Aerospace and Defense Elastomers Market Size, Share, Trends, Growth 2034

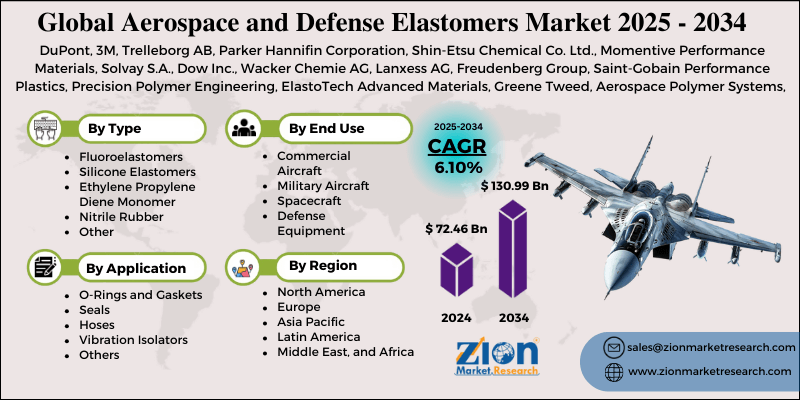

Aerospace and Defense Elastomers Market By Type (Fluoroelastomers, Silicone Elastomers, Ethylene Propylene Diene Monomer, Nitrile Rubber, and Other Types), By Application (O-Rings and Gaskets, Seals, Hoses, Vibration Isolators, and Others), By End-Use (Commercial Aircraft, Military Aircraft, Spacecraft, and Defense Equipment), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

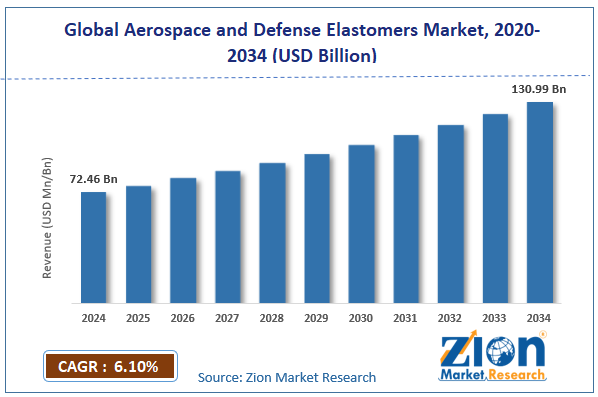

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 72.46 Billion | USD 130.99 Billion | 6.10% | 2024 |

Aerospace and Defense Elastomers Industry Prospective:

The global aerospace and defense elastomers market was valued at approximately USD 72.46 billion in 2024 and is expected to reach around USD 130.99 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 6.10% between 2025 and 2034.

Aerospace and Defense Elastomers Market: Overview

Aerospace and defense elastomers are specialized rubber-like materials engineered to maintain flexibility, resilience, and performance under extreme conditions encountered in aerospace and defense applications. These advanced elastomers provide critical solutions for sealing, vibration dampening, thermal insulation, and fluid management systems in aircraft, spacecraft, missiles, and military equipment.

The formulations of elastomers enable them to withstand high temperatures, pressure variations, exposure to fuels and chemicals, ozone, and UV radiation while maintaining mechanical integrity.

Stricter regulatory standards for material performance, the rising adoption of lightweight and durable materials, and increasing investments in aerospace research and development programs drive growth in the aerospace and defense elastomers market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global aerospace and defense elastomers market is estimated to grow annually at a CAGR of around 6.10% over the forecast period (2025-2034)

- In terms of revenue, the global aerospace and defense elastomers market size was valued at around USD 72.46 billion in 2024 and is projected to reach USD 130.99 billion by 2034.

- The aerospace and defense elastomers market is expected to grow due to rising aircraft fleet expansion, increased demand for elastomers in sealing and insulation applications, and the development of next-generation aircraft platforms.

- Based on elastomer type, fluoroelastomers lead the segment and will continue to dominate the global market.

- Based on application, seals and O-rings are anticipated to command the largest market share.

- Based on end-use, commercial aircraft are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aerospace and Defense Elastomers Market: Growth Drivers

Rising aircraft production and fleet expansion

The global aerospace and defense elastomers market is experiencing substantial growth driven by increasing commercial aircraft production and military fleet modernization programs. The commercial aviation sector's recovery post-pandemic has accelerated demand for new aircraft, with major manufacturers reporting growing order backlogs.

According to International Air Transport Association (IATA) industry reports, global passenger traffic is expected to double in the next 20 years, requiring around 40,000 new aircraft. This growth creates a huge demand for high-performance elastomers in critical aircraft systems.

Military modernization programs across developed and developing countries will further fuel the growth as elastomers play a critical role in advanced defense platforms that require materials that can withstand extreme environments and meet reliability and safety standards.

Technological advancements in elastomer formulations

Innovation in the aerospace and defense elastomers industry has significantly improved material performance characteristics crucial for demanding aerospace applications. Manufacturers have developed advanced elastomer compounds with higher temperature ranges (-65°C to +325°C), better chemical compatibility, and longer service life.

According to material science publications and industry reports from organizations like the American Chemical Society, new fluoroelastomers and silicone formulations are 30% more durable in extreme environments than the previous generation.

Nano-fillers and special additives have created elastomers with self-healing properties, lower permeability, and better plasma and atomic oxygen resistance for space applications. Custom-engineered elastomers that meet specific performance requirements for next-generation aircraft and defense systems drive market growth and technological advancement.

Aerospace and Defense Elastomers Market: Restraints

Stringent certification requirements and long qualification cycles

Despite the growing demand for aerospace and defense elastomers, the market faces challenges with certification and qualification for new materials. Industry standards like AS9100, MIL-DTL-83528, and material specifications from major aerospace OEMs require extensive testing and validation before elastomers can be approved in critical applications.

According to aerospace industry publications and reports from certification bodies like the Federal Aviation Administration (FAA), qualification cycles for new elastomeric materials typically range from 3-5 years, creating substantial barriers to market entry.

The testing requirements are long-term aging studies, environmental exposure tests, compatibility assessments, and performance evaluations under simulated service conditions. These long approval processes delay innovation and prevent manufacturers from introducing new elastomer technologies quickly despite the performance benefits.

Aerospace and Defense Elastomers Market: Opportunities

Growing demand for sustainable and environmentally friendly elastomers

The aerospace and defense elastomers market sees opportunities for environmentally sustainable elastomer formulations that meet increasingly strict environmental regulations and performance requirements. According to reports from major aerospace manufacturers like Airbus and Boeing, the industry actively pursues materials with reduced environmental impact.

Elastomer manufacturers are responding by developing bio-based alternatives, reducing or eliminating nasty chemicals, and creating lower carbon footprint formulations. Sustainable elastomers that perform while reducing environmental impact are a significant growth opportunity.

The industry is moving towards more sustainable materials in line with the broader aerospace sector's commitment to reduce environmental impact and meet future hazardous substances and end-of-life material management regulations.

Aerospace and Defense Elastomers Market: Challenges

Raw material price volatility and supply chain disruptions

The aerospace and defense elastomers industry faces fluctuating raw material prices and supply chain vulnerabilities. According to chemical industry reports and market analyses, key elastomer components have experienced price fluctuations in recent years, causing an impact on production costs and pricing strategies.

Supply chain disruptions during the pandemic and ongoing geopolitical tensions add to the challenge of maintaining material availability. The specialized nature of aerospace-grade elastomer production, with limited qualified suppliers for specific formulations, makes supply chain reliability even more complicated.

Aerospace and Defense Elastomers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace and Defense Elastomers Market |

| Market Size in 2024 | USD 72.46 Billion |

| Market Forecast in 2034 | USD 130.99 Billion |

| Growth Rate | CAGR of 6.10% |

| Number of Pages | 212 |

| Key Companies Covered | DuPont, 3M, Trelleborg AB, Parker Hannifin Corporation, Shin-Etsu Chemical Co. Ltd., Momentive Performance Materials, Solvay S.A., Dow Inc., Wacker Chemie AG, Lanxess AG, Freudenberg Group, Saint-Gobain Performance Plastics, Precision Polymer Engineering, ElastoTech Advanced Materials, Greene Tweed, Aerospace Polymer Systems, Rogers Corporation, Kirkhill Inc., Precision Polymer Engineering, Defense Materials Corporation, and others. |

| Segments Covered | By Type, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace and Defense Elastomers Market: Segmentation

The global aerospace and defense elastomers market is segmented into elastomer type, application, end-use, and region.

Based on elastomer type, the market is segregated into fluoroelastomers, silicone elastomers, ethylene propylene diene monomers, nitrile rubber, and other types. Fluoroelastomers lead the market due to their exceptional resistance to high temperatures, aggressive fuels, and hydraulic fluids, making them ideal for critical sealing applications in aircraft engines and fuel systems.

Based on application, the aerospace and defense elastomers market is divided into O-rings and gaskets, seals, hoses, vibration isolators, and others. Seals and O-rings are expected to lead the market during the forecast period as they represent critical components in virtually all aerospace systems requiring fluid containment and pressure management.

Based on end-use, the aerospace and defense elastomers industry is categorized into commercial, military, spacecraft, and defense equipment. Commercial aircraft are expected to lead the market due to the higher production volumes and ongoing fleet expansion programs worldwide.

Aerospace and Defense Elastomers Market: Regional Analysis

North America to lead the market

North America leads the global aerospace and defense elastomers market due to its strong aerospace manufacturing base, substantial defense spending, and concentration of major aircraft manufacturers and suppliers. The U.S. accounts for around 40% of the global market share with industry giants like Boeing, Lockheed Martin, and numerous tier-one suppliers.

According to aerospace industry reports and market studies from organizations like the Aerospace Industries Association, North America has a technological edge in advanced elastomer development through heavy research and development investments and strong collaboration between industry, academia, and government research institutions.

The region has a strict regulatory framework that ensures high-quality standards and provides clear guidelines for material qualification. Major elastomer manufacturers in this region are developing specialized formulations for next-generation aircraft and defense platforms, further strengthening North America's position.

Asia Pacific is set to grow significantly.

The Asia Pacific region represents a growing aerospace and defense elastomers industry, driven by expanding commercial aviation, increasing defense budgets, and growing domestic aerospace manufacturing capabilities. Countries like China, India, and Japan are investing heavily in aerospace infrastructure and defense modernization programs.

According to regional market studies and reports from organizations like the Association of Asia Pacific Airlines, the region is expected to account for around 40% of global aircraft demand over the next two decades. Local production of commercial and military aircraft is picking up in several countries with corresponding growth in elastomer demand.

Government initiatives supporting aerospace manufacturing self-reliance are creating opportunities for domestic and international elastomer suppliers. The combination of expanding aerospace manufacturing capabilities, increasing defense expenditures, and growing maintenance, repair, and overhaul activities creates a favorable environment for sustained market growth in this dynamic region.

Recent Market Developments:

- In January 2025, Huntsman and Wacker Chemie engaged in strategic alliances to expand their product offerings and market reach in the aerospace and defense elastomers sector.

- In February 2025, DuPont and Rogers Corporation are exploring eco-friendly elastomer solutions, aligning with trends toward greener manufacturing processes in the aerospace and defense industries.

Aerospace and Defense Elastomers Market: Competitive Analysis

The global aerospace and defense elastomers market is led by players like:

- DuPont

- 3M

- Trelleborg AB

- Parker Hannifin Corporation

- Shin-Etsu Chemical Co. Ltd.

- Momentive Performance Materials

- Solvay S.A.

- Dow Inc.

- Wacker Chemie AG

- Lanxess AG

- Freudenberg Group

- Saint-Gobain Performance Plastics

- Precision Polymer Engineering

- ElastoTech Advanced Materials

- Greene Tweed

- Aerospace Polymer Systems

- Rogers Corporation

- Kirkhill Inc.

- Precision Polymer Engineering

- Defense Materials Corporation

The global aerospace and defense elastomers market is segmented as follows:

By Type

- Fluoroelastomers

- Silicone Elastomers

- Ethylene Propylene Diene Monomer

- Nitrile Rubber

- Other Types

By Application

- O-Rings and Gaskets

- Seals

- Hoses

- Vibration Isolators

- Others

By End-Use

- Commercial Aircraft

- Military Aircraft

- Spacecraft

- Defense Equipment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aerospace and defense elastomers are specialized rubber-like materials engineered to maintain their flexibility, resilience, and performance under extreme conditions encountered in aerospace and defense applications, including high temperatures, pressure variations, and exposure to fuels and chemicals.

The aerospace and defense elastomers market is expected to be driven by increasing aircraft production, rising defense spending, technological advancements in elastomer formulations, growing demand for lightweight and fuel-efficient materials, and expanding applications in next-generation aircraft and defense systems.

According to our study, the global aerospace and defense elastomers market was worth around USD 72.46 billion in 2024 and is predicted to grow to around USD 130.99 billion by 2034.

The CAGR value of the aerospace and defense elastomers market is expected to be around 6.10% during 2025-2034.

The global aerospace and defense elastomers market will register the highest growth in North America during the forecast period.

Key players in the aerospace and defense elastomers market include DuPont, 3M, Trelleborg AB, Parker Hannifin Corporation, Shin-Etsu Chemical Co., Ltd., Momentive Performance Materials, Solvay S.A., Dow Inc., Wacker Chemie AG, Lanxess AG, Freudenberg Group, Saint-Gobain Performance Plastics, Precision Polymer Engineering, ElastoTech Advanced Materials, Greene Tweed, Aerospace Polymer Systems, Rogers Corporation, Kirkhill Inc., and Defense Materials Corporation.

The report comprehensively analyzes the aerospace and defense elastomers market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving aerospace and defense industry needs shaping the elastomers ecosystem.

Choose License Type

List of Contents

Aerospace and Defense ElastomersIndustry Prospective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisRecent Market Developments:Competitive AnalysisThe global aerospace and defense elastomers market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed