Agriculture Tyre Market Size, Share, Trends, Growth and Forecast 2032

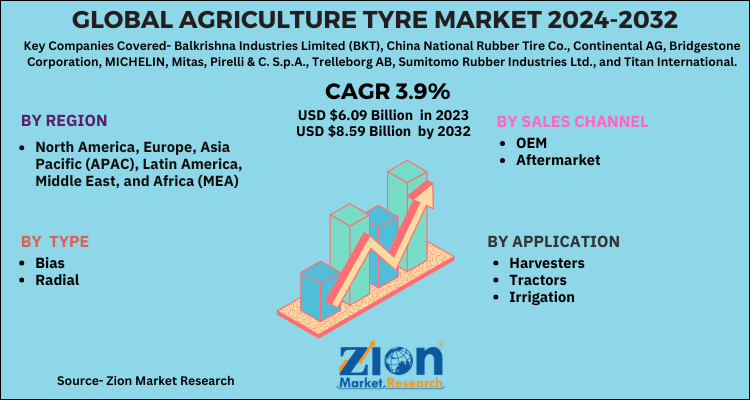

Agriculture Tyre Market by Type (Bias, Radial) by Sales Channel (OEM, Aftermarket) by Application (Harvesters, Tractors, Irrigation, Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

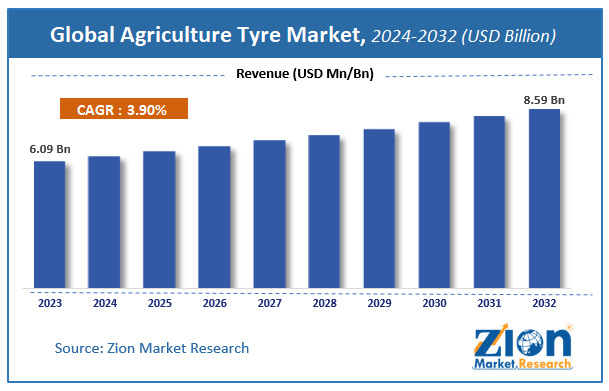

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.09 Billion | USD 8.59 Billion | 3.9% | 2023 |

Agriculture Tyre Market Size

According to Zion Market Research, the global Agriculture Tyre Market was worth USD 6.09 Billion in 2023. The market is forecast to reach USD 8.59 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.9% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Agriculture Tyre Market industry over the next decade.

Global Agriculture Tyre Market: Overview

Agriculture tyres are usually built with robust shoulder walls and are made of high-density, wear-resistant compounds. It allows the tyres last longer on the track, allowing a multipurpose use of the vehicle. However, it is important to take note of the application of the vehicle when buying agriculture tractor tyres. There are various types of tractor tyres for transportation and agricultural use. Tractor tyres, for farm use, cannot offer as much mileage as tractor tyres, for transportation and road use.

Tractor tyre for agriculture normally last longer than the typical car or bike tyre. However, with certain precautionary measures and tests, users can get more mileage out of agriculture purpose tyres and thus save on long-term maintenance costs. The regular test of the air pressure of the tractor tyres – front and back is also an important factor. Maintaining perfect air pressure helps prevent rough road wear outs and improves the fuel efficiency of the agricultural vehicle.

One of the big concerns that end users face is to distinguish between the prices of different agricultural tyre brands. Consumers are confused whether to invest in expensive quality agricultural tyres or go for low-end tyres that are affordable. The agricultural tyre industry is largely consolidated, with key players accounting for more than 45 per cent of the market share. As the rest of the market share is controlled by emerging and other fragmented players, many unscrupulous agricultural tyre manufacturers offer discount rate agricultural tyres produced from low-quality raw materials to customers. Prominent market players are therefore educating clients about the construction of casings and listings of high-tech agricultural tyres in order to increase their market uptake.

In addition, beneficial characteristics such as cross-stabilizing ply and durable sidewalls in high-end agricultural tyres build consumer value.

Global Agriculture Tyre Market: Growth Factors

Rising mechanization in agriculture in the Middle East and Africa and Latin America regions is anticipated to raise the agricultural tyre demand in these regions. Financial assistance and subsidies from government bodies and food organizations, such as the Food and Agriculture Organization (FAO), is encouraging the demand for agricultural tractors in developing economies, thereby propelling the agricultural tyre demand in these countries.

Previously, tractors were used for basic applications such as plowing and tilling. Tractors are currently engaged in a number of activities, such as harvesting, fertilizer spreader, and irrigation. Thus, more advanced tyres, with wider rim sizes, are typically used today, which tend to be more expensive as they are less common. The largest agricultural tyre had a diameter of 243 inches until 2009, but tyre manufacturers now sell sizes as wide as 256 inches. In terms of sales, the overall rise in the size of the tyre has fueled the price of the tyre and is, in turn, stimulating the market. Overall, there is a high demand for rugged and economical all-round tyres and tyre for winter and other demanding conditions.

Intelligent hybrid tyres are a new introduction to the agricultural tyre industry. Manufacturers are growing their R&D activities to incorporate pressure sensors into tyres, allowing the operator to minimize field soil compaction and reduce road wear. Hybrid agricultural tyres allow the operator to change the pressure according to the task efficiently.

The agricultural tyre market is projected to grow at a favorable CAGR of 4.98% during the forecast period. The ever-evolving nature of the agricultural industry, however, poses extra challenges for businesses in the tyre market. Therefore, companies cooperate with producers of tractors and farm equipment to fulfill particular end-user specifications.

The price of raw materials such as natural rubber and Brent crude is primarily determined by the manufacturing cost of the tyre. Market price instability has a negative effect on the manufacturers of tyres.

Impact due to the outbreak of COVID-19

As firms in the agricultural tyre industry were gaining confidence in 2020 after overcoming trade tensions and adverse weather in 2019, which hindered rubber planting and harvesting activities across North America, the outbreak of COVID-19 (coronavirus) caused further disruption in the business environment. Apollo Tyres Ltd., an Indian tyre manufacturing company, on the other hand, is scaling down its passenger vehicle operation and is concentrating now on the sales of agricultural tyres in the Netherlands, Europe.

Manufacturers comply with the rules set out in the local health advisory to conduct their development activities during the COVID-19 period. Several production units are temporarily halted to flatten the COVID-19 curve. Meanwhile, companies in the agricultural tyre industry are making efforts to determine market conditions in order to re-open their manufacturing facilities.

Global Agriculture Tyre Market: Segmentation

On the basis of application, the global agricultural tyre market is divided into tractors, harvesters, irrigation and others. In 2023, the tractor segment held a leading share of the global agricultural tyre market due to the growth in commercial farming and government initiatives. The irrigation segment is expected to grow at a fastest rate due to the growth in pivot irrigation that drive the market for irrigation tyres.

In terms of tyre type, the bias tyres segment dominated the global agricultural tyre market. Radial tyres had the highest presence in Europe and had a relatively limited market share in Asia-Pacific, Latin America and the Middle East and Africa in 2023. Developing regions such as Asia-Pacific, Latin America, and the Middle East and Africa are cost sensitive economies, so customers are not choosing expensive radial tyres. Declining raw material prices, cost of production and increased consumer purchasing power are anticipated to fuel demand for radial tyres in these developing regions.

Based on sales channel, the agricultural tyre industry is categorized into OEM and aftermarket. The aftermarket segment maintained a leading global market share in 2023 due to the nature of wear and tear of the tyre and the need for regular maintenance. The OEM segment is expected to expand due to the increase in sales of tractors and agricultural equipment in Latin America & Middle East & Africa during the projected timeline.

Agriculture Tyre Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agriculture Tyre Market |

| Market Size in 2023 | USD 6.09 Billion |

| Market Forecast in 2032 | USD 8.59 Billion |

| Growth Rate | CAGR of 3.9% |

| Number of Pages | 110 |

| Key Companies Covered | Balkrishna Industries Limited (BKT), China National Rubber Tire Co., Continental AG, Bridgestone Corporation, MICHELIN, Mitas, Pirelli & C. S.p.A., Trelleborg AB, Sumitomo Rubber Industries Ltd., and Titan International, Inc among others |

| Segments Covered | By Application, By Tyre Type, By Sales Channel, By End user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Agriculture Tyre Market: Regional Analysis

By Geography, the agriculture tyre market is segmented into North America, Europe, Latin America, Asia Pacific, and Middle East and Africa.

Asia Pacific held a significant share of the global agricultural tyre market in 2019, with China and India making a big contribution. China and India together account for many tractors used globally. They therefore offer major opportunities for agricultural tyres. The availability of key raw materials such as natural rubber, low-cost labor and strong domestic demand for tyres has enabled the emergence and expansion of key players in the region.

Asia Pacific is followed by North America and Europe in terms of global market share, with the United States, France, Germany, Turkey, and Italy, making a significant contribution to the region. The agricultural tyre market in these regions is projected to expand with a rise in population and an increasing mechanization rate, fueling the use of tractors, thereby, driving the demand for agricultural tyre.

Global Agriculture Tyre Market: Competitive Players

- Balkrishna Industries Limited (BKT)

- China National Rubber Tire Co.

- Continental AG

- Bridgestone Corporation

- MICHELIN

- Mitas

- Pirelli & C. S.p.A.

- Trelleborg AB

- Sumitomo Rubber Industries Ltd.

- Titan International

The report segment of global agriculture tyre market are as follows:

Global Agriculture Tyre Market: Type Segment Analysis

- Bias

- Radial

Global Agriculture Tyre Market: Sales Channel Segment Analysis

- OEM

- Aftermarket

Global Agriculture Tyre Market: Application Segment Analysis

- Harvesters

- Tractors

- Irrigation

- Others

Global Agriculture Tyre Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The expansion of the agriculture tyre market is driven by increased mechanization in farming, growing demand for high-efficiency equipment, and advancements in tyre technology, such as enhanced durability and traction for various agricultural applications.

According to Zion Market Research, the global Agriculture Tyre Market was worth USD 6.09 Billion in 2023. The market is forecast to reach USD 8.59 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.9% during the forecast period 2024-2032.

Asia-Pacific has been leading the Agriculture Tyre Market and is anticipated to continue on the dominant position in the years to come.

The major players in the global agriculture tyre market include Balkrishna Industries Limited (BKT), China National Rubber Tire Co., Continental AG, Bridgestone Corporation, MICHELIN, Mitas, Pirelli & C. S.p.A., Trelleborg AB, Sumitomo Rubber Industries Ltd., and Titan International, Inc among others.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed