Pharmaceutical Packaging Market Size, Share, Trends, Growth 2034

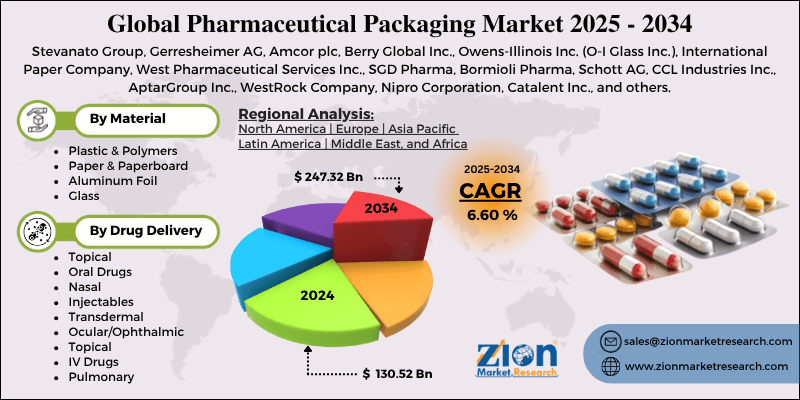

Pharmaceutical Packaging Market By Material (Plastic & Polymers, Paper & Paperboard, Aluminum Foil, Glass, and Others), By Drug Delivery Mode (Topical, Oral Drugs, Nasal, Injectables, Transdermal, Ocular/Ophthalmic, Topical, IV Drugs, Pulmonary, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

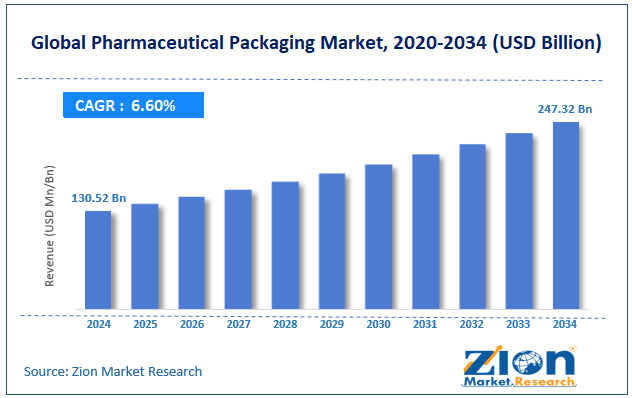

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 130.52 Billion | USD 247.32 Billion | 6.60% | 2024 |

Pharmaceutical Packaging Industry Prospective:

The global pharmaceutical packaging market size was worth around USD 130.52 billion in 2024 and is predicted to grow to around USD 247.32 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.60% between 2025 and 2034.

Pharmaceutical Packaging Market: Overview

Pharmaceutical packaging is a special segment of the global packaging industry. It deals with the production and use of various packaging solutions for storing and distributing medical drugs or pharmaceuticals. Packaging solutions used by drug manufacturing and distributing companies are expected to comply with regional and global regulatory frameworks. Pharmaceutical packaging is essential for ensuring the integrity of the drugs remains intact during storage and transportation. According to industry research, pharmaceutical packaging is currently divided into three types: primary packaging, secondary packaging, and tertiary packaging. The first type is characterized by direct contact between the packaging and the drug. Secondary form refers to external packaging such as boxes or cartons. Ternary form is a form of bulk packaging solution.

The demand for medical drug packaging solutions is growing at an unprecedented rate. The rising expansion of the healthcare infrastructure, along with a growing number of patients, has fueled the greater applications of novel pharmaceutical packaging. Moreover, rising investments in smart packaging solutions such as the use of anti-counterfeiting technologies and smart labels may open new avenues for further growth in the industry.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical packaging market is estimated to grow annually at a CAGR of around 6.60% over the forecast period (2025-2034)

- In terms of revenue, the global pharmaceutical packaging market size was valued at around USD 130.52 billion in 2024 and is projected to reach USD 247.32 billion by 2034.

- The pharmaceutical packaging market is projected to grow at a significant rate due to the rising healthcare expenditure and increasing number of patients.

- Based on the material, the plastic & polymers segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the drug delivery mode, the oral drugs segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Pharmaceutical Packaging Market: Growth Drivers

Rising healthcare expenditure and increasing number of patients to drive market demand rate

The global pharmaceutical packaging market is expected to be led by an increasing number of patients across the globe. The rising rate of the geriatric population, increasing cases of pediatric medical conditions, the surge in serious accidents worldwide, and other environmental or social factors have led to higher demand for medical care, including pharmaceutical drugs. Incidents of chronic illnesses worldwide have reached new heights in the last few years. For instance, according to the National Cancer Institute, more than 20 million people are diagnosed with cancer every year worldwide.

Furthermore, the demand for pharmaceutical packaging is also expected to be influenced by the global expansion of healthcare facilities. In recent times, several countries worldwide have registered an increase in healthcare expenditure facilitated by government-based projects or initiatives led by private companies. Access to medical care in remote parts of the world has improved, according to official reports.

For instance, between 2022 and 2024, India’s healthcare sector received a total investment of more than USD 30 billion in the form of private equity deals and mergers & acquisitions.

Surging demand for personalized medicines to offer new growth avenues to market players

One of the latest trends in the global healthcare industry is the growing acceptance of personalized medicine. This form of medical care is tailored to meet the patient’s specific medical needs. Significantly different from standardized medicine, personalized healthcare is more effective. As demand for customized medical attention improves, market players will be encouraged to innovate in terms of packaging. The surge in the use of gene therapies and biologics for treating a wide range of serious medical conditions will create scope for the development of prefilled pens or syringes that can store medicines in stable conditions.

According to the latest market growth trends, the use of 3D printing solutions to produce customized pharmaceutical products equipped with multi-drug formulations and controlled-release mechanisms can prove beneficial for the global pharmaceutical packaging market.

Pharmaceutical Packaging Market: Restraints

Lack of effective waste disposal mechanism to limit market expansion in the long run

The global pharmaceutical packaging industry is expected to be restricted due to the lack of effective waste disposal methods in the market. Pharmaceutical waste is one of the leading environmental pollutants according to official reports. For instance, studies indicate that the pharma industry produces more than 300 million tons of plastic waste every year. The ongoing use of single-use plastics in pharmaceutical packaging has become a major concern for environmental agencies, regional governments, and the general public.

Pharmaceutical Packaging Market: Opportunities

Smart and environmentally friendly packaging solutions to deliver improved growth opportunities to the industry players

The global pharmaceutical packaging market is expected to generate growth opportunities due to the rising introduction of smart packaging solutions. In addition, the emergence of environmentally friendly materials for medical drug packaging may hold higher growth potential in the future for the market players. For instance, in a recent event, LOG Pharma Primary Packaging, a leading provider of packaging solutions to pharmaceutical companies, showcased its latest offering, Pharmapack Europe 2025.

The company has launched a new eco barrier line, which optimizes oxygen scavenging while also reducing production costs for eco-friendly barrier bottles. On the other hand, Systech, a business segment of Markem-Imaje and Dover, launched an Artificial Intelligence (AI)-powered authentic solution called Unisecure Art. The product is designed to facilitate packaging quality, deliver higher protection to patients, and safeguard brand integrity. Unisecure artAI is a cloud-based Software-as-a-Service (SaaS) platform.

Additionally, growing investments in the expansion of production facilities worldwide will further facilitate market growth in the long term. In June 2023, SGD Pharma and Corning formed a joint venture to launch a new glass tubing facility in the Indian market.

Pharmaceutical Packaging Market: Challenges

Regulatory complexities and rising concerns over the sale of counterfeit drugs may challenge market growth

The global pharmaceutical packaging industry is expected to be challenged by the growing regulatory complexities around production and use of plastic packaging. In addition to this, rising sales of counterfeit medical drugs have resulted in heavy financial and brand value-associated losses for original drug producers. Pharmaceutical companies lose between USD 40 billion and over USD 205 billion per year, according to reports.

Pharmaceutical Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Packaging Market |

| Market Size in 2024 | USD 130.52 Billion |

| Market Forecast in 2034 | USD 247.32 Billion |

| Growth Rate | CAGR of 6.60% |

| Number of Pages | 216 |

| Key Companies Covered | Stevanato Group, Gerresheimer AG, Amcor plc, Berry Global Inc., Owens-Illinois Inc. (O-I Glass Inc.), International Paper Company, West Pharmaceutical Services Inc., SGD Pharma, Bormioli Pharma, Schott AG, CCL Industries Inc., AptarGroup Inc., WestRock Company, Nipro Corporation, Catalent Inc., and others. |

| Segments Covered | By Material, By Drug Delivery Mode, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Packaging Market: Segmentation

The global pharmaceutical packaging market is segmented based on material, drug delivery mode, and region.

Based on the material, the global market segments are plastic & polymers, paper & paperboard, aluminum foil, glass, and others. In 2024, the highest growth was listed in the plastic & polymers segment. It dominated nearly 37% of the total revenue. The increasing development of biodegradable plastic and high-performance polymers may facilitate higher segmental expansion in the coming years. The Glass segment is expected to continue delivering considerable revenue for the industry players.

Based on the drug delivery mode, the global market divisions are topical, oral drugs, nasal, injectables, transdermal, ocular/ophthalmic, IV drugs, pulmonary, and others. In 2024, the highest demand was listed in the oral drugs segment. It is one of the most common forms of medicine administration. The increasing number of chronic illnesses reported worldwide will further accelerate segmental expansion in the coming years. According to the World Health Organization (WHO), more than 830 million people worldwide are living with diabetes.

Pharmaceutical Packaging Market: Regional Analysis

North America to deliver the highest revenue during the forecast period

The global pharmaceutical packaging market is expected to be led by North America during the forecast period. In 2024, the region accounted for 36% of the global revenue. The increasing presence of some of the world’s most prominent pharmaceutical packaging solution providers in the region is helping North America thrive. In May 2025, Genentech, a member of the Roche Group, announced a $ 700 million investment for the construction of a new drug manufacturing facility in the US, thereby creating growth opportunities for packaging solution providers.

In September 2024, BGS Beta-Gamma-Service, a leading specialist in pharmaceutical packaging and the use of beta and gamma rays for radiation sterilization, announced its plans to open a new facility in the US in 2025. The growing number of medical patients across North America is facilitating higher demand for effective packaging solutions. In addition to this, countries such as the US and Canada are lucrative markets for smart packaging solutions, as healthcare expenditure in these countries is considerably higher compared to other parts of the world.

Pharmaceutical Packaging Market: Competitive Analysis

The global pharmaceutical packaging market is led by players like:

- Stevanato Group

- Gerresheimer AG

- Amcor plc

- Berry Global Inc.

- Owens-Illinois Inc. (O-I Glass Inc.)

- International Paper Company

- West Pharmaceutical Services Inc.

- SGD Pharma

- Bormioli Pharma

- Schott AG

- CCL Industries Inc.

- AptarGroup Inc.

- WestRock Company

- Nipro Corporation

- Catalent Inc.

The global pharmaceutical packaging market is segmented as follows:

By Material

- Plastic & Polymers

- Paper & Paperboard

- Aluminum Foil

- Glass

- Others

By Drug Delivery Mode

- Topical

- Oral Drugs

- Nasal

- Injectables

- Transdermal

- Ocular/Ophthalmic

- Topical

- IV Drugs

- Pulmonary

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical packaging is a special segment of the global packaging industry. It deals with the production and use of various packaging solutions for storing and distributing medical drugs or pharmaceuticals.

The global pharmaceutical packaging market is expected to be led by an increasing number of patients across the globe.

According to study, the global pharmaceutical packaging market size was worth around USD 130.52 billion in 2024 and is predicted to grow to around USD 247.32 billion by 2034.

The CAGR value of the pharmaceutical packaging market is expected to be around 6.60% during 2025-2034.

The global pharmaceutical packaging market is expected to be led by North America during the forecast period.

The global pharmaceutical packaging market is led by players like Stevanato Group, Gerresheimer AG, Amcor plc, Berry Global, Inc., Owens-Illinois, Inc. (O-I Glass, Inc.), International Paper Company, West Pharmaceutical Services, Inc., SGD Pharma, Bormioli Pharma, Schott AG, CCL Industries Inc., AptarGroup, Inc., WestRock Company, Nipro Corporation, and Catalent, Inc.

The report explores crucial aspects of the pharmaceutical packaging market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed