Agricultural Biological Control Agents Market Size, Share, Trends, Growth 2030

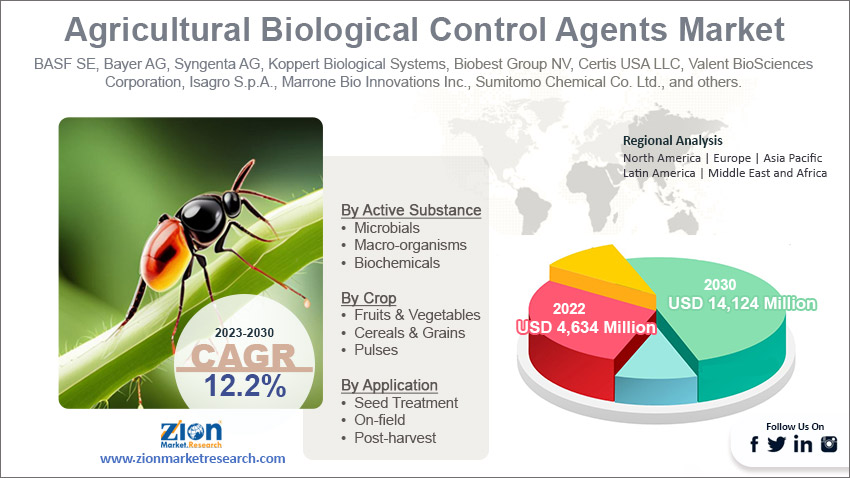

Agricultural Biological Control Agents Market By Active Substance (Microbials [Bacteria, Fungi, Virus, Protozoa, Yeasts], Macro-organism [Insects, Mites, Nematodes], and Biochemicals [Semio-Chemicals, Plant Extracts, Plant Growth Regulators, Organic Acid]), By Crop (Fruits & Vegetables, Cereals & Grains, and Pulses), By Application (Seed Treatment, On-field, and Post-harvest), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

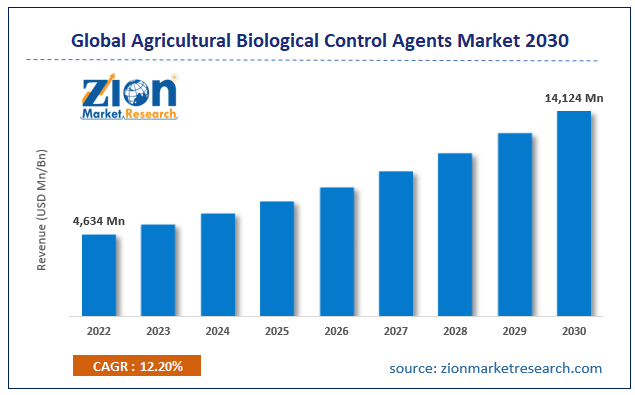

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4,634 Million | USD 14,124 Million | 12.2% | 2022 |

Agricultural Biological Control Agents Industry Prospective:

The global agricultural biological control agent market size was worth around USD 4,634 million in 2022 and is predicted to grow to around USD 14,124 million by 2030 with a compound annual growth rate (CAGR) of roughly 12.2% between 2023 and 2030.

Agricultural Biological Control Agents Market: Overview

Agricultural biological control agents are organisms used to manage pest populations in agriculture, reducing the reliance on chemical pesticides. These agents include predators, parasitoids, and pathogens that target specific pest species, helping to maintain a balanced ecosystem. Ladybugs, for instance, are natural predators of aphids, while certain wasps lay their eggs inside pest insects, ultimately killing them. Nematodes and fungi are also employed as biological control agents, targeting soil-dwelling pests. This approach offers several benefits: it is environmentally friendly, minimizes chemical residues in food, and helps preserve beneficial insects. Additionally, it reduces the risk of pesticide resistance in pest populations. However, successful implementation requires careful consideration of factors such as timing, species compatibility, and environmental conditions. Research and education play crucial roles in promoting the effective use of these agents, contributing to sustainable and resilient agricultural practices.

Key Insights

- As per the analysis shared by our research analyst, the global agricultural biological control agents industry is estimated to grow annually at a CAGR of around 12.2% over the forecast period (2023-2030).

- In terms of revenue, the global agricultural biological control agent’s market size was valued at around USD 4,634 million in 2022 and is projected to reach USD 14,124 million, by 2030.

- The global agricultural biological control agents market is projected to grow at a significant rate due to escalating concerns over environmental sustainability and food safety.

- Based on active substance segmentation, microbials was predicted to hold maximum market share in the year 2022.

- Based on crop segmentation, cereals & grains were the leading revenue generator in 2022.

- Based on application segmentation, on-field was the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Agricultural Biological Control Agents Market: Growth Drivers

Escalating concerns over environmental sustainability and food safety likely to boost the market growth.

The global agricultural biological control agents market is experiencing substantial growth, driven by escalating concerns regarding environmental sustainability and food safety. As consumers and regulators alike prioritize eco-friendly and safe agricultural practices, there is a growing shift away from chemical-intensive pest management methods. Biological control agents, which harness natural predators, pathogens, and competitors to regulate pest populations, have emerged as a sustainable and effective alternative. This approach minimizes harm to beneficial insects, reduces chemical residues in food, and curtails the risk of pesticide resistance. Furthermore, the increasing demand for organic produce is a significant driver for the adoption of biological control agents. Consumers are increasingly conscious of the impact of their food choices on the environment and personal health. As a result, there is a surging preference for organic foods produced with minimal synthetic chemicals. Agricultural biological control agents align perfectly with this trend, offering a natural and organic approach to pest management that resonates with environmentally-conscious consumers. According to a 2021 report by the United Nations Environment Program (UNEP), agriculture is a major contributor to environmental pollution, accounting for 24% of global greenhouse gas emissions, 70% of water withdrawals, and 70% of land degradation. Synthetic pesticides are a major source of agricultural pollution, contaminating soil, water, and air. Biological control agents offer a more sustainable approach to pest control, as they are non-toxic and do not harm the environment. These combined factors are propelling the agricultural biological control agents market to unprecedented levels of growth.

Agricultural Biological Control Agents Market: Restraints

Complexity of integrating biological control methods into existing agricultural practices may restrain market growth.

The agricultural biological control agents industry faces a notable challenge in the form of the complexity associated with integrating these methods into existing agricultural practices. Farmers are accustomed to traditional pest management approaches, which often involve the use of chemical pesticides. Transitioning to biological control agents requires a shift in mindset and practices. It necessitates education and training for farmers to understand the benefits, application methods, and optimal timing for these natural solutions. Furthermore, the successful integration of biological control agents is contingent on a nuanced understanding of ecological dynamics within the agricultural ecosystem. This includes factors like pest life cycles, predator-prey interactions, and environmental conditions. Achieving this level of understanding and expertise can be time-consuming and may require ongoing support and resources. Regulatory frameworks and certification processes can also vary by region, adding another layer of complexity. Overcoming these challenges is crucial for the widespread adoption of biological control agents and for realizing their full potential in sustainable agriculture.

Agricultural Biological Control Agents Market: Opportunities

Increasing demand for organic and sustainable farming practices to provide growth opportunities

The escalating demand for organic and sustainable farming practices is creating substantial growth opportunities within the agricultural biological control agents market. Consumers are increasingly concerned about the environmental impact of conventional farming methods, and they seek out produce that is grown using natural and eco-friendly approaches. This shift in consumer preferences has spurred the need for alternatives to chemical pesticides, positioning biological control agents as a key solution. These agents offer an effective and environmentally conscious means of pest management, aligning perfectly with the principles of organic farming. Furthermore, this trend is supported by regulatory bodies and governments worldwide, who are implementing policies and incentives to promote sustainable agricultural practices. This not only encourages the adoption of biological control agents but also provides a favorable environment for businesses in this sector to thrive. Companies that specialize in the development and distribution of biological control agents are well-positioned to tap into this growing market and play a crucial role in advancing sustainable agriculture practices on a global scale.

Agricultural Biological Control Agents Market: Challenges

Need for continuous research and development to challenge market growth

The imperative for continuous research and development (R&D) poses a significant challenge to the agricultural biological control agents industry. Pests and diseases in agriculture are highly dynamic, often evolving and adapting to changing environmental conditions and management practices. To effectively combat these challenges, it is essential for the industry to invest in ongoing R&D efforts. This involves identifying new strains of beneficial organisms, developing more efficient delivery methods, and optimizing the compatibility of biological control agents with various crops and pest species. Such endeavors require substantial financial resources and a dedicated scientific workforce, making it a formidable challenge for businesses to stay at the forefront of innovation. Moreover, ensuring the safety and efficacy of biological control agents in diverse agricultural settings demands rigorous scientific evaluation. Thorough testing and field trials are necessary to validate the effectiveness of these agents under different environmental conditions and against varying pest pressures. Meeting regulatory standards and ensuring that these agents are both efficient and environmentally sustainable further complicates the R&D process. The need for continuous investment in research and the ability to navigate complex regulatory landscapes represent significant hurdles that companies in the agricultural biological control agents market must navigate to foster sustained growth and success.

Agricultural Biological Control Agents Market: Segmentation

The global agricultural biological control agents market is segmented based on active substance, crop, application, and region.

Based on active substance, the global market segments are microbials [bacteria, fungi, viruses, protozoa, and yeasts], macro-organism [insects, mites, and nematodes], biochemicals [semio-chemicals, plant extracts, plant growth regulators, organic acid]. At present, the global market is dominated by the microbials segment. Their prevalence can be attributed to their versatility in targeting a wide range of agricultural pests and diseases. However, market dynamics are subject to change due to factors like evolving research, technology, consumer preferences, and regulatory shifts. For the most current and specific information on the dominant type in 2023, consulting recent market research reports or industry experts is recommended.

Based on crop, the global agricultural biological control agents industry is categorized as fruits & vegetables, cereals & grains, and pulses. Out of these, cereals & grains was the largest shareholding segment in 2022. The high share of cereals & grains is primarily due to their extensive cultivation and high demand worldwide. These crops, including staples like wheat, rice, and corn, are fundamental to global food security, providing essential nutrients and calories for a significant portion of the population. Their widespread cultivation and economic significance make them a primary target for effective pest management strategies, driving the demand for biological control agents. Additionally, as they serve as a vital component of animal feed, their significance in both human and livestock nutrition further solidifies their leading position in the market.

Based on Application, the global agricultural biological control agents market is categorized as seed treatment, on-field, and post-harvest. Out of these, on-field was the largest shareholding segment in the global market. The on-field application segment held the largest share in the global agricultural biological control agents market due to its direct and targeted approach to pest management during the growing season. This method allows for the precise deployment of biological control agents in the field, effectively addressing pest issues where they emerge. Moreover, it aligns with the growing demand for sustainable agricultural practices, as it reduces reliance on chemical pesticides while promoting natural pest control mechanisms, making it a preferred choice for modern farmers aiming for environmentally friendly and effective solutions.

Agricultural Biological Control Agents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agricultural Biological Control Agents Market |

| Market Size in 2022 | USD 4,634 Million |

| Market Forecast in 2030 | USD 14,124 Million |

| Growth Rate | CAGR of 12.2% |

| Number of Pages | 218 |

| Key Companies Covered | BASF SE, Bayer AG, Syngenta AG, Koppert Biological Systems, Biobest Group NV, Certis USA LLC, Valent BioSciences Corporation, Isagro S.p.A., Marrone Bio Innovations Inc., Sumitomo Chemical Co. Ltd., and others. |

| Segments Covered | By Active Substance, By Crop, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agricultural Biological Control Agents Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is expected to lead the global agricultural biological control agents market during the forecast period. This dominance can be attributed to several factors, including the region's vast agricultural landscape, high population density, and increasing awareness and adoption of sustainable farming practices. Additionally, governments in countries like China and India are actively promoting integrated pest management strategies, which include the use of biological control agents. These factors, combined with a growing demand for organic produce and a rising trend towards reducing chemical inputs in agriculture, position Asia Pacific as a key driver of market growth in the coming years.

Key Developments

In 2023, Koppert Biological Systems and Biobest N.V., two leading global players in the agricultural biological control agents market, announced a partnership to develop new biological control solutions for a variety of crops. This partnership is expected to accelerate the development of new and innovative biological control agents.

In 2023, the Indian government launched a new initiative, the National Agricultural Biological Control Mission, to support the use of biological control agents in Indian agriculture. This initiative is expected to boost the demand for biological control agents in India.

In 2022, BASF acquired Certis USA, a leading provider of biological control agents in the United States. This acquisition strengthened BASF's position in the agricultural biological control agents market and expanded its portfolio of biological control products.

Agricultural Biological Control Agents Market: Competitive Analysis

The global agricultural biological control agents market is dominated by players like:

- BASF SE

- Bayer AG

- Syngenta AG

- Koppert Biological Systems

- Biobest Group NV

- Certis USA LLC

- Valent BioSciences Corporation

- Isagro S.p.A.

- Marrone Bio Innovations, Inc.

- Sumitomo Chemical Co., Ltd.

The global agricultural biological control agents market is segmented as follows:

By Active Substance

- Microbials

- Macro-organisms

- Biochemicals

By Crop

- Fruits & Vegetables

- Cereals & Grains

- Pulses

By Application

- Seed Treatment

- On-field

- Post-harvest

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Agricultural biological control agents are organisms used to manage pest populations in agriculture, reducing the reliance on chemical pesticides. These agents include predators, parasitoids, and pathogens that target specific pest species, helping to maintain a balanced ecosystem.

The global agricultural biological control agent market cap may grow owing to the due to escalating concerns over environmental sustainability and food safety.

According to study, the global agricultural biological control agent market size was worth around USD 4,634 million in 2022 and is predicted to grow to around USD 14,124 million by 2030.

The CAGR value of the agricultural biological control agents market is expected to be around 12.2% during 2023-2030.

Which region will contribute notably towards the agricultural biological control agent market value?

The global agricultural biological control agent market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the vast agricultural landscape and booming chemical sector.

The global agricultural biological control agents market is led by players like BASF SE, Bayer AG, Syngenta AG, Koppert Biological Systems, Biobest Group NV, Certis USA LLC, Valent BioSciences Corporation, Isagro S.p.A., Marrone Bio Innovations, Inc., and Sumitomo Chemical Co., Ltd.

The report analyzes the global agricultural biological control agents market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Agricultural Biological Control Agents industry.

Choose License Type

List of Contents

Agricultural Biological Control AgentsIndustry Prospective:OverviewKey InsightsGrowth DriversRestraintsOpportunitiesChallengesSegmentationReport ScopeRegional AnalysisKey DevelopmentsCompetitive AnalysisThe global agricultural biological control agents market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed