Remanufactured Medical Imaging Device Market Size, Share, Trends, Growth 2034

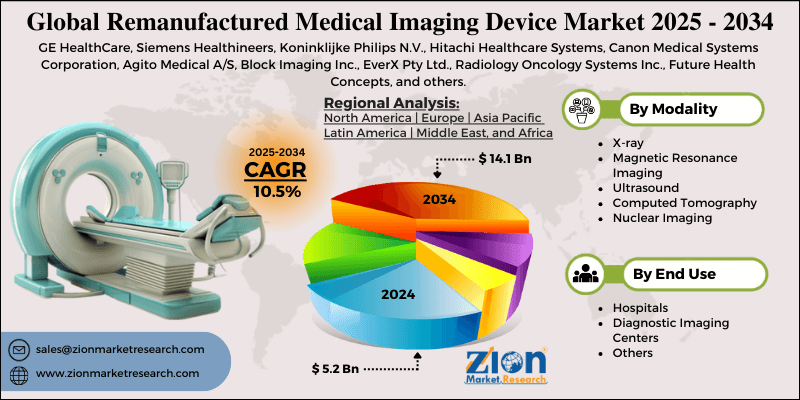

Remanufactured Medical Imaging Device Market By Modality (X-ray, Magnetic Resonance Imaging, Ultrasound, Computed Tomography, and Nuclear Imaging), By End-use (Hospitals, Diagnostic Imaging Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

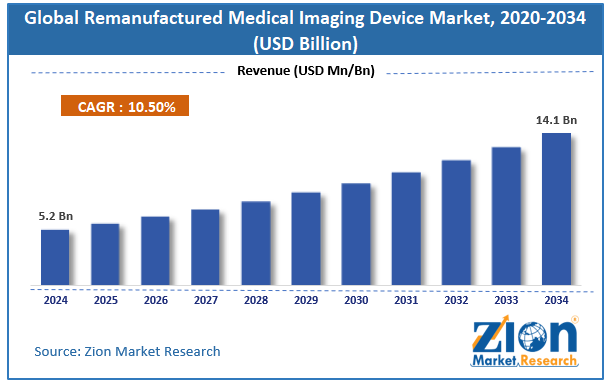

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.2 Billion | USD 14.1 Billion | 10.5% | 2024 |

Remanufactured Medical Imaging Device Industry Prospective:

The global remanufactured medical imaging device market size was worth around USD 5.2 billion in 2024 and is predicted to grow to around USD 14.1 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.5% between 2025 and 2034.

Remanufactured Medical Imaging Device Market: Overview

Remanufactured medical imaging devices are functionally equal to new ones since they have been restored to their original safety and performance criteria. Often involving service and warranty agreements, this procedure includes testing, calibration, repair, and potential upgrades.

The remanufactured medical imaging device industry is driven by several factors such as its cost-effective nature, sustainability, environmental concerns, growing demand in emerging markets, advancements in technology, regulatory support, standardization, and many others. However, the limited reimbursement policies hamper the industry expansion.

Key Insights

- As per the analysis shared by our research analyst, the global remanufactured medical imaging device market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2025-2034).

- In terms of revenue, the global remanufactured medical imaging device market size was valued at around USD 5.2 billion in 2024 and is projected to reach USD 14.1 billion by 2034.

- The growing healthcare sector is expected to drive the remanufactured medical imaging device market over the forecast period.

- Based on the modality, the computed tomography segment is expected to hold the largest market share over the forecast period.

- Based on the end-use, the hospitals segment is expected to dominate the market expansion over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Remanufactured Medical Imaging Device Market: Growth Drivers

Increasing demand for cost-effective and efficient medical imaging devices drives market growth

The remanufactured medical imaging device market is driven mostly by the increasing need for economically cost-effective medical imaging technologies. Due to the high price of new equipment and the considerable expenses related to installation and maintenance, refurbished medical imaging equipment is becoming a more economical choice for many hospitals and diagnostic facilities, especially in developing nations. Among the factors driving the global market are the growing incidence of chronic diseases, the aging population, and technological advancements.

However, the high expense of new technologies can be a substantial obstacle to entry for many medical professionals. Improved medical imaging tools can save a lot of money without compromising quality. These devices are thoroughly tested and reconditioned to ensure they meet the required specifications.

Remanufactured medical imaging equipment is therefore being used more and more by healthcare professionals searching for consistent but fairly cost-effective options. This trend is expected to keep on as demand for reasonably priced healthcare services rises.

Remanufactured Medical Imaging Device Market: Restraints

The negative perception of end-users about remanufactured medical imaging devices hinders market growth

End users' unfavorable opinions of remanufactured medical equipment are a major obstacle impeding the expansion of the remanufactured medical imaging device sector. End customers' views of quality and reliability issues pose hurdles for the market. These opinions are a result of concerns over the safety and efficacy of reconditioned gadgets in comparison to brand-new ones.

Uncertainty regarding the longevity of refurbished equipment, possible concealed flaws, and uncertainty surrounding the refurbishing procedure itself are some factors contributing to these worries.

Remanufactured Medical Imaging Device Market: Opportunities

Technological advancements offer a lucrative opportunity for market growth

One of the key shifts in the remanufactured medical imaging equipment industry is continuous improvements in refurbishing technologies. Improved imaging features and more contemporary diagnostic capabilities have changed the way worn equipment is returned to its original functioning. By allowing reconditioned equipment to run almost at new levels, these improvements appeal more to healthcare professionals.

Modern diagnostic imaging tools, including MRI machines, CT scanners, and ultrasonic equipment, are restored using state-of-the-art tools and technology, ensuring accuracy and reliability. These technical advancements are helping reconditioned equipment to be more and more accepted in clinical settings since it can satisfy the high standards needed for patient care. Nowadays, hospitals and diagnostic labs have access to used devices with equivalent features to new ones for a fraction of the cost.

Remanufactured Medical Imaging Device Market: Challenges

Limited reimbursement policies pose a major challenge to market expansion

Restricted reimbursement policies are a major barrier to the remanufactured medical imaging devices market, therefore hindering the acceptance of these reasonably priced solutions. In some places, reimbursement regulations punish the use of antiquated imaging technologies.

For example, hospitals in France are advised not to use reconditioned equipment and instead to purchase new systems since equipment over five years old results in half the reimbursement rates.

Laws in many countries, notably Romania and Bulgaria, also ban public hospitals from purchasing used equipment using loans sponsored by their governments. Since the government mostly funds public hospitals, these restrictions essentially preclude them from investing in refurbished imaging equipment.

Remanufactured Medical Imaging Device Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Remanufactured Medical Imaging Device Market |

| Market Size in 2024 | USD 5.2 Billion |

| Market Forecast in 2034 | USD 14.1 Billion |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 211 |

| Key Companies Covered | GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Hitachi Healthcare Systems, Canon Medical Systems Corporation, Agito Medical A/S, Block Imaging Inc., EverX Pty Ltd., Radiology Oncology Systems Inc., Future Health Concepts, and others. |

| Segments Covered | By Modality, By End-use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Remanufactured Medical Imaging Device Market: Segmentation

The global remanufactured medical imaging device industry is segmented based on modality, end-use, and region.

Based on the modality, the global market is bifurcated into X-ray, Magnetic Resonance Imaging, Ultrasound, Computed Tomography, and Nuclear Imaging. The computed tomography segment is expected to hold the largest market share over the forecast period. Because they are more affordable and, therefore, a more practical choice for small- and medium-sized healthcare facilities, refurbished computed tomography equipment is preferred over new equipment.

Before being offered for sale, they also undergo extensive testing and quality inspections to ensure they are in good operating order. Finally, because they support sustainability and lessen electronic waste, they are good for the environment. Thus, this is expected to favor segment expansion during the projected period.

Based on the end-use, the global remanufactured medical imaging device industry is bifurcated into hospitals, diagnostic imaging centers, and others. The hospitals segment is expected to dominate the market expansion over the projected period. Remanufactured medical imaging equipment is becoming more and more popular in hospital settings because of its reliability and affordability. Many hospitals find it difficult to buy the newest technology due to the exorbitant cost of new medical imaging systems.

On the other hand, refurbished gadgets can be bought for a fraction of the price of new ones, freeing up funds for other crucial hospital expenses. Furthermore, these gadgets are extremely dependable and have undergone testing and certification to match the same requirements as new equipment, guaranteeing their safety and efficacy for use in a medical facility.

Remanufactured Medical Imaging Device Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global remanufactured medical imaging device market, mostly as a result of the area's sophisticated healthcare system, strong demand for diagnostic imaging tools, and established market for used medical equipment.

Due to the large number of healthcare institutions in the US, strict laws guaranteeing the quality and safety of remanufactured equipment, and hospitals' need to cut costs, the US has a particularly strong market share.

Additionally, the growing focus on sustainability and waste reduction in the healthcare industry supports the use of reconditioned imaging equipment. North America continues to be the global leader due to its developed healthcare systems and strong acceptance of reconditioned equipment.

On the other side, the Asia Pacific is expected to grow at the highest CAGR over the forecast period. Growing healthcare demand, rising healthcare costs, and the need for affordable solutions in emerging countries are the main drivers of this expansion. Refurbished medical equipment is a desirable alternative in developing nations like India, where access to new imaging equipment is frequently restricted by financial restrictions.

Refurbished equipment is becoming more popular in developed countries like Australia and Japan because of improvements in technology for refurbishment procedures and an emphasis on upholding high standards of quality. The area also benefits from a growing healthcare infrastructure, including diagnostic facilities and hospitals that increasingly use reconditioned imaging equipment instead of brand-new ones.

Remanufactured Medical Imaging Device Market: Competitive Analysis

The global remanufactured medical imaging device market is dominated by players like:

- GE HealthCare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Hitachi Healthcare Systems

- Canon Medical Systems Corporation

- Agito Medical A/S

- Block Imaging Inc.

- EverX Pty Ltd.

- Radiology Oncology Systems Inc.

- Future Health Concepts

The global remanufactured medical imaging device market is segmented as follows:

By Modality

- X-ray

- Magnetic Resonance Imaging

- Ultrasound

- Computed Tomography

- Nuclear Imaging

By End-use

- Hospitals

- Diagnostic Imaging Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Remanufactured medical imaging devices are functionally equal to new ones since they have been restored to their original safety and performance criteria.

The remanufactured medical imaging device market is driven by several factors such as its cost-effective nature, sustainability and environmental concerns, growing demand in emerging markets, advancements in technology, regulatory support and standardization, and many others.

According to the report, the global remanufactured medical imaging device market size was worth around USD 5.2 billion in 2024 and is predicted to grow to around USD 14.1 billion by 2034.

The global remanufactured medical imaging device market is expected to grow at a CAGR of 10.5% during the forecast period.

Which region will contribute notably towards the remanufactured medical imaging device market value?

The global remanufactured medical imaging device market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the increasing robust healthcare infrastructure and the presence of major players.

The global remanufactured medical imaging device market is dominated by players like GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Hitachi Healthcare Systems, Canon Medical Systems Corporation, Agito Medical A/S, Block Imaging, Inc., EverX Pty Ltd., Radiology Oncology Systems, Inc., and Future Health Concepts, among others.

The remanufactured medical imaging device market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed