Refurbished Dental Lab Equipment Market Size, Share, Growth 2034

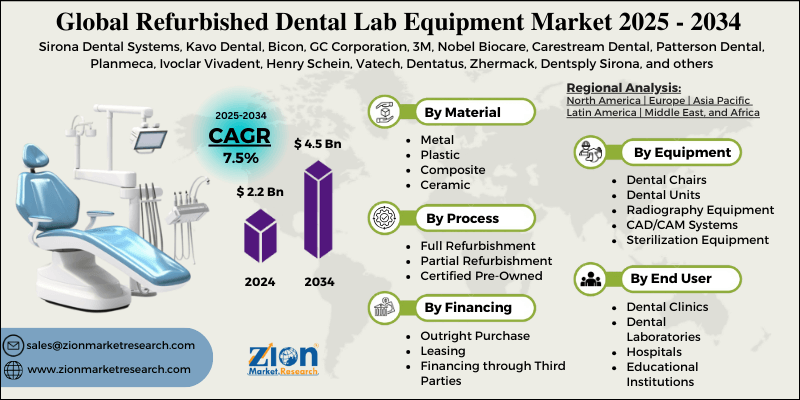

Refurbished Dental Lab Equipment Market By Equipment Type (Dental Chairs, Dental Units, Radiography Equipment, CAD/CAM Systems, and Sterilization Equipment), By Material Type (Metal, Plastic, Composite, and Ceramic), By End-User (Dental Clinics, Dental Laboratories, Hospitals, and Educational Institutions), By Process (Full Refurbishment, Partial Refurbishment, and Certified Pre-Owned), By Financing Option (Outright Purchase, Leasing, and Financing through Third Parties), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

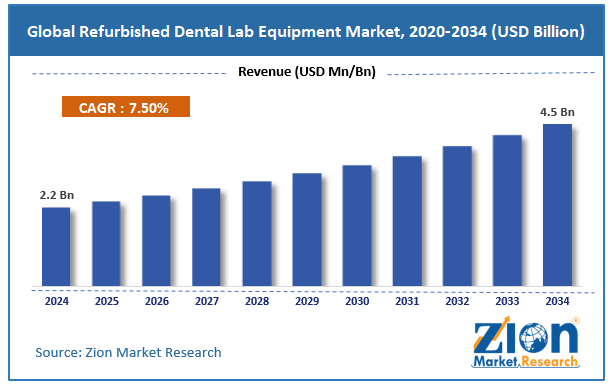

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.2 Billion | USD 4.5 Billion | 7.5% | 2024 |

Refurbished Dental Lab Equipment Industry Prospective:

The global refurbished dental lab equipment market size was worth around USD 2.2 billion in 2024 and is predicted to grow to around USD 4.5 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.5% between 2025 and 2034.

Refurbished Dental Lab Equipment Market: Overview

The term "refurbished dental lab equipment" describes used dental lab instruments and equipment that have undergone extensive testing, inspection, repair, and part replacement to return to fully operational and frequently nearly original condition. Certified manufacturers, dealers, or refurbishers resell these goods, usually for less than brand-new machinery.

Key Insights

- As per the analysis shared by our research analyst, the global refurbished dental lab equipment market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2034).

- In terms of revenue, the global refurbished dental lab equipment market size was valued at around USD 2.2 billion in 2024 and is projected to reach USD 4.5 billion by 2034.

- The cost-effective nature of refurbished dental lab equipment is expected to drive the refurbished dental lab equipment market over the forecast period.

- Based on the equipment type, the dental chairs segment is expected to hold the largest market share over the forecast period.

- Based on the material type, the ceramic segment is expected to dominate the market expansion over the projected period.

- Based on the end-user, the dental clinics segment is expected to hold the largest market share over the forecast period.

- Based on the process, the full refurbishment segment is expected to capture the largest market share during the forecast period.

- Based on the financing option, the leasing segment is expected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Refurbished Dental Lab Equipment Market: Growth Drivers

Increasing demand for cost-effective dental solutions drives market growth

The demand for economically cost-effective dental treatments is driving the expansion of the refurbished dental lab equipment market. Dental clinics and labs are increasingly looking for reasonably priced solutions without sacrificing quality as healthcare expenses keep growing.

Using modern technology and features on par with new equipment, a prudent decision to refurbish dental lab equipment at a much lower expense. Refurbished equipment is an excellent replacement since dental labs are always under pressure to increase output and lower costs.

Moreover, many dental offices are discovering they have to update to the newest models while maintaining budgetary restraint because of the fast development of dental equipment technology. Dentists can expand the range of treatments they offer without worrying about their budgets because of the expanding market for restored goods.

Moreover, the development of dental tourism has led to a situation where cost is a major determinant, and even current companies are looking for chances for renovations.

In the end, the increasing knowledge of the reliability and excellence of treatment recycled dental lab equipment offered by dental professionals is fueling a remarkable global market growth for this product.

Refurbished Dental Lab Equipment Market: Restraints

Limited warranty and after-sales support hinder market growth

Although the market for reconditioned dental lab equipment provides affordable options for dental offices, issues with limited warranties and post-purchase assistance continue to pose serious obstacles to consumer confidence and expansion of the refurbished dental lab equipment industry.

When compared to new equipment, refurbished equipment frequently has shorter guarantee periods. If equipment malfunctions after the warranty period, this restricted coverage may result in increased maintenance expenses and possible interruptions to practice activities.

Additionally, different refurbishers provide different levels of after-sales service quality. Some suppliers do not have the infrastructure in place to provide timely technical support, which could result in extended outages and compromise the reliability of dental services.

Refurbished Dental Lab Equipment Market: Opportunities

The rising prevalence of dental disorders offers a lucrative opportunity for market growth

The growing worldwide frequency of dental diseases is driving expansion in the refurbished dental lab equipment market. As dental illnesses, including cavities, periodontal disease, oral cancer, and tooth loss, become more widespread, so is the demand for dental treatments and, hence, dental equipment.

Refurbished equipment is more reasonably priced than new equipment, particularly in locations with limited healthcare resources, increasing access to modern dental technology.

According to the World Health Organization (WHO), 3.5 billion people globally suffer from oral diseases; the most common condition in permanent teeth is dental caries or tooth decay. This broad occurrence emphasizes the need for more dental care treatments and equipment.

Refurbished Dental Lab Equipment Market: Challenges

Concerns related to regulatory compliance pose a major challenge to market expansion

Particularly in India, where recent policy changes have tightly limited the importation and marketing of such equipment, the market for refurbished dental lab equipment is experiencing significant regulatory compliance concerns.

India does not yet have a particular legislative framework in place to oversee the resale and repair of dental lab equipment, among other medical equipment. The lack of clear rules limits the market growth for refurbished goods and causes uncertainty for interested parties as well.

Refurbished Dental Lab Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Refurbished Dental Lab Equipment Market |

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 4.5 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 213 |

| Key Companies Covered | Sirona Dental Systems, Kavo Dental, Bicon, GC Corporation, 3M, Nobel Biocare, Carestream Dental, Patterson Dental, Planmeca, Ivoclar Vivadent, Henry Schein, Vatech, Dentatus, Zhermack, Dentsply Sirona, and others. |

| Segments Covered | By Equipment Type, By Material Type, By End User, By Process, By Financing Option, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Refurbished Dental Lab Equipment Market: Segmentation

The global refurbished dental lab equipment industry is segmented based on equipment type, material type, end user, process, financing option, and region.

Based on the equipment type, the market is bifurcated into dental chairs, dental units, radiography equipment, CAD/CAM Systems, and sterilization equipment. The dental chairs segment is expected to hold the largest market share over the forecast period. In general, refurbished dental chairs are 40% to 60% less expensive than new ones, which makes them a desirable choice for dental offices looking to cut costs without sacrificing quality.

Additionally, dental chairs are now as useful and long-lasting as new equipment due to sophisticated refurbishment techniques that have improved reliability and quality.

Based on the material type, the global refurbished dental lab equipment industry is bifurcated into metal, plastic, composite, and ceramic. The ceramic segment is expected to dominate the market expansion over the projected period. Procedures needing ceramic restorations have increased due to the rising incidence of oral disorders and the desire for aesthetically pleasing dental solutions.

Because they are crucial to the production of dental prostheses like crowns and bridges, ceramic-related equipment like porcelain furnaces and ceramic presses is highly sought after in this sector.

Based on the end user, the global refurbished dental lab equipment market is bifurcated into dental clinics, dental laboratories, hospitals, and educational institutions. The dental clinics segment is expected to hold the largest market share over the forecast period. This expansion is driven by the growing demand for cost-effective products.

Based on the process, the global refurbished dental lab equipment industry is bifurcated into full refurbishment, partial refurbishment, and certified pre-owned. The full refurbishment segment is expected to capture the largest market share during the forecast period.

Cost-effectiveness, sustainability, and technological developments are the main drivers of this segment's growth. Fully refurbished equipment is becoming more and more popular as a practical and reliable option for dental clinics and labs looking to streamline operations and increase services.

Based on the financing option, the global market is bifurcated into outright purchase, leasing, and financing through third parties. The leasing segment is expected to dominate the market over the projected period.

Through leasing, dental clinics can obtain necessary equipment without having to make a sizable upfront investment, freeing up funds for other operating requirements. Clinics can use cutting-edge reconditioned equipment, including CAD/CAM systems and 3D imaging devices, by leasing, which can be more affordable than buying outright.

Refurbished Dental Lab Equipment Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global refurbished dental lab equipment market. Its robust dentist sector, increased focus on affordable solutions, and dedication to sustainability are the reasons for the regional expansion.

Refurbished equipment is currently viewed as a promising substitute for new equipment by roughly 36% of North American dentists. To reduce electronic waste and meet the increasing demand for reconditioned dental equipment, the Environmental Protection Agency (EPA) has also released guidelines to encourage greater reuse of medical devices.

The 20–40% cost reductions when compared to new products drive the market for refurbished goods. Prominent businesses in the sector, such as Patterson Companies Inc., Henry Schein, and Dentsply Sirona, created reconditioned product lines that included imaging systems, dental chairs, and sterilizers.

Refurbished Dental Lab Equipment Market: Competitive Analysis

The global refurbished dental lab equipment market is dominated by players like:

- Sirona Dental Systems

- Kavo Dental

- Bicon

- GC Corporation

- 3M

- Nobel Biocare

- Carestream Dental

- Patterson Dental

- Planmeca

- Ivoclar Vivadent

- Henry Schein

- Vatech

- Dentatus

- Zhermack

- Dentsply Sirona

The global refurbished dental lab equipment market is segmented as follows:

By Equipment Type

- Dental Chairs

- Dental Units

- Radiography Equipment

- CAD/CAM Systems

- Sterilization Equipment

By Material Type

- Metal

- Plastic

- Composite

- Ceramic

By End User

- Dental Clinics

- Dental Laboratories

- Hospitals

- Educational Institutions

By Process

- Full Refurbishment

- Partial Refurbishment

- Certified Pre-Owned

By Financing Option

- Outright Purchase

- Leasing

- Financing through Third Parties

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The term "refurbished dental lab equipment" describes used dental lab instruments and equipment that have undergone extensive testing, inspection, repair, and part replacement to return to fully operational and frequently nearly original condition.

The refurbished dental lab equipment sector is influenced by several variables, including cost-effectiveness and budget constraints, rising adoption of advanced technology, growing demand for dental services, increasing prevalence of dental diseases, and others.

According to the report, the global refurbished dental lab equipment market size was worth around USD 2.2 billion in 2024 and is predicted to grow to around USD 4.5 billion by 2034.

The global refurbished dental lab equipment market is expected to grow at a CAGR of 7.5% during the forecast period.

The global refurbished dental lab equipment market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and the high prevalence of dental disorders.

The global refurbished dental lab equipment market is dominated by players like Sirona Dental Systems, Kavo Dental, Bicon, GC Corporation, 3M, Nobel Biocare, Carestream Dental, Patterson Dental, Planmeca, Ivoclar Vivadent, Henry Schein, Vatech, Dentatus, Zhermack, and Dentsply Sirona, among others.

The global refurbished dental lab equipment market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed