Veterinary CRO & CDMO Market Size, Share, Trends, Growth and Forecast 2034

Veterinary CRO & CDMO Market By Application (Livestock Animals and Companion Animals), By Service Type (CDMO Services and CRO Services), By Product (Biologics, Drugs, and Medicated Feed & Supplements), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

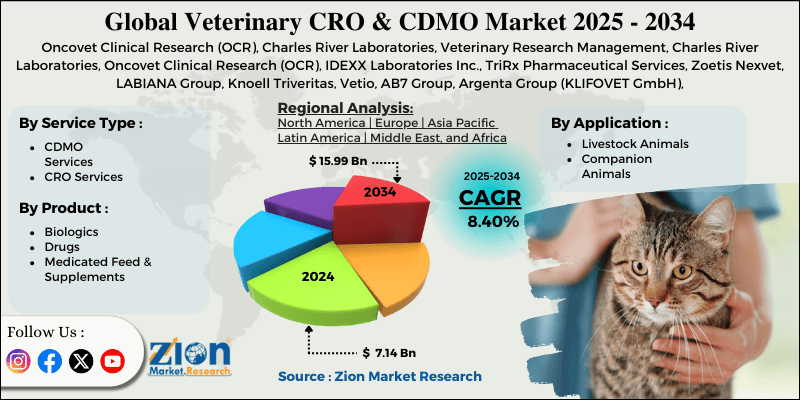

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.14 Billion | USD 15.99 Billion | 8.40% | 2024 |

Veterinary CRO & CDMO Industry Prospective:

The global veterinary CRO & CDMO market size was worth around USD 7.14 billion in 2024 and is predicted to grow to around USD 15.99 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.40% between 2025 and 2034.

Veterinary CRO & CDMO Market: Overview

Veterinary contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) are specialized agencies helping pharmaceutical and biotechnology companies develop and manufacture new drugs for veterinary care. CROs and CDMOs, at present, play a crucial role in developing novel drugs for treating a wide range of existing zoonotic medical conditions. They are also used to research future diseases and treatments in animals. The primary focus of veterinary CROs and CDMOs is curating effective treatment programs for livestock and companion animals.

Contract research, development, and manufacturing organizations are technologically equipped to formulate and manufacture medicines at a larger scale. The primary difference between a veterinary CRO and a CDMO is that the former mainly focuses on drug research.

The latter, on the other hand, focuses on innovation and production. The growing demand for effective animal care around the globe will fuel the market expansion rate, according to research. Meanwhile, the lack of standard rules governing the industry on a global scale may impede the market expansion rate in the coming years.

Key Insights:

- As per the analysis shared by our research analyst, the global veterinary CRO & CDMO market is estimated to grow annually at a CAGR of around 8.40% over the forecast period (2025-2034)

- In terms of revenue, the global veterinary CRO & CDMO market size was valued at around USD 7.14 billion in 2024 and is projected to reach USD 15.99 billion by 2034.

- The veterinary CRO & CDMO market is projected to grow significantly due to the rising number of pet owners worldwide.

- Based on the application, the companion animals segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the product, the biologics segment is anticipated to command the largest market share.

- Based on region, the US in North America is projected to dominate the global market during the forecast period.

Veterinary CRO & CDMO Market: Growth Drivers

Rising number of pet owners worldwide to propel the market expansion rate

The global veterinary CRO and CDMO market is expected to be influenced by the increasing number of pet owners worldwide. Pets such as dogs and cats are known to have several health benefits. According to the National Institutes of Health (NIH), pet ownership is linked to improved heart health, reduced stress, and managing anxiety or panic attacks.

Additionally, owning a pet can also help a child develop crucial emotional and social skills. A growing number of companion pets among patients suffering from specific medical conditions will fuel demand for improved animal care. For instance, medical professionals recommend that people undergoing cancer treatment opt for pets as they can help in dealing with tough medical treatment.

Additionally, patients recovering from neurological disorders or stroke, and those suffering from mental illnesses, are also encouraged to find a companion in animals. Awareness around pet care has improved in the last few years. It has encouraged pharmaceutical companies to partner with CROs and CDMOs to develop effective animal care programs and treatments.

Rising cases of zoonotic diseases affecting human lives may encourage greater research in animal healthcare

Zoonotic conditions are infections that can spread from animals to humans. Some of the most prevalent zoonotic conditions across the globe include Lyme disease, rabies, COVID-19, Ebola, brucellosis, and Bird Flu.

According to the World Health Organization (WHO), more than 59,000 human deaths occur globally every year due to rabies. Extensive market analysis suggests that at present, more than 60 drugs are in the development phase for treating rabies, out of which around 22 such drugs have reached the clinical stage.

As the proximity between animals and humans increases, led by urbanization and loss of animal habitat, the risk of zoonotic conditions spreading to the mass population is also amplified. The global veterinary CRO and CDMO market companies are working extensively on developing new diagnostic tools and treatment measures for handling diseases that spread from animals to humans.

Veterinary CRO & CDMO Market: Restraints

High cost of investment to limit the industry’s growth trajectory during the projection period

The global industry for veterinary CRO & CDMO is expected to be restricted by the high cost of investment. Collaborating with contract research organizations or contract manufacturing and development companies can result in increased overall cost of drug development and production. CROs and CDMOs offer specialized services. They are equipped with cutting-edge technologies and skilled resources with expertise in compliance with regional frameworks. These factors contribute to the overall high service change of CROs and CDMOs.

Veterinary CRO & CDMO Market: Opportunities

Rising focus on veterinary biologics and genetic research to create growth opportunities

The global veterinary CRO and CDMO market is expected to generate growth opportunities due to the increasing focus on developing biologics for animal care. These drugs and therapies are developed using living cells.

According to medical experts, biologics have proven highly beneficial in treating several medical conditions among various animal species. Veterinary biologics offer more targeted treatment. They are also long-lasting, further encouraging veterinary CROs and CDMOs to invest in gene-based therapies.

In February 2020, Invetx, a leading animal health biopharmaceutical company, announced a financing of USD 15 million in series A funding. Invetx has partnered with WuXi Biologics, a prominent contract manufacturing leader for developing biologic drugs for animals, leveraging advancements in human biopharma. Treatments curated using antibodies can help manage severe and rare medical conditions in animals, including diseases such as lymphoma, cancer, chronic pain, allergic disorders, and arthritis.

Increasing the rate of inter-country partnerships between pharmaceutical companies and CROs or CDMOs will facilitate greater revenue in the coming years. On the other hand, government support for such collaborations is expected to play a crucial role in industry growth during the forecast period.

Veterinary CRO & CDMO Market: Challenges

Lack of standard regulations poses a critical challenge for industry players

The global veterinary CRO and CDMO industry is projected to be limited by the lack of global standards governing the sector. It can lead to inconsistent quality of drugs being sold in the commercial market.

Moreover, companies must invest in restructuring their research and development process to comply with regional regulations. It can lead to increased cost of investments.

Veterinary CRO & CDMO Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Veterinary CRO & CDMO Market |

| Market Size in 2024 | USD 7.14 Billion |

| Market Forecast in 2034 | USD 15.99 Billion |

| Growth Rate | CAGR of 8.40% |

| Number of Pages | 214 |

| Key Companies Covered | Oncovet Clinical Research (OCR), Charles River Laboratories, Veterinary Research Management, Charles River Laboratories, Oncovet Clinical Research (OCR), IDEXX Laboratories Inc., TriRx Pharmaceutical Services, Zoetis Nexvet, LABIANA Group, Knoell Triveritas, Vetio, AB7 Group, Argenta Group (KLIFOVET GmbH), Inotiv, Aenova Group, VETSPIN, Clinvet, and others. |

| Segments Covered | By Application, By Service Type, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Veterinary CRO & CDMO Market: Segmentation

The global veterinary CRO & CDMO market is segmented based on application, service type, product, and region.

Based on the application, the global market segments are livestock animals and companion animals. In 2024, the highest demand was listed in the companion animals segment. The increasing rate of pet adoption worldwide has helped the segment thrive.

According to the European Pet Food Industry, more than 50% of European households have at least one pet under their care. Growing awareness about the importance of animal welfare and increased demand for effective treatments for serious zoonotic conditions will fuel revenue in the livestock animals segment in the coming years.

Based on service type, the global veterinary CRO & CDMO industry is divided into CDMO services and CRO services.

Based on the product, the global market divisions are biologics, drugs, and medicated feed & supplements. In 2024, the most dominant segment was biologics. The treatment efficiency of drugs and treatments developed using gene therapies is crucial to the segmental revenue. Certain studies indicate more than 70% objective response rates in canine cancers using biologics. Most veterinary CROs and CDMOs have diversified into biologics-oriented treatment programs for veterinary diseases.

Veterinary CRO & CDMO Market: Regional Analysis

The US to take the lead during the forecast period in North America

The global veterinary CRO & CDMO market will be led by North America during the projection period. According to market analysis, the US will emerge as the highest regional industry revenue generator. The US has exceptionally high animal healthcare expenditures, not only for pets but also for livestock.

In 2023, around 87 million homes in the US were reported to be pet owners. The increasing number of awareness initiatives and educational programs by animal welfare agencies across the region has helped escalate the pet adoption rate in the US. In addition, the presence of key veterinary CROs and CDMOs in North America further helps the region thrive.

Asia-Pacific is another growing region in the veterinary CRO & CDMO industry. Countries such as China, India, South Korea, Japan, and Singapore may lead the regional revenue. The presence of a large livestock population in Asian Countries will promote regional adoption of CROs and CDMOs.

Additionally, in recent times, the Asia-Pacific has witnessed a considerable rise in the rapid spread of several zoonotic diseases. COVID-19, for instance, is traced back to China. It also affected a large number of regional populations during 2020 and 2021. Additionally, the growing government support for establishing veterinary CROs or CDMOs may fuel regional expansion during the projection period.

Veterinary CRO & CDMO Market: Competitive Analysis

The global veterinary CRO & CDMO market is led by players like:

- Oncovet Clinical Research (OCR)

- Charles River Laboratories

- Veterinary Research Management

- Charles River Laboratories

- Oncovet Clinical Research (OCR)

- IDEXX Laboratories Inc.

- TriRx Pharmaceutical Services

- Zoetis Nexvet

- LABIANA Group

- Knoell Triveritas

- Vetio

- AB7 Group

- Argenta Group (KLIFOVET GmbH)

- Inotiv

- Aenova Group

- VETSPIN

- Clinvet

The global veterinary CRO & CDMO market is segmented as follows:

By Application

- Livestock Animals

- Companion Animals

By Service Type

- CDMO Services

- CRO Services

By Product

- Biologics

- Drugs

- Medicated Feed & Supplements

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Veterinary contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) are specialized agencies helping pharmaceutical and biotechnology companies develop and manufacture new drugs for veterinary care.

The global veterinary CRO and CDMO market is expected to be influenced by the increasing number of pet owners worldwide.

According to study, the global veterinary CRO & CDMO market size was worth around USD 7.14 billion in 2024 and is predicted to grow to around USD 15.99 billion by 2034.

The CAGR value of the veterinary CRO & CDMO market is expected to be around 8.40% during 2025-2034.

The global veterinary CRO & CDMO market will be led by North America during the projection period.

The global veterinary CRO & CDMO market is led by players like Oncovet Clinical Research (OCR), Charles River Laboratories, Veterinary Research Management, Charles River Laboratories, Oncovet Clinical Research (OCR), IDEXX Laboratories Inc., TriRx Pharmaceutical Services, Zoetis Nexvet, LABIANA Group, Knoell Triveritas, Vetio, AB7 Group, Argenta Group (KLIFOVET GmbH), Inotiv, Aenova Group, VETSPIN, and Clinvet.

The report explores crucial aspects of the veterinary CRO & CDMO market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Veterinary CRO CDMOIndustry Prospective:Veterinary CRO CDMO OverviewKey Insights:Veterinary CRO CDMO Growth DriversVeterinary CRO CDMO RestraintsVeterinary CRO CDMO OpportunitiesVeterinary CRO CDMO ChallengesVeterinary CRO CDMO Report ScopeVeterinary CRO CDMO SegmentationVeterinary CRO CDMO Regional AnalysisVeterinary CRO CDMO Competitive AnalysisThe global veterinary CRO CDMO market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed