Aluminium Foil Packaging Market Size, Share, Growth, Forecast 2032

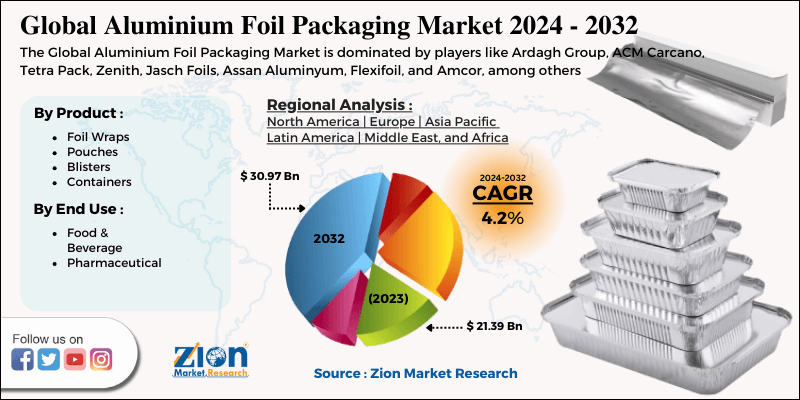

Aluminium Foil Packaging Market by Product (Foil Wraps, Pouches, Blisters and Containers), By End Use (Food & Beverage and Pharmaceutical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

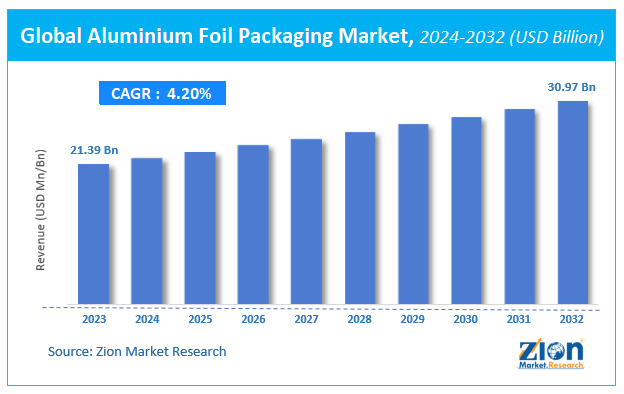

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.39 Billion | USD 30.97 Billion | 4.2% | 2023 |

Aluminium Foil Packaging Market Size

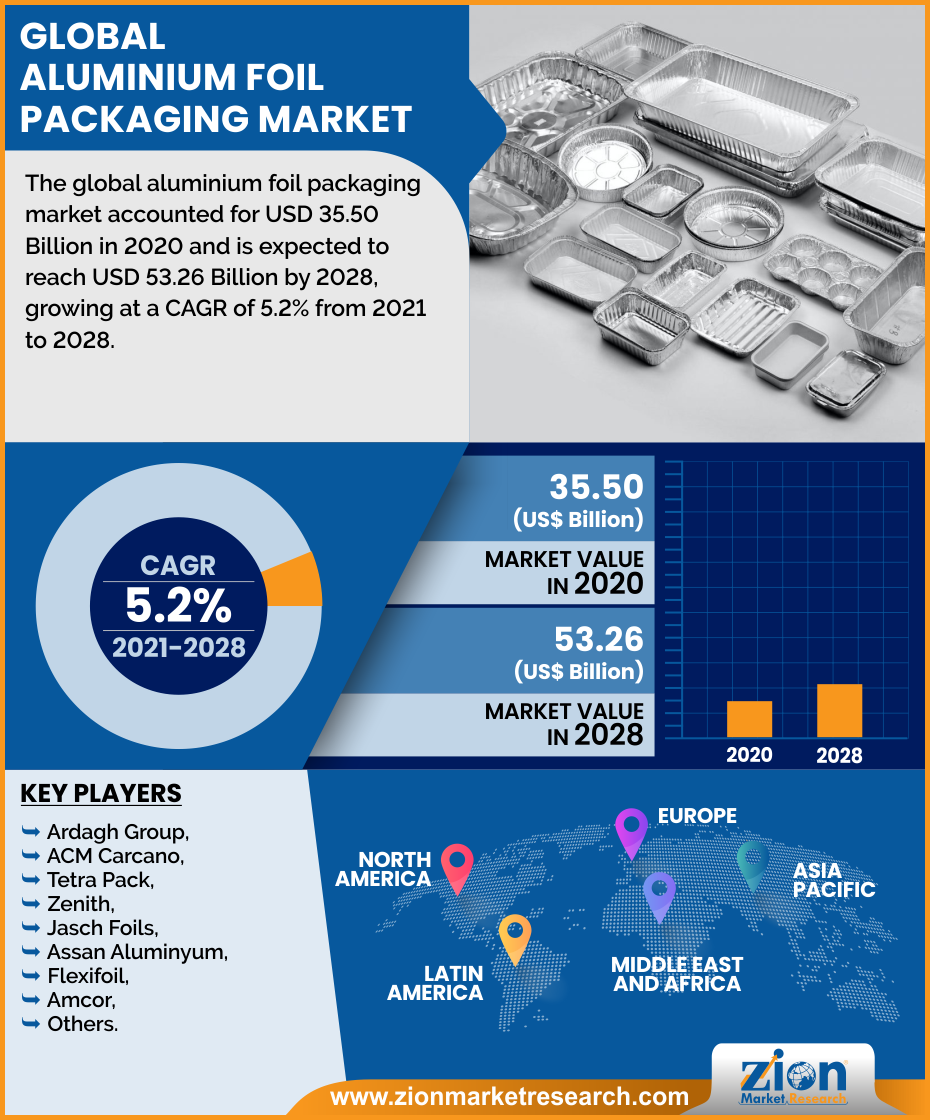

According to a report from Zion Market Research, the global Aluminium Foil Packaging Market was valued at USD 21.39 Billion in 2023 and is projected to hit USD 30.97 Billion by 2032, with a compound annual growth rate (CAGR) of 4.2% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Aluminium Foil Packaging Market industry over the next decade.

Aluminium Foil Packaging Market: Overview

Aluminium is extracted from bauxite ore, which is the third most abundant element in the Earth's crust. The majority of aluminium produced is used in packaging. Furthermore, pure aluminium is widely used in the packaging industry. However, there have been an increasing number of attempts to create alloys through modifications that could reduce thickness while increasing overall strength. The food and packaging industries benefit from aluminium foil in a variety of ways. Food items can be heated or frozen directly in the foil container.

Aluminium foil packaging is a type of flexible packaging material that is typically made from aluminium sheets. For packaging purposes, aluminium foil can be wrapped around any product. Regular casting and cold calling are used to create it. Aluminium foil packaging is a type of packaging that creates a protective barrier to protect food, beverages, cosmetics, and pharmaceuticals while also reducing waste. Aluminium is a corrosion-resistant and chemically inert material.

COVID-19 Impact Analysis

COVID-19 had a significant impact on most major industries due to an unexpected drop in demand and supply due to global lockdowns. In a few countries, demand for aluminium foil packaging products has shown a sharp V-shaped and U-shaped recovery. Few industries, such as the pharmaceutical and ready-to-eat food industries, have seen positive growth during lockdowns, creating demand for aluminium foil packaging products such as lids, laminated tubes, and blisters, to name a few. Dairy products, such as butter, cheese, and margarine, are packaged using aluminium foil coated with water-based latex and greaseproof paper. To keep chilled beverages fresh, composite containers made of aluminium foil are gaining popularity. Furthermore, rising demand for pharmaceutical products due to an increase in disease prevalence, as well as the imposition of plastic bans in several countries, are driving the market growth. Aside from that, manufacturers are utilizing aseptic packaging to maintain the sterility of products due to growing concerns about the spread of the coronavirus disease (COVID-19) through packaging surfaces, which is expected to drive the market even further. The global aluminium foil packaging market is expected to grow at a moderate rate over the next five years, according to the publisher.

Aluminium Foil Packaging Market: Growth Factors

The rising use of aluminium foil packaging in a variety of end-use industries, such as food and beverage, pharmaceuticals, tobacco, cosmetics, and electronics, is expected to boost the market growth. Aluminium is abundant on the planet and is completely recyclable. The major growth drivers are the persistent rise in demand for food and snacks from online food channels, as well as the ever-increasing demand in the pharmaceutical sector.

During the forecast period, robust economic growth, combined with a growing middle population and rising personal disposable income, is expected to accelerate the growth of the global aluminium foil packaging market. The shift in lifestyle, which includes a shift in eating habits, has resulted in a rise in packaging demand. Robust demand for aluminium foil packaging in the snack and chocolate industries is also supporting the global growth of the aluminium foil packaging market. Technological advancements to improve product quality, plant loss reduction, inclination in the obtainability of foils in various forms for critical mass consumption applications, and progress in the exportability of aluminium foils are some of the major opportunities in the global aluminium foil packaging market.

Aluminium Foil Packaging Market: Segmentation

Product Segment Analysis Preview

Foil wrappers account for a significant portion of the market. Over the forecast period, the food, tobacco, and cosmetics industries are expected to be the primary drivers of aluminium foil wraps' growth. During the review period, the global cigarette market grew steadily, and this trend is expected to continue over the forecast period as the next generation of tobacco and nicotine products, such as e-cigarettes, become more widely available. According to data released by British American Tobacco, approximately 5,600 billion cigarettes are consumed worldwide each year. Certain characteristics of an aluminium foil wrap, such as dead fold and embosses ability, are not available with other packaging materials. Aluminium foil's unique barrier properties have been identified as a way to protect tobacco products from moisture, deterioration, aroma transmission, and bacteria by maintaining a micro-climate in the package. Over the forecast period, an increase in the tobacco industry is expected to push the adoption of aluminium foil wraps proportionately.

End Use Segment Analysis Preview

The primary end-use industries in the market are food and beverages and pharmaceuticals. The product is used for a variety of packaging solutions in the food and beverage industry, including foil wraps, pouches, blisters, and containers. Rising disposable income, combined with busy lifestyles, has resulted in increased demand for ready-to-eat foods and beverages, boosting product demand.

Over the forecast period, the pharmaceutical end-user industry segment is expected to grow at the second-fastest CAGR. Aluminium foil is commonly used in the pharmaceutical end-use segment to package drugs in blisters. Foil pouches are also used in the pharmaceutical industry to package liquid drugs. Caps, lids, and closures for plastic containers are also made of aluminium foil.

Aluminium Foil Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aluminium Foil Packaging Market |

| Market Size in 2023 | USD 21.39 Billion |

| Market Forecast in 2032 | USD 30.97 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 130 |

| Key Companies Covered | Ardagh Group, ACM Carcano, Tetra Pack, Zenith, Jasch Foils, Assan Aluminyum, Flexifoil, and Amcor, among others |

| Segments Covered | By Product, By End Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aluminium Foil Packaging Market: Regional Analysis Preview

North America controls a sizable portion of the market. Though the country's aluminium foil exports were up until 2013, strong domestic demand for the metal has resulted in an increase in aluminium foil imports from China, whose foil shipments to the US have increased nearly tenfold in the last decade, to around 265 million pounds. Because of the increased demand for packaged food, the food industry accounts for around 5% of the country's GDP and is still growing.

Aluminium is included in the list of approved materials or coatings that can be used in food packaging, according to the Food and Agriculture Organization of the United Nations (FAO). The increasing availability of packaged dairy products through various retailing channels, as well as rising consumer preference for protein-based products like yogurt, cheese, and butter, are expected to drive dairy-based packaging adoption in the United States.

Asia Pacific will observe a growth of 8.3% CAGR during the forecast period. A growing number of industries, such as food and beverage, pharmaceuticals, and cosmetics, are driving the Asia Pacific market. Aluminum’s high cost when compared to plastic, which is commonly used for packaging, has limited its use in the packaging industry. Increased disposable income, on the other hand, has slowed the consumption of products packaged with single-use plastics.

Due to rapid growth in demand for use in end products such as wraps & rolls, laminated tubes, and trays, APEJ is the leading shareholder in the aluminium foil packaging space in the region. China is the region's largest market, followed by India, which holds nearly a quarter of the market in the Asia Pacific region. Chinese companies benefit from home-based advantages and are pioneering in the fields of research and technology. They are developing low-cost products and expanding their global supply. China is one of the largest exporters and producers of aluminium foil packaging, as well as a major consumer, due to the country's large end-use industry base.

Aluminium Foil Packaging Market: Key Players & Competitive Landscape

Some of the key players in aluminium foil packaging market are:

- Ardagh Group

- ACM Carcano

- Tetra Pack

- Zenith

- Jasch Foils

- Assan Aluminyum

- Flexifoil

- Amcor

- Among others

The presence of both global and domestic players distinguishes the market. However, because of the large number of players across the regions, it is highly fragmented. Aluminium's recyclable properties are expected to boost demand for aluminium foil in packaging applications, providing opportunities for market participants. Tetra pack, for example, announced a connected packing platform in April 2019 that will transform the milk and juice packing markets into interactive information channels, full-scale carriers, and digital tools.

The global aluminium foil packaging market is segmented as follows:

By Product

- Foil Wraps

- Pouches

- Blisters

- Containers

By End Use

- Food & Beverage

- Pharmaceutical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aluminium foil packaging is a versatile material used to protect and preserve products by creating a barrier against light, moisture, air, and contaminants. Commonly used in food, pharmaceutical, and cosmetic industries, it ensures product freshness and extends shelf life.

According to study, the Aluminium Foil Packaging Market size was worth around USD 21.39 billion in 2023 and is predicted to grow to around USD 30.97 billion by 2032.

The CAGR value of Aluminium Foil Packaging Market is expected to be around 4.2% during 2024-2032.

North America has been leading the Aluminium Foil Packaging Market and is anticipated to continue on the dominant position in the years to come.

The Aluminium Foil Packaging Market is led by players like Ardagh Group, ACM Carcano, Tetra Pack, Zenith, Jasch Foils, Assan Aluminyum, Flexifoil, and Amcor, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed