Pipeline Safety Market Size, Share, Trends, Growth 2034

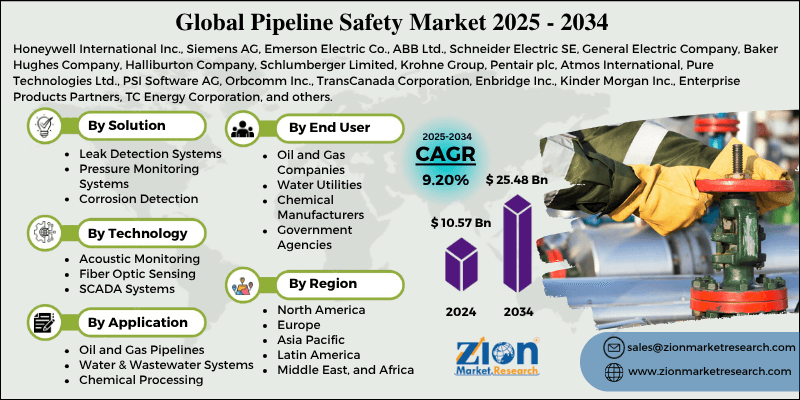

Pipeline Safety Market By Solution Type (Leak Detection Systems, Pressure Monitoring Systems, Corrosion Detection, and Emergency Shutdown Systems), By Application (Oil and Gas Pipelines, Water and Wastewater Systems, Chemical Processing, and Others), By Technology (Acoustic Monitoring, Fiber Optic Sensing, SCADA Systems, and Smart Pigging), By End User (Oil and Gas Companies, Water Utilities, Chemical Manufacturers, and Government Agencies) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.62 Billion | USD 47.19 Billion | 9.04% | 2024 |

Pipeline Safety Industry Prospective:

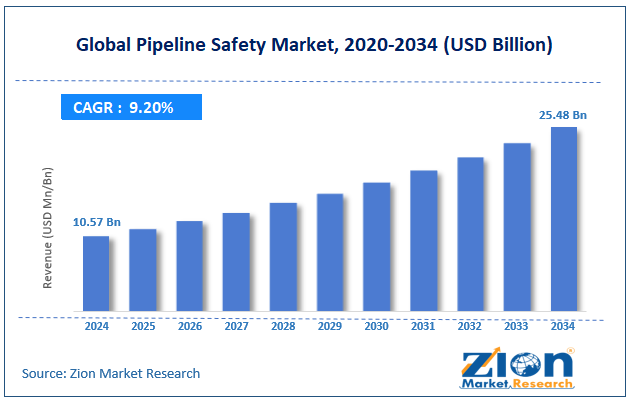

The global pipeline safety market was valued at approximately USD 10.57 billion in 2024 and is expected to reach around USD 25.48 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 9.20% between 2025 and 2034.

Pipeline Safety Market: Overview

Pipeline safety systems are infrastructure protection solutions that monitor, detect, and prevent hazards in pipeline networks that carry oil, gas, water, and chemicals over long distances. These safety solutions include advanced monitoring technologies, leak detection systems, pressure control mechanisms, corrosion monitoring equipment, and emergency response protocols that work together to ensure safe and reliable pipeline operations.

The pipeline safety market serves critical infrastructure operators, including energy companies, water utilities, chemical processors, and municipal authorities. Modern pipeline safety systems utilize the latest technologies, including acoustic monitoring, fiber optic sensing, satellite surveillance, artificial intelligence, and predictive analytics, to provide real-time monitoring and early warning systems.

The increasing focus on infrastructure safety, growing regulatory compliance requirements, aging pipeline infrastructure, and rising environmental protection concerns are expected to drive significant growth in the global pipeline safety industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global pipeline safety market is estimated to grow annually at a CAGR of around 9.20% over the forecast period (2025-2034)

- In terms of revenue, the global pipeline safety market size was valued at around USD 10.57 billion in 2024 and is projected to reach USD 25.48 billion by 2034.

- The pipeline safety market is projected to grow significantly due to rising investments in smart pipeline technologies, increasing adoption of IoT-based monitoring systems, and the expansion of oil and gas transmission networks in developing regions.

- Based on solution type, leak detection systems lead the segment and will continue to dominate the global market.

- Based on the application, oil and gas pipelines are expected to lead the market.

- Based on the technology, SCADA systems are anticipated to command the largest market share.

- Based on end-users, oil and gas companies are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Pipeline Safety Market: Growth Drivers

Critical Infrastructure Protection and Regulatory Compliance

The pipeline safety market is experiencing rapid growth due to increasing regulatory requirements and mandatory standards across various industries. Governments worldwide have implemented strict regulations that require pipeline operators to install monitoring and detection systems to prevent accidents, environmental damage, and public safety risks.

Pipeline operators face significant penalties and legal liabilities for non-compliance, making investing in safety systems a business imperative, not an optional expense. These regulations require pipeline companies to show continuous monitoring, regular integrity testing, and immediate response protocols for potential safety events.

Aging Pipeline Infrastructure and Maintenance Requirements

The pipeline safety market is witnessing demand for advanced safety solutions as aging assets pose growing operational and regulatory challenges. These aging systems need continuous monitoring and maintenance programs to ensure safe operation and regulatory compliance.

Pipeline operators are shifting towards predictive maintenance strategies that utilize advanced safety monitoring to identify issues before they escalate into critical failures. This reduces maintenance costs, extends the life of equipment, and minimizes downtime that can disrupt supply chains and cause economic losses. The integration of AI and machine learning in pipeline safety systems enables operators to predict maintenance needs and schedule inspections based on real-time condition data.

Pipeline Safety Market: Restraints

High Implementation Costs and Technical Complexity

Despite the benefits, the pipeline safety industry faces challenges related to the capital investment required to implement a safety system and the technical complexity associated with large pipeline networks. The upfront cost of installing advanced leak detection systems, fiber optic monitoring, SCADA infrastructure, and emergency shutdown systems can be restrictive for smaller pipeline operators or those with limited budgets.

The technical complexity of modern pipeline safety systems requires specialist expertise for installation, calibration, maintenance, and operation, which may not be available in all regions or market segments. Integration challenges arise when combining different monitoring technologies from multiple vendors, which can lead to compatibility issues and reduced system effectiveness.

Pipeline Safety Market: Opportunities

Digital Transformation and Smart Pipeline Technologies

The pipeline safety market offers opportunities through digital transformation and smart pipeline technologies that use the Internet of Things, cloud, artificial intelligence, and big data to improve monitoring and operations. Cloud-based monitoring platforms provide remote access to pipeline safety data, centralized management of multiple pipeline systems, and integration with enterprise resource planning systems, enabling better operational coordination.

Advanced analytics and machine learning can identify patterns in pipeline behavior that indicate potential safety risks, allowing for intervention before problems become critical. Blockchain for data security and audit trails offers more opportunities to increase trust and transparency in pipeline safety management.

Pipeline Safety Market: Challenges

Cybersecurity Threats and Data Protection Requirements

The pipeline safety industry is facing cybersecurity challenges as safety monitoring systems become more connected and reliant on digital technologies that can be hacked and breached. The integration of Internet of Things devices, wireless communication systems, and cloud-based platforms in pipeline safety systems creates multiple entry points for cyberattacks that could compromise the system or gain unauthorized access to operational data.

Pipeline operators must implement comprehensive cybersecurity measures, including network segmentation, encryption, access controls, and continuous monitoring, without compromising the safety system's functionality. Data protection requirements and privacy regulations add complexity to pipeline safety system design and operation, especially when systems collect and process data that is sensitive or proprietary.

Pipeline Safety Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pipeline Safety Market |

| Market Size in 2024 | USD 10.57 Billion |

| Market Forecast in 2034 | USD 25.48 Billion |

| Growth Rate | CAGR of 9.20% |

| Number of Pages | 212 |

| Key Companies Covered | Honeywell International Inc., Siemens AG, Emerson Electric Co., ABB Ltd., Schneider Electric SE, General Electric Company, Baker Hughes Company, Halliburton Company, Schlumberger Limited, Krohne Group, Pentair plc, Atmos International, Pure Technologies Ltd., PSI Software AG, Orbcomm Inc., TransCanada Corporation, Enbridge Inc., Kinder Morgan Inc., Enterprise Products Partners, TC Energy Corporation, and others. |

| Segments Covered | By Solution Type, By Application, By Technology, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pipeline Safety Market: Segmentation

The global pipeline safety market is segmented into solution type, application, technology, end-user, and region.

Based on solution type, the market is segregated into leak detection systems, pressure monitoring systems, corrosion detection, and emergency shutdown systems. Leak detection systems lead the market due to their critical importance in preventing environmental damage and regulatory compliance requirements.

Based on application, the pipeline safety industry is classified into oil and gas pipelines, water and wastewater systems, chemical processing, and others. Oil and gas pipelines hold the largest market share due to strict regulatory requirements and the high-risk nature of petroleum product transportation.

Based on the technology, the pipeline safety market is divided into acoustic monitoring, fiber optic sensing, SCADA systems, and smart pigging. SCADA systems are expected to lead the market during the forecast period due to their comprehensive monitoring capabilities and integration with existing control systems.

Based on the end-user, the market is segmented into oil and gas companies, water utilities, chemical manufacturers, and government agencies. Oil and gas companies lead the market share due to their extensive pipeline networks and substantial capital resources for safety investments.

Pipeline Safety Market: Regional Analysis

North America to lead the market

North America leads the global pipeline safety market due to its extensive pipeline infrastructure, strict regulations, technology adoption, and investment in pipeline integrity management programs.

The region accounts for around 35% of the global market share, with the US being the largest consumer of pipeline safety solutions due to its massive oil and gas pipeline network of hundreds of thousands of miles. The Pipeline and Hazardous Materials Safety Administration has strict regulations that require pipeline operators to have integrity management programs and invest in advanced monitoring technologies.

The region’s mature oil and gas industry has established best practices for pipeline safety management and continues to invest in technology upgrades and system modernization programs. The region is home to major pipeline safety technology providers and research institutions that support innovation and the development of advanced monitoring solutions.

Europe is expected to show steady growth.

Europe is growing in the pipeline safety market, driven by environmental regulations, aging infrastructure, and increasing focus on renewable energy transportation systems.

The region’s commitment to environmental protection and safety standards is driving demand for advanced pipeline monitoring and detection systems. The European Union’s pipeline safety and environmental protection framework requires member states to implement full monitoring and inspection programs for critical pipeline infrastructure.

The region’s move to renewable energy and hydrogen economy is creating new opportunities for pipeline safety technology providers as energy companies invest in alternative fuel transportation infrastructure. The chemical and petrochemical industries are well-established in many European countries, driving demand for specialized pipeline safety solutions for the transportation of hazardous chemicals.

Recent Market Developments:

- In April 2025, Honeywell International announced a collaboration with Argent LNG to support the development of a facility in Louisiana. This expansion is part of Honeywell's broader strategy to expand its pipeline safety portfolio, particularly in areas such as energy infrastructure.

Pipeline Safety Market: Competitive Analysis

The global pipeline safety market is led by players like:

- Honeywell International Inc.

- Siemens AG

- Emerson Electric Co.

- ABB Ltd.

- Schneider Electric SE

- General Electric Company

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited

- Krohne Group

- Pentair plc

- Atmos International

- Pure Technologies Ltd.

- PSI Software AG

- Orbcomm Inc.

- TransCanada Corporation

- Enbridge Inc.

- Kinder Morgan Inc.

- Enterprise Products Partners

- TC Energy Corporation

The global pipeline safety market is segmented as follows:

By Solution Type

- Leak Detection Systems

- Pressure Monitoring Systems

- Corrosion Detection

- Emergency Shutdown Systems

By Application

- Oil and Gas Pipelines

- Water and Wastewater Systems

- Chemical Processing

- Others

By Technology

- Acoustic Monitoring

- Fiber Optic Sensing

- SCADA Systems

- Smart Pigging

By End User

- Oil and Gas Companies

- Water Utilities

- Chemical Manufacturers

- Government Agencies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pipeline safety systems are infrastructure protection solutions that monitor, detect, and prevent hazards in pipeline networks that carry oil, gas, water, and chemicals over long distances.

The pipeline safety market is expected to be driven by increasing regulatory compliance requirements, aging pipeline infrastructure that requires continuous monitoring, technological advancements in detection systems, growing environmental protection awareness, and expanding investments in energy infrastructure.

According to our study, the global pipeline safety market was worth around USD 10.57 billion in 2024 and is predicted to grow to around USD 25.48 billion by 2034.

The CAGR value of the pipeline safety market is expected to be around 9.20% during 2025-2034.

The global pipeline safety market will register the highest revenue contribution from North America during the forecast period.

Key players in the pipeline safety market include Honeywell International Inc., Siemens AG, Emerson Electric Co., ABB Ltd., Schneider Electric SE, General Electric Company, Baker Hughes Company, Halliburton Company, Schlumberger Limited, Krohne Group, Pentair plc, Atmos International, Pure Technologies Ltd., PSI Software AG, Orbcomm Inc., TransCanada Corporation, Enbridge Inc., Kinder Morgan Inc., Enterprise Products Partners, and TC Energy Corporation.

The report provides a comprehensive analysis of the pipeline safety market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technological innovations, regulatory impacts, and industry best practices that shape the ecosystem of pipeline infrastructure protection.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed