Aerospace Gasoline Market Size, Share, Analysis, Trends, Growth Report, 2030

Aerospace Gasoline Market By Fuel Type (Avgas 100, Avgas UL94, Avgas 100LL, Avgas 115, Avgas UL91, Avgas 80, and Others), By Aircraft Type (Rotorcraft, Fixed-Wing, and Others), By End-User (Military, Commercial, and Private), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

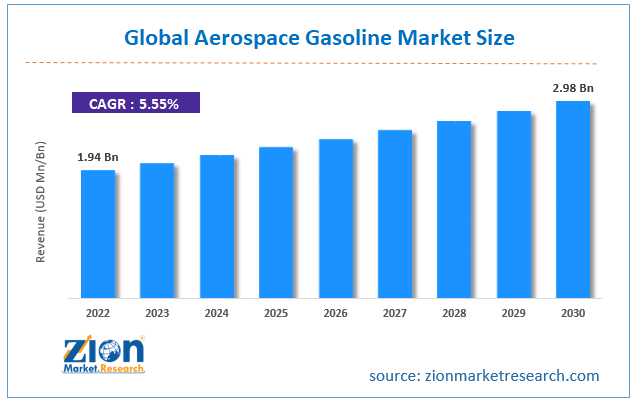

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.94 Billion | USD 2.98 Billion | 5.55% | 2022 |

Aerospace Gasoline Industry Prospective:

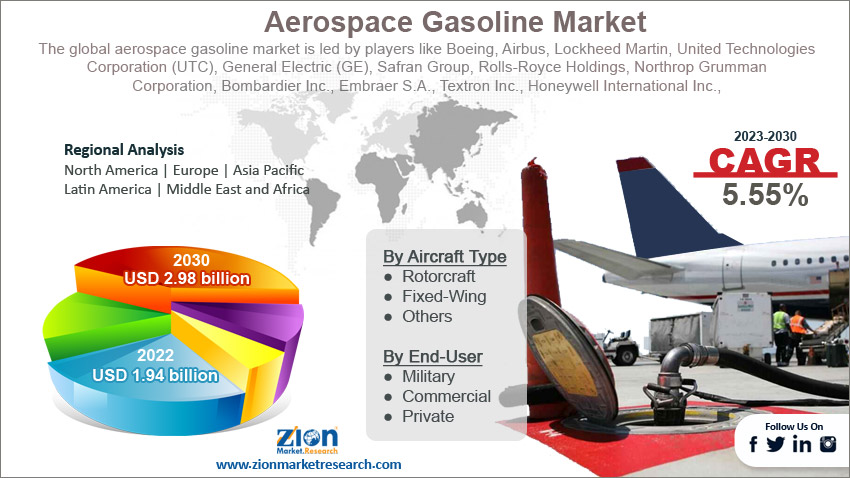

The global aerospace gasoline market size was worth around USD 1.94 billion in 2022 and is predicted to grow to around USD 2.98 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.55% between 2023 and 2030.

The report analyzes the global aerospace gasoline industry drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the aerospace gasoline market.

Aerospace Gasoline Market: Overview

The aerospace gasoline industry refers to the production and distribution of a specialized type of fuel that is used in piston-engine aircraft. It is known as aviation fuel or avgas and is specifically designed to meet the needs of small aircraft engines such as the ones found in general aviation and some military aircraft. Avgas is high-octane gasoline and contains certain additives that assist in enhancing the performance of the engine while also providing it with extensive protection. There are several factors responsible for the growth in the industry and the demand or consumption of avgas varies across regional boundaries.

Key Insights:

- As per the analysis shared by our research analyst, the global aerospace gasoline market is estimated to grow annually at a CAGR of around 5.55% over the forecast period (2023-2030)

- In terms of revenue, the global aerospace gasoline market size was valued at around USD 1.94 billion in 2022 and is projected to reach USD 2.98 billion, by 2030.

- The aerospace gasoline market is projected to grow at a significant rate due to the growing demand for sustainable packaging

- Based on fuel type segmentation, avgas 100LL was predicted to show maximum market share in the year 2022

- Based on end-user segmentation, private was the leading user in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Aerospace Gasoline Market: Growth Drivers

Increasing demand for business aviation to propel market growth

The global aerospace gasoline market is expected to witness high growth owing to the rising demand for business aviation. Multiple companies, corporations, and individuals with high net worth spend large amounts on private aviation services. There are multiple reasons for this trend. For instance, private services allow them to save time and enjoy the privacy of traveling with family or with colleagues. Furthermore, private aviation is also used for more social purposes. A common example is the use of small aircraft for land mapping and surveys for agricultural purposes or during catastrophic events such as floods and earthquakes. There are other reasons that are driving the demand for smaller piston-engine aircraft. In addition to this, the growing application of unmanned aerial vehicles (UAVs) for reasons such as surveillance, monitoring, aerial photography, and other aspects has also resulted in an increased growth rate.

Aerospace Gasoline Market: Restraints

Growing shift toward alternate fuel to restrict market expansion

In recent times, the aerospace industry has shown a shift toward alternative fuels as the focus on carbon emissions caused by extensive use of avgas and other non-renewable sources of energy has grown tremendously. Furthermore, there are growing initiatives undertaken toward the development and application of sustainable aviation fuels (SAF) or biofuels. This could substantially impact the aerospace gasoline industry expansion trajectory.

Aerospace Gasoline Market: Opportunities

Modernization and upgrades to provide growth opportunities

The global sales volume of the aerospace gasoline market may register a higher growth rate due to the ongoing efforts toward modernization and upgrades in the existing aircraft. For instance, aviation service providers and manufacturers may invest in upgrading engines or in retrofitting projects with the goal to improve performance, fuel efficiency, and compliance with international regulations. Furthermore, investments in regional aviation could add to the revenue streams. This includes commuter airlines, air taxis, and intercity air transport as they have high growth potential.

Aerospace Gasoline Market: Challenges

Relatively less commercial airway traffic to challenge the market expansion

One of the key challenges faced by the global aerospace gasoline industry players is in terms of the impact that Covid-19 had on the international and domestic travel patterns using airways. Reports have shown that despite a surge in the number of travelers since 2020, the rate has not crossed the pre-Covid-19 era. In addition to this, the recent ongoing war between multiple nations has impacted the cost of flying for commercial or business purposes, which in turn impacts the number of flyers. Aviation companies are struggling with keeping up with expenses with reduced income.

Aerospace Gasoline Market: Segmentation

The global aerospace gasoline market is segmented based on fuel type, aircraft type, end-user, and region.

Based on fuel type, the global market segments are avgas 100, avgas UL94, avgas 100LL, avgas 115, avgas UL91, avgas 80, and others. The aerospace gasoline industry registered the highest growth in the avgas 100LL segment in 2022. It stands for 100 low lead and accounted for nearly 38.1% of global sales. The term represents its high octane rating along with reduced lead content when compared to earlier formulations in the avgas sector. One of the primary reasons for segmental growth is the easy availability of the fuel type. It is also regarded as the most suitable fuel that should be used for turbine engine aircraft. Since it has a low freezing point, it can be used even at higher altitudes. Other options tend to showcase more specific applications and hence are not as popular as avgas 100LL.

Based on aircraft type, the global industry is segmented into rotorcraft, fixed-wing, and others.

Based on end-user, the global industry is segmented into military, commercial, and private. The aerospace gasoline industry witnessed the highest growth in the private segment with dominance over 58.1% of the global share. This was primarily due to the increased spending on private airplanes by companies and individuals. In recent times, the number of companies offering private chartered flights for tourism, business, air sports, and commercial purposes has grown at a rapid rate. Primarily reasons such as increased income, changing lifestyle, and easier access to private services have led to the high demand in this segment. The commercial section may also generate a high growth rate as there may be a demand for commercial flights to handle growing emergency incidents across the globe.

Recent Developments:

- In July 2022, Alder Fuels and Boeing made an announcement highlighting a strategic partnership between the two giants. These companies will work toward expanding the production of SAF worldwide. For testing the performance efficiency and quality of Alder-produced SAF, Boeing will offer its airplanes. They will also be used to expedite the shift toward renewable energy in the aviation sector

- In July 2022, A Memorandum of Understanding (MoU) was signed between Microsoft, Alaska Air Group, and Twelve, a carbon transformation company. These firms will collaborate to develop SAF and will include recaptured carbon dioxide-derived fuel along with renewable energy. The companies will work toward powering the first commercial demonstration flight in the US country using E-Jet by Twelve

Aerospace Gasoline Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Gasoline Market Research Report |

| Market Size in 2022 | USD 1.94 Billion |

| Market Forecast in 2030 | USD 2.98 Billion |

| Growth Rate | CAGR of 5.55% |

| Number of Pages | 227 |

| Key Companies Covered | Boeing, Airbus, Lockheed Martin, United Technologies Corporation (UTC), General Electric (GE), Safran Group, Rolls-Royce Holdings, Northrop Grumman Corporation, Bombardier Inc., Embraer S.A., Textron Inc., Honeywell International Inc., Leonardo S.p.A., Raytheon Technologies Corporation, BAE Systems, Pratt & Whitney (division of Raytheon Technologies), Mitsubishi Heavy Industries, Kawasaki Heavy Industries, Thales Group, Spirit AeroSystems Holdings Inc., General Dynamics Corporation, Dassault Aviation, Bell Textron Inc. (a Textron Inc. company), L3 Harris Technologies, and Meggitt PLC. |

| Segments Covered | By Fuel Type, By Aircraft Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Gasoline Market: Regional Analysis

North America to hold significant market share

The global aerospace gasoline market will be dominated by North America during the forecast period. In 2022, it contributed to nearly 34.345% of the global industry share and the leading reason is the existence of a robust aviation sector in the US region. In the last few decades, the United States has built several strategic alliances with countries across the globe and is considered one of the most advanced nations equipped with state-of-the-art aviation carriers. Furthermore, the private sector has also registered a high growth rate driven by the growing consumption of private carriers as many individuals in the US prefer private jets for flying.

Recent data by the Airbus Corporate Jets (ACJ) has pointed out that the US is home to nearly 14.632 private jets. This number indicated almost 62.% of the global fleet. The Asia-Pacific sector may grow at a steady rate driven by increasing demand for piston-engine aircraft in India, China, and neighboring nations.

Aerospace Gasoline Market: Competitive Analysis

The global aerospace gasoline market is led by players like:

- Boeing

- Airbus

- Lockheed Martin

- United Technologies Corporation (UTC)

- General Electric (GE)

- Safran Group

- Rolls-Royce Holdings

- Northrop Grumman Corporation

- Bombardier Inc.

- Embraer S.A.

- Textron Inc.

- Honeywell International Inc.

- Leonardo S.p.A.

- Raytheon Technologies Corporation

- BAE Systems

- Pratt & Whitney (division of Raytheon Technologies)

- Mitsubishi Heavy Industries

- Kawasaki Heavy Industries

- Thales Group

- Spirit AeroSystems Holdings Inc.

- General Dynamics Corporation

- Dassault Aviation

- Bell Textron Inc. (a Textron Inc. company)

- L3 Harris Technologies

- Meggitt PLC.

The global aerospace gasoline market is segmented as follows:

By Fuel Type

- Avgas 100

- Avgas UL94

- Avgas 100LL

- Avgas 115

- Avgas UL91

- Avgas 80

- Others

By Aircraft Type

- Rotorcraft

- Fixed-Wing

- Others

By End-User

- Military

- Commercial

- Private

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The industry refers to the production and distribution of a specialized type of fuel that is used in piston-engine aircraft.

The global aerospace gasoline market is expected to witness high growth owing to the rising demand for business aviation.

According to study, the global aerospace gasoline market size was worth around USD 1.94 billion in 2022 and is predicted to grow to around USD 2.98 billion by 2030.

The CAGR value of the aerospace gasoline market is expected to be around 5.55% during 2023-2030.

The global aerospace gasoline market will be dominated by North America during the forecast period.

The global aerospace gasoline market is led by players like Boeing, Airbus, Lockheed Martin, United Technologies Corporation (UTC), General Electric (GE), Safran Group, Rolls-Royce Holdings, Northrop Grumman Corporation, Bombardier Inc., Embraer S.A., Textron Inc., Honeywell International Inc., Leonardo S.p.A., Raytheon Technologies Corporation, BAE Systems, Pratt & Whitney (division of Raytheon Technologies), Mitsubishi Heavy Industries, Kawasaki Heavy Industries, Thales Group, Spirit AeroSystems Holdings Inc., General Dynamics Corporation, Dassault Aviation, Bell Textron Inc. (a Textron Inc. company), L3 Harris Technologies, and Meggitt PLC.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed