Alumina Market Size, Share, Trends, Growth and Forecast 2034

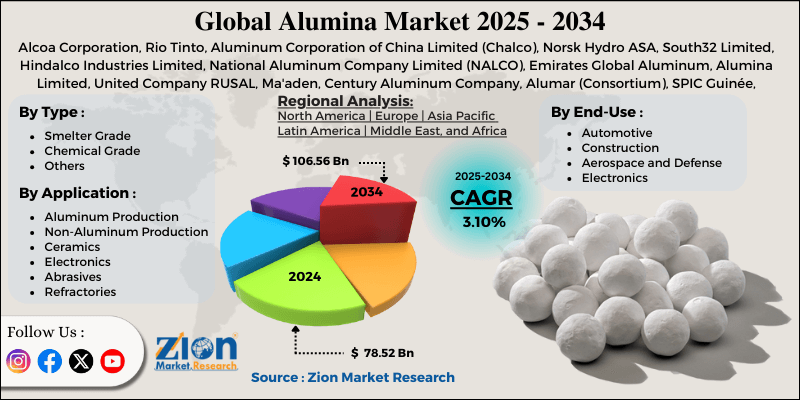

Alumina Market By Type (Smelter Grade, Chemical Grade, and Others), By Application (Aluminum Production, Non-Aluminum Production, Ceramics, Electronics, Abrasives, Refractories, and Others), By End-Use Industry (Automotive, Construction, Aerospace and Defense, Electronics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

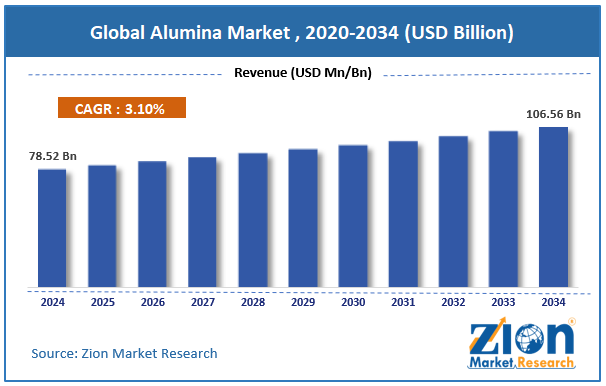

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 78.52 Billion | USD 106.56 Billion | 3.10% | 2024 |

Alumina Industry Prospective:

The global alumina market was valued at approximately USD 78.52 billion in 2024 and is expected to reach around USD 106.56 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 3.10% between 2025 and 2034.

Alumina Market: Overview

Alumina, or aluminum oxide (Al₂O₃), is a versatile industrial material derived from bauxite ore through the Bayer process, serving as the primary feedstock for aluminum metal production and numerous specialty applications. This white crystalline powder comes in many forms, but alpha alumina is the most thermodynamically stable and is used across industries.

Beyond its role in aluminum smelting, alumina’s properties – high hardness, good thermal conductivity, electrical insulation, and chemical stability at high temperatures – make it critical for ceramics, refractories, electronics, catalysts, and abrasives. The alumina supply chain includes mining, refining, and specialty manufacturing facilities that produce the material in various grades for different industrial applications.

The growing demand for lightweight materials in transportation, increased use of alumina in advanced ceramics for electronics, and the shift toward eco-friendly refining processes are expected to drive substantial growth in the alumina industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global alumina market is estimated to grow annually at a CAGR of around 3.10% over the forecast period (2025-2034)

- In terms of revenue, the global alumina market size was valued at around USD 78.52 billion in 2024 and is projected to reach USD 106.56 billion by 2034.

- The alumina market is projected to grow significantly due to rising aluminum consumption in the automotive and packaging industries, expanding alumina applications in lithium-ion batteries, and increasing demand from the refractories segment in the steel and cement sectors.

- Based on type, smelter-grade alumina leads the segment and will continue to lead the global market.

- Based on application, aluminum production is anticipated to command the largest market share.

- Based on the end-use industry, construction is expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Alumina Market: Growth Drivers

Growing aluminum demand in the transportation and packaging industries

The alumina market is growing fast as aluminum demand in the transportation and packaging sectors is accelerating for lightweight, sustainable materials. Automotive manufacturers have increased aluminum content in vehicles over the last decade to improve fuel efficiency and reduce emissions. Each kilogram of aluminum replacing heavier materials in vehicles reduces CO₂ emissions by 20kg over the vehicle's lifespan.

Simultaneously, the packaging industry has expanded aluminum usage due to its infinite recyclability and barrier properties, with beverage can production increasing annually in developing markets. This directly impacts alumina demand, as 1.9 tons of alumina are required to produce 1 ton of aluminum metal.

The combination of vehicle emissions regulations, consumer preference for sustainable packaging, and the performance benefits of aluminum will continue to drive alumina consumption growth globally.

Technological advancements in specialty alumina applications

Innovation in the alumina industry has opened up high-value applications beyond traditional metallurgical uses. Specialty alumina grades with precise particle size distribution, surface chemistry, and crystalline structure have enabled electronics, energy storage, and advanced manufacturing breakthroughs.

High-purity alumina with controlled microstructure is now a critical component in semiconductor manufacturing, LED substrates, and lithium-ion battery separators, where it provides key performance characteristics. Nanotechnology and surface modification have created aluminum oxide materials with enhanced properties for catalysts, adsorbents, and biomedical applications.

Alumina Market: Restraints

Energy-intensive production process and environmental concerns

Despite the growing demand, the alumina market faces significant challenges due to its energy-intensive production process and environmental impacts. The Bayer process to convert bauxite to alumina consumes 7-14 GJ of energy per ton produced. It also generates a lot of red mud, a highly alkaline waste material produced at a ratio of 1-1.5 tons per ton of alumina.

Managing this waste creates environmental challenges and compliance costs for producers. These factors pressure alumina economics and sustainability profiles, particularly as carbon pricing mechanisms expand globally.

Alumina Market: Opportunities

Red mud valorization and circular economy initiatives

The alumina market is witnessing expanding opportunities through innovative approaches to bauxite residue (red mud) valorization and integration into circular economy frameworks. New technologies can extract valuable components from red mud, including rare earth elements, iron oxides, titanium compounds, and construction materials.

Early trials have shown successful recovery of scandium and gallium, both critical elements for advanced electronics and clean energy technologies. Modified red mud formulations also show promise as supplementary cementitious materials, soil amendments, and catalysts.

These applications turn waste into a co-product, improving sustainability and creating new revenue streams. Integrating these resource recovery approaches is a significant growth opportunity; early adopters will get a competitive advantage through reduced waste management costs, better environmental performance, and access to new markets for recovered materials.

Alumina Market: Challenges

Price volatility and supply chain disruptions

The alumina industry faces persistent challenges related to price volatility and vulnerability to supply chain disruptions affecting production stability and cost predictability.

Alumina prices have experienced 30-70% fluctuations within a year due to factors including production curtailments, environmental regulatory changes, energy cost variations, and transportation disruptions. The concentration of bauxite reserves in a few countries – Australia, Guinea, Brazil, Jamaica, and China- accounts for 75% of global production and creates geopolitical supply risks.

The energy-intensive nature of alumina refining makes production economics very sensitive to changes in power costs. These factors make long-term planning for producers and consumers difficult and affect investment decisions and contracting strategies. The industry has to navigate these challenges through diversified sourcing and strategic inventory to mitigate the impact of disruption while maintaining customer supply relationships.

Alumina Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alumina Market |

| Market Size in 2024 | USD 78.52 Billion |

| Market Forecast in 2034 | USD 106.56 Billion |

| Growth Rate | CAGR of 3.10% |

| Number of Pages | 211 |

| Key Companies Covered | Alcoa Corporation, Rio Tinto, Aluminum Corporation of China Limited (Chalco), Norsk Hydro ASA, South32 Limited, Hindalco Industries Limited, National Aluminum Company Limited (NALCO), Emirates Global Aluminum, Alumina Limited, United Company RUSAL, Ma'aden, Century Aluminum Company, Alumar (Consortium), SPIC Guinée, China Hongqiao Group, Hangzhou Jinjiang Group, CVG Bauxilum, PT Indonesia Chemical Alumina, Vedanta Resources Limited, and others. |

| Segments Covered | By Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Alumina Market: Segmentation

The global alumina market is segmented into type, application, end-use industry, and region.

Based on type, the market is segregated into smelter grade, chemical grade, and others. Smelter-grade alumina leads the market due to its essential role as the primary feedstock for aluminum metal production, which remains the dominant application by volume.

Based on application, the market is divided into aluminum production, non-aluminum production, ceramics, electronics, abrasives, refractories, and others. Aluminum production is expected to lead the market due to the high demand for alumina as a primary raw material in smelting processes, particularly driven by the global growth of the automotive, construction, and packaging industries.

Based on the end-use industry, the alumina industry is categorized into automotive, construction, aerospace and defense, electronics, and others. Construction is expected to lead the market during the forecast period due to substantial global aluminum consumption in building systems, infrastructure projects, and architectural applications.

Alumina Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific is the largest alumina market due to its high concentration of aluminum production capacity, bauxite reserves, and large consumer base for finished aluminum products. It accounts for about 60% of the global market share, driven by China’s alumina refining and aluminum smelting dominance.

The region has grown at an average annual rate of 6-8% over the last 10 years, much faster than other regions. Investments in refining technology and capacity in China, Indonesia, and Malaysia have strengthened the region’s production capabilities.

The region’s strategic position in the global aluminum supply chain and rapidly growing domestic consumption of aluminum products in transportation, construction, and consumer goods sectors have further cemented Asia Pacific’s position in the worldwide alumina market.

The ongoing shift toward green aluminum production and energy-efficient refining practices across key countries in the Asia Pacific is further enhancing the region’s competitive advantage in the global alumina market.

The Middle East is set to grow significantly.

The Middle East is one of the fastest-growing alumina markets, driven by investments in aluminum value chain integration, energy economics, and industrial diversification. Countries like Saudi Arabia, UAE, and Bahrain have built world-class aluminum production facilities and are moving upstream into alumina refining to secure supply chains.

The region’s alumina refining capacity is expected to grow 8-10% annually until 2034, much faster than the global average. Government initiatives supporting industrial development and leveraging natural resources have created a conducive environment for long-term growth.

The region has access to cheap energy, a strategic location between European and Asian markets, and a commitment to industrial diversification beyond petrochemicals, which provides natural advantages for alumina and aluminum value chain development as global producers look for energy-efficient production locations.

The entry of global aluminum players through joint ventures and long-term supply agreements further accelerates the Middle East’s emergence as a key hub for alumina refining and integrated aluminum production.

Recent Market Developments:

- In March 2025, Hindalco Industries, a flagship company of the Aditya Birla Group, unveiled plans to invest ₹45,000 crores (approximately $5.4 billion) across its aluminum, copper, and specialty alumina businesses.

- In March 2025, Russian aluminum producer Rusal agreed to acquire a 26% stake in Pioneer Aluminum Industries Limited, an Indian alumina refinery owner, for $243.75 million.

Alumina Market: Competitive Analysis

The global alumina market is led by players like:

- Alcoa Corporation

- Rio Tinto

- Aluminum Corporation of China Limited (Chalco)

- Norsk Hydro ASA

- South32 Limited

- Hindalco Industries Limited

- National Aluminum Company Limited (NALCO)

- Emirates Global Aluminum

- Alumina Limited

- United Company RUSAL

- Ma'aden

- Century Aluminum Company

- Alumar (Consortium)

- SPIC Guinée

- China Hongqiao Group

- Hangzhou Jinjiang Group

- CVG Bauxilum

- PT Indonesia Chemical Alumina

- Vedanta Resources Limited

The global alumina market is segmented as follows:

By Type

- Smelter Grade

- Chemical Grade

- Others

By Application

- Aluminum Production

- Non-Aluminum Production

- Ceramics

- Electronics

- Abrasives

- Refractories

- Others

By End-Use Industry

- Automotive

- Construction

- Aerospace and Defense

- Electronics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Alumina, or aluminum oxide (Al₂O₃), is a versatile industrial material derived from bauxite ore through the Bayer process, serving as the primary feedstock for aluminum metal production and numerous specialty applications.

The alumina market is expected to be driven by increasing aluminum consumption in transportation and packaging, growing construction activity, technological advancements in specialty alumina applications, sustainability initiatives, and expanding demand from emerging economies.

According to our study, the global alumina market was worth around USD 78.52 billion in 2024 and is predicted to grow to around USD 106.56 billion by 2034.

The CAGR value of the alumina market is expected to be around 3.10% during 2025-2034.

The global alumina market will register the highest growth in Asia Pacific during the forecast period.

Key players in the alumina market include Alcoa Corporation, Rio Tinto, Aluminum Corporation of China Limited (Chalco), Norsk Hydro ASA, South32 Limited, Hindalco Industries Limited, National Aluminum Company Limited (NALCO), Emirates Global Aluminum, Alumina Limited, United Company RUSAL, Ma'aden, Century Aluminum Company, Alumar (Consortium), SPIC Guinée, China Hongqiao Group, Hangzhou Jinjiang Group, CVG Bauxilum, PT Indonesia Chemical Alumina, and Vedanta Resources Limited.

The report comprehensively analyzes the alumina market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, sustainability initiatives, and the evolving industrial applications shaping the alumina ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed