Peaking Power Plant Market Size, Share, Trends, Growth and Forecast 2034

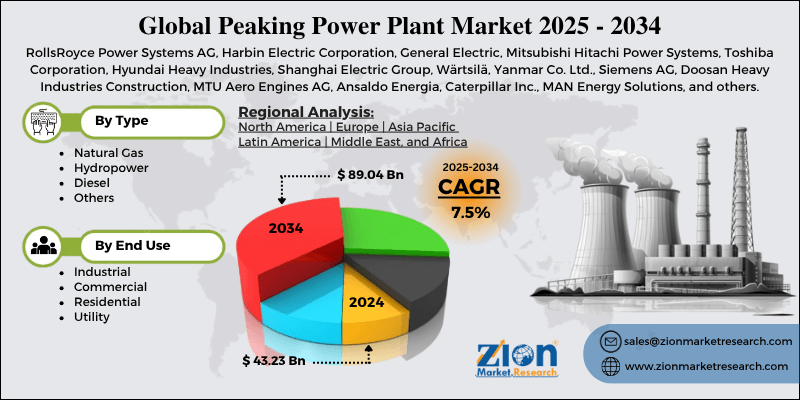

Peaking Power Plant Market By Type (Natural Gas, Hydropower, Diesel, and Others), By End User (Industrial, Commercial, Residential, and Utility), and By Region- Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025-2034

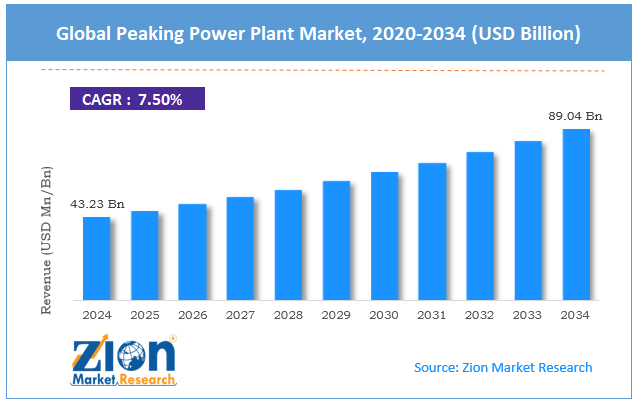

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 43.23 Billion | USD 89.04 Billion | 7.5% | 2024 |

Peaking Power Plant Industry Prospective:

The global peaking power plant market size was worth around USD 43.23 billion in 2024 and is predicted to grow to around USD 89.04 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.5% between 2025 and 2034.

Peaking Power Plant Market: Overview

Peaking power plants, also known as peaker plants, and occasionally just "peakers", are power plants that generally run only when there is a high demand, known as peak demand, for electricity.

Because they supply power only occasionally, the power they supply commands a much higher price per kilowatt-hour than base-load power. Peak load power plants are dispatched in combination with base load power plants, which supply a dependable and consistent amount of electricity, to meet the minimum demand.

Key Insights

- As per the analysis shared by our research analyst, the global peaking power plant market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2034).

- In terms of revenue, the global peaking power plant market size was valued at around USD 43.23 billion in 2024 and is projected to reach USD 89.04 billion by 2034.

- The expansion in renewable energy sources is expected to drive the peaking power plant market over the forecast period.

- Based on the type, the natural gas segment is expected to hold the largest market share over the forecast period.

- Based on the end-user, the industrial segment is expected to dominate market expansion over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Peaking Power Plant Market: Growth Drivers

Increasing adoption of renewable energy sources drives market growth

The growing use of renewable energy sources, such as solar and wind, is driving the development of peaking power plant industry. Grid stability could be impacted since renewable energy sources are inconsistent and irregular.

Peak power plants can be utilized to augment absent renewable energy sources by providing backup power. By integrating renewable energy sources with peaking power plants, utilities can provide a reliable and robust power supply.

Growing usage of renewable energy sources is expected to increase demand for peaking power plants, as they provide a reliable and reasonably priced way to balance the grid. For instance, according to the Press Information Bureau, India's total installed renewable energy capacity was 203.18 GW as of 2024.

Peaking Power Plant Market: Restraints

High operational cost hinders market growth

The peaking power plants market is severely constrained by high operating costs. These expenses have a direct impact on these facilities' viability and appeal from an economic standpoint, particularly when compared with more recent and environmentally friendly options such as battery energy storage systems. It is challenging to recoup the initial capital expenditure because peaking plants only operate during periods of peak demand, which are typically less than 10% of the year. Ineffective use of assets results from idle time.

Frequent cycling, or quick starts and stops, also strains equipment, requiring more maintenance and reducing its lifespan. Gas turbines and other quick-start systems need high-performance parts, which are expensive to maintain. Thus, the aforementioned facts hamper the industry expansion.

Peaking Power Plant Market: Opportunities

Growing business expansion by the key market player offers a lucrative opportunity for market growth

The growing business expansion by key market players is expected to offer a potential opportunity to the peaking power plant market during the projected period.

For instance, in January 2024, the Queensland Government-owned energy provider CS Energy placed an order for 12 LM2500XPRESS* aeroderivative gas turbines for a new power station in the Western Downs Region, west of Brisbane, in Queensland, Australia, according to GE Vernova's Gas Power business.

According to the Queensland Energy and Jobs Plan, which describes the state's attempts to change its energy system, the new Brigalow Peaking Power Plant is anticipated to deliver up to 400 megawatts (MW) of reliable energy supply, perfect for ensuring and improving grid stability.

With its flexibility, quick start, and capacity to support variable solar and wind power generation during periods of high demand, this peaking plant can initially run on 35 percent (by volume) green hydrogen, with a path to 100 percent hydrogen within this decade.

After it is put into service in 2026, the power plant is expected to supply the same amount of electricity, so more than 150,000 houses in Queensland typically use during periods of high demand.

Peaking Power Plant Market: Challenges

Environmental concerns pose a major challenge to market expansion

Environmental issues, particularly for those who operate diesel and natural gas-powered peaking power plants, are the main obstacle preventing the peaking power plant industry from growing. These problems compromise public acceptance, regulatory approvals, and the long-term survival of the plants.

Peak plants—especially those that use natural gas or diesel—emit notable quantities of CO₂ and other greenhouse gases per unit of power due to their low efficiency and frequent cycling (start/stop operations). This contradicts national and global goals for achieving carbon neutrality and slowing climate change.

Furthermore, some peaking plants—especially older ones—use water for cooling, which can impact surrounding ecosystems through thermal pollution or water withdrawal during dry periods, thereby hindering the industry's expansion.

Peaking Power Plant Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Peaking Power Plant Market |

| Market Size in 2024 | USD 43.23 Billion |

| Market Forecast in 2034 | USD 89.04 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 214 |

| Key Companies Covered | RollsRoyce Power Systems AG, Harbin Electric Corporation, General Electric, Mitsubishi Hitachi Power Systems, Toshiba Corporation, Hyundai Heavy Industries, Shanghai Electric Group, Wärtsilä, Yanmar Co. Ltd., Siemens AG, Doosan Heavy Industries Construction, MTU Aero Engines AG, Ansaldo Energia, Caterpillar Inc., MAN Energy Solutions, and others. |

| Segments Covered | By Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Peaking Power Plant Market: Segmentation

The global peaking power plant industry is segmented based on type, end user, and region.

Based on the type, the global peaking power plant market is bifurcated into natural gas, hydropower, diesel, and others. The natural gas segment is expected to hold the largest market share over the forecast period.

The industry is expanding because of the increased need for power, particularly from sectors like data centers and artificial intelligence development. Big energy companies are spending heavily on natural gas infrastructure to meet this demand.

Notable acquisitions in 2025 include the $1.9 billion purchase of 2.6 GW of capacity from Lotus Infrastructure Partners by Vistra, the $27 billion deal Constellation Energy signed to buy Calpine, and the $12 billion purchase of 13 GW from LS Power by NRG. These agreements show the strategic importance and financial promise of natural gas peaking plants in the modern energy environment.

Based on the end-user, the global peaking power plant industry is bifurcated into industrial, commercial, residential, and utility. The industrial segment is expected to dominate the market expansion over the projected period.

One major factor propelling the worldwide power plant market's expansion is the industrial sector. The need for reliable and flexible power solutions rises as companies grow and modernize, particularly during periods of high operational demand.

For industries like petrochemicals, mining, and manufacturing to continue operating, reliable and steady power is essential. Peaking power plants ensure minimal disturbance by providing the required backup during periods of peak demand. Additionally, the quick expansion of data centers due to greater digitization and AI applications has resulted in increased electricity usage.

Although they play a part in the surge, data centers only account for a share of the demand. Eric Gray, CEO of GE Vernova's gas power unit, stated that the main factors driving the need for gas turbines are electrification and industrialization.

Peaking Power Plant Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global peaking power plant market. The regional expansion of the market is attributed to the rising electricity demand.

For instance, according to the US Energy Information Administration, in 2024, the US electricity consumption increased by 3.0%, following a period of near-stagnant demand. Similarly, as per the same sources, in 2023, total U.S. primary energy consumption was equal to about 94 quadrillion Btu.

Furthermore, data centers make up a lower percentage of demand, which is mostly driven by industrialization and electrification. To meet the demand, GE Vernova is expanding its U.S. manufacturing operations and reports a substantial backlog of turbine orders.

Peaking Power Plant Market: Competitive Analysis

The global peaking power plant market is dominated by players like:

- RollsRoyce Power Systems AG

- Harbin Electric Corporation

- General Electric

- Mitsubishi Hitachi Power Systems

- Toshiba Corporation

- Hyundai Heavy Industries

- Shanghai Electric Group

- Wärtsilä

- Yanmar Co. Ltd.

- Siemens AG

- Doosan Heavy Industries Construction

- MTU Aero Engines AG

- Ansaldo Energia

- Caterpillar Inc.

- MAN Energy Solutions

The global peaking power plant market is segmented as follows:

By Type

- Natural Gas

- Hydropower

- Diesel

- Others

By End User

- Industrial

- Commercial

- Residential

- Utility

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Peaking power plants, also known as peaker plants, and occasionally just "peakers", are power plants that generally run only when there is a high demand, known as peak demand, for electricity.

The peaking power plant market is being driven by several variables such as the increasing electricity demand, increasing industrialization, technological advancements, and others.

According to the report, the global peaking power plant market size was worth around USD 43.23 billion in 2024 and is predicted to grow to around USD 89.04 billion by 2034.

The global peaking power plant market is expected to grow at a CAGR of 7.5% during the forecast period.

The global peaking power plant market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and the growing electricity demand.

The global peaking power plant market is dominated by players like RollsRoyce Power Systems AG, Harbin Electric Corporation, General Electric, Mitsubishi Hitachi Power Systems, Toshiba Corporation, Hyundai Heavy Industries, Shanghai Electric Group, Wärtsilä, Yanmar Co., Ltd., Siemens AG, Doosan Heavy Industries Construction, MTU Aero Engines AG, Ansaldo Energia, Caterpillar Inc., and MAN Energy Solutions, among others.

The peaking power plant market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed