Red Clover Market Size, Share, Trends, Growth and Forecast 2034

Red Clover Market By Product Type (Raw Red Clover, Red Clover Extract, Red Clover Capsules or Tablets, Red Clover Tea), By Form (Powder Form, Liquid Form, Granules, Tea Bags), By Distribution Channel (Online Retail, Health Food Stores, Pharmacies, Supermarkets and Hypermarkets), By Application (Nutritional Supplements, Cosmetics and Personal Care Products, Pharmaceutical Products, Food and Beverages), By End-User (Health-conscious Consumers, Fitness Enthusiasts, Individuals with Specific Health Conditions, Cosmetic Manufacturers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

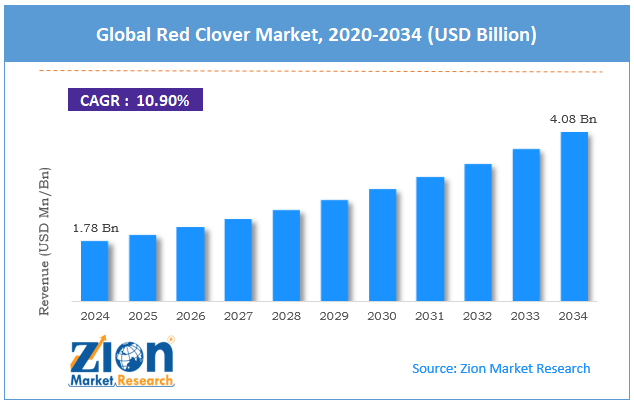

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.78 Billion | USD 4.08 Billion | 10.90% | 2024 |

Red Clover Industry Perspective:

The global red clover market size was approximately USD 1.78 billion in 2024 and is projected to reach around USD 4.08 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global red clover market is estimated to grow annually at a CAGR of around 10.90% over the forecast period (2025-2034)

- In terms of revenue, the global red clover market size was valued at around USD 1.78 billion in 2024 and is projected to reach USD 4.08 billion by 2034.

- The red clover market is projected to grow significantly due to the surging adoption in herbal medicine and nutraceuticals, the growth of organic farming practices, and the rise of the functional food sector.

- Based on product type, the red clover extract segment is expected to lead the market, while the red clover capsules or tablets segment is expected to grow considerably.

- Based on form, the powder form segment is the dominant segment, while the liquid form segment is projected to witness sizable revenue growth over the forecast period.

- Based on the distribution channel, the pharmacies segment is expected to lead the market, while the online retail segment is expected to grow considerably.

- Based on application, the nutritional supplements segment is the largest, while the pharmaceutical products segment is projected to experience substantial revenue growth over the forecast period.

- Based on end-user, the individuals with specific health conditions segment is expected to lead the market compared to the health-conscious consumers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Red Clover Market: Overview

Red clover is a perennial flowering plant that is found mainly in Western Asia, Europe, and Northwest Africa. It is extensively cultivated for its use as a forage crop, natural remedy, and soil enhancer. Red clover is rich in isoflavones, plant-based compounds with estrogen-like properties, primarily used in dietary supplements to support bone strength, cardiovascular wellness, and menopause health. The global red clover market is expected to expand rapidly, driven by its agricultural benefits, rising interest in functional foods, and increasing demand for livestock feed. Red clover enhances soil fertility by naturally fixing atmospheric nitrogen. This decreases reliance on chemical fertilizers in farming. It makes the crop highly valuable in organic agriculture and sustainable systems.

Moreover, isoflavones from red clover are infused into functional foods. The growing demand for daily wellness products increases their applications. The growth of the functional food industry significantly supports this trend. Furthermore, as a forage crop, red clover enhances animal nutrition, particularly in dairy production, thereby improving milk quality and yield. With livestock farming increasing in Africa and Asia, nutrient-rich forage is in heavy demand. Supportive government programs for sustainable livestock feeding increase the adoption of red clover.

Despite the growth, the global market is hindered by factors such as the short shelf life of forage and competition from alternative products. Fresh red clover deteriorates more quickly, losing its nutritional value if not properly preserved. In several regions lacking silage, this leads to inefficiency and wastage. Such post-harvest intricacies make farmers favor more durable forage crops, such as alfalfa. Likewise, black cohosh, flaxseed, and soy also contain phytoestrogens, competing with red clover in women's health supplements. These substitutes usually enjoy stronger clinical research and broader consumer trust.

Nonetheless, the global red clover industry stands to gain from several key opportunities, including integration in functional beverages and growing demand in the pharmaceutical sector. Herbal teas and wellness drinks are gaining immense prominence. Red clover infusion offers natural health benefits, appealing to health-conscious and young consumers.

Additionally, pharmaceutical research is increasing in the development of natural hormone regulators. Red clover could be included in novel drug formulations. Clinical validation will reveal broader pharmaceutical applications.

Red Clover Market: Growth Drivers

How does the expansion of sustainability trends and organic farming contribute to the growth of the red clover market?

The move towards sustainability and organic farming is driving demand for red clover, as it enriches soil fertility as a nitrogen-fixing legume and supports sustainable farming practices. Its dual role as a nutraceutical source and farming input boosts sustainable worldwide market appeal.

In 2024, Organic Market Info stated the expansion of organic red clover agriculture in Eastern Europe and North America. This development addresses the growing demand for eco-friendly and chemical-free herbal supplements among consumers.

How are growing R&D investments in botanical extracts remarkably fueling the red clover market growth?

Continuous product development and research are enhancing the outlook for the red clover market, with advancements in extraction technologies improving the bioavailability and potency of isoflavones. These advancements make red clover more efficient in pharmaceutical and dietary applications.

In February 2024, NutraIngredients USA reported that several biotech startups secured funding for red-clover formulations targeting cardiovascular and menopause health. This rise in investment confirms the therapeutic potential of the product and supports industry expansion through groundbreaking product offerings.

Red Clover Market: Restraints

Intense market competition from alternative botanicals unfavorably impacts the market progress

Red clover faces intense competition from herbs such as soy isoflavones, flaxseed, black cohosh, and evening primrose oil, which have gained enhanced consumer recognition and robust clinical backing. The soy isoflavone industry was estimated to be worth $1.1 billion in 2023, nearly double that of red clover products. This competitive pressure restricts the market's growth, primarily in the APAC region, where soy holds a leadership position in women's health. According to reports, in late 2024, companies are actively moving away from red clover due to easier regulatory compliance with substitutes and better margins.

Red Clover Market: Opportunities

How do potential applications in cardiovascular health offer favorable conditions for the development of the red clover market?

Progressing research underscored red clover's ability to enhance arterial elasticity and decrease LDL cholesterol, offering avenues in cardiovascular health supplements. Pharmaceutical companies are now discovering the role of red clover as an adjunctive therapy for heart health.

The European Journal of Preventive Cardiology published findings in mid-2024, suggesting red clover isoflavones decrease arterial stiffness in postmenopausal women. This presents ample opportunities in heart-protective nutraceuticals, which have a significant impact on the red clover industry.

Red Clover Market: Challenges

Concerns about hormone-sensitive health risks limit the market growth

Although phytoestrogens in red clover are beneficial, they increase safety concerns for women with hormone-sensitive conditions like uterine or breast cancer. According to the American Cancer Society's 2023 guidelines, concerns about its unsupervised use were raised, leading to restrictions on clinical recommendations.

According to the FDA's 2023 reports, approximately 2.5% of adverse events involving herbal supplements were associated with phytoestrogen-rich herbs, such as red clover. In 2024, the United States' consumer watchdog teams enhanced their awareness campaigns, thereby slowing adoption among targeted demographics.

Red Clover Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Red Clover Market |

| Market Size in 2024 | USD 1.78 Billion |

| Market Forecast in 2034 | USD 4.08 Billion |

| Growth Rate | CAGR of 10.90% |

| Number of Pages | 213 |

| Key Companies Covered | Naturex, Euromed, Sabinsa Corporation, Gencor Pacific, Xinjiang Tianye Co. Ltd., Ningxia Herb King, NutraScience Labs, Organic Herb Inc., Herbalife Nutrition, Frutarom Industries Ltd., Nature’s Way Products LLC, Gaia Herbs, NOW Foods, Nature’s Sunshine Products Inc., Pure Encapsulations, and others. |

| Segments Covered | By Product Type, By Form, By Distribution Channel, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Red Clover Market: Segmentation

The global red clover market is segmented based on product type, material type, end-user industry, and region.

Based on product type, the global red clover industry is divided into raw red clover, red clover extract, red clover capsules or tablets, and red clover tea. The red clover extract segment holds a dominant share, as it is widely used in pharmaceuticals, functional foods, and nutraceuticals due to its proven health benefits and concentrated isoflavone content.

Based on form, the global market is segmented into powder form, liquid form, granules, and tea bags. The powder form segment holds a leading share since it is extensively used in dietary supplements, functional foods, and capsules. It offers a long shelf life and is easy to process.

Based on distribution channel, the global red clover market is segmented into online retail, health food stores, pharmacies, and supermarkets and hypermarkets. The pharmacies segment holds a leadership position in the market, as consumers primarily purchase red clover extracts and supplements for health-related needs under the guidance of nutritionists or medical professionals.

Based on application, the global market is segmented into nutritional supplements, cosmetics and personal care products, pharmaceutical products, and food and beverages. The nutritional supplements segment held a substantial share since red clover isoflavones are notably popular for managing bone health, menopause, and cardiovascular wellness.

Based on end-user, the global market is segmented into health-conscious consumers, fitness enthusiasts, individuals with specific health conditions, and cosmetic manufacturers. The 'individuals with specific health conditions' segment holds a significant share since red clover is mainly consumed for managing menopause symptoms, cardiovascular concerns, and osteoporosis.

Red Clover Market: Regional Analysis

What enables North America to have a strong foothold in the global Red Clover Market?

North America is expected to maintain its leading position in the global red clover market due to strong demand for herbal and nutraceutical supplements, the high prevalence of osteoporosis and menopause cases, and advanced healthcare systems. North America holds the leading position in the dietary supplements market, with an estimated value of over $60 billion in 2023. Red clover extract is commonly used in women's health supplements, particularly for supporting bones and managing menopause symptoms. Growing awareness of plant-based remedies drives its regional dominance.

The United States alone is home to more than 50 million postmenopausal women in 2023, fueling demand for bone health and hormone balance. Osteoporosis affects nearly 10 million Americans, presenting strong opportunities for nutraceuticals and pharmaceuticals, which supports the regional prominence.

Furthermore, North America heavily invests in medical research, with red clover clinical studies being broadly used. Strong R&D support boosts trust, augmenting consumer adoption and product commercialization.

Europe ranks as the second-leading region in the global red clover industry, due to its strong tradition of herbal medicine use, the rising postmenopausal population, and the expansion of sustainable and organic farming. Europe has a long-standing tradition of using herbal remedies, with red clover being a key ingredient in traditional medications. The European herbal supplements industry was valued at over $9 billion in 2023. This cultural use fuels continuous demand for red clover-based products.

Similarly, by 2030, Europe will have approximately 90 million women aged 50+, surging the demand for menopause-associated remedies. Red clover supplements are typically used to support hormone balance and alleviate hot flashes. This demographic move promises sustained industry growth.

Additionally, Europe accounts for more than 36% of the world's organic farmland, where nitrogen-fixing crops are extensively cultivated. Its dual role as an organic feed and soil enhancer makes it a cornerstone of sustainable farming, thereby strengthening regional industry growth.

Red Clover Market: Competitive Analysis

The leading players in the global red clover market are:

- Naturex

- Euromed

- Sabinsa Corporation

- Gencor Pacific

- Xinjiang Tianye Co. Ltd.

- Ningxia Herb King

- NutraScience Labs

- Organic Herb Inc.

- Herbalife Nutrition

- Frutarom Industries Ltd.

- Nature’s Way Products LLC

- Gaia Herbs

- NOW Foods

- Nature’s Sunshine Products Inc.

- Pure Encapsulations

Red Clover Market: Key Market Trends

Rising popularity of women’s health supplements:

Red clover is becoming a key ingredient in supplements for bone health and menopause. The rising number of postmenopausal women worldwide is fueling the demand for hormone-balancing and natural remedies. This trend continues to dominate consumer adoption and product advancement.

Growth of sustainable and organic farming practices:

Red clover's nitrogen-fixing properties make it a valuable addition to organic farming systems. The growing demand for eco-friendly farming supports the expansion of large-scale agriculture. This trend improves its dual role in commercial use and sustainability.

The global red clover market is segmented as follows:

By Product Type

- Raw Red Clover

- Red Clover Extract

- Red Clover Capsules or Tablets

- Red Clover Tea

By Form

- Powder Form

- Liquid Form

- Granules

- Tea Bags

By Distribution Channel

- Online Retail

- Health Food Stores

- Pharmacies

- Supermarkets and Hypermarkets

By Application

- Nutritional Supplements

- Cosmetics and Personal Care Products

- Pharmaceutical Products

- Food and Beverages

By End User

- Health-conscious Consumers

- Fitness Enthusiasts

- Individuals with Specific Health Conditions

- Cosmetic Manufacturers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Red clover is a perennial flowering plant that is found mainly in Western Asia, Europe, and Northwest Africa. It is extensively cultivated for its use as a forage crop, natural remedy, and soil enhancer. Red clover is rich in isoflavones, plant-based compounds with estrogen-like properties, primarily used in dietary supplements to support bone strength, cardiovascular wellness, and menopause health.

The global red clover market is expected to grow due to increasing consumer demand for plant-based remedies, rising demand for natural dietary supplements, and supportive government initiatives for the cultivation of herbs.

According to study, the global red clover market size was worth around USD 1.78 billion in 2024 and is predicted to grow to around USD 4.08 billion by 2034.

The CAGR value of the red clover market is expected to be approximately 10.90% from 2025 to 2034.

Market trends and consumer preferences in the red clover market are shifting toward standardized, natural, and multifunctional products, driven by growing demand in women’s health, sustainable farming practices, and the increasing popularity of functional foods.

North America is expected to lead the global red clover market during the forecast period.

The United States is a key contributor to the global red clover market, driven by high demand for women’s health supplements, its large nutraceutical industry, and extensive use of red clover in sustainable farming practices.

The key players profiled in the global red clover market include Naturex, Euromed, Sabinsa Corporation, Gencor Pacific, Xinjiang Tianye Co., Ltd., Ningxia Herb King, NutraScience Labs, Organic Herb Inc., Herbalife Nutrition, Frutarom Industries Ltd., Nature’s Way Products LLC, Gaia Herbs, NOW Foods, Nature’s Sunshine Products, Inc., and Pure Encapsulations.

Stakeholders should focus on expanding product portfolios into functional foods and beverages, developing standardized extracts, leveraging e-commerce channels, and obtaining organic and non-GMO certifications. Additionally, they should invest in clinical research to expand global market reach and strengthen consumer trust.

The report examines key aspects of the red clover market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed