Animal Feed Market Size, Share, Trends, Growth and Forecast 2034

Animal Feed Market By Type (Compound Feed, Fodder, Forage, Concentrates, and Others), By Animal Type (Poultry, Swine, Ruminants, Aquaculture, and Others), By Form (Pellets, Crumbles, Mash, and Others), By Ingredient (Cereals, Oilseed Meal, Molasses, Fish Oil and Fish Meal, Additives, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

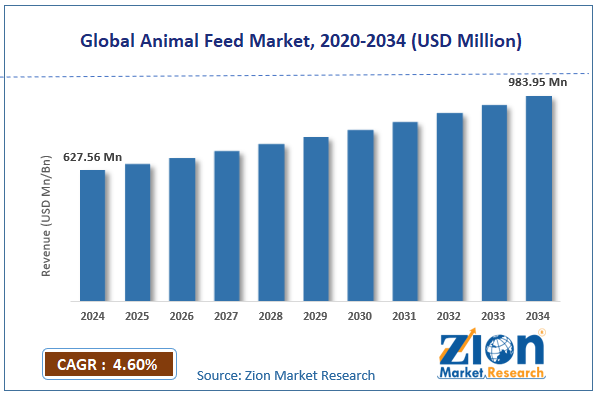

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 627.56 Million | USD 983.95 Million | 4.60% | 2024 |

Animal Feed Industry Prospective:

The global animal feed market was valued at approximately USD 627.56 million in 2024 and is expected to reach around USD 983.95 million by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.60% between 2025 and 2034.

Animal Feed Market: Overview

Animal feed is a wide range of nutritionally balanced formulations designed to provide essential nutrients, promote growth, and maintain health across various livestock species, including poultry, swine, cattle, and aquatic animals. Modern animal feeds are scientifically formulated combinations of grains, oilseed meals, plant proteins, vitamins, minerals, and specialty additives for specific growth stages, production purposes, and species requirements. The animal feed industry is an important link in the global food chain, directly impacting meat, dairy, and aquaculture productivity and quality.

Feed production involves complex supply chains of crop agriculture, ingredient processing, premix manufacturing, and commercial feed milling that deliver finished products to livestock producers worldwide. The market includes complete compound feeds, concentrates, premixes, fodder, forage, and specialty nutritional products for specific animal health and performance goals.

The growing global protein demand, increasing focus on animal health and welfare, and sustainability initiatives across livestock production are expected to drive substantial growth in the animal feed market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global animal feed market is estimated to grow annually at a CAGR of around 4.60% over the forecast period (2025-2034)

- In terms of revenue, the global animal feed market size was valued at around USD 627.56 million in 2024 and is projected to reach USD 983.95 million by 2034.

- The animal feed market is projected to grow significantly due to increasing meat consumption, industrialization of livestock production, and technological advancements in feed formulation and nutritional science aimed at improving feed efficiency.

- Based on feed type, compound feed leads the segment and will continue to lead the global market.

- Based on animal type, poultry is anticipated to command the largest market share.

- Based on form, pellets are expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Animal Feed Market: Growth Drivers

Rising global protein demand and livestock intensification

The global animal feed market is growing rapidly due to increasing protein consumption and the ongoing industrialization of livestock production systems worldwide. Commercial poultry production is annually increasing in emerging markets, while swine and aquaculture are growing at the same rate. This protein demand drives the shift from traditional livestock farming to more intensive production systems that rely on formulated feeds to maximize output.

Conversion from subsistence feeding to commercial feed usage typically improves animal growth rates and reduces time to market. The increasing consumer demand for animal protein creates long-term growth for scientifically formulated animal feeds across all agricultural systems.

Technological advancements in feed formulation and precision nutrition

Innovation in the animal feed industry has improved nutritional precision, feed conversion efficiency, and the ability to formulate specific production goals. Advanced feed formulation software using dynamic linear programming allows nutritionists to create least-cost rations that meet nutritional requirements while adapting to changing ingredient prices and availability.

Near-infrared (NIR) analysis at feed mills provides real-time nutrient composition data, allowing continuous formulation adjustments for consistency and performance. The integration of digestibility models, amino acid balancing, and nutrient release technologies has improved feed conversion ratios in major livestock species compared to previous generations of feed formulations.

Animal Feed Market: Restraints

Volatile raw material prices and supply chain disruptions

Despite growing demand, the animal feed market faces significant challenges related to raw material price volatility and vulnerability to agricultural supply chain disruptions. Major feed ingredients like corn, soybean meal, and wheat have seen price fluctuations due to weather, trade, and crop production patterns. These affect feed production costs and price stability.

Supply chain issues like transportation disruptions, export restrictions, and quality variations make feed manufacturing more complicated. Concentrated specialty ingredients with limited global suppliers add to the vulnerability. These put pressure on feed manufacturer margins and make long-term pricing tricky.

Animal Feed Market: Opportunities

Alternative protein sources and circular economy ingredients

The animal feed market is opening up by developing and commercializing new protein sources and circular economy ingredients that address sustainability and resource efficiency. These new ingredients have the same protein content as traditional sources but use less land, water, and energy.

At the same time, feed manufacturers are incorporating co-products from food production, biofuel operations, and other industrial processes and turning what were previously waste streams into feed ingredients. Early trials have shown that circular ingredients can replace traditional materials in many feed formulations without compromising nutritional quality or animal performance.

Animal Feed Market: Challenges

Evolving regulatory landscape and consumer preferences

The animal feed industry faces ongoing challenges around rapidly changing regulations on feed ingredients, medication usage, and sustainability requirements across different regions. Changing consumer preferences around antibiotic usage, genetically modified ingredients, and production practices put pressure on feed formulations and marketing claims.

The regional nature of regulations and increasing consumer interest in food production methods mean feed manufacturers need to develop adaptive formulation strategies and transparent supply chain documentation. Industry reports show that regulatory compliance and certification costs have increased in recent years, adding to the operational burden.

All this means ongoing challenges in maintaining global product offerings while meeting local regulations and evolving consumer expectations around livestock production.

Animal Feed Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Animal Feed Market |

| Market Size in 2024 | USD 627.56 Million |

| Market Forecast in 2034 | USD 983.95 Million |

| Growth Rate | CAGR of 4.60% |

| Number of Pages | 215 |

| Key Companies Covered | Cargill Inc., Archer Daniels Midland Company, Charoen Pokphand Foods PCL, Nutreco N.V., Land O'Lakes Inc., ForFarmers N.V., Alltech Inc., De Heus Animal Nutrition, New Hope Group, Perdue Farms Inc., Purina Animal Nutrition LLC (Land O'Lakes), J.D. Heiskell & Co., Kent Nutrition Group, Weston Milling Animal Nutrition, Sodrugestvo Group, Tyson Foods Inc. (Subsidiary: Tyson Feed & Ingredients), Agrifirm Group, Wen's Food Group, Muyuan Foods Co. Ltd., Nutreco N.V., and others. |

| Segments Covered | By Type, By Animal Type, By Form, By Ingredient, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Animal Feed Market: Segmentation

The global animal feed market is segmented into type, animal type, form, ingredient, and region.

Based on type, the market is segregated into compound feed, fodder, forage, concentrates, and others. Compound feed leads the market due to its complete nutritional profile, consistency, and central role in commercial livestock production systems.

Based on animal type, the animal feed market is divided into poultry, swine, ruminants, aquaculture, and others. Poultry is expected to lead the market during the forecast period due to the widespread industrialization of chicken production, shorter production cycles, and growing global consumption of poultry products.

Based on form, the animal feed industry is categorized into pellets, crumbles, mash, and others. Pellets are expected to lead the market due to their improved feed conversion efficiency, reduced waste, and logistical advantages in commercial feeding operations.

Based on ingredients, the market is segmented into cereals, oilseed meal, molasses, fish oil and fish meal, additives, and others. Cereals and oilseed meals lead the market due to their roles as primary energy sources and protein in most feed formulations.

Animal Feed Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific leads the global animal feed market due to its massive livestock population, rapidly industrializing production systems, and growing meat consumption across densely populated countries.

The region accounts for approximately 40% of the global market share, driven primarily by China's position as the world's largest feed producer and consumer. The region's commercial feed production has expanded at an average annual rate of 4-6% over the past decade, significantly outpacing other regions.

Feed mill investments and capacity expansion in China, India, Vietnam, and Indonesia have strengthened the region’s production capabilities. The transition from traditional livestock farming to commercial farming using formulated feeds continues to drive market growth.

The region’s importance in global protein production and rapidly growing domestic consumption of meat, milk, and eggs has solidified Asia Pacific’s position as the global animal feed ecosystem leader.

Latin America is set to grow significantly.

Latin America represents one of the fastest-growing regions in the animal feed industry, driven by expanding grain production capacity, increasing livestock export orientation, and strengthening domestic protein consumption. Countries like Brazil, Argentina, and Mexico have developed world-class grain and oilseed production capabilities that provide competitive advantages for feed manufacturing.

Government support for agricultural development and export-oriented livestock production has created a conducive environment for sustained growth. The region has abundant land and a well-established grain production infrastructure. It is a global protein supplier, which gives a natural advantage for feed industry growth as global demand for sustainably sourced animal products continues to rise.

Recent Market Developments:

- In April 2025, Agri-tech startup STAX is converting abandoned buildings in Glasgow into vertical insect farms to produce sustainable, protein-rich animal feed pellets.

- In March 2025, the Indian Poultry Alliance (IPA), a subsidiary of the Allana Group, acquired Kwality Animal Feeds Pvt Ltd, aiming to bolster IPA's market leadership in the poultry and animal nutrition industry.

Animal Feed Market: Competitive Analysis

The global animal feed market is led by players like:

- Cargill Inc.

- Archer Daniels Midland Company

- Charoen Pokphand Foods PCL

- Nutreco N.V.

- Land O'Lakes Inc.

- ForFarmers N.V.

- Alltech Inc.

- De Heus Animal Nutrition

- New Hope Group

- Perdue Farms Inc.

- Purina Animal Nutrition LLC (Land O'Lakes)

- J.D. Heiskell & Co.

- Kent Nutrition Group

- Weston Milling Animal Nutrition

- Sodrugestvo Group

- Tyson Foods Inc. (Subsidiary: Tyson Feed & Ingredients)

- Agrifirm Group

- Wen's Food Group

- Muyuan Foods Co. Ltd.

- Nutreco N.V.

The global animal feed market is segmented as follows:

By Type

- Compound Feed

- Fodder

- Forage

- Concentrates

- Others

By Animal Type

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

By Form

- Pellets

- Crumbles

- Mash

- Others

By Ingredient

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Animal feed is a wide range of nutritionally balanced formulations designed to provide essential nutrients, promote growth, and maintain health across various livestock species, including poultry, swine, cattle, and aquatic animals.

The animal feed market is expected to be driven by increasing global meat consumption, industrialization of livestock production, technological advancements in feed formulation, growing focus on animal health and welfare, sustainability initiatives, and expanding protein demand from emerging economies.

According to our study, the global animal feed market was worth around USD 627.56 million in 2024 and is predicted to grow to around USD 983.95 million by 2034.

The CAGR value of the animal feed market is expected to be around 4.60% during 2025-2034.

The global animal feed market will register the highest growth in Asia Pacific during the forecast period.

Key players in the animal feed market include Cargill, Inc., Archer Daniels Midland Company, Charoen Pokphand Foods PCL, Nutreco N.V., Land O'Lakes, Inc., ForFarmers N.V., Alltech, Inc., De Heus Animal Nutrition, New Hope Group, Perdue Farms, Inc., Purina Animal Nutrition LLC (Land O'Lakes), J.D. Heiskell & Co., Kent Nutrition Group, Weston Milling Animal Nutrition, Sodrugestvo Group, Tyson Foods, Inc. (Subsidiary: Tyson Feed & Ingredients), Agrifirm Group, Wen's Food Group, Muyuan Foods Co., Ltd., and Nutreco N.V. (Subsidiary: Trouw Nutrition).

The report comprehensively analyzes the animal feed market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, sustainability initiatives, and the evolving livestock production systems shaping the feed industry ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed