Software Supply Chain Security Market Size, Share, Trends, Growth and Forecast 2034

Software Supply Chain Security Market By Security Type (Data Protection, Data Visibility and Governance, and Others), By Component (Hardware, Software, Services), By Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises [SMEs]), By Vertical (Healthcare and Pharmaceuticals, Retail and E-commerce, Automotive, Transportation and Logistics, Manufacturing, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

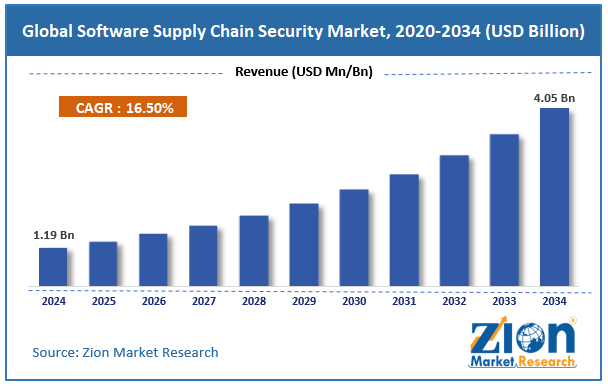

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.19 Billion | USD 4.05 Billion | 16.50% | 2024 |

Software Supply Chain Security Industry Prospective:

The global software supply chain security market size was worth around USD 1.19 billion in 2024 and is predicted to grow to around USD 4.05 billion by 2034, with a compound annual growth rate (CAGR) of roughly 16.50% between 2025 and 2034.

Software Supply Chain Security Market: Overview

Software supply chain security refers to the technologies and practices that protect software deployment and development pipelines from unauthorized access, cyber threats, and vulnerabilities. Since modern software relies on third-party components, constant integration tools, and open-source libraries, attackers primarily target these to exploit weak links and inject malicious code.

The leading drivers of the global software supply chain security market include the growing number of supply chain attacks, the rise of cloud-native applications, and the increasing digital transformation in various sectors.

High-profile cases, such as the SolarWinds breaches, have uncovered key vulnerabilities in software supply chains. These attacks have compelled enterprises to reevaluate their cybersecurity architecture. Therefore, demand for supply chain security has increased remarkably.

Moreover, containerized apps and cloud-native frameworks largely depend on orchestration platforms and shared components. These create compound security blind spots in the pipeline. The need to safeguard these cloud systems is aiding the industry's growth.

Additionally, industries such as manufacturing, banking, and healthcare are actively digitizing their operations. This transition surges software risk in interconnected services. Hence, supply chain security has become an essential business function.

However, the global market is hindered by the complexity of integrating with legacy systems and the shortage of cybersecurity professionals. Several companies still rely on outdated infrastructure that is challenging to secure with new tools and technologies. Integrating enhanced security into legacy systems can be technically complex, thus slowing down adoption in traditional sectors.

Additionally, there is an increased scarcity of cybersecurity professionals, particularly in specialized domains such as software supply chain security. This gap restricts companies' ability to install and manage efficient defenses, thereby hindering industry scalability.

Nonetheless, the global software supply chain security industry stands to benefit from the adoption of zero-trust architecture and AI-driven code scanning and vulnerability management. Zero-trust codes are largely used to reduce trust assumptions in software development. Integration with zero-trust models offers opportunities for advancement. It also boosts the enterprise's security posture.

Moreover, vendors providing AI tools to flag and scan insecure code elements are gaining prominence. These tools can accelerate and automate the detection of vulnerabilities. There is a higher demand for real-time and innovative security solutions.

Key Insights:

- As per the analysis shared by our research analyst, the global software supply chain security market is estimated to grow annually at a CAGR of around 16.50% over the forecast period (2025-2034)

- In terms of revenue, the global software supply chain security market size was valued at around USD 1.19 billion in 2024 and is projected to reach USD 4.05 billion by 2034.

- The software supply chain security market is projected to grow significantly due to the rise in open-source dependencies, increasing cases of supply chain attacks, and a surge in digital transformation across various sectors.

- Based on security type, the data protection segment is expected to lead the market, while the data visibility and governance segment is expected to grow considerably.

- Based on component, the software is the dominant segment, while the services segment is projected to witness sizable revenue growth over the forecast period.

- Based on enterprise size, the large enterprises segment is expected to lead the market, surpassing the small and medium-sized enterprises (SMEs) segment.

- Based on vertical, the healthcare and pharmaceuticals segment dominates the market, while the manufacturing segment is progressing considerably.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Software Supply Chain Security Market: Growth Drivers

The proliferation of Open-Source software in agile environments and DevOps boosts market growth

Open-source software now forms the backbone of modern software development. A recent study by GitHub (2024) disclosed that 90 percent of modern applications comprise OSS elements, while the CNCF stated that over 75 percent of DevOps teams use open-source dependencies to boost development cycles. Nonetheless, OSS usually lacks patch management and standardized security protocols, increasing its vulnerability.

As businesses incorporate OSS via CI/CD pipelines, the threat of unchecked vulnerabilities embedded in dependencies has increased. This inclination has led to an increased demand for tools such as Software Bill of Materials (SBOM), automated code auditing platforms, and vulnerability scanners.

Growing compliance mandates and regulatory pressure remarkably impel the market growth

Regulatory bodies and governments are stepping in to enforce supply chain security standards. The CISA now mandates SBOM releases for vendors contracting with federal organizations. Worldwide, the European Union’s NIS2 Directive, which took effect in October 2024, imposes stricter responsibilities on service vendors and digital service providers to disclose cyber incidents and maintain software integrity.

India and Japan have also introduced national cybersecurity architectures focusing on third-party risk and software integrity. These regulations have pressured enterprises to invest heavily in compliance-based security solutions, thus expanding the software supply chain security market.

Software Supply Chain Security Market: Restraints

Limited visibility into sub-components and deep software dependencies adversely impact market progress

Software systems typically comprise multiple tiers of dependencies, including transitive dependencies that are often deeply embedded in the software stack. These are usually overlooked or unfamiliar to developers, resulting in 'undetected vulnerabilities' or 'dependency confusion.'

Technologies like SBOMs are enhancing this visibility, but accuracy and coverage still differ majorly. The intricacy of mapping and updating nested elements makes remediation complicated, mainly in large enterprise applications and legacy systems.

Software Supply Chain Security Market: Opportunities

The emergence of decentralized security and blockchain for software provenance positively impacts market growth

Blockchain is progressing as a modern and newest solution for tamper-proof verification and software provenance. By storing cryptographic hashes of dependencies and software artifacts on a distributed ledger, businesses can promise traceability, integrity, and transparency in the software supply chain.

Projects like OpenChain, In-Toto, and Sigstore are already revolutionizing decentralized verification systems, while companies like Guardtime and IBM are testing blockchain in business-grade software assurance application cases. This denotes an unexplored niche where modernization may lead to scalable commercial solutions in the next 5 years, thereby favoring the software supply chain security industry.

Software Supply Chain Security Market: Challenges

Balancing security with developer speed and productivity restricts the market growth

Security controls can conflict with rapid software development cycles, particularly in DevOps and agile environments. Developers usually view security tools as time-consuming, intrusive, or disruptive, leading to tool circumvention or abandonment. This friction increases the likelihood of overlooked vulnerabilities and highlights the importance of secure development practices. This challenge lies in seamlessly integrating security into developer workflows without compromising agility.

Achieving this balance requires context-aware, more innovative tools and a cultural inclination towards shared responsibility – goals that remain complex for many organizations.

Software Supply Chain Security Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Software Supply Chain Security Market |

| Market Size in 2024 | USD 1.19 Billion |

| Market Forecast in 2034 | USD 4.05 Billion |

| Growth Rate | CAGR of 16.50% |

| Number of Pages | 212 |

| Key Companies Covered | Synopsys, Sonatype, Checkmarx, Veracode, ReversingLabs, WhiteSource (now Mend.io), Aqua Security, GitGuardian, Cycode, Contrast Security, Fortify (Micro Focus), Trend Micro, CrowdStrike, Anchore, Tidelift, and others. |

| Segments Covered | By Security Type, By Component, By Enterprise Size, By Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Software Supply Chain Security Market: Segmentation

The global software supply chain security market is segmented based on security type, component, enterprise size, vertical, and region.

Based on security type, the global software supply chain security industry is divided into data protection, data visibility and governance, and others. The data protection segment has registered a larger market share as businesses prioritize safeguarding sensitive source code, certificates, credentials, and proprietary algorithms from tampering and illegal access. It encompasses technologies like secure code repositories, access control, encryption, and runtime application self-protection (RASP). Companies are allocating significant budgets to prevent illegal code manipulation and exfiltration in response to the increasing number of advanced attacks.

Based on component, the global software supply chain security market is segmented into hardware, software, and services. The software segment holds a leading share, driven by the broader demand for automated tools that monitor dependencies, secure code, and detect anomalies in real time. This comprises static and dynamic application security testing, vulnerability scanning software, secure CI/CD pipeline tools, and software composition analysis. The rise of cloud-native applications, dependency on open-source libraries, and DevOps practices has notably increased the need for scalable and embedded software security solutions.

Based on vertical, the global market is segmented as healthcare and pharmaceuticals, retail and e-commerce, automotive, transportation and logistics, manufacturing, and others. The healthcare and pharmaceuticals sector registers a leading market share due to its high dependency on complex software infrastructure for EHRs, drug development software, clinical trial platforms, and medical devices.

Understanding patient data, regulatory obligations, and intellectual property requires a high level of security throughout the software lifecycle. Healthcare providers are actively investing in real-time monitoring tools, supply chain risk management, and software integrity verification tools to safeguard pipelines from IP theft and tampering.

By enterprise size, the market is divided into large enterprises and small and medium-sized enterprises (SMEs).

Software Supply Chain Security Market: Regional Analysis

North America to witness significant growth over the forecast period

North America holds a dominant share of the software supply chain security market due to the elevating number of cyberattacks aiming at software supply chains, higher security and IT spending in industries, and cloud maturity and advanced technology infrastructure. North America, particularly the U.S., has been a primary target of large-scale supply chain attacks.

Software supply chain cases surged by 742% from 2020 to 2022, according to the U.S. CISA (Cybersecurity & Infrastructure Security Agency). This propelled an urgent need for investments in security, contributing to the region's leadership in proactive defense.

Regional businesses are leading in global IT expenditure, with the United States accounting for over 40% of the global expenses. Enterprises allocate significant budgets toward 3rd party risk monitoring, secure DevOps, and automated code scanning. This investment enables the speedy adoption of improved supply chain security solutions.

Moreover, the region's early adoption of CI/CD pipelines, open-source infrastructure, and cloud-native architecture introduces better software complexity and higher risk. This complexity requires robust supply chain security measures.

Europe is the second-largest region in the software supply chain security industry, driven by rising cyber threats targeting critical infrastructure, a focus on open-source governance, and the increasing adoption of DevOps and cloud.

A majority of countries have experienced a notable increase in cyberattacks, primarily in sectors such as energy, manufacturing, and healthcare. This rising threat scenario has led to increased private and public investments in securing software pipelines.

Additionally, European businesses and public agencies are increasingly dependent on open-source software, prompting initiatives to enhance its security. The OpenSSF Europe and the EU-based Open Source Security Foundation are collaborating to improve vulnerability tracking and code integrity verification.

European businesses are actively adopting DevOps, CI/CD pipelines, and cloud-native development, mainly in the telecom, finance, and public sectors. This shift has increased awareness of the risks associated with software pipelines, stimulating investment in secure code delivery platforms and continuous monitoring.

Software Supply Chain Security Market: Competitive Analysis

The global software supply chain security market profiles players like:

- Synopsys

- Sonatype

- Checkmarx

- Veracode

- ReversingLabs

- WhiteSource (now Mend.io)

- Aqua Security

- GitGuardian

- Cycode

- Contrast Security

- Fortify (Micro Focus)

- Trend Micro

- CrowdStrike

- Anchore

- Tidelift

Software Supply Chain Security Market: Key Market Trends

Rising adoption of ‘Shift-Left Security’ in DevSecOps Pipelines:

Businesses are increasingly embedding security earlier in the development lifecycle, known as 'shift-left security.' This trend involves integrating tools for vulnerability scanning, code scanning, and policy enforcement into CI/CD workflows. It guarantees the detection of vulnerabilities at the source, thereby reducing the risk and subsequent remediation costs.

Increasing Focus on Open-Source Component Security:

With open-source software comprising more than 70 percent of business applications, its security is a growing concern. Programs like Google's OSS-Fuzz and GitHub's supply chain features are enhancing code patching and provenance. Businesses are prioritizing the use of secure open-source by deploying composition analysis solutions and stringent governance guidelines.

The global software supply chain security market is segmented as follows:

By Security Type

- Data Protection

- Data Visibility and Governance

- Others

By Component

- Hardware

- Software

- Services

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Vertical

- Healthcare and Pharmaceuticals

- Retail and E-commerce

- Automotive

- Transportation and Logistics

- Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Software supply chain security refers to the technologies and practices that protect software deployment and development pipelines from unauthorized access and vulnerabilities. Since modern software relies on third-party components, constant integration tools, and open-source libraries, attackers primarily target these to exploit weak links and inject malicious code.

The global software supply chain security market is projected to grow due to the rise of cloud-native applications, the incorporation of ML/AI in threat detection, and the emphasis on vendor risk management.

According to study, the global software supply chain security market size was worth around USD 1.19 billion in 2024 and is predicted to grow to around USD 4.05 billion by 2034.

The CAGR value of the software supply chain security market is expected to be approximately 16.50% from 2025 to 2034.

North America is expected to lead the global software supply chain security market during the forecast period.

The key players profiled in the global software supply chain security market include Synopsys, Sonatype, Checkmarx, Veracode, ReversingLabs, WhiteSource (now Mend.io), Aqua Security, GitGuardian, Cycode, Contrast Security, Fortify (Micro Focus), Trend Micro, CrowdStrike, Anchore, and Tidelift.

The report examines key aspects of the software supply chain security market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed