Acrylic Acid Market Growth, Size, Share, Trends, and Forecast 2030

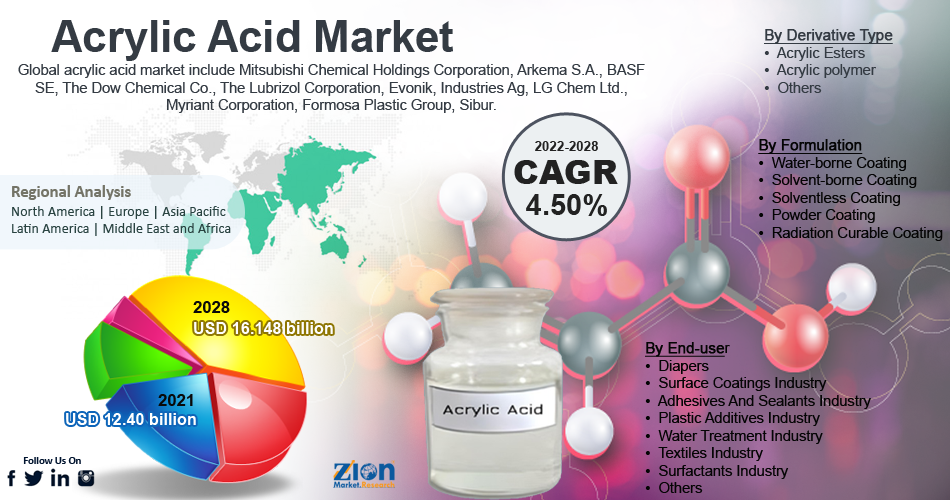

Acrylic Acid Market By Derivative Type (Acrylic Esters, Acrylic polymer, Others), By Formulation (Water-borne Coating, Solvent-borne Coating, Solventless Coating, Powder Coating, Radiation Curable Coating), By End-user (Diapers, Surface Coatings Industry, Adhesives And Sealants Industry, Plastic Additives Industry, Water Treatment Industry, Textiles Industry, Surfactants Industry, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.40 billion | USD 16.15 billion | 4.50% | 2022 |

Acrylic Acid Market Size And Industry Analysis

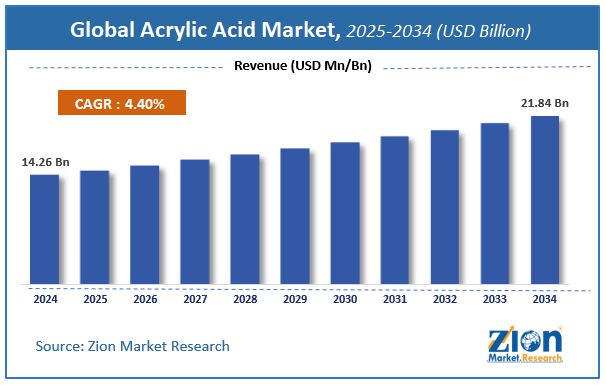

The global acrylic acid market size was worth USD 12.40 billion in 2021 and is estimated to grow to USD 16.148 billion by 2028, with a compound annual growth rate (CAGR) of approximately 4.50 % over the forecast period. The report analyzes the acrylic acid market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the acrylic acid market.

Acrylic Acid Market: Overview

Acrylic acid is an acidic or acrid-smelling chemical substance. Acrylic acid is a feedstock used in the manufacture of acrylate esters. Among the many applications for acrylate ester are paper treatment, plastic additives, textiles, sealants, adhesives, and surface coatings. Furthermore, acrylic acid is used to manufacture hygienic medical equipment, detergents, and wastewater treatment chemicals.

Processes for generating acrylic acid from petrochemicals are being developed and commercialized by the industry. Due to strict commercial acrylic acid laws, companies are moving to bio-based ways to create acrylic acid and acrylates from renewable resources such as glycerol and sugar. Renewable feedstock delivers cost-competitive results when compared to petrochemical processes. Asia-Pacific is driving the acrylic acid market. Because of environmental concerns, stringent government restrictions on acrylic acid usage are enforced in places such as North America and Europe, acting as a significant restricting factor for the growth of the acrylic acid market.

The commercialization of bio-based acrylic acid and the growing demand for poly (methyl methacrylate) or PMMA resins in different sectors are likely to provide this market with several potential prospects. As a result, acrylic acid producers concentrate on R&D to identify bio-based sources for acrylic acid synthesis.

Covid-19 Impact:

Manufacturers of superabsorbent polymers (SAP) benefited from a short-term increase in sales as customers raced to stock up on diapers and other hygiene items due to nationwide lockdowns imposed in response to the COVID-19 epidemic. This was especially visible in the European and American markets, where a rush in demand caused a temporary tightness of the system and bare grocery shelves. However, the situation improved when the supply chain was standardized and purchasing patterns returned to a more usual pattern.

Key Insights

- As per the analysis shared by our research analyst, the global acrylic acid market value is expected to grow at a CAGR of 4.50% over the forecast period.

- In terms of revenue, the global acrylic acid market size was valued at around USD 12.40 billion in 2021 and is projected to reach USD 16.14 billion by 2028.

- Over the projected period, rising demand for superabsorbent polymers in the personal care industry will likely fuel development. Growing demand for surfactants, surface coatings, adhesives & sealants are also expected to alter the business.

- By derivative type, the acrylic polymer category dominated the market in 2021.

- By formulation, the solvent-borne coating category dominated the market in 2021.

- Asia-Pacific dominated the global acrylic acid market in 2021.

Acrylic Acid Market: Growth Drivers

There is a growing need in the engineering plastics, copolymer, and paints sectors.

Acrylic acid is largely supplied to the engineering plastics, copolymers, paints, and coatings industries as raw ingredients. Acrylic acid is used to produce a wide variety of goods, including flat sheets, plastic extruded tubes, molded items, paints, and other industrial chemicals. Paints, surface coatings, emulsion coatings, adhesives, and sealants are examples of applications where the industry has enormous potential. Global manufacturing revenue growth is substantially impacting the global acrylic acid market, and new product development & innovation are creating new growth prospects.

Acrylic Acid Market: Restraints

Concerns about environmental and health hazards, as well as capital-intensive production hamper market expansion

The manufacture of acrylic acid is a capital-intensive and sophisticated process. For example, land, labor, and machinery are three primary manufacturing variables necessary to produce acrylic acid. As a result, the initial investment is relatively expensive, as is the amount of money necessary to operate such firms. The rate of growth in return on invested capital (ROIC) has had a significant influence on market revenue growth. According to studies, the ROIC in this area is quite low, averaging around 9%. Furthermore, producing acrylic acid relies heavily on petroleum costs, and crude oil prices are a key influence in altering raw material prices.

Acrylic Acid Market: Opportunities

Growing demand for super absorbent polymers (SAP) in sanitary pads to drive market opportunities

Superabsorbent polymers (SAPs) are ideal for sanitary items and diapers. They can frequently absorb their weight in fluids, making them excellent for water-absorbing applications such as newborn diapers, adult incontinence pads, absorbent medical dressings, and controlled release medications. In the worldwide situation, SAPs account for around 30% of total acrylic acid consumption. Acrylic acid and sodium hydroxide are used as raw ingredients to make polyacrylic acid, which is then used to make superabsorbent polymers.

Acrylic Acid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Acrylic Acid Market |

| Market Size in 2021 | USD 12.40 billion |

| Market Forecast in 2028 | USD 16.15 billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 287 |

| Key Companies Covered | Mitsubishi Chemical Holdings Corporation, Arkema S.A., BASF SE, The Dow Chemical Co., The Lubrizol Corporation, Evonik, Industries Ag, LG Chem Ltd., Myriant Corporation, Formosa Plastic Group, Sibur., |

| Segments Covered | By Derivative Type, By Formulation, By End-user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 - 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Acrylic Acid Market: Segmentation

The global acrylic acid market is segregated based on derivative type, formulation, end-user, and region.

Based on derivative type, the market is segmented into acrylic ester, acrylic polymer, and others. Because of the rising usage of superabsorbent polymers by disposable diaper manufacturers, the acrylic polymer segment led the worldwide acrylic acid market in 2021 and is likely to retain its dominance over the forecast period.

Based on formulation, the global acrylic acid market is classified into water-borne coating, solvent-borne coating, solventless coating, powder coating, and radiation curable coating. In 2021, the solvent-borne coating category was expected to maintain its revenue share. The solvent-borne coating is an ester of acrylic acid that finds widespread use in plastics and polymers. Ethyl Acrylate is an organic compound utilized in polymer synthesis that is used as a raw ingredient in the manufacturing of high-density polyethylene (HDPE), low-density polyethylene (LDPE), and medium-density polyethylene (MDPE) (MDPE).

Based on end-user, the market is segmented into diapers, surface coatings industry, adhesives and sealants industry, plastic additives industry, water treatment industry, textiles industry, surfactants industry, and others. In 2021, the engineering plastics and copolymer segment will account for a greater revenue proportion. Acrylic acid is widely used as a raw ingredient in producing technical plastics and copolymers. Polypropylene (PP) and acrylic acid are blended to produce flat sheets, plastic extruded tubes, and molded items. Because acrylic acid is transparent and discoloration resistant, it is commonly used as a raw material in producing transparent plastic goods such as film, sheets, and tubes. Acrylic acid may also be used to make copolymers using process suspension polymerization.

Recent Development:

- BASF and SINOPEC recently broke ground in Nanjing to develop their Verbund facility, which is run by BASF-YPC Co., a 50/50 joint venture between the two firms. To fulfill the increased demand from diverse businesses in the Chinese market, the expansion comprises expanded capacity for multiple downstream chemical facilities and a new tert-butyl acrylate factory. The partners want to expand the capacity for pure ethylene oxide, ethanolamines, propionic acid, and propionic aldehyde and build the most modern tert-butyl acrylate factory.

Acrylic Acid Market: Regional Landscape

Asia-Pacific dominated the acrylic acid market in 2021

The Asia Pacific dominated the acrylic acid market with the highest estimated demand share. For the same year, China and India accounted for most regional demand. Over the projection period, rising derivatives use in surfactants, coatings, personal care products, and adhesives are predicted to boost regional growth. In the acrylic acid market, Asia Pacific had the highest revenue share. The region's primary drivers are a rapid investment in chemical technology, increasing oil refining capacity, and fierce competition. Acrylic acid consumption in the region is driven by domestic demand for technical plastics, polymers, paints, and other goods. Because of major chemical companies like Mitsubishi Chemical Corporation, Sumitomo Chemical, and others, Asia Pacific has become the largest acrylic acid exporter. Several major acrylic acid companies are extending their regional operations to enhance their market share. Furthermore, governments in several countries, like China, Japan, and India, support forming export-oriented manufacturing enterprises to spur economic growth.

Acrylic Acid Market: Competitive Landscape

Some of the main competitors dominating the global acrylic acid market include

- Mitsubishi Chemical Holdings Corporation

- Arkema S.A.

- BASF SE

- The Dow Chemical Co.

- The Lubrizol Corporation

- Evonik

- Industries Ag

- LG Chem Ltd.

- Myriant Corporation

- Formosa Plastic Group

- Sibur.

Global Acrylic acid Market is segmented as follows:

By Derivative Type

- Acrylic Esters

- Acrylic polymer

- Others

By Formulation

- Water-borne Coating

- Solvent-borne Coating

- Solventless Coating

- Powder Coating

- Radiation Curable Coating

By End-user

- Diapers

- Surface Coatings Industry

- Adhesives And Sealants Industry

- Plastic Additives Industry

- Water Treatment Industry

- Textiles Industry

- Surfactants Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The main reasons anticipated to propel the acrylic acid market during the forecast period are the rising demand for superabsorbent polymers in the personal care industry is likely to fuel development. Growing demand for surfactants, surface coatings, and adhesives & sealants is also expected to alter the business.

According to the report, the global acrylic acid market size was worth USD 12.40 billion in 2021 and is estimated to grow to USD 16.1480 billion by 2028, with a compound annual growth rate (CAGR) of approximately 4.50 percent over the forecast period.

In 2021, the Asia-Pacific region held the greatest share of the acrylic acid market. The Asia-Pacific acrylic acid market is predicted to develop at the fastest CAGR in terms of both volume and value, owing to a comparatively large adult population in growing nations such as China, India, and others.

Some of the main competitors dominating the global acrylic acid market include - Mitsubishi Chemical Holdings Corporation, Arkema S.A., BASF SE, The Dow Chemical Co., The Lubrizol Corporation, Evonik, Industries Ag, LG Chem Ltd., Myriant Corporation, Formosa Plastic Group, Sibur.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed