Pharmaceutical Plastic Packaging Market Size, Share, Trends, Growth 2034

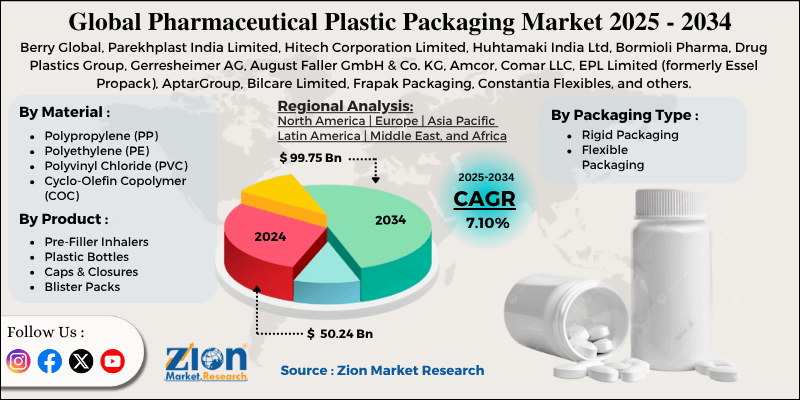

Pharmaceutical Plastic Packaging Market By Material (Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Cyclo-Olefin Copolymer (COC), Polyamide (PA), and Others), By Product (Pre-Filler Inhalers, Plastic Bottles, Caps, & Closures, Blister Packs, Ampoules & Vials, Prefillable Syringes, Jars & Canisters, and Others), By Packaging Type (Rigid Packaging and Flexible Packaging), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

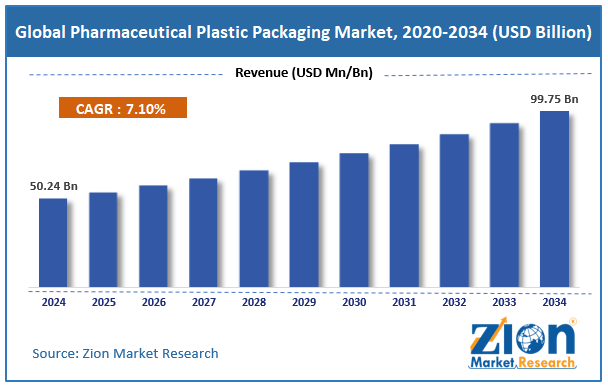

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 50.24 Billion | USD 99.75 Billion | 7.10% | 2024 |

Pharmaceutical Plastic Packaging Industry Prospective:

The global pharmaceutical plastic packaging market size was worth around USD 50.24 billion in 2024 and is predicted to grow to around USD 99.75 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.10% between 2025 and 2034.

Pharmaceutical Plastic Packaging Market: Overview

Pharmaceutical plastic packaging refers to protective containers or accessories made of plastic and designed to store or transport pharmaceutical products. The most common applications of plastic packaging in the pharmaceutical industry are in the form of closures, containers, and accessories such as droppers or syringes. Furthermore, at present, market players are showing a greater interest in additives, as they are used to improve the performance of plastic packaging solutions. In producing plastic packaging solutions for medicines and drugs, five different technologies are used. These production engineering solutions include compression, injection molding, injection-blow molding, extrusion, and injection-stretch-blow molding.

During the forecast period, demand for pharmaceutical plastic packaging is expected to continue growing due to the rising demand for medicinal drugs worldwide. Additionally, international partnerships for drug manufacturing and procurement may further aid market expansion.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical plastic packaging market is estimated to grow annually at a CAGR of around 7.10% over the forecast period (2025-2034)

- In terms of revenue, the global pharmaceutical plastic packaging market size was valued at around USD 50.24 billion in 2024 and is projected to reach USD 99.75 billion by 2034.

- The pharmaceutical plastic packaging market is projected to grow at a significant rate due to the increasing demand for medicinal drugs.

- Based on the material, the Polyethylene (PE) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the packaging type, the rigid packaging segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Pharmaceutical Plastic Packaging Market: Growth Drivers

Increasing demand for medicinal drugs to propel market growth rate during the projection period

The global pharmaceutical plastic packaging market is expected to be driven by the rising demand for medicinal drugs worldwide. The rising number of patients due to the higher prevalence of mild and severe diseases has accelerated the demand for medical drugs. Furthermore, the surge in birth rate worldwide along with a rising geriatric population has burdened the healthcare infrastructure across the globe. As the demand for pharmaceutical drugs rises, more investments are being directed toward the amplifying production of packaging solutions.

In March 2023, ALPLApharma, the pharmaceutical division of the ALPLA Group, announced a partnership with Spanish packaging company Inden Pharma. The joint venture will allow the development of new production facilities in Poland and Greece. By 2028, the collaborative efforts of the companies are expected to deliver an annual production of 800 million pharmaceutical packaging products.

Surge in international partnerships for drug production and procurement will aid in higher market revenue

In recent times, the number of international partnerships for producing novel drugs or procuring large consignments of existing drugs on the market has increased. Plastic packaging for pharmaceutical products is designed to not only store but also protect the medical solutions during transportation until they reach final consumers.

For instance, in September 2024, the US government donated around 1 million vaccines against Mpox to African countries. According to official reports, India supplies around 45% of generic medicines to the US market. As more international collaborations for drug development and trade grow, the global pharmaceutical plastic packaging market can expect more revenue.

Pharmaceutical Plastic Packaging Market: Restraints

Environmental impact of waste generated by the market players affects overall revenue

The global pharmaceutical plastic packaging industry is expected to be restricted due to the growing concerns over the environmental impact of waste generated by industry players. According to market research, the global pharmaceutical industry generates waste between 300 million tons and 200,000 metric tons annually.

Most of the plastic waste reaches water bodies, contaminating marine ecosystems while also causing soil degradation on land. The alarming rate of environmental damage caused by plastic packaging from the medical industry will create more growth barriers for industry players.

Pharmaceutical Plastic Packaging Market: Opportunities

Rising innovation rate in the industry to generate market growth opportunities for industry players

The global pharmaceutical plastic packaging market is expected to generate growth opportunities due to the rising innovation rate in the industry. Plastic packaging producers for medical drugs are actively working on developing more sustainable solutions that can open new avenues for further growth. For instance, the increasing use of recycled blister packs or Polypropylene (PP) bottles is a leading example of new measures employed to develop a more circular economy in the industry.

In November 2024, Bormioli Pharma, Selenis, and UPM Biochemicals announced a strategic partnership for developing the world’s first pharmaceutical bottles produced using partially wood-based Polyethylene Terephthalate (PET). The companies aim to deliver eco-friendly solutions in the market without compromising the overall performance of the packaging.

In addition, the top-load packaging format is expected to gain momentum in the coming years due to its unique applications in injectable pharma. The emergence of remote medical care and growing demand for self-administered medicines is likely to further encourage research & development in the industry during the projection period.

Pharmaceutical Plastic Packaging Market: Challenges

Supply chain disruptions and regulatory changes to impact market growth trends

The global pharmaceutical plastic packaging industry is expected to be challenged by the supply chain disruption of raw materials required for plastic production. Moreover, regulatory changes in terms of the use of plastic for packaging pharmaceutical products may further impact smooth growth trends in the industry. The rising number of incidents related to the sale of counterfeit products may also create growth challenges for the market players.

Pharmaceutical Plastic Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Plastic Packaging Market |

| Market Size in 2024 | USD 50.24 Billion |

| Market Forecast in 2034 | USD 99.75 Billion |

| Growth Rate | CAGR of 7.10% |

| Number of Pages | 217 |

| Key Companies Covered | Berry Global, Parekhplast India Limited, Hitech Corporation Limited, Huhtamaki India Ltd, Bormioli Pharma, Drug Plastics Group, Gerresheimer AG, August Faller GmbH & Co. KG, Amcor, Comar LLC, EPL Limited (formerly Essel Propack), AptarGroup, Bilcare Limited, Frapak Packaging, Constantia Flexibles, and others. |

| Segments Covered | By Material, By Product, By Packaging Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Plastic Packaging Market: Segmentation

The global pharmaceutical plastic packaging market is segmented based on material, product, packaging type, and region.

Based on the material, the global market segments are Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Cyclo-Olefin Copolymer (COC), Polyamide (PA), and others. In 2024, the highest growth was listed in the Polyethylene (PE) segment, which dominated nearly 27.76% of the total revenue. The overall higher performance of PE-based packaging in the form of higher flexibility and durability is expected to drive segmental demand in the future.

Based on product, the global pharmaceutical plastic packaging industry is divided into pre-filler inhalers, plastic bottles, caps, & closures, blister packs, ampoules & vials, prefillable syringes, jars & containers, and others.

Based on the packaging type, the global market divisions are rigid packaging and flexible packaging. In 2024, the industry was dominated by the rigid packaging segment, which held prominence over 58% of the total market share. Rigid packaging is preferred in the pharmaceutical industry because it provides higher protection for the stored drugs. Moreover, rigid packaging is more effective when transporting drugs across distances. Flexible packaging is expected to deliver higher CAGR in the coming years as compared to the last few years.

Pharmaceutical Plastic Packaging Market: Regional Analysis

Asia-Pacific to emerge as the highest revenue generator during the forecast period

The global pharmaceutical plastic packaging market will be led by Asia-Pacific during the projection period. China and India are the leading revenue generators for the regional market. During the projection period, China is expected to deliver a CAGR of over 5.45% and India will encounter a CAGR of more than 6.9%. The growing demand for medical drugs in Asia-Pacific is promoting regional revenue. The healthcare infrastructure across major Asian countries is expanding rapidly, particularly in terms of producing affordable generic medicines. Furthermore, rising efforts by regional players to accelerate plastic packaging production rates may aid in higher addition of market revenue in the coming years.

In December 2024, ACG Engineering, a leading producer of integrated manufacturing solutions to the global pharmaceutical and nutraceutical industries, launched a new ADAPT X feeder at the Convention on Pharmaceutical Ingredients and Pharmaceutical Machinery and Equipment Convention 2024 in India’s capital, Delhi.

Additionally, ongoing investments in the development of sustainable and environmentally friendly plastic packaging for pharma products will further accelerate regional expansion during the projection period. A prominent example of such a move was registered in 2021 when Japan-based Astellas initiated the use of a biomass-based plastic blister package for the "Irribow® Tablet 5µg".

Pharmaceutical Plastic Packaging Market: Competitive Analysis

The global pharmaceutical plastic packaging market is led by players like:

- Berry Global

- Parekhplast India Limited

- Hitech Corporation Limited

- Huhtamaki India Ltd

- Bormioli Pharma

- Drug Plastics Group

- Gerresheimer AG

- August Faller GmbH & Co. KG

- Amcor

- Comar LLC

- EPL Limited (formerly Essel Propack)

- AptarGroup

- Bilcare Limited

- Frapak Packaging

- Constantia Flexibles

The global pharmaceutical plastic packaging market is segmented as follows:

By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Cyclo-Olefin Copolymer (COC)

- Polyamide (PA)

- Others

By Product

- Pre-Filler Inhalers

- Plastic Bottles

- Caps & Closures

- Blister Packs

- Ampoules & Vials

- Prefillable Syringes

- Jars & Canisters

- Others

By Packaging Type

- Rigid Packaging

- Flexible Packaging

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical plastic packaging refers to protective containers or accessories made of plastic and designed to store or transport pharmaceutical products.

The global pharmaceutical plastic packaging market is expected to be driven by the rising demand for medicinal drugs worldwide.

According to study, the global pharmaceutical plastic packaging market size was worth around USD 50.24 billion in 2024 and is predicted to grow to around USD 99.75 billion by 2034.

The CAGR value of the pharmaceutical plastic packaging market is expected to be around 7.10% during 2025-2034.

The global pharmaceutical plastic packaging market will be led by Asia-Pacific during the projection period.

The global pharmaceutical plastic packaging market is led by players like Berry Global, Parekhplast India Limited, Hitech Corporation Limited, Huhtamaki India Ltd, Bormioli Pharma, Drug Plastics Group, Gerresheimer AG, August Faller GmbH & Co. KG, Amcor, Comar LLC, EPL Limited (formerly Essel Propack), AptarGroup, Bilcare Limited, Frapak Packaging, and Constantia Flexibles.

The report explores crucial aspects of the pharmaceutical plastic packaging market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed