Substation Maintenance Market Size, Share, Trends, Growth and Forecast 2034

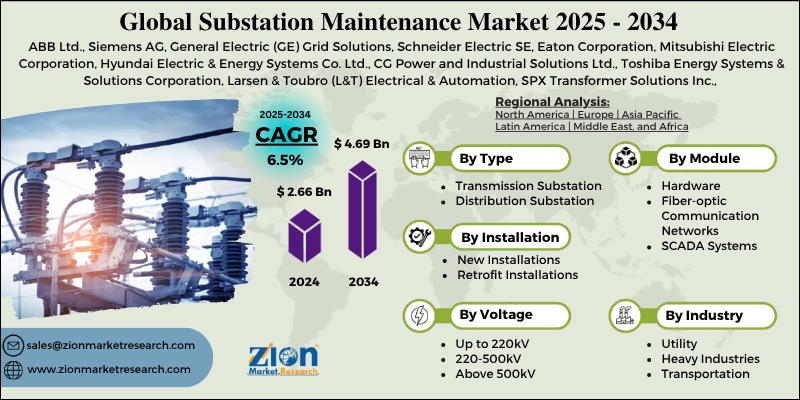

Substation Maintenance Market By Type (Transmission Substation, Distribution Substation), By Installation Type (New Installations, Retrofit Installations), By Module (Hardware, Fiber-optic Communication Networks, SCADA Systems), By Voltage (Up to 220kV, 220-500kV, Above 500kV), By Industry (Utility, Heavy Industries, Transportation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

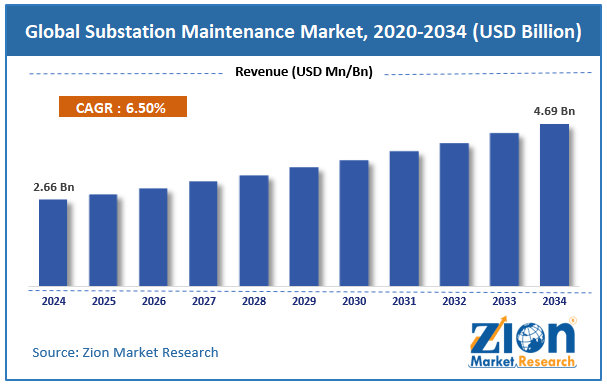

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.66 Billion | USD 4.69 Billion | 6.5% | 2024 |

Substation Maintenance Industry Prospective:

The global substation maintenance market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 4.69 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034.

Substation Maintenance Market: Overview

Substation maintenance encompasses regular inspection, servicing, and testing of electrical substation equipment to ensure reliable, safe, and efficient power transfer and distribution. This comprises maintenance of circuit breakers, transformers, control systems, switches, and protective relays. Right upkeep aids prevent failure, extends the lifecycle, and reduces downtime of the infrastructure. The key propellers of the global substation maintenance market include the increasing demand for electricity, aging infrastructure, and initiatives for grid advancements.

Growing urbanization and global population are fueling the electricity demand. This global electricity demand is projected to accelerate with the rise of electrification trends in the coming years, according to the International Energy Agency (IEA). This notably requires the maintenance of power substations to ensure safe and consistent power delivery.

Moreover, a majority of the current power infrastructure in the established nations is aging, with parts in service for more than 40 years. This increases the need for refurbishment and condition monitoring, which in turn impacts the demand for precautionary substation maintenance services.

Additionally, governments in many regions are investing in upgrading their electric grids to enhance flexibility and resilience. Innovation projects typically involve ongoing maintenance and upgrades of substations to manage advanced automation, integrate smart grids, and enhance cybersecurity.

Nevertheless, the global market is hindered by the scarcity of skilled labor and the complexity of integrating legacy systems. Substation maintenance requires a specialized workforce with expertise in diagnostics, safety protocols, and high-voltage systems. The global scarcity of such expertise hinders the scalability of services.

In addition, older substations heavily rely on outdated or proprietary solutions. Integrating them with advanced maintenance technologies and systems is expensive and challenging, thus limiting service efficacy and upgrades.

However, the global substation maintenance industry is expected to experience substantial growth in the coming years due to the implementation of digital twins and the expansion of microgrids and renewable energy sources.

Digital twins enable the evaluation of conditions and real-time simulation of substations. Maintenance facilities that offer digital twin capabilities will gain a competitive advantage in predicting maintenance contracts.

Also, with the growing expansion of distributed renewable energy systems and microgrids, the need for specialized maintenance for localized substations increases. This presents new opportunities in decentralized energy systems.

Key Insights:

- As per the analysis shared by our research analyst, the global substation maintenance market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034)

- In terms of revenue, the global substation maintenance market size was valued at around USD 2.66 billion in 2024 and is projected to reach USD 4.69 billion by 2034.

- The substation maintenance market is projected to grow significantly due to the ever-increasing global demand for electricity, the emphasis on reducing power outages, and the digitalization of substations.

- Based on type, the transmission substation segment is expected to lead the market, while the distribution substation segment is expected to grow considerably.

- Based on installation type, the retrofit installations segment leads the market, while the new installations segment is anticipated to progress notably.

- Based on module, the hardware segment is the dominating segment, while the SCADA systems segment is projected to witness sizeable revenue over the forecast period.

- Based on voltage, the 220-500kV segment is the largest, while the segment above 500kV is the second-largest in the market.

- Based on industry, the utility segment is expected to lead the market compared to the heavy industries segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Substation Maintenance Market: Growth Drivers

Integration of distributed generation and renewable energy sources drives market growth

The global shift towards renewable energy is driving a transformation of the grid that relies on robust substation operations. Substations should accommodate intermittent energy flows from wind, solar, and hydropower sources, which need dynamic voltage regulation and adaptive protection systems.

Utilities in North America and Europe are enhancing their substations with FACTS (Flexible AC Transmission Systems), fault detection systems, and dynamic reactive power compensators. For instance, GE Vernova partnered with ScottishPower in 2024 to advance substations in the United Kingdom. The partnership aimed to improve offshore wind farms, requiring sustained maintenance of modern substation equipment.

Regulatory mandates for grid safety and reliability propel the market growth

Energy consumption and government regulations are imposing stringent protocols for outage management, infrastructure safety, and power reliability. Regulatory agencies, such as CEA, ENTSO-E, and FERC, have established clear guidelines for outage reporting, relay testing, and inspection frequency for substations.

Non-compliance may result in reputational damage, necessitating that utilities prioritize condition-based and scheduled maintenance. This drives the demand for third-party maintenance providers, thermal imaging solutions, and drones for inspection, turning regulation into a recurring source of revenue for the substation maintenance market.

Substation Maintenance Market: Restraints

Deferred maintenance and aging infrastructure negatively impact market progress

The maximum share of the grid infrastructure, especially in Europe and North America, is 40 years old. Despite the requirement for proactive maintenance, several utility firms have delayed upgrades due to regulatory uncertainty, a lack of professional labor, or budget cuts, thereby increasing the likelihood of failures.

In October 2024, a massive substation fire in Chicago was attributed to outmoded machinery that had not been inspected for over six years, prompting federal inquiries into utility asset management.

Substation Maintenance Market: Opportunities

Technological integration: AI, remote monitoring, and drones positively impact market growth

The application of advanced technologies, including thermal imaging, AI-based predictive analytics, digital twin models, and drones, is revolutionizing substation maintenance. These advancements enhance safety, reduce human intervention, and enable faster fault detection while also establishing a novel tech-based service domain. This presents a significant opportunity in the substation maintenance industry.

Tech companies have a clear opportunity to offer end-to-end digital maintenance services, comprising asset health dashboards, remote diagnostics, and condition-based analytics, mainly as digital substations are mandated in the 2030 smart grid landscape.

Substation Maintenance Market: Challenges

Inadequate analytics capabilities and data overload restrict the growth of the market

Advanced substations equipped with sensors generate substantial amounts of diagnostic and operational data. Nonetheless, several utilities lack the skilled personnel or advanced analytics tools to understand this data and convert it into actionable maintenance strategies.

Southern California Edison acknowledged that unprocessed substation sensor data led to missed early warnings of machinery degradation, ultimately resulting in a local blackout that affected 50,000 consumers.

Substation Maintenance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Substation Maintenance Market |

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2034 | USD 4.69 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 213 |

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric (GE) Grid Solutions, Schneider Electric SE, Eaton Corporation, Mitsubishi Electric Corporation, Hyundai Electric & Energy Systems Co. Ltd., CG Power and Industrial Solutions Ltd., Toshiba Energy Systems & Solutions Corporation, Larsen & Toubro (L&T) Electrical & Automation, SPX Transformer Solutions Inc., OMICRON electronics GmbH, Emerson Electric Co., MYR Group Inc., Siemens Energy, and others. |

| Segments Covered | By Type, By Installation Type, By Module, By Voltage, By Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Substation Maintenance Market: Segmentation

The global substation maintenance market is segmented based on type, installation type, module, voltage, industry, and region.

Based on module, the global substation maintenance industry is divided into hardware, fiber-optic communication networks, and SCADA systems. The hardware segment registers a notable share of the market. It comprises switchgear, circuit breakers, relays, transformers, and protective gear, which are the base of any substation. These parts are susceptible to electrical stress and physical wear, demanding periodic testing, inspection, oil replacement, repairs, and calibration. Since hardware failures may cause outages, utilities distribute the maximum share of maintenance resources to hardware preservation.

By type, the market is categorized into transmission substation and distribution substation.

Based on voltage, the global substation maintenance market is segmented as up to 220kV, 220-500kV, and above 500kV. Substations in the 220-500kV range are broadly used in regional and national transmission networks for industrial and intercity power distribution. These substations serve as crucial nodes linking load centers and generation sources; therefore, they require regular and thorough maintenance. Utilities prioritize maintaining this voltage range to ensure grid stability, given their high energy throughput and the broad range of applications they support.

By installation type, the market is segregated into new installations and retrofit installations.

Based on industry, the global market is segmented into utility, heavy industries, and transportation. The utility segment holds the largest market share, driven by its responsibility for nationwide power generation, distribution, and transmission. Utilities operate a broader range of substations, such as medium-voltage and high-voltage distribution systems. These establishments must comply with strict safety and reliability regulations, making predictive and routine maintenance essential and a top operational priority.

Substation Maintenance Market: Regional Analysis

Asia Pacific is anticipated to witness significant growth over the forecast period.

The Asia Pacific region holds a leadership position in the global substation maintenance market, driven by rapid industrial growth and urbanization, high electricity demand, and significant investments in grid modernization. The Asia Pacific is experiencing substantial urbanization, with more than 2.3 million people projected to reside in urban areas by 2023.

Nations such as Indonesia, India, and China are rapidly expanding their industrial bases, thereby increasing their energy demand. This growth puts pressure on grid infrastructure, necessitating ongoing maintenance to prevent outages.

Additionally, the APAC region accounted for over 50% of global electricity demand in 2023, according to the IEA. This heavy energy demand needs reliable and efficient substation operations. Repetitive condition monitoring and inspections are vital for ensuring a smooth and consistent power supply.

In addition, governments in the region are heavily investing in power infrastructure and smart grids. For example, China's State Grid Corporation declared over USD 50 billion in investment in energy grid upgrades in 2023. A majority of this spending is distributed to automation-based maintenance and substation refurbishment.

North America also advances as the second-leading region in the global substation maintenance industry, driven by its high industrial load and electricity consumption, susceptibility to harsh weather conditions, and the presence of a majority of substation service providers.

On a global scale, North America is the leading region in terms of electricity demand, with the United States alone consuming over 4,000 TWh in 2023. Data centers, industrial sectors, and electric vehicle (EV) charging contribute to the massive load pressure. Here, substation reliability is vital, thus fueling firm maintenance timelines and asset management systems.

Furthermore, hurricanes, wildfires, and ice storms in Canada and the United States are causing damage to distribution and transmission substations. Utilities are enhancing their maintenance programs to reduce outage times and strengthen their infrastructure. Grid resilience programs are directly impacting the growth of the global market.

Also, the region is home to major service providers, including Schneider Electric, Quanta Services, General Electric, Eaton, and more. These companies offer exhaustive predictive analytics and maintenance programs. Their presence promises stable growth and a regional maintenance segment.

Substation Maintenance Market: Competitive Analysis

The leading players in the global substation maintenance market are:

- ABB Ltd.

- Siemens AG

- General Electric (GE) Grid Solutions

- Schneider Electric SE

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hyundai Electric & Energy Systems Co. Ltd.

- CG Power and Industrial Solutions Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Larsen & Toubro (L&T) Electrical & Automation

- SPX Transformer Solutions Inc.

- OMICRON electronics GmbH

- Emerson Electric Co.

- MYR Group Inc.

- Siemens Energy

Substation Maintenance Market: Key Market Trends

The inclination toward condition-based and predictive maintenance:

Utilities are shifting toward predictive approaches with real-time data from IoT devices and sensors. Technologies such as vibration analysis, AI-based diagnostics, and thermal imaging help identify faults before they occur. This trend decreases maintenance costs and downtime while enhancing system reliability.

Integration of Smart Monitoring Tools and Digital Twins:

A digital twin is adopted to monitor assets virtually and simulate substation performance. These digital replicas allow fault prediction, scenario analysis, and remote assessments. Integrated with cloud-based platforms and SCADA, they are changing substation maintenance into a data-driven and proactive process.

The global substation maintenance market is segmented as follows:

By Type

- Transmission Substation

- Distribution Substation

By Installation Type

- New Installations

- Retrofit Installations

By Module

- Hardware

- Fiber-optic Communication Networks

- SCADA Systems

By Voltage

- Up to 220kV

- 220-500kV

- Above 500kV

By Industry

- Utility

- Heavy Industries

- Transportation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Substation maintenance encompasses regular inspection, servicing, and testing of electrical substation equipment to ensure reliable, safe, and efficient power transfer and distribution. This comprises maintenance of circuit breakers, transformers, control systems, switches, and protective relays. Right upkeep aids prevent failure, extends the lifecycle, and reduces downtime of the infrastructure.

The global substation maintenance market is projected to grow due to improvements in monitoring technologies, the increasing need for a consistent power supply, and the growth of electric vehicle (EV) infrastructure.

According to study, the global substation maintenance market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 4.69 billion by 2034.

The compound annual growth rate (CAGR) value of the substation maintenance market is expected to be around 6.5% from 2025 to 2034.

Asia Pacific is expected to lead the global substation maintenance market during the forecast period.

The key players profiled in the global substation maintenance market include ABB Ltd., Siemens AG, General Electric (GE) Grid Solutions, Schneider Electric SE, Eaton Corporation, Mitsubishi Electric Corporation, Hyundai Electric & Energy Systems Co., Ltd., CG Power and Industrial Solutions Ltd., Toshiba Energy Systems & Solutions Corporation, Larsen & Toubro (L&T) Electrical & Automation, SPX Transformer Solutions, Inc., OMICRON electronics GmbH, Emerson Electric Co., MYR Group Inc., and Siemens Energy.

The report examines key aspects of the substation maintenance market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed