Aircraft Interior Decoration Materials Market Size, Share, Growth Report 2032

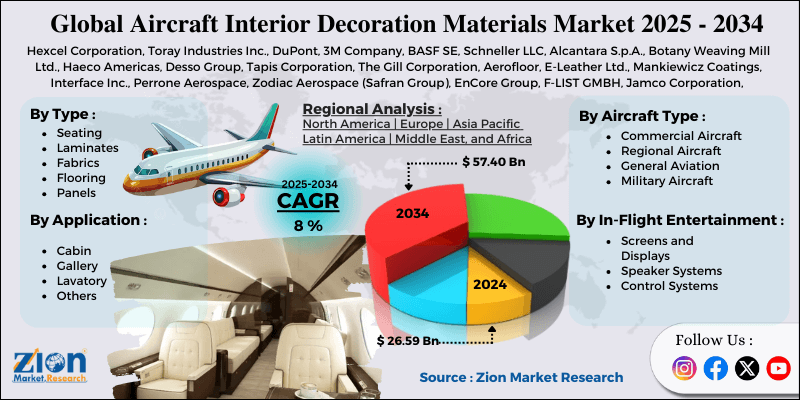

Aircraft Interior Decoration Materials Market By Type (Seating, Laminates, Fabrics, Flooring, Panels, and Others), By In-Flight Entertainment (Screens And Displays, Speaker Systems, and Control Systems), By Aircraft Type (Commercial Aircraft, Regional Aircraft, General Aviation, and Military Aircraft), By Application (Cabin, Galley, Lavatory, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

Aircraft Interior Decoration Materials Industry Prospective:

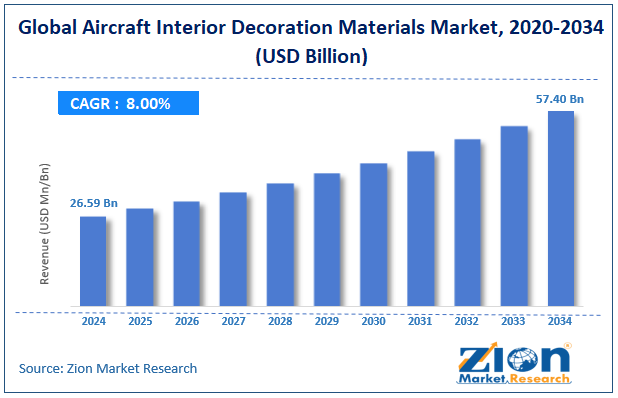

The global aircraft interior decoration materials market was valued at approximately USD 26.59 billion in 2024 and is expected to reach around USD 57.40 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 8.00% between 2025 and 2034.

Aircraft Interior Decoration Materials Market: Overview

Aircraft interior materials are a wide range of products that enhance cabin looks, functionality, and passenger comfort while meeting aviation safety standards. These materials include specialty textiles, lightweight composites, engineered plastics, sustainable laminates, technical leathers, and advanced polymer systems used in seats, wall panels, overhead bins, galleys, lavatories, and flooring.

Modern aircraft interiors balance multiple performance characteristics like low smoke density, low toxicity, durability, weight reduction, and antimicrobial properties. The market serves aircraft manufacturers (OEMs), maintenance and refurbishment companies, and airlines with cabin upgrade programs. Interior materials are key to airline brand differentiation and passenger experience initiatives.

The growing emphasis on passenger comfort, increasing aircraft deliveries, cabin retrofit activities, and advancements in sustainable material technologies are expected to drive substantial growth in the aircraft interior decoration materials industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft interior decoration materials market is estimated to grow annually at a CAGR of around 8.00% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft interior decoration materials market size was valued at around USD 26.59 billion in 2024 and is projected to reach USD 57.40 billion by 2034.

- The aircraft interior decoration materials market is projected to grow significantly due to the rising demand for modular cabin designs, expanding premium economy and business class, increasing adoption of antimicrobial materials, and growing focus on noise-reduction technologies.

- Based on material type, fabrics, and laminates lead the market and will continue to dominate the global market.

- Based on in-flight entertainment, screens, and displays are expected to lead the market during the forecast period.

- Based on aircraft type, commercial aircraft are anticipated to command the largest market share.

- Based on application, cabin interiors are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aircraft Interior Decoration Materials Market: Growth Drivers

Passenger experience enhancement and airline brand differentiation

The global aircraft interior decoration materials market is experiencing growth driven by airlines' strategic focus on improving passenger experience and enhancing brand identity through distinct cabin designs. Major carriers allocate significant portions of their expenditure budgets toward cabin refreshes, creating demand for innovative interior materials.

Industry reports have shown that unique cabin design and comfort features can influence passenger airline choice, with frequent flyers considering the cabin environment when booking long-haul flights. This competitive landscape has led to investment in unique material applications, custom finishes, and signature design elements that reflect airline brand values while ensuring passenger comfort during flight.

Technological advancements in lightweight and sustainable materials

Innovation in the aircraft interior decoration materials has improved both performance characteristics and environmental sustainability. These weight savings directly impact aircraft fuel efficiency, with industry estimates suggesting that one kilogram reduced from aircraft weight saves approximately 3,000 liters of fuel over the lifetime of a commercial aircraft.

Meanwhile, major material suppliers have developed bio-based alternatives with natural fibers, recycled content, and renewable polymers that reduce environmental impact while meeting aviation safety standards. These developments drive growth as they deliver solutions for operational efficiency and airline and aircraft manufacturer sustainability commitments.

Aircraft Interior Decoration Materials Market: Restraints

Stringent regulatory requirements and certification processes

Despite the growing demand, the aircraft interior materials industry faces significant challenges regarding the extensive regulatory compliance requirements and the long certification process.

All cabin materials must meet rigorous flammability, smoke emission, and toxicity standards established by aviation authorities, including the Federal Aviation Administration (FAA), the European Union Aviation Safety Agency (EASA), and others. Qualification cycles for new materials take 12-18 months of testing and documentation before approval for commercial aircraft use. These include vertical burn tests, heat release rate measurements, smoke density evaluations, and toxicity assessments.

The complexity and duration of these approval processes create big barriers to entry for new materials and increase development costs. Material suppliers must navigate different regional certification requirements while ensuring consistent performance across various operating conditions, limiting the speed of innovation implementation despite the potential performance or sustainability benefits.

Aircraft Interior Decoration Materials Market: Opportunities

Growing demand for antimicrobial and self-cleaning surfaces

The aircraft interior decoration materials industry is witnessing new opportunities by developing surfaces with antimicrobial, self-cleaning, and hygiene-enhancing properties. Airlines report increasing passenger concerns regarding cabin cleanliness and surface hygiene, with travelers citing it as a significant consideration in post-pandemic travel decisions.

Material suppliers have responded by developing polymer systems and surface treatments with silver ion technology, photocatalytic compounds, and special additives that inhibit bacterial and viral growth on high-touch surfaces. Early implementations have shown a 99.9% reduction in microbiological contamination on tray tables, armrests, and lavatory surfaces.

Aircraft Interior Decoration Materials Market: Challenges

Supply chain complexity and material qualification consistency

The aircraft interior decoration materials market faces challenges with complex global supply chains and maintaining material performance across manufacturing locations. This complexity creates quality control issues, potential bottlenecks, and regional disruptions. Material qualifications are specific to exact formulations and manufacturing processes and require rigorous change management protocols to limit manufacturing flexibility.

Aerospace-grade decorative materials are specialized with limited qualified suppliers for specific categories, which adds to supply chain resilience. Industry reports state that material specification changes or supplier transitions take 6-9 months of validation testing and documentation to be compliant.

Aircraft Interior Decoration Materials Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Interior Decoration Materials Market |

| Market Size in 2024 | USD 26.59 Billion |

| Market Forecast in 2034 | USD 57.40 Billion |

| Growth Rate | CAGR of 8.00% |

| Number of Pages | 212 |

| Key Companies Covered | Hexcel Corporation, Toray Industries Inc., DuPont, 3M Company, BASF SE, Schneller LLC, Alcantara S.p.A., Botany Weaving Mill Ltd., Haeco Americas, Desso Group, Tapis Corporation, The Gill Corporation, Aerofloor, E-Leather Ltd., Mankiewicz Coatings, Interface Inc., Perrone Aerospace, Zodiac Aerospace (Safran Group), EnCore Group, F-LIST GMBH, Jamco Corporation, Innovint Aircraft Interior GmbH, FACC AG, and others. |

| Segments Covered | By Type, By In-Flight Entertainment, By Aircraft Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Interior Decoration Materials Market: Segmentation

The global aircraft interior decoration materials market is segmented into type, in-flight entertainment, aircraft type, application, and region.

Based on type, the market is segregated into seating, laminates, fabrics, flooring, panels, and others. Fabrics and laminates lead the market due to their extensive use across multiple interior applications and their significant influence on cabin aesthetics and passenger comfort.

Based on in-flight entertainment, the aircraft interior decoration materials industry is segmented into screens and displays, speakers, and control systems. Screens and displays are expected to lead the market due to increasing demand for high-resolution entertainment systems, rising passenger expectations for personalized content, and continuous upgrades by airlines to enhance the in-flight experience.

Based on aircraft type, the aircraft interior decoration materials market is divided into commercial aircraft, regional aircraft, general aviation, and military aircraft. Commercial aircraft are expected to lead the market during the forecast period due to their larger cabin volumes, more frequent interior refreshes, and growing global fleet size.

Based on application, the market is categorized into cabin, galley, lavatory, and others. Cabin interiors are expected to lead the market due to their larger surface area requirements and significant impact on passenger experience and airline branding.

Aircraft Interior Decoration Materials Market: Regional Analysis

North America to lead the market

North America leads the global aircraft interior decoration materials market due to its concentration of major aircraft manufacturers, interior completion centers, and the strong presence of material innovation hubs. The U.S. accounts for around 35% of the global market share, driven by Boeing’s commercial aircraft production, numerous business jet manufacturers, and the presence of major airline headquarters that lead interior design.

North America leads in advanced material development through significant research and development investments and collaboration between material scientists, design studios, and certification authorities.

The region has an established aerospace supply chain infrastructure to rapidly introduce new materials and finishes and a mature airline industry that drives regular cabin refresh cycles. These factors collectively strengthen North America's position as the primary market for premium aircraft interior decoration materials across commercial and business aviation segments.

Asia Pacific is set to grow significantly.

Asia Pacific represents the fastest-growing region in the aircraft interior decoration materials industry, driven by expanding commercial aviation activity, increasing aircraft deliveries to regional carriers, and growing domestic manufacturing capabilities.

Countries like China, Japan, and Singapore are investing heavily in aerospace manufacturing infrastructure, including interior components. The rising middle class in India, China, and Southeast Asia drives air travel growth, and airlines invest in aesthetic cabins.

Government initiatives supporting aerospace manufacturing development create domestic and international material supplier opportunities. The combination of aircraft deliveries, expanding maintenance and retrofit facilities, and growing passenger demand for a premium travel experience create a good growth environment for this region.

Recent Market Developments:

- In April 2025, Safran participated in the annual Aircraft Interiors Expo (or AIX) in Hamburg, Germany, where it showcased its extensive product range, earning its 16th Crystal Cabin Award.

- In April 2025, Insperial announced its acquisitions of the MGR Foamtex and Airline Graphics brands at Aircraft Interiors Expo 2025.

Aircraft Interior Decoration Materials Market: Competitive Analysis

The global aircraft interior decoration materials market is led by players like:

- Hexcel Corporation

- Toray Industries Inc.

- DuPont

- 3M Company

- BASF SE

- Schneller LLC

- Alcantara S.p.A.

- Botany Weaving Mill Ltd.

- Haeco Americas

- Desso Group

- Tapis Corporation

- The Gill Corporation

- Aerofloor

- E-Leather Ltd.

- Mankiewicz Coatings

- Interface Inc.

- Perrone Aerospace

- Zodiac Aerospace (Safran Group)

- EnCore Group

- F-LIST GMBH

- Jamco Corporation

- Innovint Aircraft Interior GmbH

- FACC AG

The global aircraft interior decoration materials market is segmented as follows:

By Type

- Seating

- Laminates

- Fabrics

- Flooring

- Panels

- Others

By In-Flight Entertainment

- Screens and Displays

- Speaker Systems

- Control Systems

By Aircraft Type

- Commercial Aircraft

- Regional Aircraft

- General Aviation

- Military Aircraft

By Application

- Cabin

- Gallery

- Lavatory

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aircraft interior materials are a wide range of products that enhance cabin looks, functionality, and passenger comfort while meeting aviation safety standards.

The aircraft interior decoration materials market is expected to be driven by increasing aircraft deliveries, passenger demand for enhanced comfort, airline brand differentiation strategies, sustainability initiatives, advancements in lightweight materials, and growing retrofit activities across global fleets.

According to our study, the global aircraft interior decoration materials market was worth around USD 26.59 billion in 2024 and is predicted to grow to around USD 57.40 billion by 2034.

The CAGR value of the aircraft interior decoration materials market is expected to be around 8.00% during 2025-2034.

The global aircraft interior decoration materials market will register the highest growth in North America during the forecast period.

Key players in the aircraft interior decoration materials market include Hexcel Corporation, Toray Industries, Inc., DuPont, 3M Company, BASF SE, Schneller LLC, Alcantara S.p.A., Botany Weaving Mill Ltd., Haeco Americas, Desso Group, Tapis Corporation, The Gill Corporation, Aerofloor, E-Leather Ltd., Mankiewicz Coatings, Interface, Inc., Perrone Aerospace, Zodiac Aerospace (Safran Group), EnCore Group, F-LIST GMBH, Jamco Corporation, Innovint Aircraft Interior GmbH, and FACC AG.

The report comprehensively analyzes the aircraft interior decoration materials market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving aviation industry needs shaping the interior materials ecosystem.

Choose License Type

List of Contents

Aircraft Interior Decoration MaterialsIndustry Prospective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisRecent Market Developments:Competitive AnalysisThe global aircraft interior decoration materials market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed