Postal Services Market Size, Share, Trends, Growth and Forecast 2034

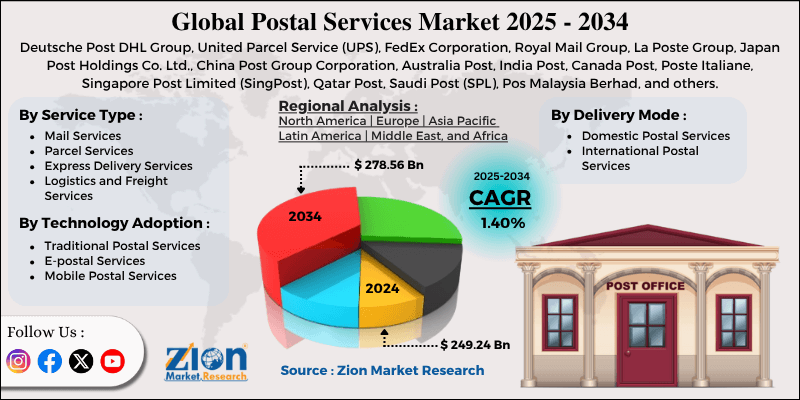

Postal Services Market By Service Type (Mail Services, Parcel Services, Express Delivery Services, Logistics and Freight Services, and Others), By Delivery Mode (Domestic Postal Services, International Postal Services), By Technology Adoption (Traditional Postal Services, E-postal Services, Mobile Postal Services), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

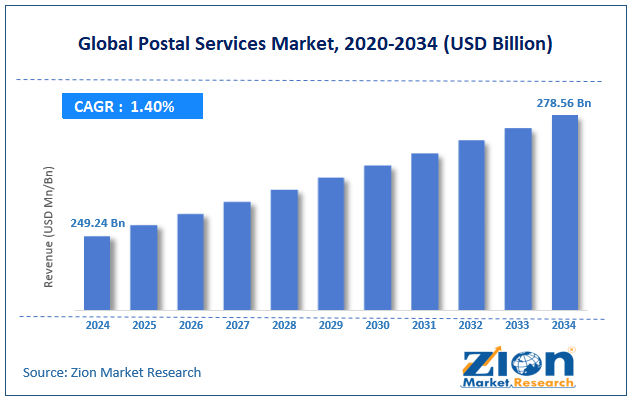

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 249.24 Billion | USD 278.56 Billion | 1.40% | 2024 |

Postal Services Industry Prospective:

The global postal services market size was approximately USD 249.24 billion in 2024 and is projected to reach around USD 278.56 billion by 2034, with a compound annual growth rate (CAGR) of approximately 1.40% between 2025 and 2034.

Postal Services Market: Overview

Postal services are essential commercial and public systems responsible for gathering, sorting, transporting, and delivering parcels and mail. They are operated by private entities or the government and play a crucial role in logistics and communications, mainly in remote and rural regions. The global postal services market is projected to experience substantial growth, driven by the booming e-commerce industry, increasing cross-border trade, and the digitalization of postal networks. The development of global e-commerce is amplifying parcel volume for postal operators.

In 2024, global e-commerce sales surpassed $6.5 trillion, as the number of individuals shopping online continued to increase. This increases the significance of postal services for domestic and last-mile parcel deliveries. The rise of international trade has boosted cross-border parcel shipping. Cross-border volumes are surging by 15% yearly, according to UPU, fueled by online retail. Postal services are advancing international logistics to meet this growing demand. Moreover, postal organizations are adopting automation, IoT, and real-time tracking technologies. AI-based route planning and smart sortation are enhancing cost efficiency and service reliability. These advancements are crucial for competing with private couriers.

Despite the growth, the global market is hindered by factors such as a decline in traditional mail volumes and inadequate infrastructure in emerging regions. Digital platforms and email have dramatically reduced conventional mail volumes. Yearly decreases of 5 – 10% are common, reducing a once-stable profit stream. This inclination forces operators to diversify or restructure speedily. In addition, developing nations often lack reliable road infrastructure or a well-structured address system. This results in losses, delays, and high last-mile costs. It restricts service quality and industry penetration in the underserved and rural areas.

Still, the global postal services industry benefits from several favorable factors, including its association with e-commerce platforms and the adoption of autonomous and drone delivery. Postal bodies are joining hands with platforms like Flipkart, Amazon, and Alibaba. These associations promise steady parcel volumes and logistical incorporation. It also helps traditional operators adopt the digital commerce chain. Furthermore, autonomous delivery vehicles and drones are being experimented with for faster last-mile services. Mainly in congested or remote areas, they offer budget-friendly solutions. Early adoption may help postal companies gain a competitive edge in logistics technology.

Key Insights:

- As per the analysis shared by our research analyst, the global postal services market is estimated to grow annually at a CAGR of around 1.40% over the forecast period (2025-2034)

- In terms of revenue, the global postal services market size was valued at around USD 249.24 billion in 2024 and is projected to reach USD 278.56 billion by 2034.

- The postal services market is projected to grow significantly due to the growth in cross-border trade for international shipping and mailing, modernization in last-mile delivery, and the expansion of urban populations.

- Based on service type, the parcel services segment is expected to lead the market, while the express delivery services segment is expected to grow considerably.

- Based on delivery mode, the domestic postal services segment is the largest, while the international postal services segment is projected to experience substantial revenue growth over the forecast period.

- Based on technology adoption, the traditional postal services segment is expected to lead the market compared to the e-postal services segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe

Postal Services Market: Growth Drivers

Financial inclusion through postal banking services drives the market growth

Postal networks, primarily in emerging regions, are serving as key channels for financial inclusion. With high penetration in the underserved and rural areas, post offices are used to deliver basic banking, remittance, and insurance services. More than 1.5 billion individuals worldwide remain unbanked (as of 2024), according to the World Bank, creating a significant opportunity for postal financial services.

In 2024, PostBank Kenya reported a 40% rise in mobile banking transactions, driven by its rural outreach through postal branches. These services are helping postal agencies diversify their revenue streams while enhancing the relevance of the postal services market in a highly digital economy.

Smart postal infrastructure and digital transformation noticeably fuel the market growth

The adoption of digital technologies, including IoT, cloud computing, blockchain, and AI, is transforming the postal infrastructure. The Universal Postal Union (UPU) introduced its Postal Vision 2030 program to encourage smart networks worldwide. Operators are incorporating dynamic routing, digital tracking, and automated lockers to reduce operational costs and improve service quality.

Deutsche Post DHL Group expanded its AI-based logistics hubs in Germany in 2024, resulting in a 25% reduction in delivery times.

Postal Services Market: Restraints

Growing competition from logistics providers and private couriers negatively impacts market progress

The growth of tech-based logistics companies, such as Amazon, FedEx, DHL, and UPS, as well as several local courier startups, has significantly eroded the industry share of traditional services. These private players usually offer real-time tracking, faster delivery, and enhanced customer service, domains where government postal systems are still in progress.

In markets like the United States, private carriers lead the way in express parcel delivery. In contrast, companies like Ekart and Delhivery have witnessed a boom in India, registering e-commerce shipping services alongside India Post. This elevated competition decreases pricing power for postal services and restricts their growth opportunities in express and urban delivery markets.

Postal Services Market: Opportunities

Sustainability, innovation, and green delivery positively impact market growth

As sustainability becomes increasingly central to public policy and logistics, postal services have an opportunity to lead with environmentally friendly models. Several companies are capitalizing on electric vehicles, carbon offset programs, recyclable packaging, and bike couriers to comply with the changing climate regulations and appeal to eco-conscious consumers.

Royal Mail UK introduced its most extensive fleet of electric cargo bikes in London, reducing emissions in congested zones. These ecological practices not only minimize environmental impact but also enhance brand value and meet the growing B2B needs for green logistics, ultimately driving the growth of the postal services industry.

Postal Services Market: Challenges

Technological lag and legacy infrastructure restrict the growth of the market

Several postal systems, particularly in emerging nations, continue to rely on outdated infrastructure and older IT systems, resulting in delays, subpar customer experiences, and inefficiencies. This restricts their ability to compete with responsive private couriers who use modernized tracking, an AI-based logistics platform, and route optimization.

Solving this technological divide requires massive investments, reliable electricity, internet access, and staff retraining — challenges that are not easily resolved, especially in low-income countries.

Postal Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Postal Services Market |

| Market Size in 2024 | USD 249.24 Billion |

| Market Forecast in 2034 | USD 278.56 Billion |

| Growth Rate | CAGR of 1.40% |

| Number of Pages | 211 |

| Key Companies Covered | Deutsche Post DHL Group, United Parcel Service (UPS), FedEx Corporation, Royal Mail Group, La Poste Group, Japan Post Holdings Co. Ltd., China Post Group Corporation, Australia Post, India Post, Canada Post, Poste Italiane, Singapore Post Limited (SingPost), Qatar Post, Saudi Post (SPL), Pos Malaysia Berhad, and others. |

| Segments Covered | By Service Type, By Delivery Mode, By Technology Adoption, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Postal Services Market: Segmentation

The global postal services market is segmented based on service type, delivery mode, technology adoption, and region.

Based on service type, the global postal services industry is divided into mail services, parcel services, express delivery services, logistics and freight services, and others. The parcel services segment accounted for a larger market share due to the boom in e-commerce, which increased the volume of small packages shipped to customers. Postal operators are expanding their parcel-sorting centers, investing in last-mile networks, and implementing real-time tracking to meet the growing demand. In addition, associations with marketplaces and online retailers are strengthening parcel services as the primary growth engine of modern postal operations.

Based on delivery mode, the global postal services market is segmented into domestic postal services and international postal services. The domestic postal services segment held a dominant market share, owing to high parcel volumes within national boundaries. This rapid growth in subscription services, local e-commerce, and intra-city deliveries has significantly increased the demand for domestic shipping. Consumers expect low-cost and faster deliveries, prompting postal operators to invest in smart urban hubs and last-mile networks. In countries such as China, the United States, and India, domestic parcels account for more than 70% of overall postal volumes. This segment also benefits from stronger infrastructure and lower regulatory complexity, thereby increasing its key revenue driver.

Based on technology adoption, the global market is segmented into traditional postal services, e-postal services, and mobile postal services. Traditional postal services remain dominant, driven by their universal accessibility and broader legacy infrastructure. Notwithstanding the growth of digital alternatives, services such as physical parcel delivery, letter mail, and in-person counter operations continue to lead in transaction volumes. In emerging nations, traditional systems serve as the backbone of commerce and communication, particularly in remote and rural areas. This segment generates remarkable revenue, primarily from registered mail, governmental services, and parcel handling. While the ongoing modernization, traditional models stay foundational in several postal networks across the globe.

Postal Services Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

The Asia Pacific is expected to maintain its leading position in the global postal services market, driven by high parcel volumes, increasing e-commerce penetration, urbanization, a large population, and the integration of advanced technologies. The Asia Pacific region is home to the world's largest e-commerce markets, comprising India, China, and Southeast Asia. China alone handled more than 110 billion parcels in 2024, driven by platforms such as JD.com, Alibaba, and Pinduoduo.This huge e-commerce activity majorly drives the demand for last-mile and postal services.

The region's vast and densely populated areas, comprising more than 4.6 billion people, create a persistent demand for domestic parcels. Rapid urbanization in countries like Indonesia and India is driving up logistics needs and parcel deliveries in cities. Postal services are expanding to meet the growing needs of urban consumers.

Moreover, Asia Pacific postal operators are initial adopters of AI, automation, and smart logistics. For instance, Japan utilizes robotics for sorting, while China Post incorporates artificial intelligence into delivery routing. This technological adoption improves speed, scalability, and operational efficiency.

Europe ranks as the second-largest region in the global postal services industry, thanks to its mature e-commerce ecosystem, emphasis on sustainable and environmentally friendly delivery solutions, and government-supported modern postal systems. Europe boasts a well-established e-commerce infrastructure, with economies like the United Kingdom, Germany, and France leading the way in online shopping.

Europe's e-commerce industry reached Euro 900 billion, highly reliant on effective parcel and postal delivery networks. National postal operators associate with retailers to satisfy the surging demand. Europe is a global leader in ecological postal logistics, complying with its Green Deal goals. Operators are shifting to carbon-neutral operations and electric vehicles.

For example, Deutsche Post DHL aims to deploy nearly 80,000 electric cars by 2030. These environment-friendly practices enhance market competitiveness and public trust. European economies have advanced their postal services with robust regulatory frameworks and public investment. National players like La Poste, Deutsche Post DHL, and Royal Mail continue to hold leadership positions, offering global services supported by innovation and well-developed infrastructure. European Union postal directives promise transparency, service quality, and affordability.

Postal Services Market: Competitive Analysis

The prominent players in the global postal services market include:

- Deutsche Post DHL Group

- United Parcel Service (UPS)

- FedEx Corporation

- Royal Mail Group

- La Poste Group

- Japan Post Holdings Co. Ltd.

- China Post Group Corporation

- Australia Post

- India Post

- Canada Post

- Poste Italiane

- Singapore Post Limited (SingPost)

- Qatar Post

- Saudi Post (SPL)

- Pos Malaysia Berhad

Postal Services Market: Key Market Trends

Move to parcel-centric operations from mail:

Postal services are speedily moving to parcel-focused logistics from traditional letter mail. Dropping mail volumes are being replaced by the growing demand for e-commerce-based parcels. Operators are reconfiguring their infrastructure to focus on parcel sortation, last-mile delivery, and tracking.

Adoption of smart logistics and automation:

Postal systems are incorporating robotics, AI, machine learning, and IoT to optimize routes, automate warehouses, and enable real-time tracking. Technologies such as smart lockers and drone deliveries are being piloted for contactless and faster service. This move enhances operational efficacy, enhances scalability, and reduces costs.

The global postal services market is segmented as follows:

By Service Type

- Mail Services

- Parcel Services

- Express Delivery Services

- Logistics and Freight Services

- Others

By Delivery Mode

- Domestic Postal Services

- International Postal Services

By Technology Adoption

- Traditional Postal Services

- E-postal Services

- Mobile Postal Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Postal services are essential commercial and public systems responsible for gathering, sorting, transporting, and delivering parcels and mail. They are operated by private entities or the government and play a crucial role in logistics and communications, mainly in remote and rural regions.

The global postal services market is projected to grow due to government initiatives that support the development of postal infrastructure, growth in subscription-based businesses, and integration of banking services.

According to study, the global postal services market size was worth around USD 249.24 billion in 2024 and is predicted to grow to around USD 278.56 billion by 2034.

The CAGR value of the postal services market is expected to be approximately 1.40% from 2025 to 2034.

Asia Pacific is expected to lead the global postal services market during the forecast period.

The key players profiled in the global postal services market include Deutsche Post DHL Group, United Parcel Service (UPS), FedEx Corporation, Royal Mail Group, La Poste Group, Japan Post Holdings Co., Ltd., China Post Group Corporation, Australia Post, India Post, Canada Post, Poste Italiane, Singapore Post Limited (SingPost), Qatar Post, Saudi Post (SPL), and Pos Malaysia Berhad.

The report examines key aspects of the postal services market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed