoming increasingly mobile-centric, with applications that enable users to consult with lawyers, draft contracts, and access legal documents at any time and from anywhere. Cloud integration facilitates the sharing, secure storage, and electronic signing of documents, enhancing convenience and collaboration.

The global online legal services market is segmented as follows:

By Service Type

- Legal Document Preparation

- Legal Advice and Consultation

- Legal Representation

- Legal Research

- Others

By User Type

- Individuals

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Legal Professionals

- Others

By Platform Type

- Websites

- Mobile Applications

- Desktop Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Online legal services are digital tools and platforms that offer legal assistance, consultation, and documentation over the internet. These legal services provide a cost-effective and convenient alternative to traditional legal practices, enabling users to access legal documents, representation, and advice remotely.

The global online legal services market is projected to grow due to growing legal needs among consumers, rising adoption of automation and AI in legal tech, and surging demand from startups and SMEs.

According to study, the global online legal services market size was worth around USD 11.53 billion in 2024 and is predicted to grow to around USD 36 billion by 2034.

The CAGR value of the online legal services market is expected to be approximately 15.30% from 2025 to 2034.

North America is expected to lead the global online legal services market during the forecast period.

The key players profiled in the global online legal services market include LegalZoom, Rocket Lawyer, Avvo, Clio, LawDepot, UpCounsel, LegalShield, Nolo, LegalMatch, DoNotPay, DocuSign, Lawyers.com, MyCase, Contractbook, and Lexoo.

The report examines key aspects of the online legal services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed